By now, everyone is aware

The world we had known is not there

While populist views

Are turning the screws

On governments ‘bout everywhere

The upshot is capital’s lead

O’er labor is like to recede

So, wages will rise

With yields, and surprise

Risk assets are likely to bleed

For the first time in quite a few sessions, certainly since ‘Liberation Day’, market activity has calmed down a bit. It is not that markets have stopped moving, just that the wild gyrations have disappeared for the moment. I would estimate that for most investors, and certainly for risk managers with hedging requirements, this is a blessing. However, for the trading desks at Wall Street firms, maybe not so much. I couldn’t help but notice the lead headline in the WSJ this morning, “Bank Trading Desks Are Minting Money From Tariff Chaos”

Now, we cannot be surprised by this, as volatile markets are what traders, especially bank traders with customer flow, live for. This is where they truly have an edge, even over the algos, because they have information the algos don’t have, the order flow. This got me to thinking about the idea, one which I have embraced, that President Trump is concerned with Main Street, not Wall Street. Well, if Wall Street is going to play second fiddle, I’m sure many there are perfectly comfortable with this situation. Arguably, if this continues, we are going to see many internecine battles at the big Investment Banks as traders gain power at the expense of bankers, but the firms overall will be just fine. (I know you were all worried 🤣.)

But let’s go back to the Main Street, Wall Street question. Someone who I have been following on Substack, Russell Clark, a UK hedge fund manager, has described this point very well. In the battle between labor and capital for corporate resources, Wall Street benefits when capital is favored by legislation/regulation while Main Street benefits when the rules turn in labor’s favor.

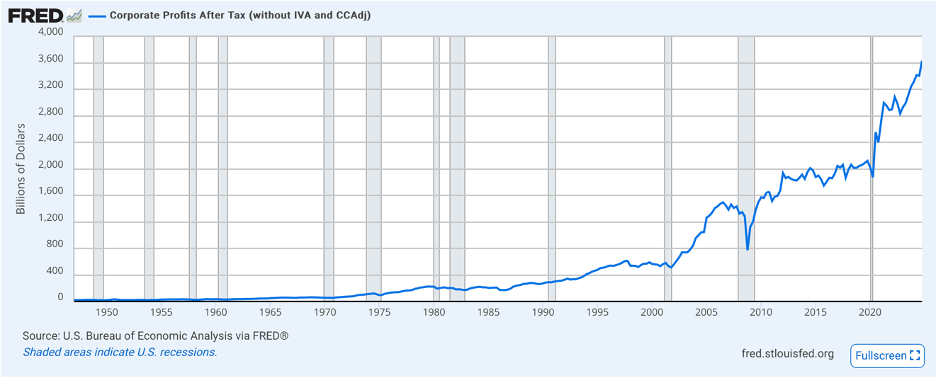

For the past 25 years, the rules have been helping capital at labor’s expense. Especially since the GFC, when the financialization of the economy really took off, this has been the case. Just look at the extraordinary rise in corporate profits during this period compared to the long history. This is a direct result of the globalization effort, with the outsourcing of much manufacturing to China and other low-wage nations.

Source: fred.stlouisfed.org

But let us consider what we have seen fomenting for the past decade, arguably since President Trump’s first election and Brexit occurred in 2016. Those were populist outcomes. And we have seen populism rise around the world. It is couched as right-wing fascism by many in the media, but whether in Germany, France, Italy, the Netherlands, here in the US or many other Western nations, the people’s voice is being heard. And what they are saying is, labor wants a bigger piece of the pie.

This idea offers solid explanations for several current situations. Labor, aka Main Street, wants government to work for them, to protect their jobs and incomes. They care far less about a company’s share price and far more about the company investing in the business and expanding. Capital, aka Wall Street, wants the government to work for them, to keep financing costs down to increase capital productivity and drive share prices higher, whether through share repurchase or reduced expenses (aka job cuts).

Right now, labor is in the ascendancy. (It is ironic that labor’s ascent has been deemed right-wing, given the long history of its left-wing tendencies, but there you go). As long as this remains the case, I think we need to consider how it will impact markets going forward. Russell’s short-hand trade idea has been long GLD vs. short TLT (the long-bond ETF) and it has worked well for quite a while. Can bond yields continue the rise that began in 2022? Certainly. Can gold continue its rally? Of course. Look at the chart below of gold and 10-year Treasury yields over the past 5 years. There is nothing about the chart that says we are topping in either case. Higher yields and higher gold prices seem contradictory, but they have been the reality for three years already. I have explained numerous times that the world we knew is gone. This may well be part of the new reality. What about equities? I have to believe multiples will be compressed which will not help them at all. And the dollar? While higher rates seem like they should support the greenback, the case for capital flows leaving the US equity market is very real. We could easily see the dollar decline further over time.

Source: tradingeconomics.com

Ok, let’s look at markets overnight. Green continues to be the theme today after solid rallies yesterday in the equity markets. I know this is not what I discussed above, but that is the long-term perspective, not the day-to-day. Right now, the tariff pauses have traders and investors feeling a little more secure, as well as word that several nations are close to new trade deals with the US with significantly lower tariffs. Yesterday’s modest US rally was followed by similar modest gains in Asia with the Nikkei (+0.8%) leading the way while both Hong Kong (+0.2%) and China (+0.1%) managed to gain, but only just. Meanwhile, in Europe, the gains are somewhat better as the DAX (+1.0%) and IBEX (+1.2%) are leading the way with the FTSE 100 (+0.8%) and CAC (+0.25%) lagging a bit. We did see some solid employment data from the UK with employment rising 206K over the past 3 months while earnings and the Unemployment Rate remained unchanged. However, Germany is a bit more confusing given the ZEW Economic Sentiment Index there fell from 51.6 to -14.0, as the trade concerns really start to bite. As to US futures, at this hour (7:20) they are slightly higher, about 0.15%.

In the bond markets, Treasury yields have edged higher by 1bp but remain below the recent peak at 4.50%. In Europe, we are seeing yields climb everywhere except the UK, where gilt yields are unchanged. But Italian BTPs (+5bps), French OATs (+3bps) and German bunds (+3bps) are all under a bit of pressure this morning. Perhaps this is a day where risk managers feel more comfortable about things, so bonds feel less compelling.

Oil (-0.4%) had a pretty big trading range yesterday but closed close to unchanged. This morning it is slipping a bit as we continue to see demand forecasts reduced by various analysts with the IEA the latest culprit. Personally, I see prices declining from here. As to the metals markets, gold (+0.25%) which slipped yesterday morning and rebounded all day and through the night continues to have significant support. Silver is little changed this morning and copper (-0.7%) is backing off some of its recent gains, although is still higher by ~14% in the past week.

Finally, the dollar, which has been under general pressure lately, is stabilizing with the DXY clinging just below 100.00. This morning, we see the euro softer but the pound and Antipodean currencies rallying, albeit not that much. But generally, after several days of very large moves, with 2% gains for the euro and Aussie last week, most movement is 0.5% or less today and the randomness implies we are seeing positions being adjusted rather than new activity.

On the data front, here is what the rest of the week brings.

| Today | Empire State Manufacturing | -14.5 |

| Wednesday | Retail Sales | 1.3% |

| -ex Autos | 0.3% | |

| IP | -0.2% | |

| Capacity Utilization | 78.0% | |

| Bank of Canada Rate Decision | 2.75% (unchanged) | |

| Thursday | ECB Rate Decision | 2.25% (-0..25%) |

| Initial Claims | 225K | |

| Continuing Claims | 1870K | |

| Philly Fed | 2.0 |

Source: tradingeconomics.com

The only release yesterday was the NY Fed inflation expectations data which, it should be no surprise, rose to 3.6%. I suppose that the virtual nonstop reporting that the tariff regime is going to raise inflation is having an impact. From the Fed, yesterday we heard that patience remains a virtue and Governor Waller is in the transitory impact of tariffs on inflation camp. There are two more Fed speakers today, Barkin and Cook, but nothing has changed my view that they are not that relevant now.

Big picture, my take is this is a reprieve before the next bout of risk selling. The selling can last into the summer as I think it will take until then before we get a better understanding of the outcome of the trade situation. Maybe that will be the bottom, or if trade relations worsen, perhaps another leg lower is to come. As to the dollar, while I don’t see a collapse, I do think lower is the way.

Good luck

Adf