The question’s now, who will blink first?

With Democrat leaders immersed

In internal strife

Concerned their shelf life

Is short and their party’s been cursed

Or will the Republican leaders

Start caring if New York Times readers

Scream loudly enough

The polls will turn rough?

My bet’s on the Dems as conceders

So, the government is shut down and yet, the sun continues to rise and set, and life pretty much goes on as before. Is this, in fact a big deal? It all depends on your point of view, I suppose. It is certainly a big deal for those furloughed government employees, especially those whose jobs may disappear in the pending RIF. But as I have often said, if they leave government and become baristas at Starbucks, they are almost certainly adding more value to the economy. And consider, whenever you have to interface directly with the federal government (post office, passports, IRS, etc.) has the customer service ever been useful or effective? Explaining that people will have to wait longer is hardly a compelling argument. In fact, of all the places where AI is likely to be most useful, repetitive government tasks seems one of the most beneficial potential applications.

Nonetheless, this is the story that is going to lead the headlines for a few more days. Ultimately, as we have already seen several Democrat senators vote to pass the CR, I expect enough others to do so to reopen the government, if not at the next scheduled vote tomorrow, then at the one following next week. Ultimately, I believe what we’ve relearned is that most politics is simply performance art.

Too, remember that the decision as to who is considered essential, when the government shuts down, is left up to the president. So, the Democrats shut down the government and have allowed President Trump to decide what gets done. Pretty soon, I suspect they will figure out that was a bad idea as we have already seen specific projects in NY (home to both House and Senate minority leaders) get halted with the funds flows stopping as well.

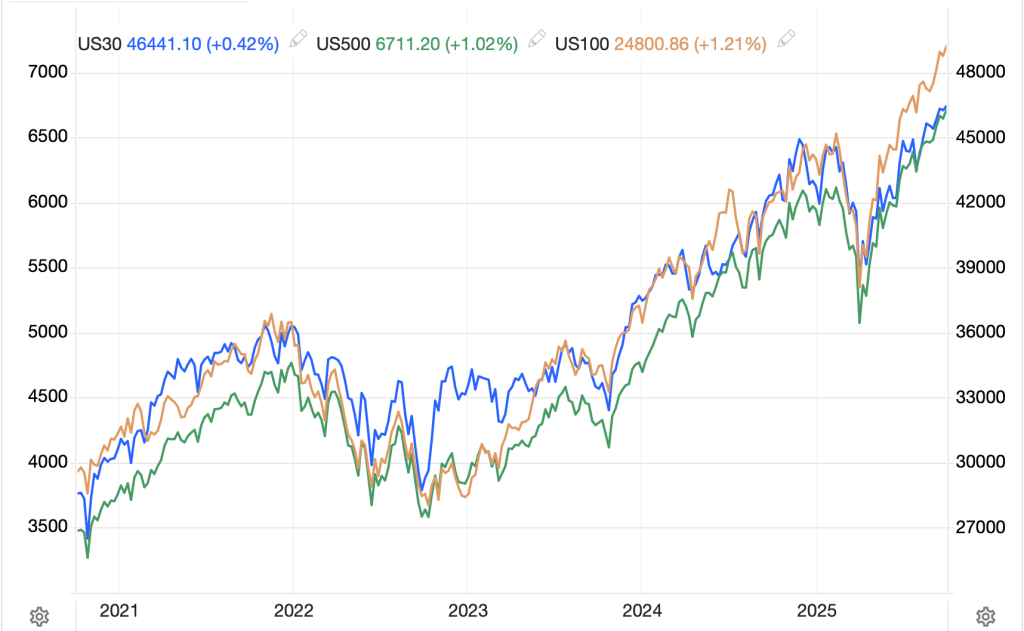

Meanwhile, in the markets, nobody appears to have noticed that the government has shut down. That is the key conclusion to be drawn from the continuation of the equity market rally where all three major US indices closed at record highs yet again. I am hard pressed to look at the below chart of those indices and glean any concern by markets regarding the government shutting down. Perhaps, even, they are applauding the idea as it means less spending!

Source: tradingeconomics.com

Arguably, the market’s biggest concern is that government data releases will be missing from the mix, although, that too, might be a blessing. The person most upset there will be Ken Griffin, as Citadel’s algorithms will not be able to take advantage of the data prints before everyone else! In fact, I suspect that he is already bending the ears of the Democratic leadership to get things back to normal.

Meanwhile, would it be too much to ask to close the Fed during the shutdown? Asking for a friend!

Ok, what is happening elsewhere in the world. Japanese Tankan data the night before last came in a tick weaker than forecast, and than last month, but remains solid overall. Deputy BOJ Governor Uchida reiterated that if the economy performs as currently expected, the BOJ will continue to remove policy accommodation going forward with expectations for a rate hike at the end of the month priced at a 60% probability. Interestingly, despite that, the Nikkei (+0.9%) rallied overnight along with the yen (+0.3% overnight, +2.1% in the past week), although the yen move makes more sense. As to the rest of Asian equity markets, China (+0.5%) and HK (+1.6%) are clearly unperturbed by the US situation as a positive outlook on trade talks with the US are the narrative there heading into their weeklong National holiday. Elsewhere in the region, every major bourse is higher with some (Korea +2.7%, Singapore +1.7%) substantially so. The US rally is dragging along the world.

This is true in Europe as well with the DAX (+1.4%) and CAC (+1.3%) leading the way as all major bourses rise alongside the US. Apparently, increasing global liquidity is good for risk assets.

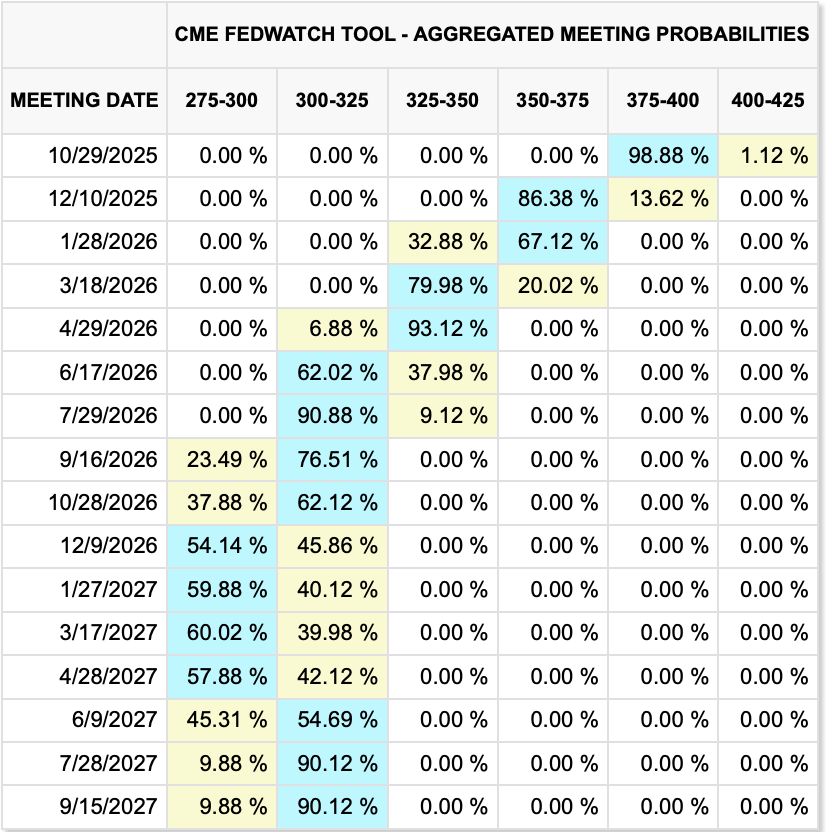

In the bond market, Treasury yields continue to slide, down another -1bp overnight after slipping -4bps yesterday. The only data was the ADP Employment Report which showed a decline of -32K jobs compared to expectations of +50K. It is important to recognize that this report included ADP’s benchmark revisions which, not surprisingly, resulted in fewer jobs create last year just like the QCEW showed with the NFP report two months’ ago. This data took the probability of a Fed cut at the end of the month up to 99% and pushed the probabilities for cuts next year higher as well.

Source: cmegroup.com

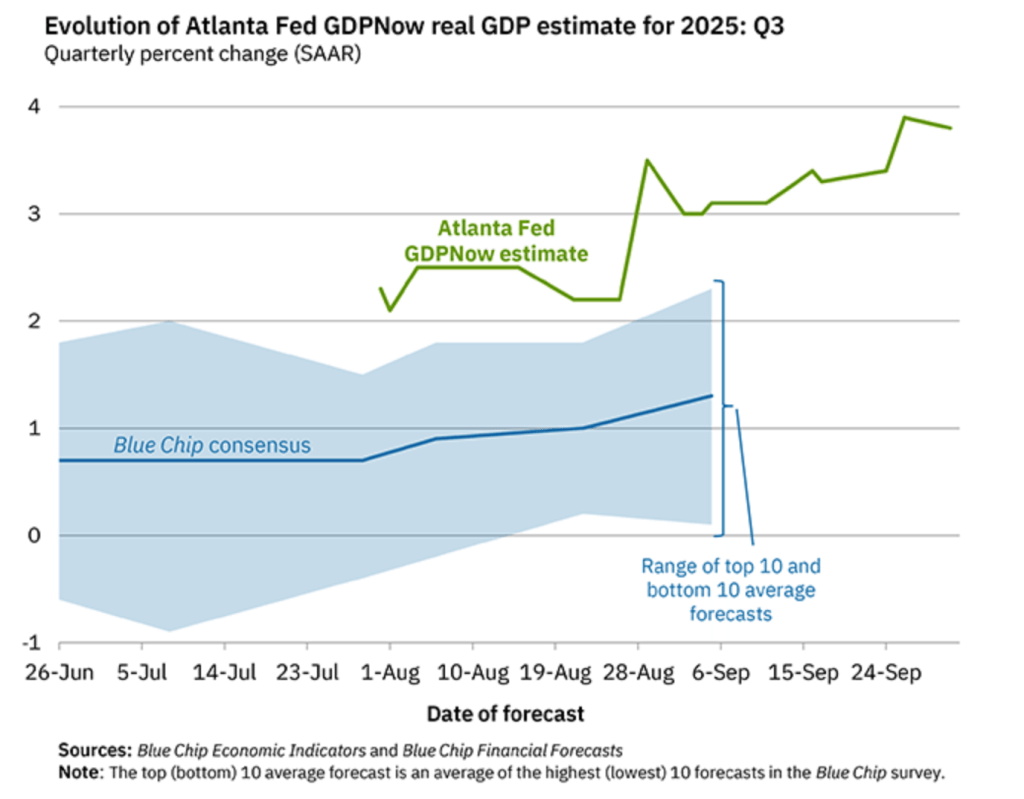

Of course, this is the very definition of bad news is good for equities and bonds, as there continues to be a strong expectation that rate cuts are designed to support asset prices rather than address real weakness in the economy. And in a way, this makes sense. After all, the Atlanta Fed’s GDPNow forecast for Q3 is currently at 3.8%, hardly the sign of an impending recession.

So, stronger than long-term growth and rate cuts seem an odd policy pairing, but the stock markets love it!

The other markets that love this policy are precious metals which continue to make new highs as well, for gold (+0.5%) these are all-time highs, for silver (+0.3%) they are merely 14-year highs. But the one thing that is clear (and this is true of platinum and palladium as well) is that investors are starting to look at the current policy mix and grow concerned over the value of fiat currencies. Oil (-0.7%), though, is currently on a different trajectory, trading right back to the bottom of its months’ long trading range less than a week after touching the top.

Source: tradingeconomics.com

There seems to be a difference of opinion regarding future economic activity between equity and oil markets. I have read a number of analyses describing peak oil, yet again, although this time they are calling for peak demand, not peak supply. Given that fossil fuels continue to generate more than 80% of global energy, and that oil also is the base for some 6000 products utilized around the world in everyday applications and the fact that there are some 7 billion people who are energy starved compared to the Western nations, I find the peak demand story to be hard to accept. But that’s just me and I’m an FX guy, so what do I know?

Speaking of FX, the decline in yields and growing belief in easier US monetary policy has worked its way into the dollar, pushing it a bit lower, about -0.15% based on the DXY. But looking across both G10 and EMG currencies, the yen’s 0.3% move describes the maximum gain with the rest having either gained less or declined a bit. Right now, the dollar doesn’t appear to be the focus of the macro world, although that is certainly subject to change at a moment’s notice.

We know there is no government data coming, although apparently, the Treasury is still auctioning T-bills today, that activity will not be delayed! We also hear from Dallas Fed President Logan, someone who ostensibly has been mooted as a potential next Fed chair. Again, the one thing we know about the FOMC right now is that there is no consensus opinion on what to do next, at least based on the dispersion of the dot plot from the last meeting.

While the Trump administration may be getting ready to axe a lot of Federal jobs, that will not stop the liquidity impulse. It’s not that this government is going to spend less, it is just spending money on different priorities. But running it hot is clearly the MO for now and the foreseeable future. Ultimately, if the GDPNow forecast is correct, a much weaker dollar seems unlikely regardless of the Fed’s moves. But that doesn’t mean a dollar rally, rather we could stay near here for a lot longer.

Good luck

Adf