Remember when everyone knew

That BOJ hikes would come through

The Fed would cut rates

And all the debates

Were focused on what next to do?

It turns out the very next thing

For those getting back in the swing

Was selling the yen

(Yes, that trade again)

And buying stuff that has more zing

We all know that the carry trade died two weeks ago. After all, the BOJ hiked rates in a surprise to the markets which was followed by Chairman Powell essentially promising to cut rates. Those actions spooked traders, and arguably algorithms as well, and we saw a dramatic decline in equity markets around the world, led by Japanese stocks. The premise was that much of the market activity was driven by borrowing yen at near 0.0% and then converting those yen into other currencies and buying other assets, or just depositing the dollars, or Mexican pesos or Brazilian reals and earning the interest rate differential.

Now, don’t get me wrong, that was an active trade and clearly a part of the ongoing risk asset rally that was evident throughout most of the world. But that trade took several years to build up, and the idea that it was unwound in a week is laughable. But, that sharp move two weeks ago succeeded in doing one thing, it scared the 💩 out of the central bankers around the world. Within days, the BOJ walked back all their tough talk about normalizing monetary policy and ending QQE. As well, despite desperate calls from some of the punditry for an emergency rate cut, or at the very least, a guarantee of a 50bp cut in September by the Fed, the few Fed speakers we have heard continue with their mantra that while some things are looking encouraging, the time is not yet right to cut rates.

And, you know what that means? It means that the interest rate differentials between Japan and the rest of the world remain plenty wide enough to reinvigorate that self-same carry trade that was declared dead just two weeks ago. The obvious proof is in the equity markets which, while not quite back to the highs of July 16th, have rebounded between 6.8% (S&P500) and 8.8% (NASDAQ) from the bottoms seen at the beginning of the month. (see chart below)

Source: tradingeconomics.com

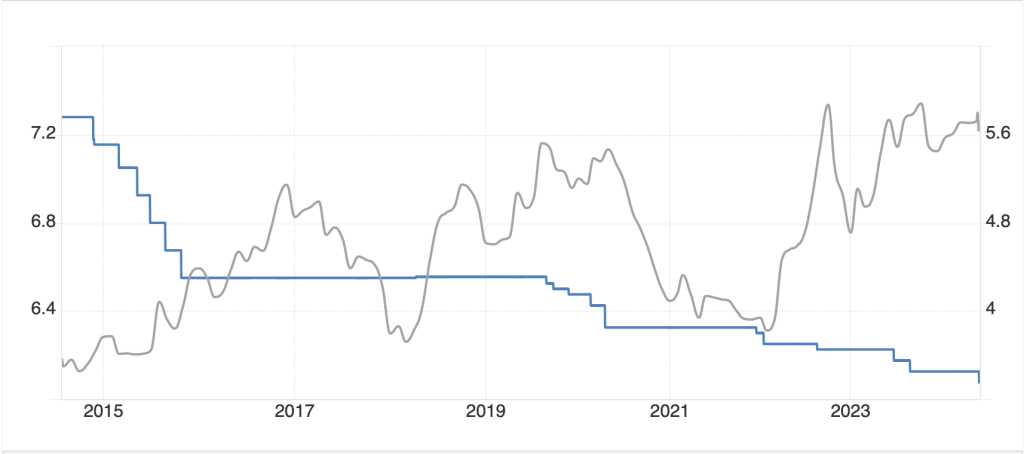

But equally important to this story is the fact that the yen has declined more than 4% from its highs at the peak of the fear as investors are far less concerned about much tighter BOJ policy. This is also evident in the JGB market, where 10-year yields, while climbing 3bps overnight, remain well below the 1.0% level that was seen as a harbinger of the new monetary framework in Japan.

Source: tradingeconomics.com

Of course, there has been other news that has abetted this price action, namely the recent US data which showed that the employment situation may not be as dire as the NFP report at the beginning of the month. This was demonstrated yet again yesterday when Initial Claims fell to 227K, its lowest point in 5 weeks and the second consecutive decline in the result. As well, Retail Sales were a much stronger than expected 1.0% (although the autos component seemed a bit funky), indicating that real economic activity was still growing. Granted, the IP (-0.6%) and Capacity Utilization (77.8%) data were soft as were both the Philly Fed (-7.0) and Empire State Manufacturing (-4.7) surveys, but none of that matters when the markets get on a roll.

If I had to describe the narrative this morning it would be, everything’s fine. The economy is still doing well, the jobs market is not collapsing, and the Fed is still on track to cut rates next month. Goldilocks has come out of hiding and is back headlining the show. While there are still some doubters out there, their voices are being drowned out by all the shouting to buy more stocks.

So, as we head into the weekend, let’s see how things have performed overnight. In Asia, markets everywhere rallied following the strength in the US yesterday. The Nikkei (+3.6%) led the way and has now rebounded more than 20% from its nadir at the height of the fear. But the Hang Seng (+1.9%) showed strength and we saw strength throughout the region (Australia +1.3%, Korea +2.0%, India +1.7%) with one notable exception, mainland China, where shares edged up just 0.1%. It seems that President Xi has, at the very least, a marketing problem with respect to getting investors to put money into China. In Europe, most markets are higher between 0.25% (CAC) and 0.6% (DAX) although the FTSE 100 (-0.4%) is struggling this morning after Retail Sales data there were seen as less than stellar. As to the US, ahead of the opening futures markets are little changed at this hour (7:15).

In the bond market, yesterday’s stock euphoria played out as a sale of bonds with the corresponding rise in yields of 7bps in the US Treasuries. However, this morning, those yields have backed off by 5bps and we have seen similar price action throughout Europe with sovereigns there showing yield declines of between 3bps and 5bps after following Treasury yields higher yesterday. For now, bonds are certainly behaving like a haven asset. Also, it is worth noting that the yield curve inversion is back to -17bps, edging slowing away from normalization.

In the commodity markets, after a solid performance yesterday, oil (-2.6%) is under real pressure this morning as market participants look to the lackluster Chinese economic activity and are worried that demand is not going to pick up anytime soon. Certainly, yesterday’s Chinese data was nothing to write home about, and this morning they released their Foreign Direct Investment data showing it had decline -29.6% YTD in July. This does not inspire confidence. In fact, under the rubric a picture is worth 1000 words, here is a chart of that Chinese FDI. It seems clear that something has changed in the way the world views China.

Source: tradingeconomics.com

As to the metals markets, gold (+0.4%) continues to find support as despite the equity rally, there remains a steady interest to hold something other than USD and fiat currencies. However, the rest of the complex is softer this morning as weaker industrial activity would indicate less demand.

Finally, the dollar is ceding some of its gains from yesterday with some pretty substantial moves in both G10 and EMG blocs. Versus the G10, the yen, which fell sharply yesterday, has rebounded 0.75% this morning, although remains above 148. But we have seen strength in AUD (+0.3%), NZD (+0.7%) and GBP (+0.35%) as virtually all the G10 is firmer. The pound is a bit odd given the equity market’s response to the UK data, but the other currencies seem to be simply retracing yesterday’s weakness. In the EMG bloc, ZAR (+0.4%) is firmer on the back of gold and the generally weak dollar, but we are seeing MXN (-0.2%) lag the move. CNY (+0.2%) is also benefitting today as broad dollar weakness plays out far more aggressively here than it has historically. While the dollar’s long-awaited demise is still far in the future, today it is under some pressure.

On the data front, this morning brings Housing Starts (exp 1.33M), Building Permits (1.43M) and Michigan Consumer Sentiment (66.9). As well, this afternoon we hear from Chicago Fed president Goolsbee. He has been one of the more dovish FOMC members so look for him to talk up the chances of a more aggressive rate cut next month. However, there is still a lot to learn between now and then with PCE next week, then another NFP and CPI report as well as the Jackson Hole conference. As it stands this morning, the Fed funds futures market is pricing a 27% chance of a 50bp cut, with 25bps a lock. But if the data continues to shine, please explain why they need to cut. I think we are in a ‘good news is good’ scenario, so strength in this morning’s data should support the dollar and weakness impair it. We shall see.

Good luck and good weekend

Adf