As markets all take a deep breath

Concerns are that, just like Macbeth

The President will

The ‘conomy kill

The question is, fast or slow death?

Personally, I am hopeful that we can stop discussing tariffs after today. It’s not that they will decrease in importance, but they will no longer be the primary topic. Instead, they will be a secondary explanation for anything that anybody decides is wrong with the economy, or the country or the world. Recession? Tariffs are the cause. Inflation? Tariffs are the cause. War? Tariffs are the cause. Duke loses in the semis? Tariffs are the cause.

FWIW, which is probably not that much, my view is the market has absorbed this conversation and the correction we have seen over the past weeks in the equity market is the result of growing expectations of much slower growth or a recession. Arguably, the biggest concern should be that US equity markets continue to trade at historically rich valuations and any negative catalyst can serve to both depress future expectations and compress multiples, and that’s how you get large equity market declines.

The thing about the tariff story is that while later today we will all find out the details, the actual impacts will take months, at least, to be determined. For instance, the story that Israel has just decided to drop all tariffs on US made products, thus avoiding them on Israeli products is something I suspect we may see more frequently than now assumed. Perhaps there would be no greater irony for all the naysayers than if this ‘end of free trade’ moment actually inspired a significant reduction in tariffs around the world as nations seek to retain access to the US. I’m not saying this will be the case, but given the US is the consumer of last resort, running a nearly $1 trillion trade deficit, pretty much every other nation relies on the US as a market for some portion of their production.

Along these lines, I must ask, why is it that other nations, who apply tariffs and other non-tariff barriers like quotas or regulatory restrictions, to US products do so if tariffs are such a great evil? Apparently when the French, for example, seek to protect their industries and farmers, it is healthy for the economy, but when the US does, it is world-ending. Just sayin’

So, is the dip now to be bought?

Or are things still overly fraught?

The overnight session

Did naught for that question

As no one knows what Trump has wrought

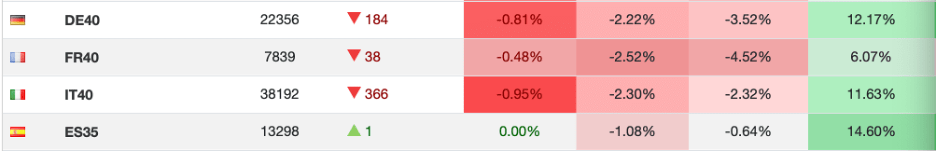

Since there are literally no other stories to discuss regarding finance and markets right now, let’s turn to the overnight and see how markets are behaving in the runup to the Liberation Day announcement. Yesterday’s mixed, but mildly positive, session in the US led to a mixed session in Asia with no real trend. Even within a nation (Nikkei +0.3%, TOPIX -0.4%) there was no clarity. Chinese shares were basically flat, Korea and Singapore fell while India and Malaysia rallied. No movements approached even 1.0% so it is probably fair to say we didn’t learn anything. However, European bourses are under pressure across the board this morning led by the DAX (-1.3%) and FTSE 100 (-0.9%). Clearly, there is significant concern that the US tariffs, which are set to come into force immediately upon their announcement, will have a significant negative impact on European companies. Certainly, German auto makers, who rely greatly on the US market, are likely to be negatively impacted, but as I said, it remains to be seen what actually occurs. I guess considering that European shares have been performing well of late, with gains on the order of 10% or more YTD, some investors have decided to take their money and run.

source: tradingeconomics.com

Meanwhile, US futures are pointing lower at this hour (7:10) down about -0.5% across the board.

In the bond market, while there is a lot of huffing and puffing that tariffs will be inflationary, yields are sliding this morning with Treasury yields (-2bps) declining to their lowest levels since last October, and a similar amount to most European sovereigns. I suppose bond investors are more concerned over the mooted recession than the inflationary impact of tariffs. Too, JGB yields slid -3bps, back to their lowest level in a month as questions remain about the BOJ’s future path as well as Japanese growth prospects in the new trade regime.

Turning to commodities, oil (-0.35%) has slipped a bit further but remains well up on the week as a story regarding the US moving more military assets toward the Middle East from Asia makes the rounds. We cannot forget that President Trump has already initiated secondary sanctions on Venezuelan crude, and threatened to do so on Russian crude if Putin doesn’t agree to the ceasefire. Meanwhile, Iran is always in Trump’s crosshairs while they remain a perceived threat to go nuclear. As to the metals markets, gold (+0.1%) continues to edge higher with any pullbacks both short term and modest. One look at the chart below shows how many more green days there have been than red ones over the past 6 months. I see nothing to stop this trend. As to the other metals, they are higher this morning and continue to trade well overall. I believe the case can be made that going forward, commodity markets, and the shares of companies in the space, are set for some real outperformance in the new world order.

Source: tradingeconomics.com

Finally, the dollar is mixed as well, with some widely disparate movements seen. For instance, NZD (+0.9%) is having a good day, perhaps because direct trade with the US is di minimus, or perhaps because it has been weakening so much for the past 6 months, down nearly 10% even after today’s rally, over that period, that it is a simple bounce. At the same time, ZAR (-1.0%) is sliding despite the ongoing gold rally, although there are growing concerns over the outcome of the budget there and how it will be funded and impact the economy. But in truth, as I look across the board, there are probably more currency gainers than losers this morning, which ironically is exactly the opposite of the forecast impact of tariffs by the US. Just remember, as Yogi Berra allegedly explained, “in theory, there is no difference between theory and practice, in practice there is.” Detailed market outcomes based on economic theories rarely hold up.

On the data front, this morning brings ADP Employment (exp 105K) and Factory Orders (0.5%, 0.7% ex-Transport) as well as the EIA oil inventories. Yesterday afternoon’s API inventories showed a large build, but expectations are for draws today. We also hear from Adriana Kugler, Fed governor, but ironically, all the Fed talk is now about tariffs and not about monetary policy.

Today is a crapshoot, with no way to even guess how things will evolve. Also, beware the initial reaction as it may not represent a new view, but rather the unwinding of current positions. Until further notice, though, I still think the dollar has a slow decline in its future.

Good luck

Adf