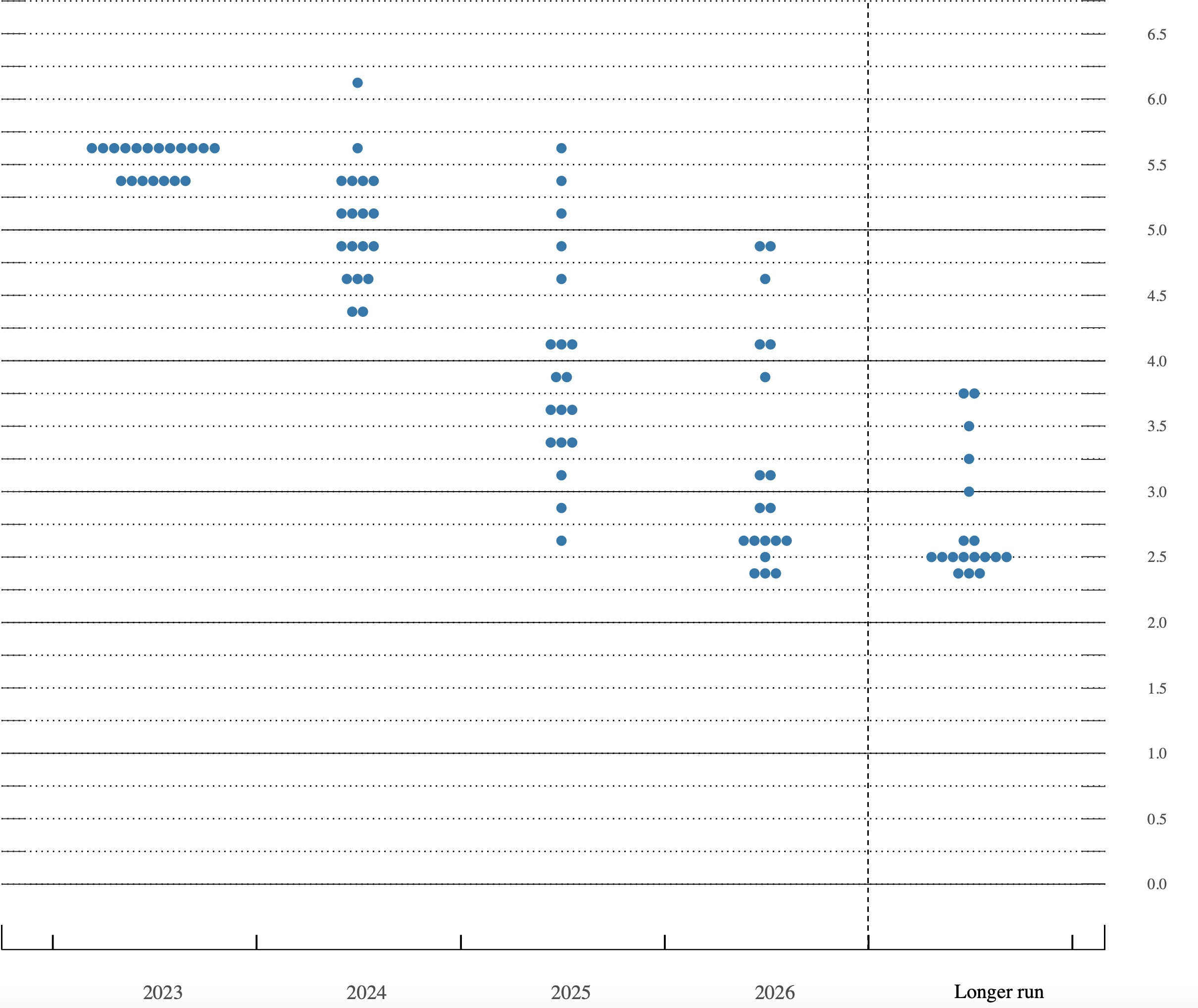

One look at the dot plot makes clear Inflation concerns are severe So, higher for longer Is growing still stronger And Jay implied few cuts next year

First, let’s recap the FOMC meeting. The term hawkish pause had been used prior to the meeting as an expectation, and I guess that was a pretty apt description. While they left policy on hold, as expected, the change in the dot plots, as seen below, indicate that even the doves on the Fed see fewer rate cuts next year, with just two now priced in from four priced in June.

Source: Fedreserve.gov

A quick reading shows that a majority of members expect one more hike this year, and now the median expectation for the end of 2024 has moved up to 5.125%, so 50bps lower than the median expectation for the end of 2023 and 50bps higher than the June plot. To me, what is truly fascinating is the dispersion of expectations in 2025 and 2026, where there are clearly many opinions. And finally, the longer run expectation has risen to 2.5% with many more members thinking it should be even higher than that. The so-called neutral rate estimations seem to be creeping higher. If you think about it, that makes some sense. After all, given the ongoing forecasts for continued labor market tightness due to demographic concerns, and add in the massive budget deficits leading to significantly higher Treasury debt issuance, there is going to be pressure on rates to find a higher level.

The market response was quite negative, albeit not immediately, only after Powell started speaking. But in the end, equity markets fell across the board in the US, with the NASDAQ taking the news the hardest, down -1.5%, as its similarity to long duration bonds was made evident. Asian markets all fell overnight as well, with most tumbling more than -1.0% and European bourses are all under similar pressure, down -1.0% or so as well. The one exception in Europe is Switzerland, where the SNB surprised the market and left rates on hold resulting in a weaker CHF and a very modest gain in their equity market.

However, the bigger market response was arguably in bonds, where yields rose to new highs for the move with the 2yr at 5.15% and the 10yr at 4.43%. Once again, I point to the significant increase in debt that will be forthcoming from the US Treasury as they need to fund those budget deficits. I have been making the case that a bear steepener would be the more likely outcome for the US yield curve. That is where long-term rates rise more quickly than short-term rates due to the US fiscal policy and shrinking demand for US debt by key players, notably the Fed, but also China and Japan. Nothing has changed that view.

Then early this morning, up north Both Sweden and Norway brought forth A quarter point hike To act as a dike Preventing price rises henceforth

After the Fed’s hawkish pause, we turn our attention to Europe, where the early movers, Sweden and Norway, both hiked twenty-five basis points, as expected, while both hinted that further hikes are not out of the question. Inflation remains higher than target in both nations and in both cases, the currency has been relatively weak overall. Switzerland left rates on hold, pointing to the fact that for the past three months, inflation has been within their target range, and they are beginning to see downward pressure on economic activity which they believe will keep that trend intact.

And lastly, from London we’ve learned Another rate hike has been spurned Though voting was tight They said they’re alright With waiting to see if things turned

As to the bigger story, the UK, expectations were split on a hike after yesterday’s tamer than expected CPI report while the pound fell ahead of the news. And the change in expectations was appropriate as in a 5-4 vote, the BOE opted to remain on hold for the first time in two years. They see that inflation may be easing more rapidly than previously expected, and they are concerned about overtightening. While I have a hard time understanding how a 5.15% Base rate is tight compared to CPI running at 6.7% and core at 6.2%, I am clearly not a central banker. At any rate, the pound fell further on the news and is now at its lowest level since March, while the FTSE 100 rallied back and is close to flat on the day from down nearly -1.0% before the announcement. Gilt yields, however, are moving higher as the bond market there doesn’t seem to believe that the BOE is serious about fighting inflation.

And really, those are today’s key stories. Late yesterday, Banco Central do Brazil cut the SELIC rate by 0.50%, as expected, and at the same time the BOE announced, the Central Bank of Turkey raised their refinancing rate by 5 full percentage points, to 30.0%, exactly as expected. And to think, we get concerned over rates at 5%!

As to the rest of the day, there is a bunch of US data as follows: Philly Fed (exp -0.7), Initial claims (225K), Continuing Claims (1695K), Existing Home Sales (4.1M) and Leading Indicators (-0.5%). As is typical, there are no Fed speakers scheduled the day after the FOMC meeting, but we will start to hear from them again tomorrow.

Putting it all together tells me that the Fed is not nearly ready to back off their current stance and will need to see substantial weakness in economic activity before changing their mind. Meanwhile, last week’s ECB meeting and this morning’s BOE meeting tell me that the pain of higher interest rates in Europe is becoming palpable and the central banks are leaning more toward inflation as an outcome despite their mandates. This continues to bode well for the dollar as the US remains the place with the highest available returns in the G10.

Tonight, we hear from the BOJ, where no change is expected. I would contend, though, that the risk is there is some level of hawkishness that comes from that meeting as being more dovish seems an impossibility. As such, there is a risk that the yen could see some short-term strength. Keep that in mind as you look for your hedging levels.

Good luck

Adf

Inflation is like an uncontrollable virus. Germany, Argentina, and Brazil are good examples. Once it get going, it is hard to get under control, especially when Government spending is out of control. Two interest rate cuts next year are a mirage and a pipe dream unless the world and US economies collapse. Eventually, the Fed will will move the inflation goal posts above 2%.

It’s funny Keith, I agree with you completely that they will not be able to ultimately tolerate the pain required to get inflation back to 2% on a longer term basis. But I expect that there will be a cyclical. downturn in inflation that will allow them to declare victory. I don’t think that Powell will allow them to adjust the target on his watch, and he would rather resign then let that happen. but it could just be he bows out when his term is up and the next Chair does the deed. alas, I agree that higher inflation is in our future, that’s for sure