With Tokyo having conceded

On trade, focus turns to what’s needed

For Europe to sign

A deal to align

Its interests and trade unimpeded

But headlines about the EU

Explain they have made a breakthrough

With China on carbon

Which might be a harbin-

Ger of why their economy’s poo

Yesterday’s market activity was focused on the benefits of the fact that the US and Japan had reached a trade deal, whatever the terms, and that it seemed to set the stage for other deals to come. Naturally, all eyes turned to the EU, where negotiations are ongoing, and the working assumption is that they, too, will wind up with a 15% tariff on all goods exported to the US, like the Japanese deal, and that non-tariff barriers would be removed reduced as well. My sense is that is a reasonable assumption as it will clarify the process going forward and allow businesses to plan and invest accordingly.

As an aside, I am curious why there is so much angst over tariffs from the economist’s community. Generically, most economists will explain that consumption taxes are better than income taxes as they are more efficient, and fairer in many ways. After all, if something has a high tariff, you can avoid paying it by not buying the item (I know that’s simplistic but work with me here). However, an income tax is unavoidable if you earn income. In fact, that is why so many economists love the VAT. Yet when it comes to President Trump’s tariff plans, combined with the fact that the OBBB prevented a major tax hike and cut rates for certain parts of income like tips and overtime, these same economists are up in arms over the process. I would have thought that is exactly what most economists would want to see. But then, I am just a poet.

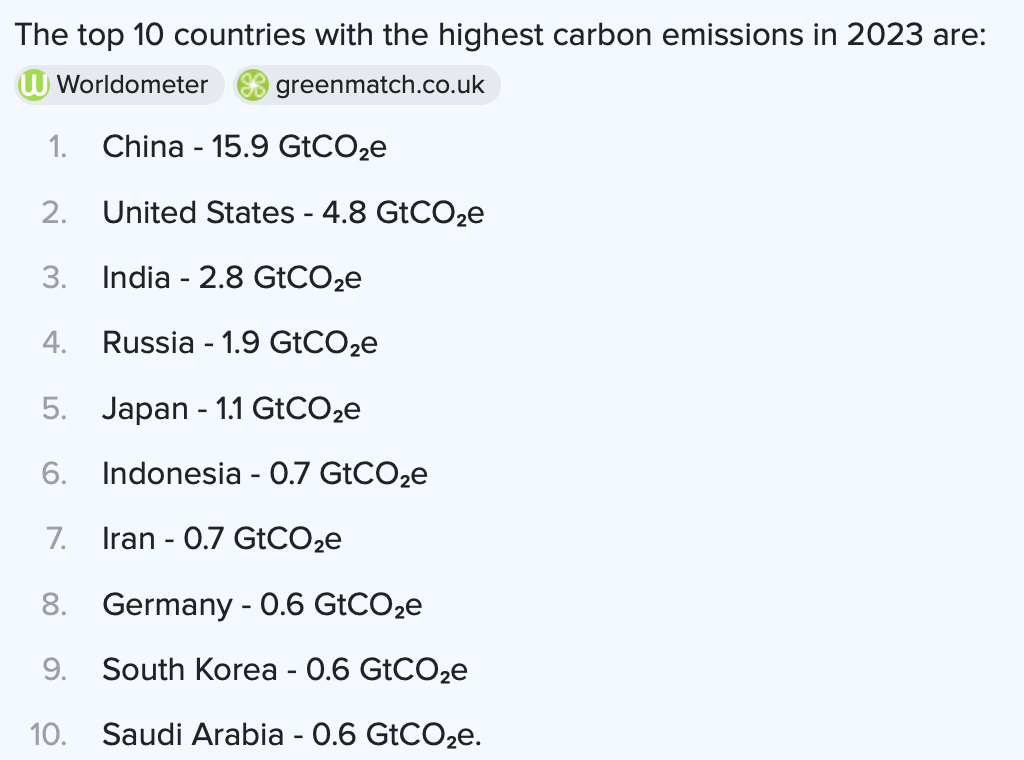

Ok, back to the EU, where while the trade deadline with the US is fast approaching, EU Commission president Von der Leyen was in China where she agreed with President Xi to lead the way on CO2 reduction. Apparently, it was the only thing on which they could agree, and it is, quite frankly, hilarious. Whatever your views on CO2’s impact on global warming, and if there even is global warming, China is by far the largest emitter of the stuff on the planet. As of 2023 (which apparently is the most recent data available) here is a list of the top ten countries regarding emissions.

Obviously, only one EU nation is on the list, but if you sum up the entire EU, it comes in at about 2.9 million tons. (GtCO2e = gigatons of CO2 emitted). Meanwhile, China continues to build out its electricity infrastructure by expanding its fleet of coal-fired generation, adding 94.5 gigawatts last year. My point is that if you wonder why Europe’s economy has lagged the US so badly for so many years, this is a perfect encapsulation of the problem. They are highly focused on virtue signaling for something over which they have essentially no control, and the one nation that could impact things, literally doesn’t care. For their sake, I hope they agree trade terms.

But away from that, and all the news that DNI Tulsi Gabbard is making with document declassifications and releases, markets continue to trade as though all is well. It is noteworthy that recent concerns over US Treasury issuance and how foreign investors would be shunning the US because of its uncontrollable debt situation have not been heard in several weeks now that Treasury auctions seem to be going along fine with plenty of foreign buyers attending and buying. Maybe the worst case is not the default case here.

Ok, so let’s see how markets are digesting the most recent news. More record highs in the US stock market were followed by gains throughout much of Asia last night with Japan (+1.6%) continuing to benefit from the trade deal and both China (+0.7%) and Hong Kong (+0.5%) feeling some love as talk is a deal there is also getting closer. Elsewhere in the region, there were a mix of gainers (Singapore, Korea, Malaysia) and laggards (India, Australia, Thailand) but a little bit more positivity than negativity. In Europe, only France (-0.25%) is lagging today with the rest of the continent (DAX +0.4%, IBEX +1.7%) generally in good shape as investors await the ECB decision, although no policy change is expected. The UK (+0.9%) is also having a solid day despite lackluster data which seems to be all about the potential US EU trade deal. As to US futures, at this hour (7:25) they are mixed with the DJIA (-0.4%) lagging while the other two key indices are higher by about 0.25%.

In the bond market, yields are ticking higher across the board with Treasuries (+2bps) back at 4.40%, although still below the top if its recent trading range. In fact, I think the below chart does an excellent job of describing the fact that the bond market, despite much angst, has done nothing and is trending nowhere for the past six months.

Source: tradingeconomics.com

As to European sovereigns, yields there are higher by 4bps across the board. The story I read tells me this is optimism that a US-EU deal will help juice the EU economy, thus driving yields higher. I’m skeptical.

In the commodity markets, oil (+0.8%) is bouncing off its lows, allegedly also responding to the positive trade news. I guess. Precious metals, though, are lower (Au -0.7%, Ag -0.5%, Pt -1.25%) as either there is less fear about the future or somebody sold a lot of metals after their recent rally. Copper (+1.0%) though, continues to benefit from the trade story as well as the underlying story regarding insufficient supply for the future electrification of the world.

Finally, the dollar is a bit firmer this morning, rising 0.2% against both the euro and pound with the yen (-0.15%) also moving in that direction. Surprisingly, CHF (-0.3%) is the biggest mover in the G10 while ZAR (-0.4%) is the EMG laggard as it follows (leads?) precious metals lower. This trend remains downward, although as discussed yesterday, it is possible we have seen a true break of that trend. If Trump successfully concludes the main trade deals, I imagine that we will see significant inflows to the US and that should support the greenback.

On the data front, after the ECB announcement at 8:15, we see Initial (exp 227K) and Continuing (1960K) Claims as well as the Chicago Fed National Activity Index (-0.1) which had a terrible showing last month. Later we get flash PMI data (Manufacturing 52.6, Services 53.0) and then New Home Sales (650K) at 10:00.

Right now, the market feels like it is embracing the potential for more trade deals to remove uncertainty. Earnings numbers have been generally strong in the US, which continues to support the stock market, but it remains to be seen how much of the tariffs will be absorbed by corporate margins and how much will find its way into prices. If the former, that implies earnings will start to lag. Meanwhile, given the market is generally short dollars, and it appears the next piece of news is more likely to be dollar positive than negative, I have a feeling we could see the dollar bounce nicely in the next weeks.

Good luck

Adf