The committee is not in a hurry

Said Jay, but the bulls needn’t worry

‘Cause Jay knows what’s what

And he can still cut

Quite quickly and watch the bears scurry

Meanwhile, at all ports in the east

The longshoremen’s working has ceased

With them now on strike

We could see a hike

In costs soon with ‘flation increased

“Overall, the economy is in solid shape; we intend to use our tools to keep it there. This is not a committee that feels like it’s in a hurry to cut rates quickly. Ultimately, we will be guided by the incoming data. And if the economy slows more than we expect, then we can cut faster. If it slows less than we expect, we can cut slower.”

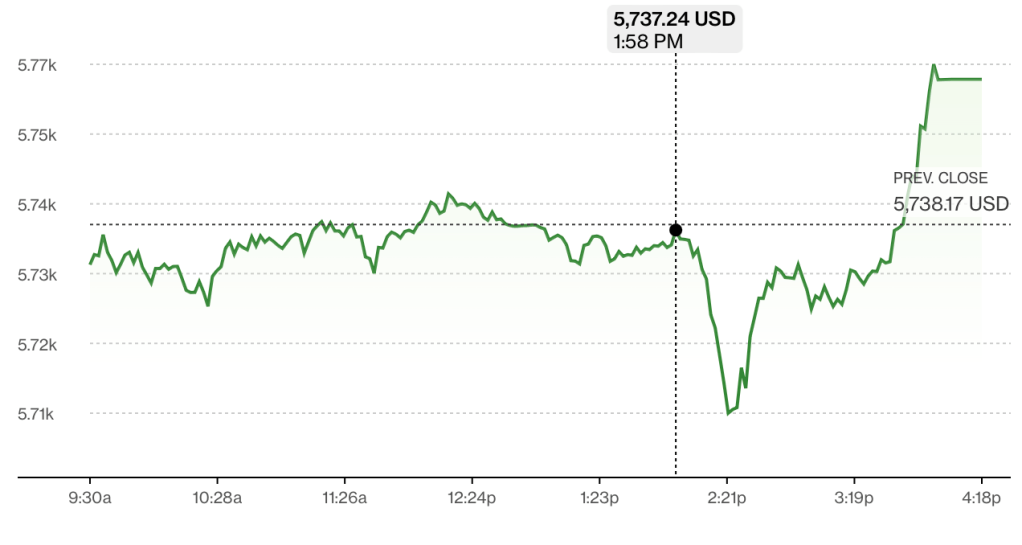

These were the key comments by Chairman Powell yesterday at the National Association for Business Economics annual meeting in Nashville. They were the very essence of the two-handed economist who explains both sides of an issue without drawing a conclusion. However, it appears what the market heard was ‘the Fed’s only going to cut 25bps at a clip going forward’. This was made evident by the fact that when he began speaking, we saw equity markets dip right away as per the chart below of the S&P 500, although as he continued, and made clear that they expected to continue to cut rates and support the economy, traders (and algorithms) decided things were fine.

Source: Bloomberg.com

We also heard from two other Fed members, Atlanta Fed president Bostic and Chicago Fed president Goolsbee, who both explained 50bps could well be the appropriate next move if things don’t follow their current script perfectly. Naturally, equity markets heard that news and were soothed, hence the result that all three major indices closed slightly higher on the day.

The other major story this morning is that the International Longshoreman’s Association, the union for dockworkers along the entire East Coast and Gulf of Mexico, have gone on strike as of midnight. They are demanding a 77% increase in wages over the next 6 years as well as promises about the speed with which further automation will occur in order to save jobs. While the Taft-Hartley act could be invoked by the president to force both sides back to the bargaining table and require the workers to get back on the job for the next 80 days, President Biden has chosen not to do so in an effort to polish his political bona fides with unions.

The ultimate impact of the strike will depend entirely on its length. This was not a surprise and many retailers and other importers pre-ordered inventory to tide them over as the holiday shopping season gets going. However, estimates range up to an economic cost of $5 billion per day for each day of the strike, and the longer it goes on, the bigger the problem because rescheduling once things are settled will be that much more complex. Regardless of the timing, though, one can be pretty certain that this will pressure prices higher as either shortages of certain items develop, or the wage gains result in higher shipping costs which will almost certainly be passed through the value chain.

Remember, while headline PCE fell to 2.2% last month, core remained at 2.7%. In the CPI readings, headline is still 2.5% with core at 3.2%, and perhaps more disconcertingly, median CPI at 4.2%. Powell’s decision to cut rates 50bps last month with GDP still growing at 3%, the Unemployment Rate at a still historically low level of 4.2% and inflation, whether measured as PCE or CPI well above 2.0% was quite aggressive. If this strike lasts a while, more than one week, expect to see price pressures begin to build again and that is going to put the Fed in a very difficult position.

One last thing to consider is the fact that virtually every major central bank around the world is in easing mode now that the Fed has begun to cut despite the fact that growth remains in decent shape in most places (Germany excepted). This morning’s Eurozone CPI data (1.8%, 2.7% core) was even softer than expected virtually guaranteeing more aggressive action by the ECB and of course the PBOC was hyperaggressive last week in their easing actions. Yesterday, Banxico indicated they may begin to cut more aggressively after having started their easing stance with 25bp cuts, as inflation in Mexico continues to decelerate to their target level of 3% +/- 1%. The point is that policy worldwide is easing, or even in the few places where it is not, e.g. Japan and Australia, they are not tightening at any great pace. The upshot is there is greater scope for a rebound in inflation while the dollar and other currencies continue to devalue vs. real items like commodities and real estate. That is another way of saying that prices in those two asset classes should continue to climb. As to the fiat currency world, relative values will depend on the pace with which individual nations ease, but they will all sink over time.

So, how have markets responded to the latest news? After the modest US gains yesterday, and remember China is closed all week, Japan (+1.9%) regained about half of Monday’s declines after Ishiba-san was officially named PM and he appointed and Abenomics veteran, Katsunobu Kato, as his FinMin, helping encourage the idea that the BOJ may not be quite as aggressive as previously thought. The rest of Asia saw more gainers than laggards with Taiwan (+0.75%) the next best performer and a mix otherwise. In Europe, the picture is mixed with some gainers (FTSE 100 +0.4%, DAX +0.3%) and some laggards (IBEX -0.6%, CAC -0.2%) after Manufacturing PMI data across the continent continued to show lackluster results with Germany falling even further to a reading of 40.6 although Spain’s reading jumped to 53.0. I must admit the stock market outcomes seem backward although I can understand the German view that the ECB will be more aggressive, thus supporting stocks, but why that is not helping Spain is a mystery. As to US futures, at this hour (7:20) only the DJIA (-0.35%) is showing any discernible movement.

In the bond market, after yields backed up 5bps yesterday over concerns that the Fed’s more aggressive stance would lead to inflation and the port strike would not help that situation, they are sliding this morning. Treasury yields, after touching 3.80% during yesterday’s session are down to 3.74% this morning and European sovereign yields have fallen even more sharply, between -7bps (Germany) and -12bps (France) as traders and investors become convinced that the ECB is going to become more aggressive in their easing. JGB yields also slid 1bp last night after Kato-san’s appointment.

It should be no surprise that metals prices are rebounding this morning given the decline in yields as well as the growing concerns over inflation. So, gold (+0.5%) is leading the way higher but the entire group is higher on the session. However, oil (-0.8%) remains under pressure as news of Israel’s ground incursion into Lebanon to root out Hezbollah seem to be ignored while news that Libya is getting set to restart production after a political settlement was reached there adds to the supply picture.

Finally, the real surprise is the dollar, which based on yields and metals would have been expected to continue sliding, but instead has rebounded sharply. In fact, yesterday, the DXY rallied virtually all day and that has continued this morning with the index now above 101.00. You may recall I highlighted that it was testing the 100 level which is seen as a key support. I guess there is no break coming today. This morning, the dollar’s move is universal, rising versus both the euro (-0.5%) and pound (-0.5%) as well as the rest of the G10 save the yen which is unchanged on the day. In fact, 0.5% is the magnitude of that move virtually all the other currencies in the bloc. As to the EMG bloc, these currencies have also suffered by -0.5% or so regardless of the region with the CE4 the worst performers, averaging -0.7%, while Asian currencies were down more on the order of -0.3% and LATAM -0.5%.

On the data front, ISM Manufacturing (exp 47.5) and JOLTS Job Openings (7.655M) are the main features and we hear from four more Fed speakers (Bostic, Cook, Barkin and Collins) before the day is done.

It is hard for me to look at the current situation without growing concern that the Fed is in the process of making a catastrophic error by easing policy into the base of an inflation cycle that just got more impetus from a key labor situation. In the end, it is not clear to me how the dollar will behave against other currencies in the short run, but I see only upside for commodity prices. If things do get ugly, the dollar will be seen as the best of a bad lot, and as commodity demand grows, so will demand for the greenback in order to buy those commodities, but this is not a positive story.

Good luck

Adf