Trump’s meeting with Putin went well

At least that’s the best we can tell

Now, later this week

Zelenskiy will speak

With Vlad, and say you go to hell

So, will peace be found in Ukraine?

Or will fighting grow once again

If looking for clues

One thing we might choose

Is oil that’s falling like rain

The aftermath of the Trump-Putin meeting on Friday has certainly been interesting. While the administration, as would be expected, highlighted any and all positives as the president pushes for an uncomfortable peace process, the administration’s opponents, which include not merely the Democratic party, but most of Europe as well, are concerned he has just sold Ukraine down the river. I am not nearly smart enough to have an informed opinion on this issue, which is likely the case for almost every commentator as well, but I know I come down on the side of anything that moves the conversation toward an end to the war and a lasting peace, even if the terms aren’t the ones either side would like, is a step in the right direction.

But this is not a political commentary, rather we are trying to understand market behavior and remain highly cognizant of global events on markets. With that in mind, arguably the market most directly impacted by this war is oil and based on what we have seen over the past month, during which time the peace process accelerated, the participants in the oil market appear to be saying that Russian oil is coming back to the market on an unfettered basis. One need only look at the chart below, which shows a very clear downtrend to understand.

Source: tradingeconomics.com

Certainly, some of this price decline may be attributed to the belief that the long-awaited recession in the US is upon us, although given that has been a view for nearly three years, it is not clear to me why this month is the moment. I understand that the payroll data was weak, but I also understand that Retail Sales data on Friday was pretty strong. The observation that the goods and services sectors of the economy are out of sync remains appropriate, I believe. As long as that remains the case, a significant downturn seems unlikely, but so too does a significant growth spurt. In fact, this is one of the reasons I take the decline in the price of oil to be a harbinger of an end to the Ukraine war.

Come Friday, we’ll hear Chairman Jay

As he tries, his views, to convey

No doubt he’ll explain

Inflation’s a bane

And that’s why, rate cuts, he’ll delay

But also, employment is key

And so, he will want us to see

His minions are willing

To cut, if distilling

The data less growth they foresee

Arguably, the other big market story this week is the speech that we will hear Friday morning from Chairman Powell at the Jackson Hole Symposium. Many in the market continue to look to Powell and the Fed for their guidance although my take is the Fed’s impact on market’s has been waning over time as fiscal dominance continues apace. Nonetheless, it is still a key moment for the market as those who have been anticipating a Fed cut in September, as well as at least two more before the end of the year, will want confirmation that the weak payroll data was the trigger. And while some of the Fed speakers since the NFP data have started to move toward a more dovish stance, I would contend the majority is still on the patience bandwagon.

With that in mind, a look at the Fed funds futures markets shows that although the probability being priced in for a cut next month has fallen from its peak level, it remains extremely high at 85% with a 78% probability of two cuts by December and a third cut now likely by March.

Source: cmegroup.com

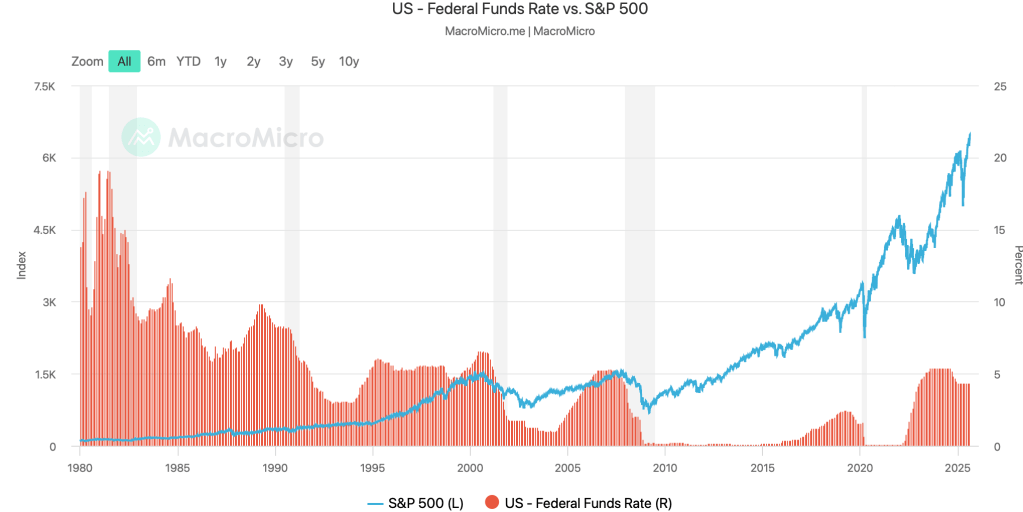

Remember, the reason this is so closely watched is the strong belief that when the Fed cuts rates, equity prices rise. However, one need only look at a chart to note that frequently, equity markets are falling sharply when the Fed is cutting Fed funds. That makes sense because given the reactive nature of Fed funds and the Fed in general, it is typically responding to weakness that is already evident in equity prices. Which begs the question, why does everyone want the Fed to cut if it implies a weak economy and already declining stock prices?

Many measures continue to show equity valuations quite high, and there have been numerous calls that a correction in equity markets around the world is due. I understand that view and have even bought put protection as it is pretty cheap to do so. But I have given up on calling for a recession. I can only be wrong for so long before I accept the evidence that one has not yet come, nor is obviously imminent.

Ok, let’s look at markets this morning. While there was a late selloff in the US on Friday, Asian markets saw the world as a brighter place. Perhaps they were encouraged by the Alaska meeting, or perhaps by the view that the Fed will cut, because there was no data there of which to note. But the Nikkei (+0.8%), CSI 300 (+0.9%) and Australia (+0.25%) all managed gains although the Hang Seng (-0.4%) slipped a bit. There was, however, a major laggard with Korea’s KOSPI (-1.5%) suffering on the back of concerns over potential new tariffs on Korean chips. European equities, though, are on a bit shakier footing. Perhaps it is the concern that despite their collective voice on Ukraine, they remain largely irrelevant. Or perhaps it is the realization that the trade surpluses they have run in the past are set to decline as evidenced by the data showing Spain’s deficit growing to -€3.59B increasing more than €1B and the Eurozone’s surplus shrinking to €7B, down from €16.5B last month. So, declines of -0.4% to -0.8% are today’s results in major markets there. As to the US, futures are little changed at this hour (8:00).

In the bond market, yields have been edging lower this morning with Treasury yields (-2bps) slipping despite the stronger Retail Sales and PPI data from last week, while European sovereign yields are all lower by -3bps, perhaps anticipating slower growth overall.

In the commodities space, oil (+0.5%) has bounced from its overnight lows but remains in its downtrend. Gold (+0.3%) continues to hover at its pivot point of $3350 or so while silver (+0.15%) and copper (-0.4%) are mixed this morning. Away from the tariff story on copper, it remains an important economic indicator, so we must watch it closely.

Finally, the dollar is ever so slightly firmer this morning with the euro (-0.25%) leading the G10 slide although both Aussie and Kiwi are slightly firmer this morning. In the EMG bloc, MXN (-0.4%) is the laggard along with HUF (-0.4%) and CZK (-0.4%) although the rest of the bloc, while mostly softer, hasn’t moved that far. It does feel like a dollar story.

On the data front, as I am running late and there is nothing as important as Friday’s Powell speech, I will list it tomorrow. Overall, my take is peace is nearer than further and that should adjust spending from fighting to rebuilding but spending it will be. I expect to hear more about recession going forward, although it is not yet clear to me one is upon us. While the dollar’s trend remains lower, I have a feeling we are at the end of that move so beware.

Good luck

Adf