In France, there’s a government mess

That lately’s been causing some stress

For French sovereign debt

With stocks under threat

Of further declines and duress

In one of the most colossal political blunders in recent memory, French President Emmanuel Macron completely misread the country and called a snap election after the European Parliament elections sent his party and allies to a significant defeat in June. In what should not have been a surprise to anyone, his party was decimated in the national election, although the results have been even more unfortunate for the people of France as they have basically left the nation without a working government. While there is currently a caretaker PM in place, Monsieur Barnier is almost certainly going to lose a no-confidence vote tomorrow as both the left and right express their displeasure at the situation.

Alas, the pattern we observe of late is that European citizens have been generally unhappy with the decisions made by their governments, with a universal issue being immigration policies, and when elections have been held, the parties in power have been shown the door. Or they would have been except that they are extremely reluctant to leave office and are willing to do anything at all, except work with the anti-immigration parties (typically on the right) to govern their nations. The result has been a series of election results with very weak minority governments and no power to do anything to help their citizens by addressing key issues. Budgets are a problem; massive debt loads are constraining and economic activity is shrinking.

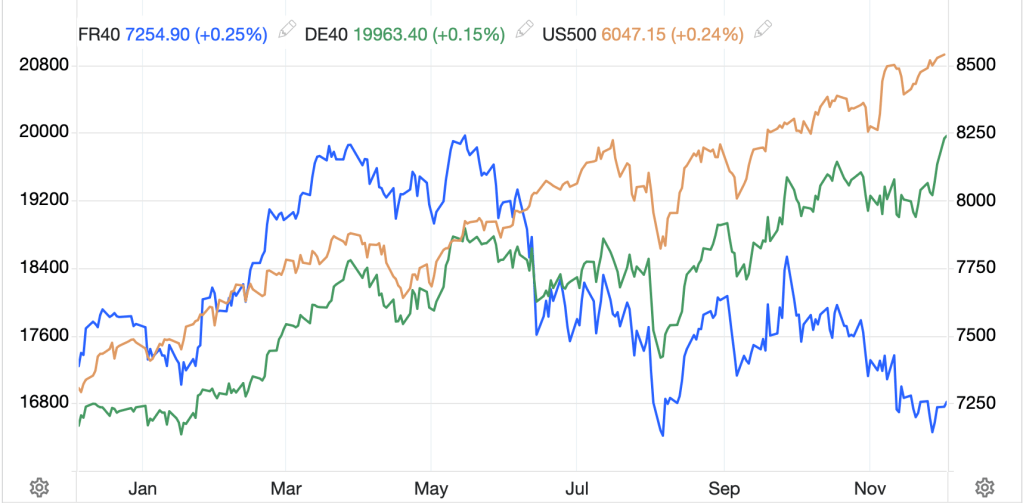

France is merely the current fracas although we have seen the same things occur in Germany, the Netherlands, Austria, Sweden and much of Eastern Europe. From our perspective, the issue here is what does it mean for the economic prospects of the euro (and other European currencies) and how might the ECB respond. Consider that as poorly as things are going in Germany, and they are really having a tough time, a quick look at the performance of the DAX and CAC (as well as the S&P 500) shows that France is really a laggard right now.

Source: tradingeconmics.com

Since the dip in the beginning of August, French equities are essentially unchanged while even German equities have risen 15% alongside their US brethren. During that same period, French 10-year yields have been rising relative to their German counterparts as fears over a French fiscal disaster rise. In fact, there is now discussion that the ECB will need to use their TPI program, originally designed to support Italian debt, to prevent the spread between French and German yields from widening too far.

If you were wondering why the euro has been having problems lately, this has clearly been a piece of the puzzle, and likely a key piece. While the single currency has rallied slightly this morning, up 0.2%, the below chart speaks volumes as to the direction of travel.

Source: tradingeconomics.com

While yesterday I explained why I thought over time the dollar might eventually decline, right now, I think we need to look for the euro to test parity and potentially go below for the first time since November 2022.

As well, there’s another key nation

That’s seeking its ‘nomic salvation

Their currency’s falling

As pundits are calling

For stimulus midst their frustration

This brings our attention to China, where next week, the Central Economic Work Conference will be held as President Xi tries to shake the nation out of its economic lethargy. There are high hopes for yet more stimulus despite the fact that the efforts so far have had a limited impact at best. Perhaps the Chinese problem can best be described as they produce far too many goods for their own consumption and so run large trade surpluses angering their trade partners. While President-elect Trump gets most of the press regarding his complaints about China’s economic behavior, it turns out that many countries around the world are pushing back. This morning’s WSJ had an article on this very issue and it seems possible that President Xi may find himself even more isolated on the issue than before.

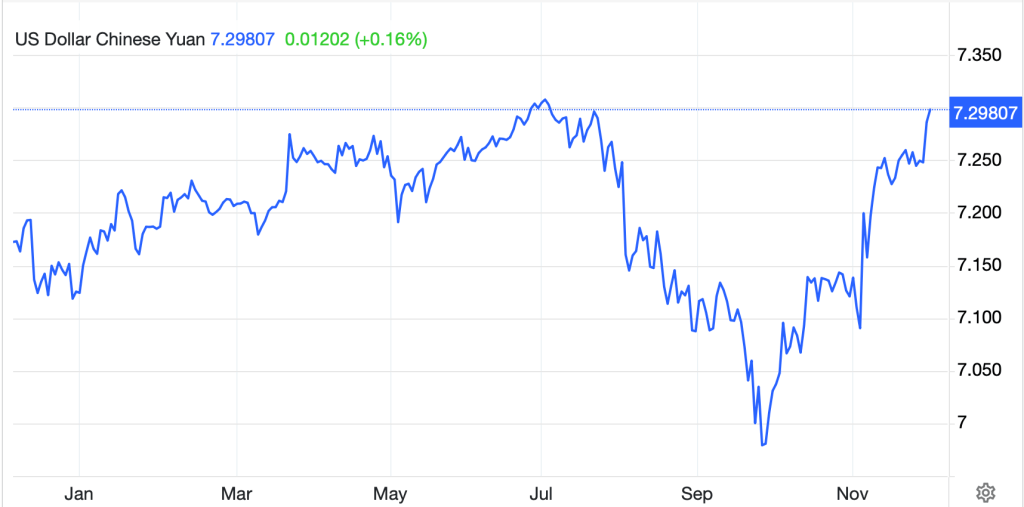

The natural solution is for China to consume more of what it produces, but that is far easier said than done, especially as the youth unemployment rate in China remains quite high, above 17%, while demographics continue to work against the country. Arguably, one way to solve this issue would be for the renminbi to strengthen dramatically, simultaneously increasing the price of Chinese exports, so likely reducing demand, while increasing demand for imports. Unfortunately, as can be seen below, the currency is moving in the opposite direction as the tariff threats from the US and elsewhere feed into the market psyche.

Source: tradingeconomics.com

It will be interesting to see if the PBOC is comfortable allowing the renminbi to weaken further. It is currently at its weakest point since July, but also at levels where historically, the PBOC has entered the market over the past several years to prevent further declines. With tariffs imminent, will this time be different?

Ok, let’s turn to the overnight market activity. Asian equity markets were all strong overnight led by Japan (+1.9%) although we saw gains throughout the region (Korea +1.9%, India +0.75%, Taiwan +1.3%). In China, Hong Kong (+1.1%) fared far better than the mainland (+0.1%) although both these markets closed well off early session lows after discussion of the economic conference and more subsidies made the rounds. In Europe, screens are green this morning as well, seemingly on growing hopes that the ECB will be cutting more aggressively as data there remains soft, and comments from Fed Governor Waller yesterday indicated he was on board with further cuts despite the current data showing solid performance. However, US futures are little changed at this hour (7:30) as focus begins to turn toward Friday’s NFP report.

In the bond markets, yields are edging higher with 10-year Treasuries up 2bps while most European sovereigns are higher by between 1bp and 3bps. France is an exception this morning as that TPI talk has traders thinking there will be a price insensitive bid for OATs soon.

In the commodity markets, oil (+1.2%) is rebounding nicely from yesterday’s selloff although continues to trade below that $70/bbl level. In the metals market, yesterday’s declines, which seemed to have been driven by the much stronger dollar, are being reversed in silver (+0.8%) and copper (+1.0%) although gold is essentially unchanged on the day.

Finally, the dollar, after a ripping rally yesterday, is backing off a bit, but not very much. In fact, there are a number of currencies which are still sliding somewhat, notably CNY (-0.2%) and SEK (-0.2%) with the only gainer of note this morning being CLP (+0.6%) as it follows the price of copper higher. Broadly speaking, the current setup remains quite positive for the dollar I believe.

On the data front, this morning brings only the JOLTS Job Openings report (exp 7.48M) and a bit more Fedspeak. Yesterday’s ISM data was stronger than expected but still, at 48.4, below the key 50.0 level indicating manufacturing is still in a funk. Perhaps better news was that the Prices Paid survey declined to 50.3, potentially indicating reduced inflation pressures.

While the market keenly awaits Chairman Powell’s speech on Wednesday as well as the NFP release on Friday, I sense that there is limited appetite to take on new positions. Implied volatility is climbing as uncertainty reigns over the market but has not yet reached extremely high levels. For hedgers, this is when options make the most sense.

Good luck

Adf