The ISM data was weak

And traders, more bonds, did soon seek

The oil price fell

The dollar, as well

But stocks ended close to their peak

So, is now bad news really good?

‘Cause Jay will cut rates, or he should

Or is it the case

That growth’s slowing pace

Means risk is not well understood

The narrative had a little hiccup yesterday as the ISM data was released far weaker than expected. The headline number, 48.7, fell vs. last month and was a full point below market expectations. The real problem was that while the Employment sub-index was solid, New Orders tanked, and Prices remained high. If you add this to the Chicago PMI data from Friday, which at 35.4, was the lowest print since the pandemic in May 2020 and back at levels seen in the recessions of 2001 and 2008, it is fair to question just how strong the US economy is right now.

Adding to this gloom is the news that the Atlanta Fed’s GDPNow estimate slipped to 1.8% for Q2, down from 2.7% last Friday, and the trend, as per the below chart, is not very pretty.

Given the data, it can be no surprise that the Treasury market rallied sharply, with yields declining 8 basis points on the session, although they are little changed this morning. After all, if the economy is slowing, the theory is that inflationary pressures will decline, and the Fed will be able to cut rates sooner rather than later. And maybe that is true. But when we last heard from the FOMC membership, most were pretty convinced they needed to see more proof that inflation was actually lower, rather than simply that slowing growth should help their cause. And I might argue that a weak ISM print, especially with the prices portion remaining high, is hardly the proof they require.

But yesterday’s markets were a bit confusing overall. While the initial response to the weak data led to immediate selling across all equity markets, by the end of the day, those losses were reversed such that the NASDAQ had a fine day, rising 0.5%. Ask yourself the question, why would stocks rebound despite further evidence that the economy is slowing down. The obvious answer is that a slower economy will lead to slowing inflation and allow the Fed to reduce interest rates before long. Of course, the flip side of that story is that a slower economy implies companies will lose pricing power as demand slides, thus reducing available profit margins and overall profits. It seems hard to believe that stock prices will rally amid declining earnings, although these days, anything is possible.

While the Fed’s quiet period has many advantages (in truth I wish the entire time between meetings was the quiet period) one of its key attributes is that the narrative can run wild in whatever direction it likes. As we will be receiving quite a bit of data this week, I suspect the narrative will have a few more twists and turns yet to come, although there is no question that the bulls remain in control of the conversation.

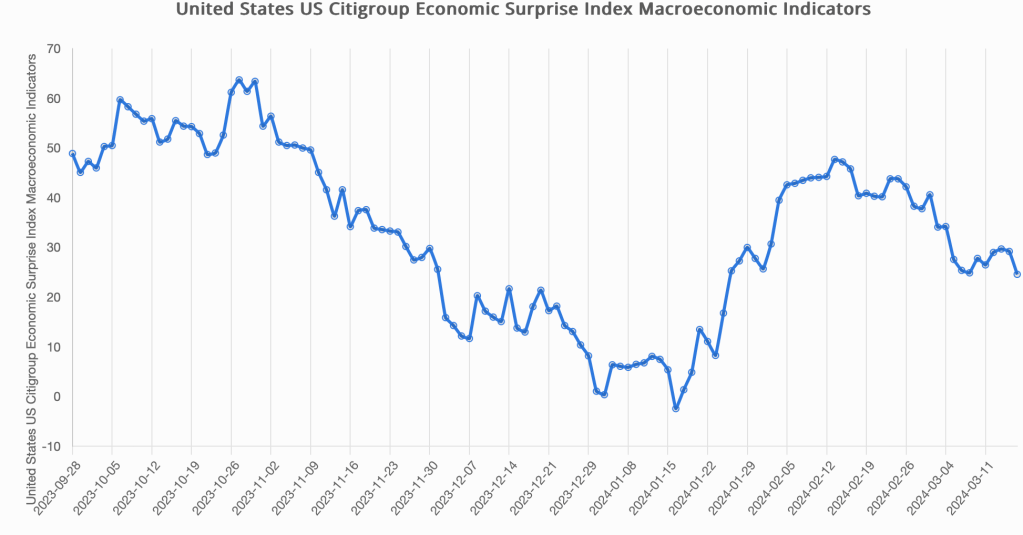

One other thing to keep in mind about that ISM data is that while the US data was weak, the PMI data elsewhere in the world indicated that the worst had been seen elsewhere. While it is not full speed ahead yet in Europe or the UK or China, the trend is far better than in the US. Remember, a key part of the narrative is that the US is the ‘cleanest shirt in the dirty laundry’ and so funds continue to flow into US equities and the dollar by extension supporting both. But what if other nations are starting to see an uptick in their growth stories while the US is starting to slide a bit? Perhaps the non-stop bullishness for the NASDAQ will find a limit after all. Perhaps another way to consider this is to look at the Citi Economic Surprise Index, which is designed to compare actual data releases with the forecasts before the release. As such, a high number shows better than expected data and vice versa. As you can see from the below chart, the trend here is lower.

Source: macrovar.com

One interesting aspect of this chart is that you can see during Q1, when the equity markets rallied and bullishness was rife, this index was rallying as well. But remember what we learned last week regarding Q1’s GDP, it was revised lower to just 1.3% annualized. So, if better than expected data still led to weak growth, what will declining data do?

In the end, at least in my view, the economy is struggling overall, although not collapsing. If I am correct, then it leads to several potential, if not likely, outcomes. While the Fed has continuously claimed they remain focused on inflation, if growth starts to decline more sharply, and unemployment starts to rise more rapidly, they will cut rates regardless of CPI or PCE, and they may well end QT if not start QE again. The clear loser here will be the dollar. Equity markets are likely to initially react to the rate cuts and rise, but if earnings suffer, I think that will reverse. Bond markets, too, will rally initially, but if inflation rebounds, which seems highly likely if the Fed eases policy, I don’t think the long end of the yield curve will be very happy, and we could easily see 5.0% or higher in 10-year yields. Finally, commodities will see a lot of love and rally across the board.

Ok, let’s look at what happened overnight, as other markets responded to the surprisingly weak US data. Asia wound up mixed, similar to the US indices, as Japan (-0.25%) slipped while China (+0.75%) rallied along with Hong Kong (+0.25%). But the big mover overnight was India (-5.75

%) which fell sharply as the election results there indicated that PM Narendra Modi, while winning a third term, saw a decline in his support that left him somewhat weakened. The rupee (-0.5%) also slipped, although nothing like what we saw yesterday in Mexico. As to the rest of the region, we saw winners (Indonesia, Malaysia) and laggards (Taiwan, Korea, Australia) so no real trend. In Europe, this morning, there is a trend, and it is all red, with losses ranging from -0.4% in the UK to -1.1% in Spain. The only data here was employment in both Spain and Germany, and while both numbers were a touch soft, neither seemed dramatic. And, as I type (8:00), US futures are all lower by -0.3%.

In the bond markets, yesterday’s Treasury rally was mimicked by European sovereigns, with yields there falling as well, albeit not quite as much as in the US. This morning, the European market is extremely quiet, with yields +/-1bp from yesterday’s closes. However, overnight, we did see Asian government bond yields fall, with JGB’s -3bps and greater declines elsewhere in the space.

Oil prices (-1.85%) are under severe pressure this morning, following on yesterday’s $3/bbl decline, falling another $1.50/bbl. It seems the combination of the weak ISM data and the OPEC+ discussion of an eventual return of more production to market next year was enough to convince a lot of long positioning to throw in the towel. As is its wont, the oil market can move very sharply and overshoot in either direction. It feels to me this could be one of those cases. But commodity prices are getting killed everywhere this morning as although metals held up well yesterday, this morning we are seeing blood in the water. Both precious (Au -0.9%, AG -3.4% and back below $30/oz) and industrial (Cu -2.3%, Al -0.5%) are falling as slowing growth and the belief that it will reduce inflationary pressures is today’s story.

Finally, the dollar, which sold off sharply yesterday in the wake of the ISM data, is bouncing a bit this morning, at least against most of its counterparts. While most of the G10 is softer, led by NOK (-1.2%), the outlier is JPY (+0.85%) which is suddenly behaving like a safe haven amid troubled times. I think that the increased uncertainty amid Japanese investors as to the state of the global economy may have them bringing home their funds, especially now that 10yr JGB yields are above 1.0% with no hedging costs. As to the EMG bloc, MXN (-1.7%) remains under severe pressure but today they are not alone with all EEMEA currencies and other LATAM currencies declining as well.

The two data points this morning are the JOLTS Jobs Openings (exp 8.34M) and Factory Orders (0.6%), both released at 10:00. Obviously, there is no Fedspeak, so I expect that equities will be the driver, and if fear starts to grow, we could get an old-fashioned risk off day with stocks falling, bonds rallying and the dollar gaining as well.

Good luck

Adf