The headline today is ‘bout peace

In Gaza, and hostage release

Can this program last?

And both sides hold fast?

Or once more will violence increase?

Now, turning to markets we see

Risk assets continue their spree

But it’s no surprise

More warnings arise

That markets shun reality

In what can only be described as a monumental breakthrough in the Middle East, a peace plan between Israel and Hamas has been agreed that will see to the release of the remaining hostages and the disarmament of Hamas fighters while the Israeli army pulls back to specified lines near the border. The idea is that a group of Arab nations will oversee the Gaza strip with funding coming from the Saudis, amongst others, and it appears this may be the best chance for peace in the area in centuries if not millennia. President Trump has orchestrated this and deserves enormous credit for a truly momentous outcome. I certainly hope the plans are fulfilled and we can remove one historical warzone from the map. While this has had no immediate market impact, its importance is such that it cannot be ignored IMHO.

Ok, let’s move to the markets. Stocks, gold and the dollar continue to rally, continuing the conundrum that we have observed for the past several weeks. However, my take is there has been an increase in the number of warnings that the end is nigh. For instance, Bloomberg has a headline article about Nassim Taleb, the author of Black Swans, explaining that a debt crisis is looming and you need to hedge against that outcome. As well, all over my XFin feed, I continue to see comments about how the end is nigh with respect to the equity market rally as the debt situation is going to soon overwhelm everything.

And I understand this concept well (and have been carrying Index put options for a while accordingly) but thus far, the mooted equity market collapse seems to be awaiting the mooted recession that has also yet to arrive. The government shutdown has had essentially no impact on markets, perhaps improving them given the lack of data that tends to cause significant gyrations. The Russia/Ukraine war is just background noise to markets at this point and the one thing that remains constant is that money supply continues to grow around the world with the result that both asset prices and high street prices rise. In other words, governments around the world are ‘running it hot’ and will continue to do so for as long as they can.

The FOMC Minutes were released yesterday, and they explained what we already knew based on the dot plot (shown below), there is a wide dispersion of views on the committee.

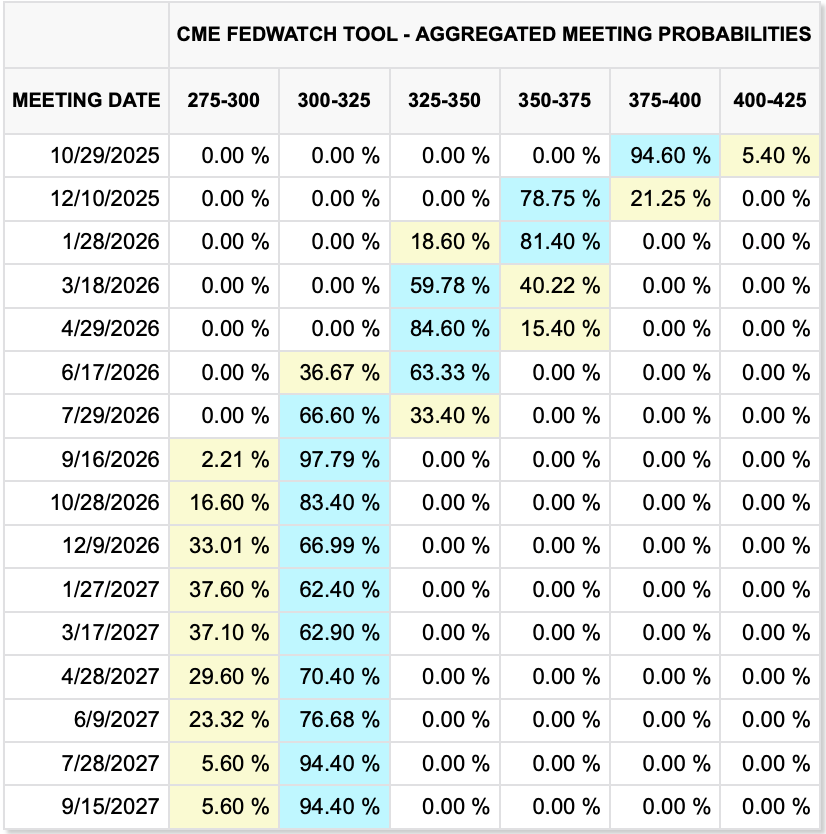

Perhaps the most interesting thing is that despite there being a pretty even split between those expecting two more rate cuts this year and those expecting no more rate cuts this year, the Fed funds futures market is still pricing a 95% probability for a cut at the end of this month and a 79% probability for a second cut in December as per the below CME table.

As well, given the absence of recent data, the Fed speak is not coalescing around a single narrative so that dot plot is still our best estimate of what FOMC members are thinking, i.e. there are 17 independent views right now.

I understand the concerns which range from an incipient debt crisis to the risks that stem from AI and AI investment representing virtually all economic growth right now to the exclusion of almost all other economic sectors. But markets are going to do what markets are going to do, and right now, the bears are having a tough time making their case.

Remember, timing is everything in life, and in markets being early is effectively the same as being wrong unless one has significant ability to withstand drawdowns. There are certainly signs around of the beginning of the unraveling (sudden bankruptcies of large firms like Tricolor and First Brands; SOFR spreads widening; difficult Treasury auctions, etc.). For now, there is no obvious catalyst to change the recent direction of travel, but markets don’t need a specific catalyst, sometimes it is just time to change. This is why hedging matters.

Ok, let’s recap how things played out overnight. After more record closes for the S&P 500 and NASDAQ, Tokyo (+1.8%) exploded higher again on the back of more AI related news. China (+1.5%) opened higher after its one-week hiatus although HK (-0.3%) lagged. The news on the mainland appears to be some optimism regarding the upcoming Trump-Xi meeting. Korea remains closed although India and Taiwan both had positive sessions, which given the tech focus there should not be surprising. Elsewhere it was mostly modest gains although the Philippines saw a decline despite the central bank cutting rates in a surprise move.

I fully admit I no longer understand the reaction function in European shares as the DAX (+0.3%) continues to rally despite one dire economic report after another. This morning Germany released trade data showing both exports (-0.5%) and imports (-1.3%) fell far more than expected which given the declines indicates a complete lack of growth, if not shrinkage. Too, the CAC (+0.2%) is modestly higher as the French are going to try to get another PM to pass a budget, although I am skeptical. However, the rest of Europe is modestly softer this morning. As to US futures, at this hour (7:00), they are essentially unchanged.

In the bond market, yields are basically unchanged across the board, with French OATs the best performers (-2bps) on the positive political news. While we have definitely seen an uptick in commentary about the unsustainable debt story in the US over the past month, market participants don’t seem to be reading those stories. A quick look at the chart below shows that we have spent the bulk of the time of the last month with 10-year Treasury yields trading between 4.05% and 4.15%, hardly a sign of crisis.

Source: tradingeconomics.com

On the commodity front, oil (-0.5%) continues to trade within the middle of its recent range and is just not very interesting right now. Metals, however, remain the focus and while gold (0.0%) is unchanged consolidating at its new highs, we see silver (+1.65%, and just 35¢ from $50/oz), copper (+2.3%) and platinum (+1.6%) all continuing their recent rallies.

Finally, the dollar continues to rally as well with the euro (-0.2%) looking a lot like it is going to trade below 1.16 soon. Remember, it wasn’t that long ago when the “consensus” view was it was going to trade to and through 1.20! The pound (-0.3%) is slipping and JPY (-0.1%) while not moving much so far today, is just below 153 and shows no signs of stopping its recent decline (dollar rally). The Scandies are weak, CLP (+0.4%) is benefitting from copper’s rise and overall, the DXY is now above 99.00 and looking like 100.00 is just a matter of days away.

Arguably, the biggest news this morning is Chairman Powell speaking at the Community Bank Conference in Washington, but given the venue, I have a feeling we will not hear very much of note regarding monetary policy.

The current correlations seem to be holding, so higher stocks and higher metals lead to a higher dollar, although it is not clear that is the causation route. Perhaps it is demand for those dollar-denominated instruments is driving dollar demand. But I don’t see a reason for it to change for now. Risk is still there, and hedging still matters, don’t forget that, but enjoy the ride!

Good luck

Adf