Give plaudits to President Xi

Who’s trying to show it is he

That’s offering deals

To help grease the wheels

Of trade, which he claims will be free

The problem is Chinese consumers

Have not been in very good humors

And history shows

The Chinese impose

Restrictions that are aren’t just rumors

Market activity can well be described as lackluster, with equity indices generally slipping lower while bond markets wobble and the dollar retraces some of its recent losses. In fact, the only markets really showing a trend right now are gold (+0.4%), silver (-0.1%) and copper (-0.2%), all of which have rallied sharply over the past month and year. Obviously, the major discussion point is President Trump’s tariff policy and how that will impact economies around the world. Recent focus has been on how other nations will respond with a variety of poses taken by different leaders, from conciliatory to combative.

So, it is with great interest that we see another impact of the Trump administration, the sight of China’s communist party leader, Xi Jinping, trying to convince foreign company CEO’s that investing in China is a good deal. A lead article in Bloomberg this morning describes a large gathering in China where President Xi hosted CEO’s of numerous companies from around the world in an effort to portray China’s policies as investment friendly.

This makes sense given the trend in foreign direct investment toward China over the past years. As can be seen in the chart below from the Bloomberg article, it has not been a pretty sight. And remember, this all occurred before President Trump was elected. Clearly, there were concerns prior to Mr Trump escalating the trade conflicts with the US.

I find it somewhat ironic, though, that Xi is trying to promote Chinese policy as an island of stability in the world. Consider how he has capriciously destroyed the private education market, or even the tech market until reversing course after the DeepSeek announcement, all while the housing market continues to implode. Given the rest of the world has lost patience with China’s mercantilist policies and the flood of cheap goods they produce with government support, I am at a loss to understand the appeal of investing in China. Using it as an export base is a nonstarter, and history has shown that nearly every foreign company that looked at China’s population as a great untapped market for their products has been hugely disappointed. The exceptions are the luxury goods makers, where the global brand and cachet were too strong for domestic competitors to overcome. But that is a small segment of the market.

Instead, the usual outcome is forced technology transfer which results in a state-supported competitor for their products around the rest of the world. I am confident there will be companies that choose to invest, if for no other reason than to curry favor with Xi and open the doors to further potential sales, but the trend of late is not promising. Ultimately, property laws and their enforcement are the keystone for inward investment into any nation and China has no history of treating foreign companies fairly, or domestic ones for that matter.

But really, the flow of direct market news and economic data has been secondary with far more political news leading conversations. The impact of tariffs on economic activity and inflation, as well as on market performance remains unclear with arguments being made on both sides as to potential benefits or detriments. FWIW, which is probably not much, my take is the impacts will be very unevenly spread, and how that impacts broad based numbers is unknowable at this time. I fear we will all need to be reactive for now, although for those with outstanding exposures, there is no better argument for maintaining robust hedge ratios given the overall uncertainty.

Ok, let’s take a look at the overnight action in markets. After yesterday’s US declines, we saw much of Asia follow suit with Tokyo (-1.8%) particularly hard hit as PM Ishiba thought that he was making headway with President Trump but found out that Japanese auto manufacturers were going to be subject to those tariffs as well. Adding to the pressure were the “Minutes” from the last BOJ meeting which implied further rate hikes are on the horizon. Both Hong Kong (-0.65%) and China (-0.45%) also slipped and, in fact, almost every major market in Asia (Korea, India, Taiwan, Malaysia, Singapore and Thailand) also fell, some quite sharply. Apparently, Xi’s efforts at creating that stability haven’t yet been successful.

In Europe, red is also the dominant color with most continental bourses lower by around -0.6%, also on the tariff story. The one exception here is the UK, which released a passel of data showing growth was modestly firmer than expected at 1.5% led by Retail Sales growing 1.0%, rather than declining by -0.3% as expected. As to US futures, at this hour (7:15) they are pointing slightly lower, about -0.2%.

In the bond market, yields are backing off around the world with Treasuries (-3bps) lagging European price action where sovereigns have seen yields decline between -4bps and -6bps. Even JGB yields have slipped -4bps. In Europe, inflation data from France and Spain came in softer than expected which has encouraged the move there, and we even heard arch ECB hawk, Robert Holzmann, explain that funding defense spending via bond purchases (i.e. QE) was viable.

In the commodity markets, oil (-0.2%) which rallied yesterday to touch the elusive $70/bbl level is slipping back a bit, but the trend remains clearly higher as per the below.

Source: tradingeconomics.com

Finally, in the currency markets, the dollar is firmer once again with modest rallies vs. the euro (-0.3%) and pound (-0.2%) as well as strength against the Scandies (SEK -0.6%, NOK -0.3%). However, the picture in the EMG bloc is more mixed with ZAR (+0.35%) showing strength alongside gold’s rally, and INR (+0.2%) bucking the trend after having agreed to reduce tariffs on US products. Throughout the rest of the bloc, there has been generally little change.

Turning to the data this morning, there is plenty that will be keenly watched. Personal Income (exp 0.4%), Personal Spending (0.5%) and the PCE data (headline 0.3%, 2.5% Y/Y and core 0.3%, 2.7% Y/Y) all get released at 8:30. Then at 10:00 we see Michigan Sentiment (57.9) and you can be sure people will be talking about the Inflation Expectations piece (1yr 4.9%, 5yr 3.9%), especially if it syncs with their narrative. There are two more Fed speakers, Governor Barr and Atlanta Fed president Bostic, but nothing any Fed speaker has uttered has mattered at all, maybe since Trump was inaugurated.

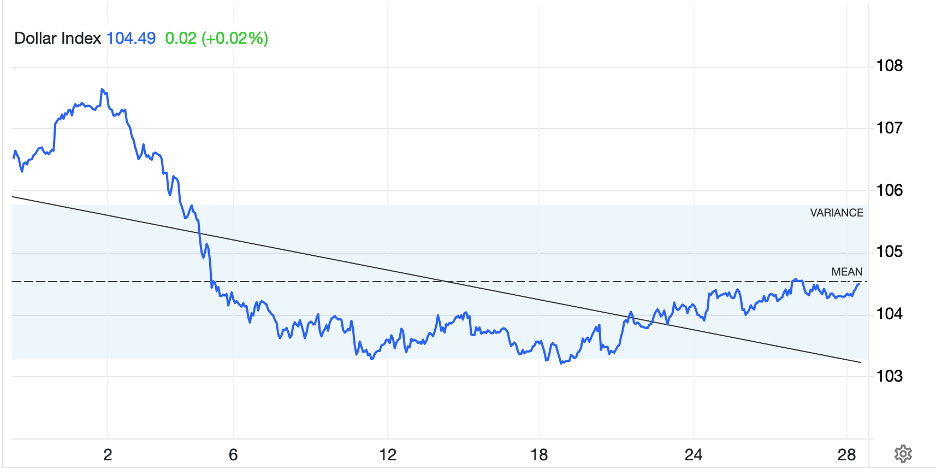

My read on overall sentiment is that investors are wary of the future, but not yet ready to abandon the stocks only go up narrative. Regarding the dollar, the recent trend remains modestly lower, as per the below, but it is hard to get excited about large moves, at least for today. Again, Trump clearly wants it lower and seems likely to get his way, at least to some extent. The one thing I truly do like is commodities, which I believe will remain well bid overall.

Source: tradingeconomics.com

Good luck and good weekend

Adf