Said Bessent, when speaking of rates

The 10-year yield’s what dominates

Our focus and goals

As that’s what controls

Most mortgages here in the States

Remember, our goal’s three-three-three

With job one on deficits key

So, that’s why we’ll slash

The wasting of cash

With tax cuts set permanently

There is a new voice in Washington that matters to Wall Street, that of the new Treasury Secretary Scott Bessent. Yesterday in his first significant comments since his swearing-in, he made very clear that he and the president were far more focused on the 10-year Treasury yield, and driving that lower, than they were concerned over the Fed funds rate. Talk about a different focus than the last administration! At any rate, he expounded on his views as to how that can be achieved, namely lower energy prices and a reduced budget deficit alongside deregulation. Recall, his three-three-three plan is 3% budget deficit, 3mm barrels of oil/day additional supply and 3% GDP growth. Clearly, this is a tall order given the starting point, but he has not shied away from these goals and insists they are achievable.

Yesterday also brought the Quarterly Refunding Announcement, the Treasury’s announced borrowing schedule for the current quarter. Under then-Secretary Yellen, the US shifted its borrowing to a much greater percentage of short-term T-bills (<1-year maturity) while avoiding the sale of longer date notes and bonds. This is something which Bessent has consistently explained his predecessor screwed up given her unwillingness to term out more debt when the entire interest rate structure was much lower. After all, homeowners were smart enough to refinance down to 3% fixed rate mortgages, but the Treasury secretary thought it was a better idea to stay short.

Of course, changing the current treasury mix is one of the impediments to lower 10-year yields because changing it would require an increase in the sale of longer dated paper which would depress the price and raise those yields. Bessent has his work cut out for him. However, my take is this is a goal, but one that will be achieved gradually. He even commented that until the debt ceiling is raised, there will be no changes in the debt mix. Arguably, if the administration can make real progress on reducing the budget deficit, that is what will allow for the gradual adjustment of the debt mix without a dramatic rise in long-term yields.

Perhaps it is still the honeymoon period, but the market is showing some deference to Mr Bessent as 10-year yields have fallen steadily in the past two weeks, dropping from a high of 4.81% the week before the inauguration to their current level at 4.44%.

Source: tradingeconomics.com

While we cannot attribute the entire move to Bessent, certainly investors are showing at least a little love at this stage. I believe the 10-year yield will grow in importance for all markets as movement there will be seen as the report card for Bessent and this administration’s goals.

Meanwhile, in the UK, stagflation

Is now the Old Lady’s vexation

But cut rates, they will

Lest growth they do kill

As prices continue dilation

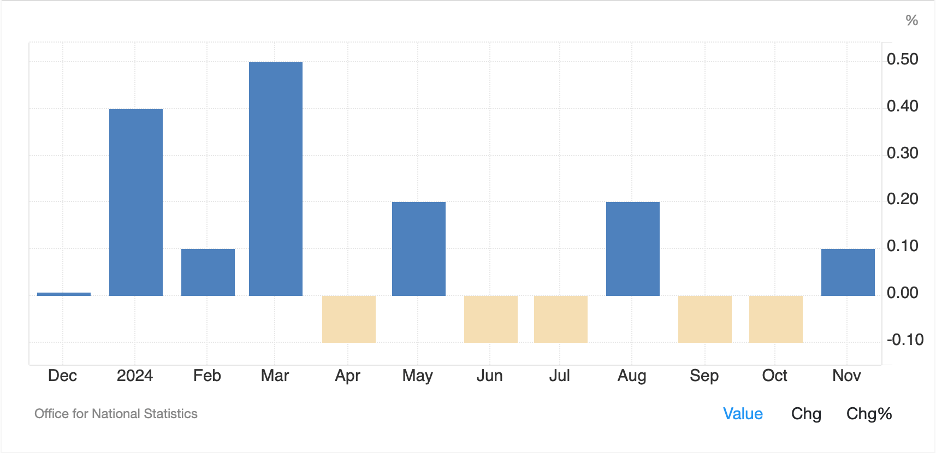

The BOE is currently meeting, and expectations are nearly universal that they will cut their base rate by 25bps to 4.50% with 8 of the 9 MPC members set to vote that way. The only hawk on the committee, Catherine Mann, is expected to vote for no change. The problem they have (well the problem regarding monetary policy, there are many problems extant in the UK right now) is that core inflation continues to run above 3.0% while GDP is growing at approximately 0.0% in recent quarters and at 1.0% in the past year. A quick look at the monthly GDP readings below shows that things have not been moving along very well, certainly not since PM Starmer’s election in July.

Source: tradingeconomics.com

In stagflationary environments, the most successful central bank responses have been to kill the inflation and suffer the consequences of the inevitable recession first, allowing growth to resume under better circumstances. Of course, Paul Volcker is most famous for this model, which he derived after numerous other countries, notably the UK, failed to effectively solve the problem in the mid 1970’s in the wake of the first oil price shocks. Now, the UK has created its own energy price supply shock via its insane efforts to wean itself from fossil fuels without adequate alternate supplies of energy, and stagflation is the natural result. However, addressing inflation does not appear to be the primary focus of the Bank of England right now. I am skeptical that they will be successful in achieving their goals which is one of the key reasons I dislike the pound over time.

Ok, let’s turn to market activity overnight. The party continues on Wall Street with yesterday’s equity gains attributed to many things, perhaps Bessent’s comments being amongst the drivers. Certainly, a reduced budget deficit and reduced 10-year yields are likely to help the market overall. That attitude has been uniform overnight and through the morning session with every major Asian market (Japan, +0.6%, Hong Kong +1.4%, China +1.3%) and European market (Germany +0.8%, France +0.8%, UK +1.45%) higher on the session. As it happens, the BOE did cut rates by 25bps as expected and now we await Governor Bailey’s comments. As to US futures, at this hour (7:25) they are little changed on the session.

In the bond market, the ongoing rally has stalled for now with Treasury yields higher by 2bps this morning while most European sovereign yields are little changed on the day. A key piece of information that is set to be released tomorrow comes from the ECB as their economists are going to report the ECB’s estimate of where the neutral rate lies in Europe. With the deposit rate there down to 2.75%, many pundits, and ECB speakers, are targeting 2.0% as the proper level implying more rate cuts to come.

In the commodity markets, oil (+0.65%) is bouncing off its recent trading lows but in truth, a look at the chart and one is hard-pressed to discern an overall direction. More choppiness seems likely as the market tries to absorb the latest information from the Trump administration and its plans.

Source: tradingeconomics.com

As to the metals markets, gold, which had a strong rally yesterday and made further new all-time highs, is unchanged this morning while silver (-0.75%) consolidates its recent gains and copper (+0.6%) adds to its gains. The thing about copper is it is, allegedly, a good prognosticator of economic activity as it is so widely used in industry and construction, and it has been rallying sharply for the past month. That does seem to bode well for future activity.

Finally, the dollar is firmer this morning, recouping some of its recent losses although I would contend we have merely been consolidating after a sharp move higher during the past three months. The pound (-1.0%) is today’s laggard after the rate cut but we are seeing weakness almost everywhere in both G10 and EMG currencies. One exception is the yen (+0.2%) which seems to be benefitting from comments by former BOJ Governor Kuroda that the BOJ is likely to raise rates above 1.0% during the coming year. Interestingly, he explained that given the recent economic trajectory, it was only natural that the BOJ would seek to normalize rates. However, given that interest rates in Japan have been 0.5% or below for the past 30 years, wouldn’t that be considered normal these days? Just sayin’!

On the data front, with the BOE out of the way, we now get the weekly Initial (exp 213K) and Continuing (1870K) Claims data as well as Nonfarm Productivity (1.4%) and Unit Labor Costs (3.4%). Yesterday’s ADP Employment data was much stronger than expected with a revision higher to last month as well, certainly a positive for the job outlook. As well, this afternoon we hear from three more Fed speakers, but so far this week, the word caution has been the most frequently used noun in their vocabulary. Of course, with Mr Bessent now starting to make his views known, perhaps more focus will turn there and away from the Fed for a while.

Market participants are clearly feeling pretty good right now, especially about the recent activity in the US. I think you have to like US assets, both stocks and bonds, while expecting the dollar to continue to hold its ground. This sounds like a recipe for weaker commodity prices, notably gold, but so far, that has not been the case.

Good luck

Adf