We all know that birds of a feather

Eventually will flock together

So, yesterday’s color

From Williams and Waller

Implied cuts are when and not whether

As I described yesterday morning, and have been observing since Chairman Powell’s Congressional testimony, all the members of the FOMC are on the same page. Yesterday it was NY Fed president John Williams and Governor Chris Waller who explained that [Williams] “It is not really a story about a ‘last mile’ or some part that’s particularly sticky.” [Different inflation measures are] “all moving in the right direction and doing that pretty consistently,” and [Waller] “The time to lower the policy rate is drawing closer. Right now, the labor market is in a sweet spot. We need to keep the labor market in this sweet spot.”

This is the same message Powell gave us in his testimony and on Monday. It is what we have heard from Barkin, Kugler, Daly and Goolsbee so far this week and are likely to hear from Daly and Williams again today and Bowman and Bostic before they all go quiet ahead of the July 31st meeting. While there are those who are calling for a cut at the July meeting (Goldman Sachs analysts explained their reasons and in this morning’s WSJ, pundit Greg Ip did the same), and, even though I think it is an interesting risk/reward opportunity, with less than a 5% probability currently priced into the market, I do not believe that the FOMC is going to cut even if next week’s PCE data is extremely soft.

Consider, though, that between now and the September FOMC meeting, we will receive two more each of CPI, PCE and payroll reports as well as hear all the talk from the Jackson Hole Symposium. If, and it’s a big if, the economy shows that it is slowing more rapidly than currently seems to be the case, I would not rule out a 50bp cut then, although that is clearly not my base case.

I think it says a great deal about the market’s narrative overall that the ECB is meeting as I write and will release their policy statement and actions, if any, shortly and it is not a top ten topic of conversation right now. There is no expectation of movement, and the market has lined up for a September cut there as well. In other words, everything remains all about the Fed.

Well, the Fed and the US stock market. Since its high print a week ago, the NASDAQ is down by 4% with some of its key constituents (NVDA -14.3%, MSFT -5.1%, GOOGL -5.6%) having fallen much further. At the same time, the DJIA has rallied 3.7% as the new discussion is a rotation from growth to value stocks as the latter will ostensibly be better served by the Fed’s now-imminent rate cuts. At least, that’s the story that has become the universal belief set. It certainly sounds good and is logical so let’s go with it. However, I guess the question we need to answer is, can it continue?

Can it continue for another day or two? Certainly, given positioning that exists and the fact this new idea has developed some momentum, it can go a bit further. But is this the beginning of an entirely new trend? Somehow, I do not see that being the case. Remember, the Magnificent-7 story had evolved from an idea into a cult, not dissimilar to the Bitcoin story. People believed and were rewarded for doing so. Plus, they had the benefit of feeling like they were taking part in the cutting edge of technology and economic activity. But buying the Dow Jones, the very definition of old-line manufacturing and traditional service companies, is not something that inspires that same fervor. My take is this narrative will soon end. The thing for which we must all watch out, though, is that investors have now seen that their golden stocks, specifically NVDA, can go down, and go down quickly. The thing about momentum is that once it gets going in either direction, it can continue for quite a while. Stay alert.

Ok, let’s see how all this has impacted markets elsewhere in the world. In Asia, the Nikkei (-2.4%) continued its recent struggles even though the yen (-0.5%) has slipped a bit overnight. But just like in the US, the momentum in the Nikkei seems to be pointing lower for now as it tracks the NASDAQ. Meanwhile, Chinese stocks showed modest gains with the rest of the region showing wildly disparate outcomes, (Korea -0.7%, Taiwan -1.6%, India +0.8%, Indonesia +1.3%) so it is hard to take a consistent message from here. However, European bourses are all in the green this morning as they resemble the DJIA far more than the NASDAQ. Granted, the gains have been modest (CAC +0.5%, FTSE 100 +0.7%, DAX +0.2%) but that is better than the red they have been showing lately. Lastly, US futures at this hour (7:15) are reverting to the DJIA under pressure while the NASDAQ futures are higher by 0.4%.

In the bond market, yields are edging higher, pretty much by 2bps across the board in both Treasuries and European sovereigns. However, I would contend that price action here has been a mere consolidation over the past several sessions after a sharp decline in yields since the beginning of the month. In truth, during the past 3 sessions, there has been no net movement.

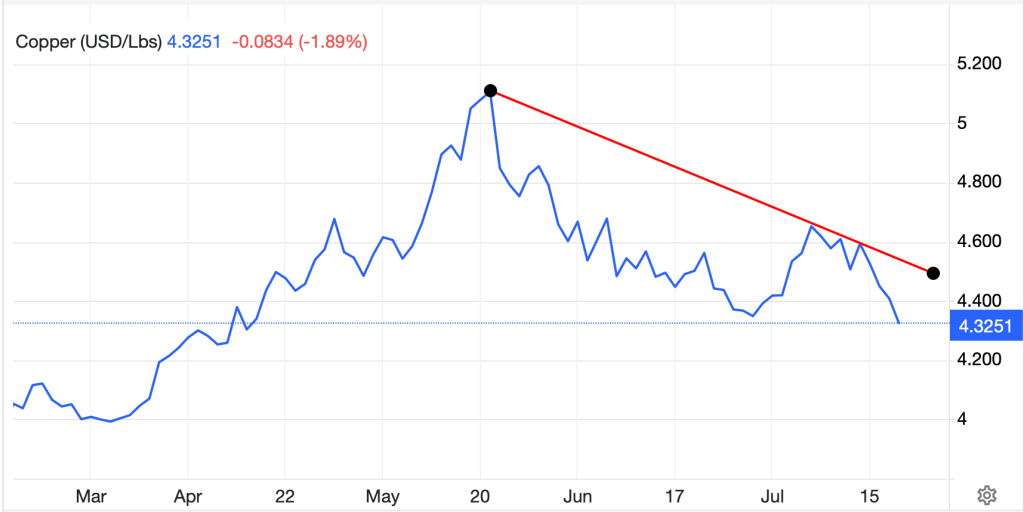

Commodity markets are mostly little changed this morning as oil, which rallied yesterday on further inventory draws according to the EIA, is unchanged and gold and silver are also unchanged this morning. The one outlier is copper (-1.8%) which is continuing its recent declines as it seems the market is calling into question the demand side of the story. While supply is currently adequate, Chinese economic weakness has been a major drag on the perception of demand. I suspect that will change over time, but right now, the chart looks awful.

Source: tradingeconomics.com

Finally, the dollar is rebounding a bit this morning with modest gains against most of its G10 counterparts, although other than the yen, those gains are on the order of 0.1% to 0.2%. In the EMG bloc, it is basically the same story, very modest USD gains with no outliers of which to speak. One broader picture comment is that there have been several analysts who have discussed the dollar selling off sharply recently and how that is a harbinger of the end of the dollar’s dominance as the world’s reserve currency. To put things in context, using the DXY as our proxy (which is very imperfect), for the past year, the DXY has traded between 101 and 107 and this morning it is trading at 103.8. This is neither the story of a major move in either direction, nor of a trend of any consequence. In order for things to change, we will need to see the Fed change its policy at a much different pace than the rest of the world’s central banks, and that is not yet an obvious outcome.

On the data front this morning, we get the weekly Initial (exp 230K) and Continuing (1860K) Claims data as well as Philly Fed (2.9) and the Leading Indicators (-0.3%). I think we already know what the Fed speakers are going to tell us, as per the opening monologue, so absent some new piece of news, today is shaping up to be a very dull one. The summer doldrums are clearly here.

Good luck

Adf