The trends in the market of late

Continue, and there’s no debate

The dollar keeps falling

With stocks, downward, crawling

While gold never has looked so great

The latest concerns are that Trump

Chair Powell, is looking to dump

The narrative shows

That if Powell goes

That Treasuries clearly will slump

Europe remains closed today for its Easter Monday holiday, as was Hong Kong last night, but the rest of Asia and the US are open. With that in mind, though, I’m guessing there are many who would prefer markets to remain closed given the price action. At least those who remain invested in the US as equity futures are pointing lower, yet again, this morning, with all three major indices down by about -1.0% at this hour (6:00). But really, the market story that is atop the headlines today is the dollar and its continued weakening. Since President Trump’s inauguration, so basically in the past three months, the euro (+1.3% today) has climbed about 11% as you can see in the chart below.

Source: tradingeconomics.com

While that is not an unprecedented move, it is certainly swift in the world of foreign exchange. Of course, it is important to remember that the current level, and higher levels, were extant for more than a year (July 2020 – November 2021) not all that long ago. My point is perspective is key, and while the dollar has been declining sharply of late, this is not unexplored territory. In fact, stepping back a bit, as I’ve shown before, the euro remains in the lowest quartile of its value over the past twenty years.

Source: finance.yahoo.com

One of the interesting ways in which the narrative has changed has been that prior to the imposition of tariffs by President Trump, when they were only threatened, the economic intelligentsia were convinced that the only outcome would be other currencies declining in value sufficiently to offset the tariff, thus a stronger dollar with the end result that US exports would no longer be competitive. Now those same analysts are explaining that the weaker dollar is a problem because imports will be more expensive, thus raising the inflation rate.

However, the lesson I have learned throughout my career is that movement in the dollar, while important on a very micro level for businesses and foreign earnings calculations, is rarely a driver of any macroeconomic trend. In fact, it is a response. Other things happen and the dollar adjusts based on the flows that occur. While theoretically, at the margin, a weaker dollar will tend to result in higher import prices, and ceteris paribus, that would feed through to the inflation rate, no ceteris is paribus these days. For one thing, oil prices are lower by nearly 18% since the inauguration and oil prices have a far larger impact on inflation than does the value of the dollar. My point is that neither the dollar’s level nor the fact that it is declining is a sign of the end of times.

Source: tradingeconomics.com

Of more concern to many is the Treasury bond market as that is a true Achilles heel for the US. Given the massive amount of debt outstanding, and the fact that there is so much to roll over this year, and the fact that the budget is still running a massive deficit, the need to refinance is the biggest issue facing the US economy in my view. Of course, the US will be able to refinance, the question is the price.

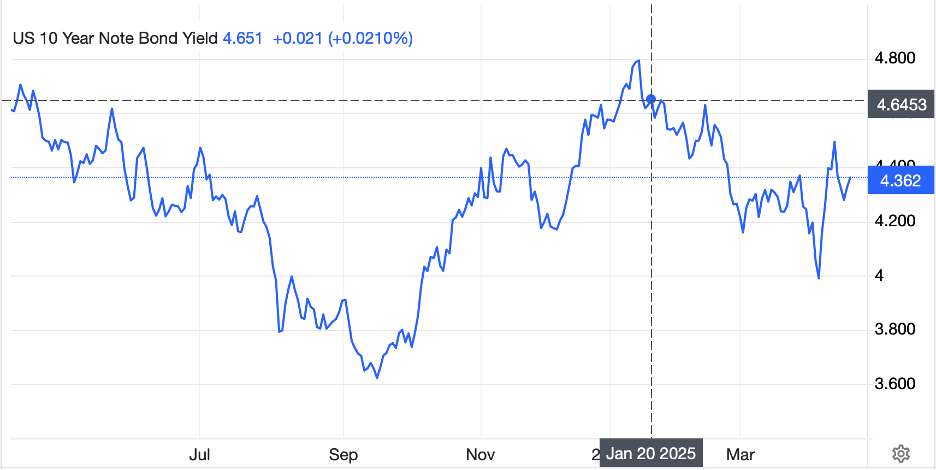

Since we’ve been measuring things from Trump’s inauguration, a look at 10-year Treasury yields shows they have declined a modest 28bps as of this morning’s pricing. There has also been some volatility, but again, hardly unprecedented volatility.

Source: tradingeconomics.com

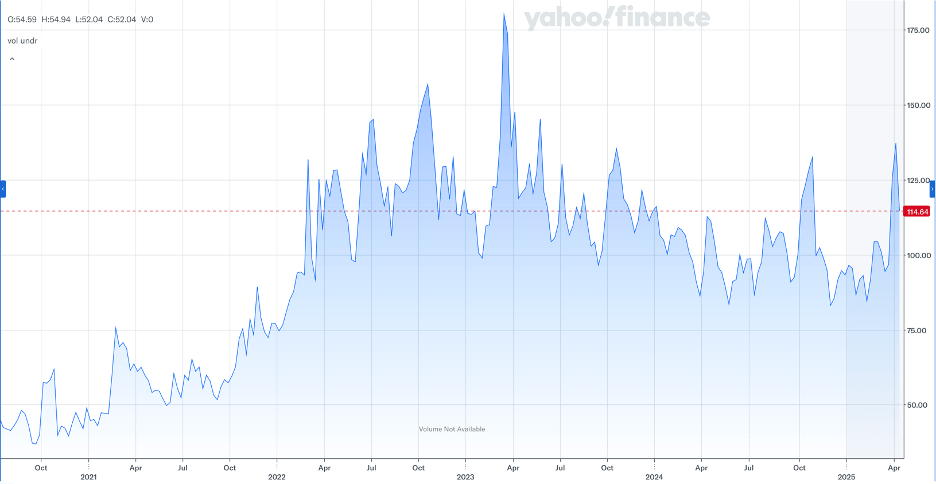

For instance, a widely followed measure of bond market volatility is the MOVE Index, currently produced by BofA. At Friday’s close, it sat at 114.64. A quick look at this chart shows the index, and by extension bond market volatility, is in the upper one-third of its range since inflation kicked off in 2022. Again, it has spent a lot of time at higher levels and a lot of time at lower levels.

Source: finance.yahoo.com

There are numerous stories being written these days about reduced liquidity in the bond market, and there are many stories being written about how the Chinese, or the Japanese, or Europeans are selling Treasury bonds as a signal that all is not well. First, we know all is not well, so that should not be a surprise. Second, there has been no indication that Treasury auctions are failing, in fact the opposite, with the most recent 10-year and 30-year auctions showing substantial foreign demand.

The funny thing about the bond market is to many it is a Rorschach test as people see what they want to see. To some, it is entirely about inflation and inflation expectations, so rising yields portend inflation on the horizon. To others, it is a recession/growth indicator, which for most people is a coincident indicator, higher growth leads to higher inflation in that view. But these days, much ink is spilled discussing how it is now and indicator of confidence in the US, especially with the growing antagonism between President Trump and Chairman Powell. The same folks who lambasted Powell for keeping rates too high, now seem to be cheering him on to keep rates “too” high as a sign of his independence.

There is no doubt that despite the fact that the Fed’s press has diminished, and the market’s focus on the Fed has waned, their actions remain important to the US economy. But is Jay Powell the last bastion of confidence in the US? That, too, seems a stretch.

Trying to summarize, things in the US are quite messy right now. For many investors, and hedgers, the previous status quo was so comfortable, and actions were easy to take. However, Donald Trump’s election back in November was a very clear signal that things were going to change. And they are changing. In situations like this, investors tend to bring their money as close to home as possible. This process has only just begun. Since March, I have maintained that I see the dollar lower, and for a long time that the equity market was overvalued. While the recent speed of movement is unlikely to be maintained, I expect the direction is pretty clear.

Ok, a really quick tour of markets overnight. In Tokyo (-1.3%) equity markets slumped further as the yen strengthened and the status of the trade talks with the US remains unclear. Chinese shares (+0.3%) edged higher and the rest of Asia that was open was mixed. With all of Europe closed today, all eyes will be on the States where things are pointing to a lower opening.

Treasury yields have risen 4bps this morning and European sovereign markets are all closed. Last night, JGB yields edged higher by 1bp, but the narrative of Japanese interest rates rising closer to other national levels has not had much press lately.

The commodity markets have been where all the action is, with oil (-2.5%) lower this morning as I have seen comments that the US-Iran talks are making progress. As well, it appears that the Russia / Ukraine peace talks are reaching a denouement. Successful conclusions in either, or both, of these discussions would very likely point to a lot more available crude on the market, and lower prices ahead. I still think $50/bbl is in the cards. But gold (+1.9%) is the story of the day here as the barbarous relic makes yet another new all-time high vs. the dollar dragging silver (+1.3%) and copper (+3.9%) along for the ride. Not only are foreign central banks continuing to buy, as well as populations in China, India and elsewhere in Asia, but it appears that US retail is waking up to the fact that gold has been the best performing asset for the past year (+45%). I continue to see the metals complex benefitting from the current macro environment.

Finally, we have already discussed the dollar which is lower this morning against virtually all its counterpart currencies in Europe and Asia. As it happens, LATAM currencies are gaining the least and BRL (-0.1%) has even managed a slight decline on the opening. But overall, this is a dollar selling day.

On the data front, today brings Leading Indicators (exp -0.5%) at 10:00 and that is all that is on the calendar. It is a quiet week, and I will outline the rest tomorrow.

It should be a quiet market given Europe’s absence, and given how far the dollar has fallen leading into the open, I wouldn’t be surprised to see a modest bounce, but the trend, as I explained, remains clearly for a lower dollar going forward.

Good luck

Adf