The PCE data was warm

And still well above Powell’s norm

The problem for Jay

Despite what folks say

Is tariffs ain’t causing the storm

Instead, service prices keep rising

With wages not yet stabilizing

And so, long-date debt

Is under real threat

As traders, those bonds, are despising

Under the rubric, economic synchronization remains MIA, I think it is worth looking at the performance of 30-year bond yields across all major nations as per the below chart. While the actual rates may be different, the inescapable conclusion is that yields across the board continue to rise to their highest levels in more than five years and the trend remains strongly in that direction. Regardless of central bank actions, or perhaps more accurately because of their attempts to keep rates low, it is increasingly clear that confidence in government debt, the erstwhile safest assets around, continues to slide.

Arguably, this is a direct response to the fact that despite their vaunted independence, central banks around the world have very clearly abandoned their inflation targets and are now doing all they can to support their respective economies with relatively easy money. Friday’s PCE data is merely the latest in a long line of data points showing that although most of these banks are allegedly targeting 2.0% Y/Y inflation, the outcomes have been higher than target, yet excuses to cut rates are rife. If you are wondering why gold continues to rally, look no further than this.

Source: tradingeconomics.com

In fact, this morning’s Eurozone CPI reading of 2.1%, 2.3% core, is merely another chink in the armor as it was a tick higher than expected. One of the problems, I believe, is that there remains a very strong belief that the key driver of inflation is economic growth, not money supply growth, despite all evidence to the contrary. But it is a Keynesian fundamental belief, and every central bank around the world is convinced that slowing economic activity will result in declining inflation rates. Alas, as long as central banks continue to support their domestic government bond markets, inflation will remain.

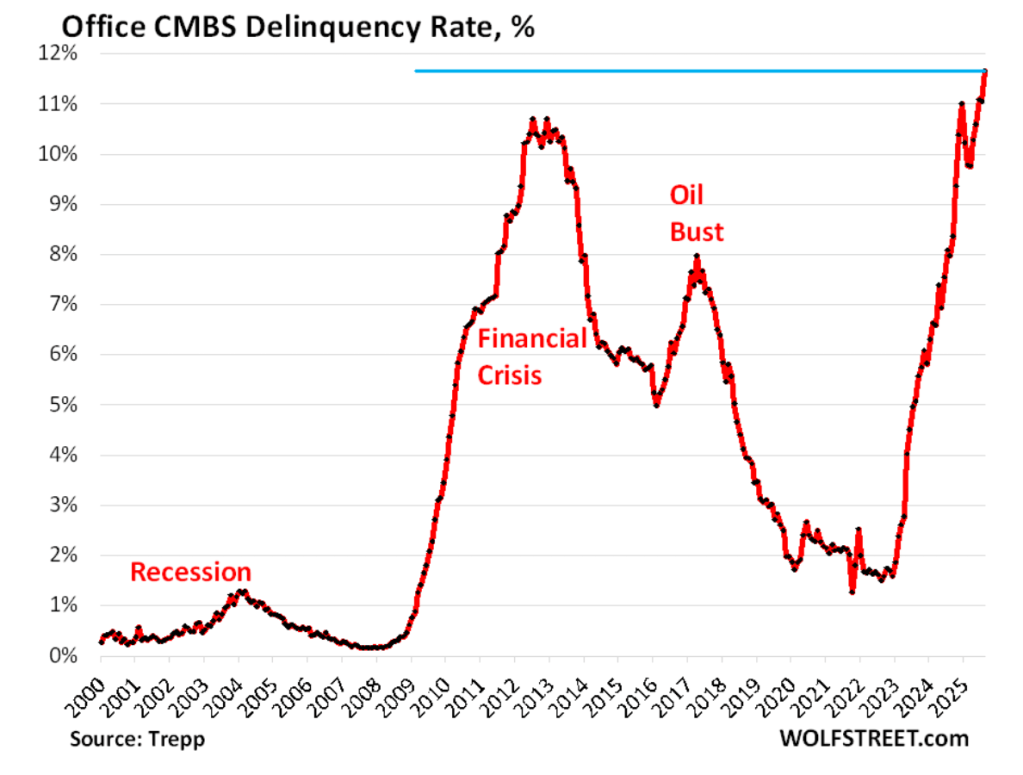

This is where the synchronicity, or lack thereof, of the economy is having its biggest impact. The fact that certain parts of the economy, notably AI investment, continues to run at record pace and continues to support excess demand for certain things offsets weakness in other parts of the economy, for instance, commercial property, which is looking at a significant deterioration in its finances. A look (see chart below) at Commercial Mortgage-Backed Securities (CMBS) for office buildings shows that the delinquency rate has reached an all-time high, higher even than the GFC, as the changes in the US working population and the increase in work-from-home have devastated the value of many office buildings.

Perhaps more interesting is the fact that multifamily CMBS (financing for apartment buildings) is also suffering despite a housing shortage and rising rents. While delinquency rates have not reached GFC levels, as you can see, they are rising rapidly as well.

So, which is it? Are yields rising because growth is driving inflation higher (the Keynesian view of the world)? How does that accord with rising delinquencies if growth is the driver? In the end, there is no single, simple answer to explain the dynamics of an extraordinarily complex system like the economy. I do not envy policymakers’ current situation as there are no correct answers, merely tradeoffs (just like all economics). But it is increasingly clear that investors are losing their interest in holding onto government debt as they seemingly lose faith in governments’ ability to manage their respective finances. Which brings us to one more chart, the barbarous relic (which for those of you who don’t know, was Keynes’ term of derision for gold). I thought it might be instructive to see how gold and 30-year Treasury yields seem to have the same trajectory as the shiny metal regains its all-time highs this morning.

Source: tradingeconomics.com

With that cheery thought after a beautiful Labor Day weekend, let’s see how markets are behaving now that September is upon us. Friday’s selloff in the US (a disappointing way to end the month) was followed by a mixed session in Asia with the Nikkei (+0.3%) managing to rally although China (-0.75%) and Hong Kong (-0.5%) followed the US lower despite a slightly better than expected RatingDog (formerly Caixin) PMI of 50.5 released Sunday night. Elsewhere in the region, Korea (+0.95%) was the big winner with modest losses almost everywhere else in the region. As to Europe, the DAX (-1.25%) is the worst performer, although Spain’s IBEX (-0.95%) is giving it a run for its money as the higher Eurozone inflation squashed hopes that the ECB may cut rates again soon. Interestingly, French shares are unchanged this morning, significantly outperforming the rest of the continent despite continued concerns over the status of the French government which seems likely to collapse next week after the confidence vote on Monday. Perhaps the idea that the government will not be able to do anything is seen as a benefit! As to US futures, negative is the vibe this morning, with all the major indices pointing lower by at least -0.6%.

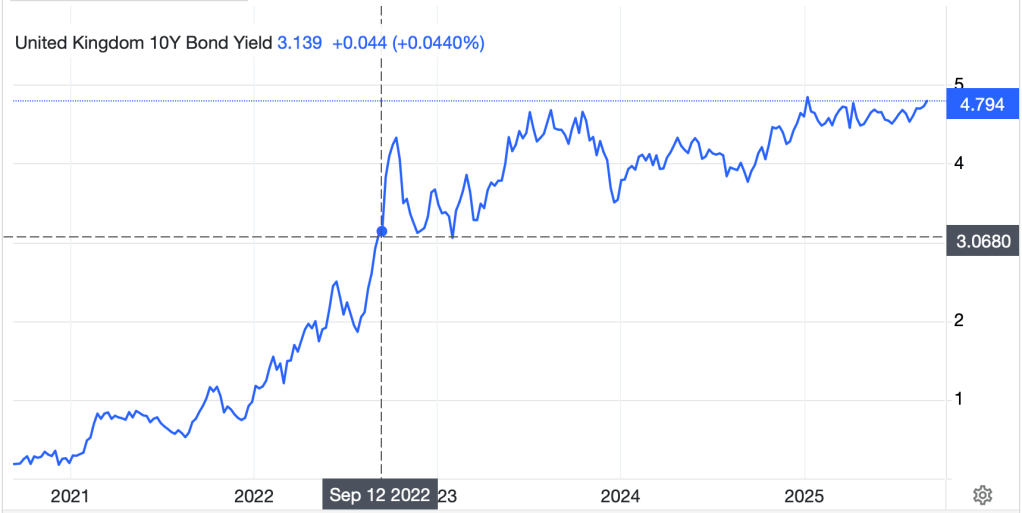

In the bond market, based on my commentary above, you won’t be surprised that Treasury yields are higher by 6bps this morning and European sovereign yields are all higher by between 4bps and 6bps. The big story here is that French yields are rising to Italian levels as the former’s finances are crumbling while Italy has stabilized things for the time being. Of course, all this pales compared to UK yields (+4bps) where 30-year yields have climbed to their highest level since 1998 and the 10-year yields are now nearly 200 basis points higher than during the ‘Liz Truss’ moment of 2022 as per the below. It is not clear to me if the UK or France will collapse first, but I suspect that both may be begging at the IMF soon!

Source: tradingeconomics.com

Oil prices (+1.8%) continue to rise as Russia and Ukraine intensify their fighting with Ukraine attacking Russian refining capacity, apparently shutting down up to 17% of their output. However, while we have seen oil rebound over the past several weeks, the longer-term trend remains lower.

Source: tradingeconomics.com

As to metals, this morning gold (+0.2%) continues to set new highs while silver (-0.4%) is backing off of its recent multi-year highs, although remains well above $40/oz. Precious metals are in demand and likely to stay that way for a long time to come in my view.

Finally, the dollar is much firmer this morning with the pound (-1.25%) the laggard across both G10 and EMG currencies as investors flee from the ongoing policy insanity there (between the zeal with which they are trying to reduce CO2 and the crackdown on free speech, it seems the government is trying to alienate the entire native population.). But the euro (-0.7%), Aussie (-0.7%), yen (-1.0%) and SEK (-0.75%) are all under pressure in the G10 bloc. The UK is merely the worst of the lot. As to the EMG bloc, MXN (-0.7%), ZAR (-0.7%) and PLN (-0.9%) are also sharply lower although Asian currencies (KRW -0.2%, INR -0.2%, CNY -0.15%) are faring a bit better overall.

On the data front this week, we have a bunch culminating in payrolls on Friday.

| Today | ISM Manufacturing | 49.0 |

| ISM Prices Paid | 65.3 | |

| Wednesday | JOLTS Job Openings | 7.4M |

| Factory Orders | -1.4% | |

| Fed’s Beige Book | ||

| Thursday | Initial Claims | 230K |

| Continuing Claims | 1960K | |

| Trade Balance | -$75.3B | |

| Nonfarm Productivity | 2.7% | |

| Unit Labor Costs | 1.2% | |

| ISM Services | 51.0 | |

| Friday | Nonfarm Payrolls | 75K |

| Private Payrolls | 75K | |

| Manufacturing Payrolls | -5K | |

| Unemployment Rate | 4.3% | |

| Average Hourly Earnings | 0.3% (3.7% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.1% |

Source: tradingeconomics.com

In addition, we hear from four Fed speakers with NY Fed president Williams likely the most impactful. The current probability for a Fed funds cut according to CME futures is 92%. A weak print on Friday will juice that and get people talking about 50bps to start. A strong number will stop that talk in its tracks. But until then, it is difficult to look at the messes everywhere else in the world and feel like you would rather own other currencies than the dollar (maybe the CHF).

Good luck

Adf