Ishiba’s fallen

Who’ll grab the poisoned chalice

For the next go round?

Well, it was inevitable after the LDP lost the Upper House election a few weeks ago, but now it is official, Japanese PM Shigeru Ishiba has resigned effective today and will only stay on until a new LDP leader is chosen. You must admit, for a politician he was exceptionally ineffective. He managed to lead the LDP to two major election losses in the span of 10 months, quite impressive if you think about it. However, now that he has agreed a trade deal with the US, where ostensibly US tariffs on Japanese autos will be reduced from 25% to 15%, he felt he had done enough damage and is getting out of the way. Frankly, I wouldn’t want to be the next man up here as the situation there remains fraught given still high inflation and a central bank that is so far behind the curve, it makes the Fed seem like it is Nostradamus!

The intricacies of Japanese politics are outside the bounds of this note, but the initial market response is a weaker yen (-0.7% as of 7:30pm Sunday night) and 1% gain in the Nikkei. JGB yields have barely moved at all as it seems Japanese investors are not yet abandoning ship in hopes of a stronger PM. However, my take is they have further to climb going forward as the BOJ’s ongoing unwillingness to tackle inflation will undermine their value. Japan has a world of hurt and lacking an effective government is not going to help them address their problems. It is hard to like Japanese assets or the yen in my view, at least until something or someone demonstrates competence in government.

The jobs report basically sucked

As companies smoothly conduct

More layoffs each week

While they try to tweak

Their staffing ere management’s f*cked

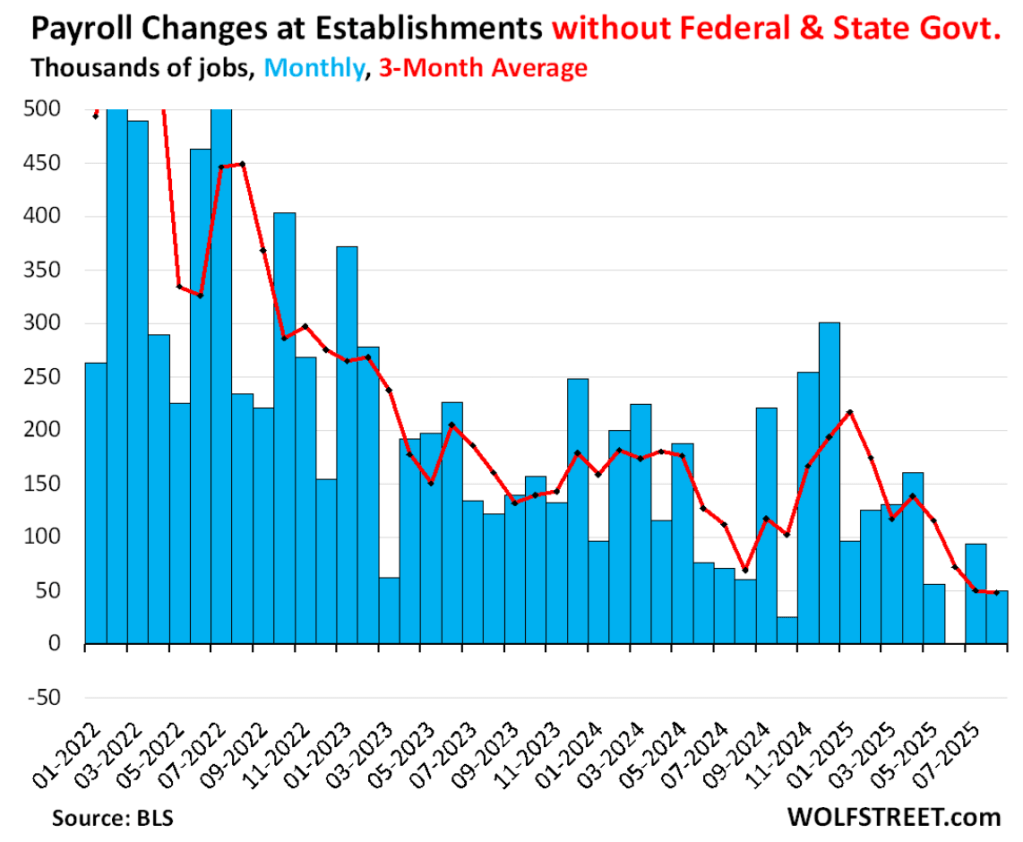

By now, I’m sure you’re all aware that the payroll report was pretty weak across the board. NFP rose only 22K, well below expectations and although there was a marginal increase in last month’s results, just 6K, the overall picture was not bright. The Unemployment Rate ticked up 0.1%, as expected with the labor force growing >400K, but only 288K of them getting jobs. However, layoffs are down, and the real positive is that government jobs continue to fall, having declined 56K in the past three months with private hiring making up the slack. In fact, if you look at the past three months, private job creation has been 144K or 48K/month. That is the best news of the entire process. Eliminating government employees will eventually result in lower government expenditures and let’s face it, if the government employees who leave become baristas at Starbucks, they are likely adding more value to the economy than their government roles! The chart below from Wolfstreet.com does a great job of highlighting private sector jobs growth, which is slowing but still positive. Maybe it is not yet the end of the world.

As to my efforts to prognosticate on the market behavior based on a range of outcomes, I mostly got the direction right, although some of the movement was a bit more aggressive than I anticipated. The one place I missed was equities, which started higher, but ultimately fell on the day. Nostradamus I’m not.

The last thing to mention today

Is France, where a vote’s underway

When finally completed

And Bayrou’s unseated

Macron will have naught but dismay

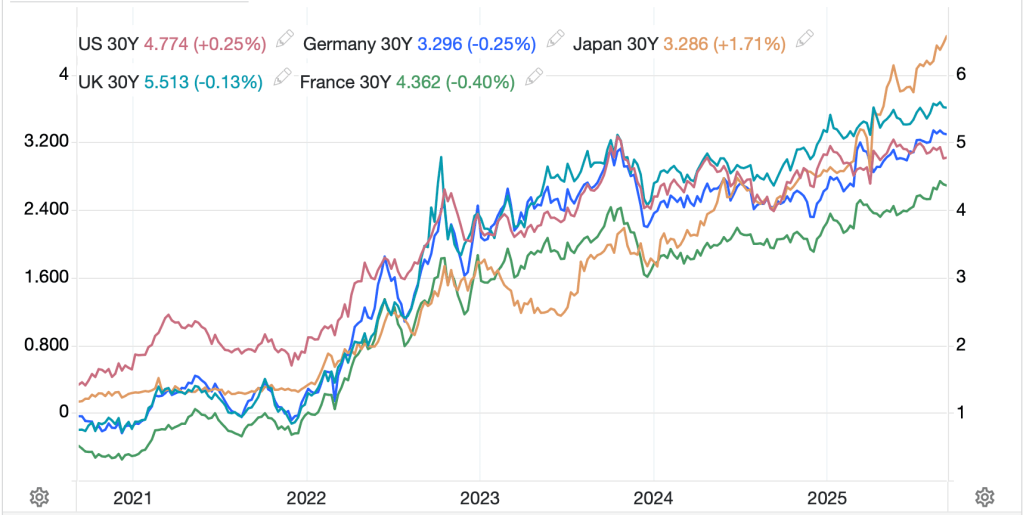

The last key story to discuss is the vote today in France’s parliament where another snap election has been called by a minority government (see Japan for previous results) and in all likelihood will result in the government falling. The problem here, as it is pretty much everywhere in the Western world is that the government’s budget deficit is exploding higher and legislators cannot agree to cut spending. The result is rising bond yields (see below chart as I discussed this last week here), and growing concern as to how things will ultimately play out. The prognosis is not positive.

Source: tradingeconomics.com

While the US is in a similar situation, we have substantially more tools available and more runway given our status as the global hegemon and owning the global reserve currency. But France, and the UK or Japan for that matter, have no such backstop and investors are growing leery of the increasing risk of a more substantial meltdown. Apparently, the results of this vote ought to be known by 3:00pm Eastern time this afternoon.

The question is, if/when he loses, what happens next? The choice is President Macron appoints a different PM to head another minority government, which will almost certainly be unable to achieve anything else, or there is another parliamentary election, which at least could result in a majority government with the ability to enact whatever fiscal policies they believe. Remember, France is the second largest economy in the Eurozone, so if it remains under pressure, it is difficult to make the case that the euro will rally very much, especially given Germany’s many issues.

And that feels like enough for one day. Let me recap the overnight session but since there is no data of note today and the Fed is in its quiet period, I will list data tomorrow. While US equity markets sold off a bit at the end of the day, that was not the vibe this morning anywhere else in the world as green is the predominant color on screens. In Japan, no PM is no problem as the Nikkei (+1.45%) rallied after much stronger than expected GDP data (2.2% in Q2) helped convince investors things would be fine. Hong Kong (+0.85%) and China (+0.2%) also managed gains as hopes for a Fed rate cut spring eternal. In fact, the bulk of Asia saw gains on that basis.

Europe, too, has embraced the weaker US payroll data and prospective Fed rate cut to rally this morning, although in fairness, German IP rose 1.4% for its first gain in four months, so that helped the cause. But even French stocks are higher despite the imminent collapse of the government. I am beginning to notice a pattern of equity investors embracing the removal of ineffective governments, but perhaps I am looking too hard. US futures are also modestly higher at this hour (7:15) this morning, rising about 0.25%.

In the bond markets, after Friday’s rally, Treasury yields have edged higher by 1bp while European sovereign yields are largely unchanged, perhaps +/- 1bp on the day. Surprisingly, even JGB yields have not risen despite the lack of fiscal rectitude there. It certainly appears that bond investors are ignoring a lot of potential bad news. Either that or someone is buying a lot of bonds on the sly.

In the commodity markets, oil (+2.0%) after a down day Friday ahead of expectations that OPEC+ would be increasing production again, has rallied back as those increases were less than feared by the market. But net, oil is just not going anywhere these days, trading between $62/bbl and $66/bbl for the past month. It feels like we will need a major demand story to change this narrative, either up or down. As to metals, they continue to rally sharply (Au +0.7%, Ag +0.7%, Cu +0.5%, Pt +1.9%) as no matter the bond markets’ collective ennui over global fiscal profligacy, this segment of the market is paying attention. If this week’s CPI data is cooler than expected, I suspect that 50bps is going to be the default expectation and metals will climb further.

Finally, the dollar is under modest pressure this morning, with the euro and pound both rising 0.2% although AUD (+0.6%) and NZD (+0.8%) are having far better sessions on the back of commodity price strength. JPY (-0.3%) has recouped some of its early losses from the overnight session, though my money is still on weakness there. In the EMG bloc, it is hard to get excited about much with ZAR (+0.25%) appreciating the rally in gold and platinum, but only just, while the rest of the bloc hasn’t even moved that much.

And that’s really all for today. The discussion will continue around the Fed and whether 50bps is coming with Thursday’s CPI the last big piece of data that may sway that conversation. Personally, I am surprised that the government upheavals in Japan and France (with the UK also having major fiscal problems) have not had a bigger impact on markets. My sense is that there is an opportunity for more fireworks in those places in the near future. But apparently not today. As investors whistle past those particular graveyards, I imagine we will see a risk-on session continue with the dollar remaining under modest pressure.

Good luck

Adf

Hello Andy,

Just in case you haven’t seen the details, the National Assembly vote has begun and the results will be known at 6:50 PM Paris time (2:50 PM your time). After the speeches from each party leader, Bayrou’s chances of remaining PM are nil.

E. Macron’s choice to replace Bayrou will be complicated, but he will also have the option of dissolving the government, although this option remains unlikely.

We should also note the risk of September 10th, as a new “Block Everything” movement is planned, and although this is very different from the “Yellow Vest” crisis, the risk of the country being shut down immediately after the fall of the current government should not be underestimated.

Sincerely, Eric

Great to hear from you Monsieur! yes, that is what I read this morning that we will know by this afternoon here in the States. I have to say it appears that governments that embraced the globalization concept have run out of room and are falling left and right. my take is it will take a few more elections before it is completely washed away, but France is always a standard bearer for national action. I hope your refrigerator is well stocked !

I would like to take this opportunity to congratulate you on this newsletter, which is often very accurate.

Going to supermarket for my fridge…

Best,

Eric