Well, Jay and the doves got their wish

As CPI data went squish

In fact, it’s not clear

Why cuts aren’t here

Already, it’s just unfair-ish

But something surprising occurred

‘Cause rallies in stocks weren’t spurred

But yields and the buck

Got hit by a truck

While gold was both shaken and stirred

Chairman Powell must be doing his happy dance this morning as the CPI data was the softest seen since May 2020 during the height of the Covid shutdowns. Now, after four years of steadily rising prices, the Fed is undoubtedly feeling better. One look at the chart below, though, shows that the inflation rate since the end of Covid was clearly much higher than that to which the population became accustomed prior to Covid.

Source: tradingeconomics.com

While the annualized data for both core and headline readings remains above 3.0%, there was certainly good news in that shelter and rental costs rose more slowly than they have in nearly three years. However, for market participants, they are far less concerned over the whys of the soft reading than in the fact that the reading was soft and so they can now anticipate a rate cut even sooner than before. As of this morning, the Fed funds futures market is now pricing a 92.5% probability that the Fed cuts in September and a total of 61bpsof cuts by the end of the year.

In truth, I was only partially joking at my surprise they didn’t call an emergency meeting and cut yesterday. While the market is only pricing a 6% chance of a cut at the end of this month, I think that is a pretty good bet. Speaking of bets, the trader(s) who established that big SOFR options position earlier in the week is set to have a really good weekend!

To recap, we’ve had the softest inflation reading in 4 years and the market is anticipating the end of higher for longer. As I have written consistently, my take is when the Fed starts cutting, the dollar will fall, commodity prices will rise, yields will start to decline, but if (when?) inflation reasserts itself, those yields will head higher. And finally, stocks are likely to see support, but a very good point was made today that if prices stop rising, then so to do profit margins at companies and profits in concert. Perhaps, slowing inflation is not so good for the stock market, even if it means that rates can be lowered. Ultimately, there is still a lot to learn, and this was just one number, but boy, is everyone excited!

Did the BOJ

Take advantage of the news

And sell more dollars?

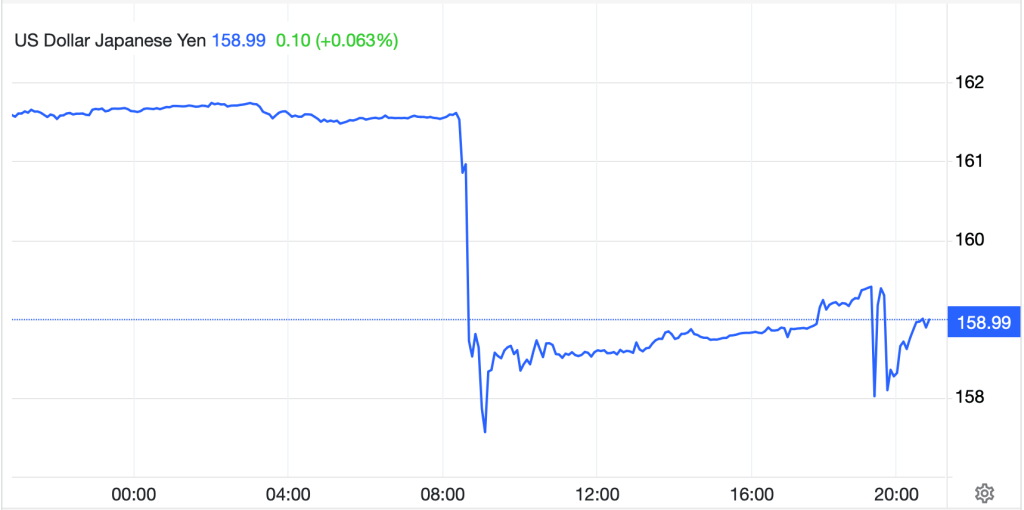

In the FX markets, the biggest mover, by far, was the yen, which at its high point of the session (dollar’s lows) had risen 4 full yen, or 2.5%. The move was virtually instantaneous as can be seen in the chart below, and it is for that reason that I do not believe the BOJ/MOF was involved in the market.

Source: tradingeconomics.com

While I understand that the BOJ is pretty good at their jobs, it seems highly unlikely that the MOF made a decision in seconds and was able to convey that decision to Ueda-san’s team to sell dollars. Rather, my sense is that since the short yen trade is so incredibly widespread as the yen has served as a funding currency for virtually every asset on the planet, the fact that the story about higher for longer may be ending led to instant algorithmic selling by hedge funds everywhere and a massive rally in the yen. When the MOF was asked about intervention, Kanda-san, the current Mr Yen, gave no hint they were in and said only that people will find out when they release their accounts at the end of the month, by which time this episode will have been forgotten. Remember, too, the yen has fallen, even after today’s rally, nearly 13% thus far in 2024. It needs to rally a great deal further before it has any macroeconomic impact on Japan’s economy. For my money, this was just a market that was caught long dollars and weak hands got stopped out, although Bloomberg is out with an article this morning claiming data showing it was intervention. One thing in favor of the intervention story, though, is that this morning, USDJPY is higher by 0.6% and pushing 160.00 again.

And lastly, the story in China

Continues to give Xi angina

Domestic demand

Is stuck in quicksand

So, trade is his only lifeline-a

The other story that is on market minds this morning is about the Chinese data that was released last night. The Trade Balance there expanded to $99B, much larger than last month and forecast. A deeper look also shows that not only did exports grow more than expected but imports actually declined. Declining imports are a sign of weak domestic demand, a harbinger of weak economic growth. Later, they released their monetary data showing that loan growth, along with M2 growth, continue to slide as Chinese companies are reluctant to take on debt to expand. While Xi’s government is pushing some money into the system, it is apparent that the collapsing property market remains a major obstacle to any sense of balanced economic activity in China.

Of course, this is a problem because of the international relation problems it continues to raise, notably with respect to charges of Chinese dumping of manufactured goods, and the proposed responses from both the US and EU on the subject. While my crystal ball is somewhat cloudy, when viewing potential future outcomes of this situation it seems increasingly likely that both the US, regardless of the election outcomes in November, and the EU are going to impose tariffs and other restrictions on Chinese goods, if not outright bans. Neither of these two can afford the social disruption that comes with domestic companies being forced out of business by subsidized Chinese competition. While inflation looks better this morning than it did last month, its future is far less certain given this growing political attitude.

Ok, let’s see how markets have behaved in the wake of all the new information. Arguably, the biggest surprise is that the US equity markets did not really have a good day with the NASDAQ tumbling -2.0% although the DJIA eked out a 0.1% gain. Given the yen’s strength, it is no surprise that the Nikkei (-2.5%) fell sharply, and given the Chinese trade data, it is no surprise that the Hang Seng (+2.6%) rallied sharply. But mainland shares were lackluster, and the rest of APAC was mixed with some gainers (Australia, India, New Zealand) and some laggards (South Korea, Taiwan, Malaysia). European bourses, though, are all in the green as traders and investors there look to the increased odds of the US finally cutting rates, therefore allowing the ECB and other central banks to do the same, as distinct positives. As to US futures, at this hour (7:00), they are unchanged to slightly higher.

In the bond market, after US yields fell sharply yesterday, with 10yr yields closing lower by 8bps, although they traded as low as 4.17%, a 12bp decline from the pre-data level, this morning, we are seeing a modest rebound with yields 1bp higher. European sovereign yields are all firmer this morning as well as markets there closed before the US yields started to creep back up. So, this morning’s 4bp-5bp moves are simply catching up to the US activity. Lastly, JGB yields dipped 2bps last night as traders sought comfort in the decline in US yields.

In the commodity markets, yesterday saw a sharp rally immediately after the CPI print with gold jumping nearly $40/oz and back above $2400/oz, while oil had a more gradual rise, although is higher by nearly $1/bbl since the release. This is all perfectly in line with the idea that the Fed is going to start to cut rates soon. However, gold (-0.4%) is giving back some of those gains today.

Finally, the dollar, which fell sharply against all currencies after the CPI print, notably against the yen, but also against the rest of the G10 and most EMG currencies, is slightly softer overall this morning with both the euro (+0.15%) and pound (+0.3%) doing well and offsetting the yen’s weakness this morning. Elsewhere throughout the G10 and EMG blocs the picture is far less consistent with CE4 currencies all following the euro higher although ZAR is unchanged as it suffers on gold’s weakness this morning.

On the data front, this morning brings PPI (exp 0.1% M/M, 2.3% Y/Y) and its core (0.2% M/M, 2.5% Y/Y) although given yesterday’s surprisingly low CPI data and the ensuing market movements, it doesn’t feel like this number has the potential for much surprise. After all, a soft reading would already be accounted for by the CPI and a strong one would be ignored. We also see Michigan Sentiment (exp 68.5) at 10:00, but that, too, seems unlikely to shake things up. There are no Fed speakers scheduled and really, the big thing today is likely to be the Q2 earnings releases from the big banks.

It has been an eventful week with Powell’s testimony being overshadowed by yesterday’s CPI data. While the market is almost fully priced for a September cut, I think the best risk reward is to expect the Fed to act at the end of July. Next week we hear from 10 Fed speakers, including Chairman Powell on Monday afternoon. I would not be surprised to hear them start to guide markets to a July cut which would bring dollar weakness alongside commodity price strength. As to bonds and equities, the former should do well to start, but as yesterday showed, and history has shown, equities tend to underperform when the Fed starts cutting rates.

Good luck and good weekend

Adf