Five years ago, some will remember

George Floyd was the riotous ember

But while cities burned

What some of us learned

Was markets ignored the mayhem-ber

Of late, as the headlines are filled

With riots, no one’s been red-pilled

While some may disdain

Risk assets, it’s plain

That most buying stocks are still thrilled

The tragic goings on in LA remain the top story as we have now passed the fourth day of rioting. It strikes me that ultimately, the constitutional question that may be addressed is how much power the federal government has in a situation where a state government seemingly allows rampant destruction of private property. Of course, we saw this happen just over five years ago in the wake of George Floyd’s death in May 2020 and the ensuing riots in Minneapolis which ultimately spread to Portland, Oregon and Seattle.

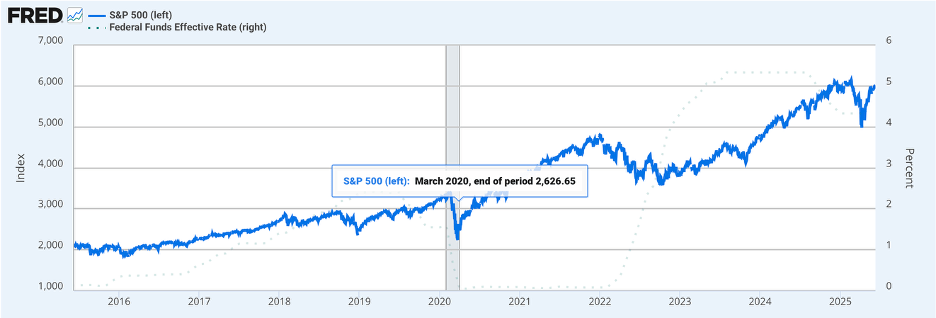

With this as a backdrop, I thought I would take a look at market behavior during that period, if for no other reason to be used as a baseline. Of course, there are major caveats here as that was during Covid and the government had recently passed a massive stimulus bill while the Fed began to monetize that debt. Now, we cannot ignore the BBB which looks a lot like a massive stimulus bill as well, so perhaps things are closer in kind than I originally considered. At any rate, the chart below shows the S&P 500 leading up to and through the 2020 riots.

The huge dip before the riots began was the Covid dip, and the faint dotted line is the Fed Funds rate, so you can see things were clearly different. However, the point I am trying to make is that despite the violence and disagreements over President Trump’s authority, I would contend the market doesn’t care at all about the situation there. Investors remain far more concerned about the ongoing trade talks with China that are taking place in London and are “going well” according to Commerce Secretary Lutnick. From what I read on X, it seems there is a growing expectation that a China deal of some sort will be announced soon and that will be the latest buy signal for stocks. My larger point is that just because something dominates the headlines, it doesn’t mean that something is relevant in the financial world.

Funnily enough, because the LA riots are sucking the oxygen from every other story, there is relatively little to drive market activity, hence the relatively benign market activity we have been seeing for the past few days. Yesterday was a perfect example with US equity markets trading either side of unchanged all day and closing pretty much in the same place as Friday. In Asia overnight, the picture was mixed with the Nikkei (+0.3%) edging higher while both the Hang Seng (-0.1%) and CSI 300 (-0.5%) finished slightly in the red. The one big outlier there was Taiwan (+2.1%) with other markets showing less overall interest. I suspect this movement was on the back of the positive vibe the market is taking from the US-China trade talks.

As to Europe, the continent has a negative flavor this morning with the DAX (-0.5%) the laggard and other major indices edging lower by just -0.1% or so. However, the FTSE 100 (+0.4%) has managed a gain after softer than expected employment data has increased discussion that the BOE will be cutting rates a bit more aggressively. US futures are still twiddling their proverbial thumbs with no movement at this hour (7:10).

In the bond market, Treasury yields have slipped -3bps and we are seeing similar yield declines throughout the continent. However, UK gilts (-7bps) are really embracing the slowing labor market and story of a more aggressive BOE rate cut trajectory.

In the commodity markets, oil (+0.5%) continues to climb higher despite the alleged increases in supply and is close to filling the first gap seen back in April (see chart below from tradingeconomics.com)

Given OPEC+ and their production increases, this is a pretty impressive move, especially as the recession narrative remains largely in place. One tidbit of information, though, is that the Baker Hughes oil rig count is down 37 rigs since the 1st of May, a sign that US production, despite President Trump’s desires for more energy, may be slipping a bit. As to the metals markets, gold (+0.45%) keeps on trucking, with a steady grind higher although both silver and copper are little changed this morning. I must mention platinum as well, given I discussed it yesterday, and we cannot be surprised that after a remarkable run, it is softer by -1.3% this morning taking a breather.

Finally, the dollar, like equities, is directionless overall with the pound (-0.3%) slipping on the weak labor data but the rest of the G10 within 0.1% of Monday’s closing levels. In the EMG bloc, KRW (-0.9%) is the outlier, apparently responding to the positive signals from the US-China trade talks. However, I question that narrative as no other APAC currency moved more than 0.1% on the session in either direction. And truthfully, that pretty well describes the rest of the bloc in LATAM and EEMEA.

On the data front, the NFIB Small Business Optimism Index was released this morning at a better than expected 98.8, which as you can see below, is a solid reading overall, certainly compared to most of 2022-2024.

Source: tradingeconomics.com

And here is the rest of what we get this week:

| Wednesday | CPI | 0.2% (2.5% Y/Y) |

| -ex food & energy | 0.3% (2.9% Y/Y) | |

| Thursday | PPI | 0.2% (2.6% Y/Y) |

| -ex food & energy | 0.3% (3.1% Y/Y) | |

| Initial Claims | 240K | |

| Continuing Claims | 1908K | |

| Friday | Michigan Sentiment | 53.5 |

| Michigan Inflation Expected | 6.6% |

Source: tradingeconomics.com

However, we must take that Inflation expectation number with at least a few grains of salt (even assuming it has value as an indicator at all), as yesterday, the NY Fed released their own survey of Inflation expectations which fell to 3.2%. A quick look at the two indicators overlaid on one another shows that the Michigan indicator, if nothing else, has much greater volatility which reduces its value as an indicator.

Source: tradingeconomics.com

It is difficult to get excited about movement in either direction right now. At some point, the mayhem in LA will end and news sources will look for the next story. I suspect that trade deals are going to grow in importance as Mr Trump will need to sign some more before long. As well, the BBB, which I continue to believe will be passed in some form, is going to add some measure of certainty and stimulus to the economy, which, ceteris paribus, implies that the long-awaited reckoning in the stock market may be awaited even longer. If that is the case, then the weak dollar story, one I understand, is likely to fade for a while as well.

Good luck

Adf