The Chairman is ready to speak

To Congress, and there’s some mystique

Will he indicate

The Fed’s favorite rate

Is likely soon in for a tweak?

Or will Chairman Powell explain

Inflation continues to drain

The ‘conomy’s health

And with it the wealth

He’s garnered through much of his reign

With recent elections behind us, market participants now turn their attention to Chairman Powell and his testimony today before the Senate Banking Committee and tomorrow before the House Financial Services Committee. Of course, all eyes and ears will be searching for clues that the recent spate of softer than expected economic data has been sufficient to allow him, and his FOMC brethren, to gain the necessary confidence to cut the Fed funds rate. Recall, to a (wo)man, every speaker has indicated that things were looking pretty good, but that they needed to see several months of this type of economic data before acting.

Lately, the punditry has become far more vocal about the possibility of a recession, with a number of well-known analysts claiming we are already in that state. They point to the employment situation, notably the discrepancies between the establishment and household surveys. Their argument revolves around the idea that the number of people working continues to decline despite the claim that there are more jobs being created. It is true that job growth has been driven by an increase in part-time work, so this is not impossible. And it is also true that when part-time work is ascendant, it typically signifies a weaker economy.

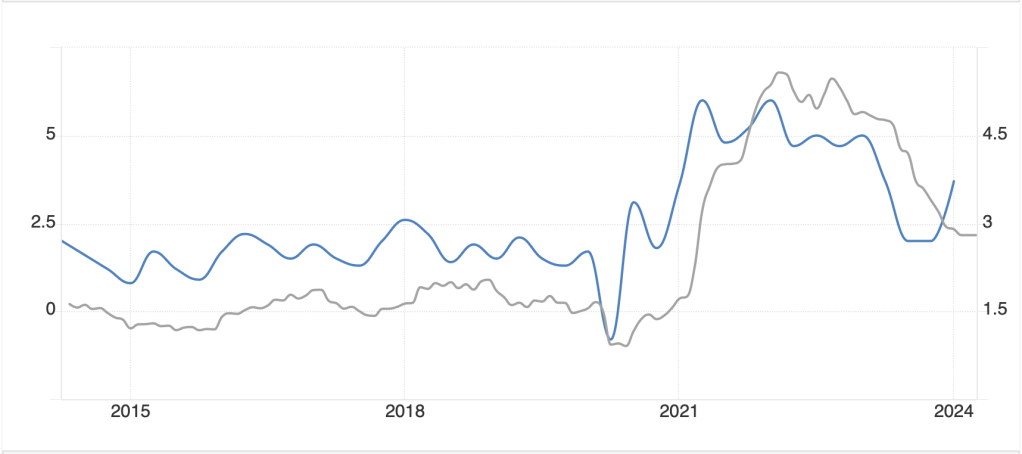

These same pundits point to the discrepancy between GDP and GDI (Gross Domestic Income) which ostensibly measure the same thing from different sides of the ledger. Over the past year and change, as can be seen from the below chart, GDP has been growing at a faster rate than GDI with the difference between the two now at 2.3% of GDP.

Source: St Louis Fed FRED data base

Putting that in context, the most recent Atlanta Fed GDPNow forecast for Q2 2024 has fallen to just 1.5% annual growth. The implication is that GDP growth may well be negative. Over time, these two measures get revised so that they are the same, but this particular discrepancy is both wider than normal and has been ongoing for a relatively long time in the history of the two. Something is amiss and many pundits believe that the result will be GDP will be revised lower to match GDI rather than the other way around. In other words, GDP growth is slower than reported and the chances we are currently in a recession are greater.

Of course, the other side of the story is also widely believed by other pundits who point to the consumer, which as evidenced by yesterday’s Consumer Credit data, continues to spend aggressively. They also rely on the continued growth in the NFP data as a key indicator of economic activity and remain confident that the economy is simply in a slow patch during a continued growth period.

Now, it seems to me that the Fed are likely rooting for a bit more aggressive economic slowdown as that would give their models the signal that inflation is well and truly under control. Perhaps Chairman Powell will give us those hints this morning, although he will certainly not explain that outright to the Senate. (The one certainty from this morning’s testimony is that certain Senators from the Northeast are sure to rail at the current level of interest rates and berate Mr Powell for not having cut them already.) In any event, that is really all we have on the calendar today, and likely the biggest news until Thursday’s CPI release. After all, tomorrow’s House testimony will be identical by Powell, although we can look forward to even stupider questions from the likes of Representatives Maxine Waters and Ayanna Pressley.

And so, to markets. Yesterday’s lackluster US session has seen a mix of results elsewhere in the world. In Asia, the Nikkei (+2.0%) rallied sharply to new all-time highs, on the back of tech share enthusiasm and the AI story as well as the still weak JPY. While the BOJ is slated to meet later this month, there is no clarity as to whether they will tighten policy given the still mixed data from Japan. As well, Chinese shares (+1.1%) and Australian shares (+0.9%) both had solid performances although the Hang Seng was unable to gain any traction and was unchanged on the day.

In Europe, all is red this morning, led by the CAC (-0.8%) as it seems investors are beginning to understand that the electoral outcomes may not have been net beneficial for both the French and UK economies. While the two nations have different issues (no leadership in France, a socialist one in the UK) I fear that both nations will have manifest economic problems going forward when it becomes clear that increased spending is unaffordable. But for now, absent any additional data, investors are lightening up on exposures there. US futures, though, are edging higher at this hour (8:00).

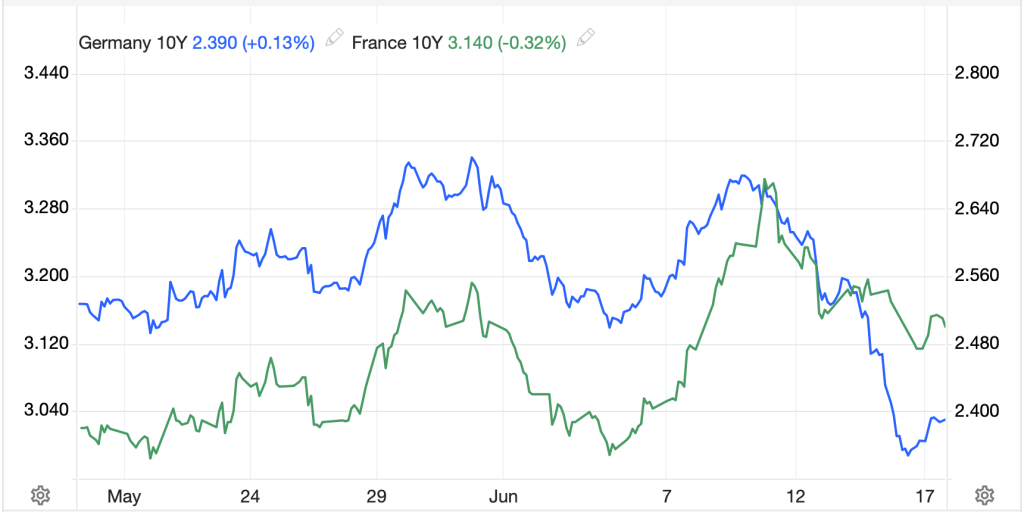

In the bond markets, yields are starting to turn higher again despite some lackluster economic data. Treasury yields are higher by 2bps and across the UK and Europe, yields are higher by 3bps to 4bps universally. This means there have been no changes to the spreads of OATs to Bunds, but it may not be that welcome overall.

In the commodity markets, oil (-0.4%) remains under pressure as concerns over US production being reduced by Hurricane Beryl have diminished now that wind speeds have fallen after landfall. It did not impact the offshore drilling significantly. As to metals markets, after a rough day yesterday, this morning both precious and industrial metals are little changed overall, arguably awaiting the next key catalyst, whether that is from Powell or CPI or something else.

Finally, the dollar is a bit firmer this morning across the board. Both the euro (-0.15%) and the pound (-0.15%) have performed surprisingly well lately given the political backdrop. Perhaps that is a hint that politics is not necessarily a key short-term driver of FX rates. However, today, along with the rest of their G10 brethren, they are under pressure. In the EMG bloc, ZAR (-0.6%) continues to demonstrate the greatest amount of volatility amongst the most traded currencies and is under pressure alongside metals prices. As well, both HUF (-0.3%) and CZK (-0.4%) are showing their high beta response to the euro’s weakness. However, today appears very much to be a dollar day, not a currency day.

The NFIB Survey was released at a better than expected 91.5, although that level remains in the lowest decile of readings in the history of the series. In addition to Powell, we hear from Vice-chair for supervision Barr as well as Governor Bowman during the day, but really, it is all about Powell. Personally, I doubt he tells us anything new and do not expect him to hint strongly at a rate cut coming soon. However, if he does, look for the dollar to decline sharply.

Good luck

Adf