The scuttlebutt had it correct

Trudeau hit the button, eject

But he’s yet to leave

And there’s no reprieve

His legacy will be neglect

Those reports from yesterday morning were spot on as around 11:00am, PM Trudeau announced that he would, in fact, be stepping down. There is a somewhat convoluted process involved which sees the Canadian Parliament prorogued until late March, while the ruling Liberal party seeks a new leader. At that point, Parliament will be called back into session, and it seems likely a vote of no confidence will be held. Assuming that vote goes against the new leader, an election will be called. No matter how long the Liberals delay this process, and you can bet they will hang on for as long as possible, by October, an election is required. As well, currently all things point to the Conservative party led by Pierre Poilievre winning that election and taking power with a significant majority. Obviously, Poilievre would like the election to happen sooner, rather than later, but it seems hard to believe now, regardless of the new Liberal leader, that the Conservatives will fail to win.

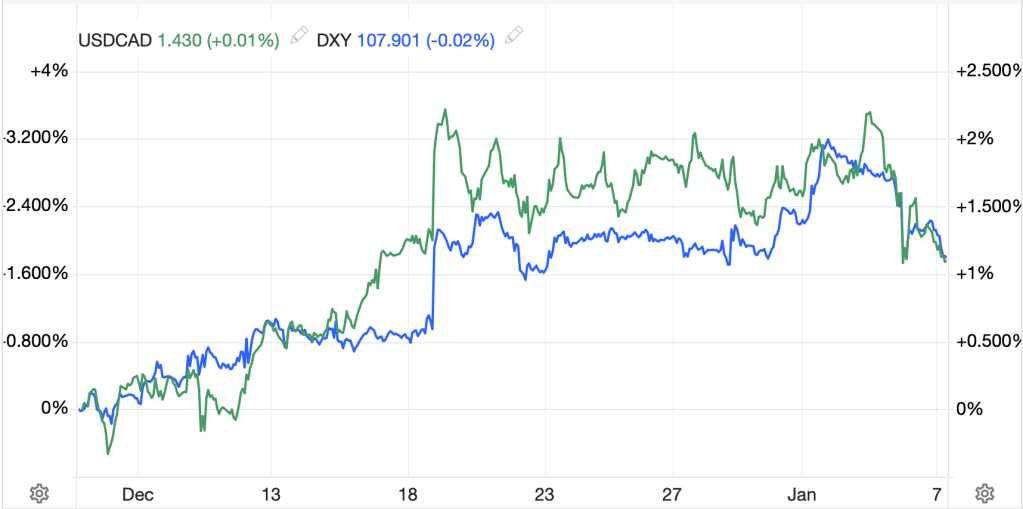

The market impact of this news needs to be separated from the broader drivers, but as I showed yesterday, CAD had been weakening more quickly than the dollar writ large, and now it seems to be moving back into line with the general movement as per the below chart showing the movements between the DXY and USDCAD right on top of each other.

Source: tradingeconomics.com

My sense is that Canada has now had its day in the sun and will soon retreat to the background of most market consciousness going forward. After all, despite it being our largest trading counterparty, it has a small population and small economy with limited impact on the global situation.

Certification’s complete

And Trump, in two weeks, takes his seat

Between now and then

Again and again

Prepare for a surfeit of Tweet(s)

In truth, aside from the Canadian story, the bulk of the discussion in both financial and political circles is focused on exactly what President Trump will do when he is inaugurated on the 20th. The biggest financial discussion revolves around tariffs and exactly how he plans to utilize them going forward. For the surface thinkers, tariffs are an unadulterated bad policy with significant negative consequences. As well, the idea that tariffs = higher dollar is axiomatic to these people. In fact, yesterday’s reversal in the dollar’s recent substantial gains was based entirely on a story that despite some campaign rhetoric of large tariffs imposed on Day 1 of the new Trump administration, in fact things would be far more nuanced.

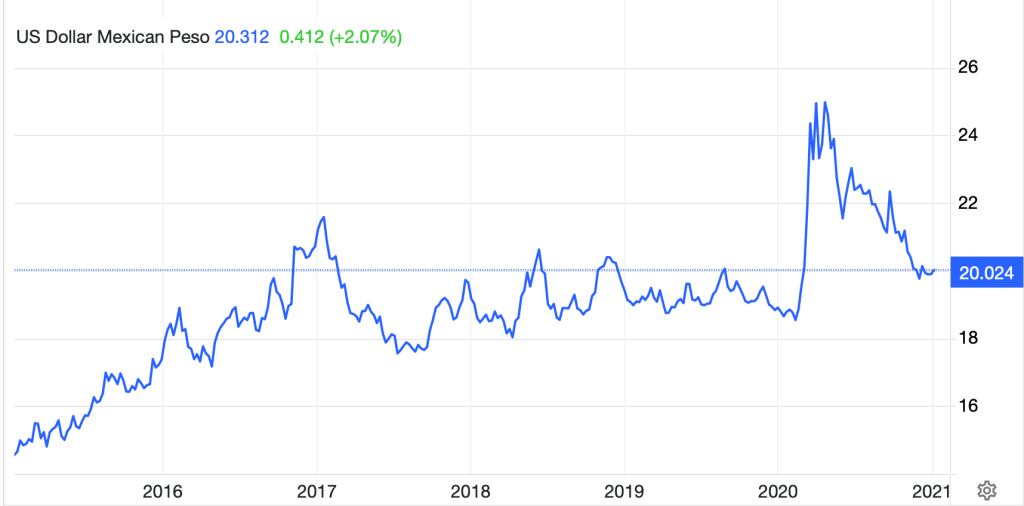

While I understand the economic case behind tariffs driving the dollar higher (nations hit with tariffs will devalue their currency sufficiently to offset the tariff and allow their exports to remain competitive in the US), I have always been suspect of that theory and logic. First, we can look at Trump’s first term and see how things played out. The chart below of USDMXN, a tariff target, shows that, in fact, initially the peso strengthened upon Trump’s inauguration and range traded for the bulk of his term, only weakening substantially during the Covid market dislocations.

Source: tradingeconomics.com

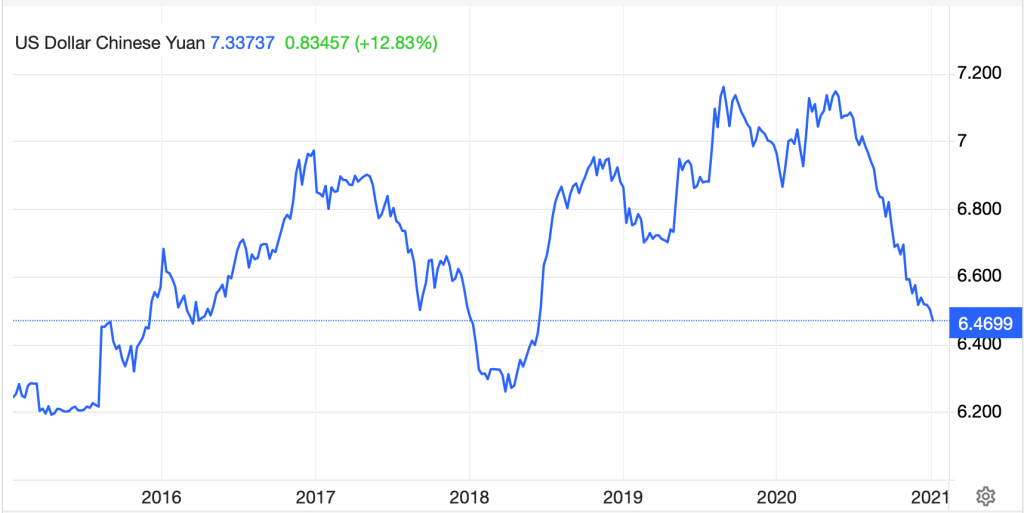

We can look at USDCNY as well and see that over Trump’s first term, there were several large ebbs and flows in the yuan but that, in fact, CNY was stronger vs. the dollar at the end of his term than at the beginning. Again, this assumption the dollar will appreciate strongly because of tariffs is a talking point, not an empirical reality.

Source: tradingeconomics.com

The other thing to remember about Trump (although it is not clear how you can forget it) is that he is a businessman, not a politician. He is very transactional and wants to make deals. I am a strong proponent of the idea that Trump sees tariffs as a negotiating tool and while he is a man of great bluster in his public pronouncements, his ultimate goal remains clearly to achieve his sense of fairness in trade relations. If his belief is that a nation is maintaining a weak currency to enhance its mercantilist model, Trump will respond aggressively. Ultimately, I believe a large part of the angst that is evident in governments around the world is that Trump will not behave in a diplomatic manner and will call out all the problems he sees or believes. And other governments are uncomfortable with their own dirty laundry left to air dry. While I continue to believe that inflation remains far stickier than the Fed is willing to admit now, nothing has changed my view that the Fed will not cut again and may be forced to raise rates before the year ends. And that will support the dollar!

Ok, let’s turn to the overnight session. After a mixed Wall Street performance, where the Mag7 continue to shine, but not so much else, we saw the Nikkei (+2.0%) rally sharply as well, following the NASDAQ. Chinese shares (CSI 300 +0.7%, Hang Seng -1.2%) were split with the former benefitting from the reduced tariff story while the Hang Seng suffered largely on the back of Tencent Holdings being named a military contractor by the US DOD with its shares tumbling 8% in the US and HK. Elsewhere in the region, there were both gainers and laggards but nothing of any note in either direction. In Europe, UK shares (-0.3%) are under pressure as 30yr Gilt yields have risen to their highest level since 1998, an indication that investors are becoming concerned over the UK’s future path. For context, current levels are 50bps above those which triggered the October 2022 gilt crisis and spelled the end of PM Liz Truss’s time in office. Meanwhile, continental bourses are modestly higher led by the CAC (+0.6%) which seems to be benefitting from both the lower tariff story as well as hopes that Chinese stimulus will support the luxury goods sector. As to US futures, at this hour (7:05) they are essentially unchanged.

In the bond market, yields are continuing to edge higher everywhere with Treasuries up 1bp and European sovereign yields higher by between 2bps and 4bps across the board. Asian government bond markets continue to sell off as well, with yields there climbing in Japan and Australia and even Chinese 10yr yields edging higher by 1bp. As long as central banks around the world insist that rate cuts are the future (and most of them do) look for bond yields to continue to climb.

In the commodity space, oil (+0.8%) continues to hold its own as trading activity remains modest and hopes are pinned on Chinese stimulus. NatGas (-3.2%) is backing off its highs as the winter storm has passed (although it is still really cold here!) while the metals markets are performing well. Gold (+0.5%) continues to trade either side of $2650/oz as speculators await the next major leg. However, silver (+1.1%) and copper (+0.5%) have both bounced nicely from recent lows as specs look for another breakout higher.

Finally, the dollar is under modest pressure this morning compared to yesterday’s closing levels but is actually slightly firmer than when I wrote yesterday morning. My point is that while it has been selling off from its peak late last week, there is no collapse coming and all eyes will be turning toward the data later this week to see if the Fed will have room to ease further, or if the NFP report will once again show strength and push any further rate cuts off in time. The leading gainer in the G10 is NZD (+0.65%) which is benefitting from a combination of higher commodity prices, hopes for more Chinese stim and the tariff reduction story. But for the rest of the market, 0.2% gains are the norm with only JPY (-0.15%) bucking the trend.

On the data front, this morning brings the Trade Balance (exp -$78.0B) as well as ISM Services (53.3) and JOLTS Job Openings (7.70M). Yesterday’s PMI data while solid was softer than forecast and Factory Orders, too, were a tick lower than expected at -0.4%. First thing this morning we will hear from Richmond Fed president Barkin who has been on the more hawkish side lately. After the weekend chorus that cuts needed to be deliberate, I expect more of the same here.

For now, the broad themes remain unchanged, higher US yields on the back of inflation concerns forcing the Fed to reverse course this year. But on a day-to-day basis, it would not be surprising to see the dollar continue to give back some of its recent gains given the significant size and speed with which they were attained. I still like hedgers picking levels and leaving orders to buy dollars a bit cheaper from here.

Good luck

Adf