Seems Europe is having a fit

‘Cause Putin and Trump may submit

A plan for the peace

Where there’s an increase

In spending the Euros commit

Remarkably, though peace would seem

The basis of many a dream

Seems many despise

The fact that these guys

Don’t care Europe can’t stand this scheme

Here’s the thing about President Trump, you never know what he is going to do and how it is going to impact market behavior. A case in point is the growing momentum for further peace negotiations between the US and Russia, with Ukraine basically going to be told how things are going to wind up. On the one hand, you can understand Ukraine’s discomfort as they don’t feel like they are getting much say in the matter. On the other hand, it seemed increasingly clear that the end game, if there is no US intervention of this nature, would be for Russia to bleed Ukraine of its fighting age population while systematically destroying its infrastructure.

The thing I find most remarkable is the number of pundits who hate this outcome despite the end result of the cessation of the fighting and destruction. After three years of conflict, and with other nations willing to allow Ukrainians to die on the front lines while they preened about saving democracy, there was no serious push to find a solution. I have no strong opinion on the terms that have been floated thus far, and I don’t believe rewarding a nation for aggressive action is the best outcome, but Russia has proven throughout history that they are willing to sacrifice millions of their own citizens in warfare, and the case for a Ukrainian victory seemed remote at best. As experienced traders well understand, sometimes you have to cut your position so you can focus on something else. Seems like a good time to cut the positions here.

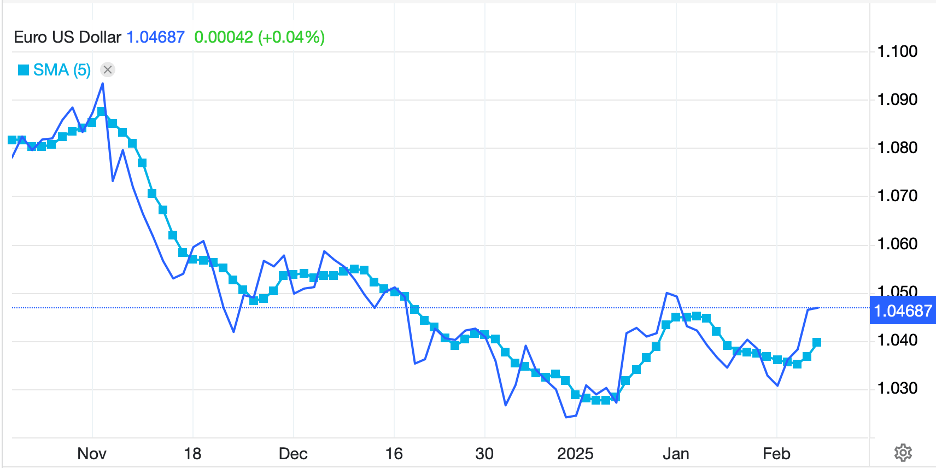

Speaking of positions, let us consider what peace in Europe may mean for financial markets. Yesterday I discussed how European NatGas prices have more than doubled since the war began. If they return to their pre-war levels, that dramatically enhances Europe’s economic prospects, despite their ongoing climate policies. Clearly, the FX market got that memo as the euro has rallied back to its highest level since December 2024 save for a one-day spike just after Trump’s inauguration. In fact, it is not hard to look at the chart below and see a bottom forming in the single currency. While the moving average I have included is only a short-term, 5-day version, you have to start somewhere. While the fundamentals still seem to point to further downside in the single currency, between the Fed’s pause and more hawkish stance opposite the ECB’s ongoing policy ease, the medium-term picture could be far better for the Europeans. If the war truly does end, it would likely see a significant uptick in investment and economic activity as they seek to rebuild Ukraine, and we could see substantial capital flows into the European economies.

Source: tradingeconomics.com

As well, oil prices, continue to trade near the bottom of their recent trading range as the working assumption seems to be that with a peace treaty, Russian oil would no longer be sanctioned, enhancing global supplies. A look at the trend line in the chart below seems to indicate that is the direction of the future.

Source: tradingeconomics.com

The other remarkable thing is the decline in yields, where yesterday, despite a very hot PPI number, which followed Wednesday’s hot CPI number, Treasury yields fell back 7bps. While there are likely some other aspects to this move, notably the ongoing story regarding DOGE and the attack on waste and fraud in the US, yesterday’s move was not indicative of fear, rather I read it as a positive sign that investors are betting on a chance that President Trump can be successful with respect to reducing the massive overspending by the government. Clearly, this is early days regarding President Trump’s ability to get a handle on spending, and it could all blow up as legislative compromises may significantly water down any benefits, but I contend the market is showing hope right now, not fear.

And that, I would contend, is the big underlying driver of markets right now. The prospects for peace and the potential impacts are the focus. While tariffs are still a big deal, and yesterday’s talk about reciprocal tariffs is simply the latest in a long line of these discussions and pronouncements, the market seems to be getting tired of that conversation. If we recap the current situation, central bank activities have lost their importance amid a huge uptick in governmental actions, both fiscal and geopolitical. In many ways, I think this is great, the less central bank, the better.

Ok, let’s see how markets continue to absorb these daily haymakers from President Trump and the responses from other governments. Clearly, the US equity market remains far more fixated on Trump’s actions than on higher inflation potentially forcing the Fed to raise rates. In fact, despite the hot PPI print, the futures market has actually increased its expectation for rate cuts this year to 35bps. That doesn’t make sense to me, but I’m just an FX poet.

If we turn to Asian markets, Hong Kong (+3.7%) was the big winner overnight as a combination of growing expectations for more Chinese government stimulus to be announced soon, along with the ongoing tech positivity in the wake of the DeepSeek announcement got investors excited. On the mainland, shares (CSI 300 +0.9%) were also higher, but not as frothy. Meanwhile, the weaker dollar hindered the Nikkei (-0.8%) as the yen has gained 1.3% since the CPI data on Wednesday. In Europe, the picture is mixed with the CAC (+0.4%) the best performer and the DAX (-0.4%) the worst performer. Eurozone GDP surprised on the upside in Q4, growing…0.1%!! Talk about an explosive economy. However, that was better than forecast and helped avoid a recession. The interesting thing about European equity markets, though, is that despite a dismal economic backdrop, most major markets are trading at or near all-time highs. Further proof that the market is not the economy. As to US futures, ahead of this morning’s Retail Sales data, they are flat.

After several days of substantial movement in the bond market, it seems that traders have taken a long weekend given the virtual absence of movement here. Treasury yields are unchanged on the day and European sovereign yields are higher by 1bp.

In the commodity markets, on the day, oil prices are unchanged, although as per the above chart, it appears the trend is lower. US NatGas (+1.8%) is rallying on forecasts for another cold spell, but European NatGas (-4.85%) continues to fall as prospects for peace indicate new supplies, or perhaps, renewed supplies. In the metals markets, gold (+0.15%) is continuing its positive momentum but the big mover today is silver (+2.7%) which seems to be responding to some large option expirations in the SLV ETF (h/t Alyosha) which seem set to drive substantial demand for delivery.

Finally, the dollar remains under pressure overall, although the movement has generally not been that large today. The big outlier in the G10 is NZD (+0.9%) which has responded to the delay in the reciprocal tariff implementation until April. Elsewhere in this bloc, gains are universal, but modest with movement between just 0.1% and 0.2%. In the EMG bloc, the dollar is also under pressure with ZAR (+0.65%) a major gainer as precious metals continue to be in demand. CLP (+1.15%) is also continuing to benefit from copper’s ongoing rally. The exception to this movement has been Asia where most regional currencies are modestly softer this morning, KRW, TWD, INR, as the tariff talks still seem to be the driving force in these markets.

On the data front, we finish the week with Retail Sales (exp -0.1%, +0.3% ex autos), then IP (0.3%) and Capacity Utilization (77.7%). Yesterday’s PPI data was several ticks hotter than forecast and seems to put paid to the idea that inflation is heading back to the Fed’s target. This afternoon we hear from Dallas Fed president Lorrie Logan, but again, it is hard to make the case that the Fed is the driver of anything right now.

Fundamentals still point to dollar strength, I would argue, but the market is not paying attention. Rather peace and the peace dividend are now the driver in the FX markets and to me, that implies we are set to see the dollar give back some of its gains from the past 6 months.

Good luck and good weekend

Adf