Well, Fednesday is finally here

And traders, for fifty, still cheer

But arguably

The prices we see

Account for a half-point rate shear

So, if they just cut twenty-five

Prepare for a market nosedive

The doves will all scream

Jay’s killing the dream

While hawks everywhere all will thrive

First, I did not create the term Fednesday, I saw it on Twitter but thought it quite appropriate. In fact, looking, I cannot determine who did create it but kudos to them.

As I have already written twice on the subject of today’s meeting, I will be brief this morning, especially because not much has changed. Yesterday’s stronger than expected Retail Sales data resulted in Fed funds futures reducing the probability of a 50bp hike during the session, but overnight, we have returned to the 65%/35% probability spectrum for a 50bp cut. I continue to believe that will be the case based on the number of articles we have seen in the mainstream media about the merits of a 50bp cut, mostly centering on the idea that rates are “too” high despite the fact that growth continues apace, the employment situation remains solid, if cooling somewhat, and inflation remains well above target. Perhaps the big surprise will be that there will be a dissent on the vote, something we have not seen in two years. (In fact, the last time a governor dissented was 2006 I believe).

But something I have not touched on is the dot plot which will give us an idea as to the members’ collective belief for the rest of the year. For instance, if the dot plot indicates Fed funds will be at 4.5% by year end, then 25bps today will be followed by at least one 50bp cut. That should be net equity bullish and bearish for the dollar. If the dot plot indicates only 75bps of cuts, so 4.75% at year end, my take is that will be seen as somewhat hawkish overall, and we should see risk assets decline while the dollar rallies. Finally, if it is more than 100bps expected, I think that could be a situation of the market asking, what does the Fed know that we don’t? That would not be a positive for risk assets but would also hammer the dollar. Bonds would rally as would gold. At least those are my views.

Moving on, tomorrow brings a BOE meeting where the current expectation is for no cut, although one is priced for the next meeting in the beginning of November. Early this morning, the UK released its inflation report which showed headline CPI at 2.2%, as expected while the core rate rose to 3.6%, a tick more than expectations and up 0.3% from the July reading. Arguably, that is what has the BOE concerned, the fact that despite the decline in energy prices which has taken headline CPI lower, the underlying stickiness of inflation remains extant within the UK. As well, the UK also released its PPI data, all of which showed declines greater than expected, if nothing else implying that UK corporate margins should be healthy. The pound (+0.35%) has rallied on the news, although the dollar is weaker overall, so just how much of this move is UK related is open to debate. I guess we can say that the short-term differences in central bank stance is likely to continue to help the pound for a while. In fact, the pound is back to levels last seen in summer 2022 and there is a growing bullish sentiment for the currency based on current perceptions of the divergence between the Fed and BOE. My view is the BOE will fall in line pretty quickly so this will change, but for now, especially with the dollar under broad pressure, the pound has further to go.

On Friday we’ll learn

If Ueda can once more

Surprise one and all

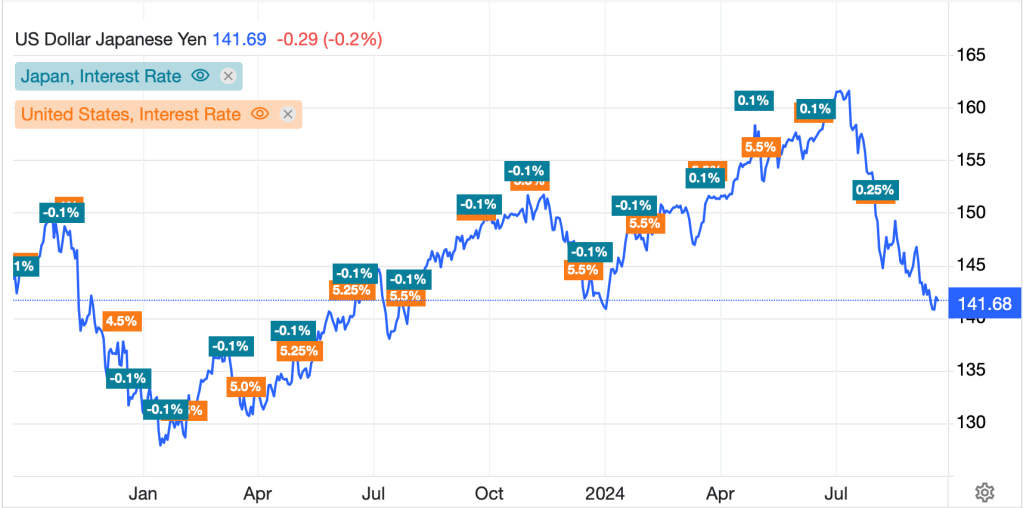

The other central bank meeting this week is the BOJ early Friday morning. Currently, there is no expectation of a BOJ policy change although many analysts are looking for a rate hike by December. However, I think it is worth looking at USDJPY in relation to the policy adjustments we have seen by both central banks over the past several years. Hopefully you can see in the chart below that the exchange rate here has returned to the level when the Fed last raised rates in July 2023.

Source: tradineconomics.com

Since then, after a dramatic further decline in the yen, with both policy rates on hold, the BOJ first adjusted the cap on YCC higher (from 0.50% to 1.0%) then eventually raised the policy rate from -0.1% to +0.25% where it is today. During that time, Ueda-san has surprised markets several times, and has had help from the MOF regarding intervention, taking a completely different approach to the process than the Fed, who never wants to surprise markets. With this in mind, we must be prepared for another surprise on Friday. One thing to remember is that the BOJ meeting announcement occurs after the market in Tokyo closes, so even though other markets, and of course the FX market will be able to respond, the Tokyo equity and JGB markets won’t be able to move until Monday. The point is the reaction may take time to play out. In this situation, I don’t have enough information to take a view, but I will say that if he tightens policy in any manner, USDJPY is likely to fall much further.

One other thing I realize is that I have not discussed QT/QE. If the Fed changes that process, the current $25 billion/month of balance sheet runoff, that will be extremely dovish and be quite a boost for stocks, bonds and commodities while the dollar will get run over.

Ok, heading into this morning, and after a mixed and lackluster session yesterday in the US, Asian equity market all rallied with Japan (+0.5%) continuing its recent rally, while even mainland Chinese shares (CSI 300 +0.4%) managed a gain today. However, European bourses are all softer this morning with the FTSE 100 (-0.6%) lagging after the higher-than-expected inflation data driving concerns the BOE won’t cut rates much. But screens everywhere are red, albeit only modestly so. US futures are currently (7:45) edging slightly higher as I continue to believe traders and investors are looking for a 50bp cut.

In the bond market, yields are higher across the board as the euphoria we have seen lately seems to be running into a bit of profit taking with Treasury yields higher by 3bps and European sovereign yields all higher by between 4bps and 6bps. Perhaps the one surprise is that JGB yields are unchanged this morning as there seems to be no anticipation of a BOJ move, at least not yet.

In the commodity markets, oil (-1.0%) is giving back some of its recent gains but remains above $70/bbl. It seems that the stories of a massive military strike by Ukraine deep in Russia have raised concerns amongst the punditry of an escalation of the war there, but it has not concerned energy markets, at least not yet. In the metals markets, gold (+0.2%), which sold off yesterday, continues to find support while copper has been on a roll and has risen once again.

Finally, as mentioned above, the dollar is softer overall against all its G10 counterparts and most EMG currencies as well. The one outlier here was KRW (-0.35%) where traders are starting to price in rate cuts by the BOK after yet another mild inflation report earlier this week.

Ahead of the Fed we see Housing Starts (exp 1.31M) and Building Permits (1.41M) as well as the EIA oil inventory data where expectations are for no real changes. Until the FOMC release, look for quiet markets. Afterwards, I’ve given my views above.

Good luck

Adf