This week all the problems in China Have given the markets angina Last night, we are told Stocks oughtn’t be sold While Xi tries to hold a hard line-a

For the third day in a row, China is the story du jour. Two stories from last night illustrate the problems in the Chinese economy are either spreading more widely or simply becoming more widely known outside China. The litany of issues are as follows: Chinese authorities requested that investment funds not be net sellers of equities this week; the PBOC added the most cash to the economy via reverse repos in six months; investors who have not been repaid by Zhongrong International Trust were seen outside the company’s Beijing HQ protesting openly; and the yuan continues to slide despite PBOC efforts to moderate the currency’s decline.

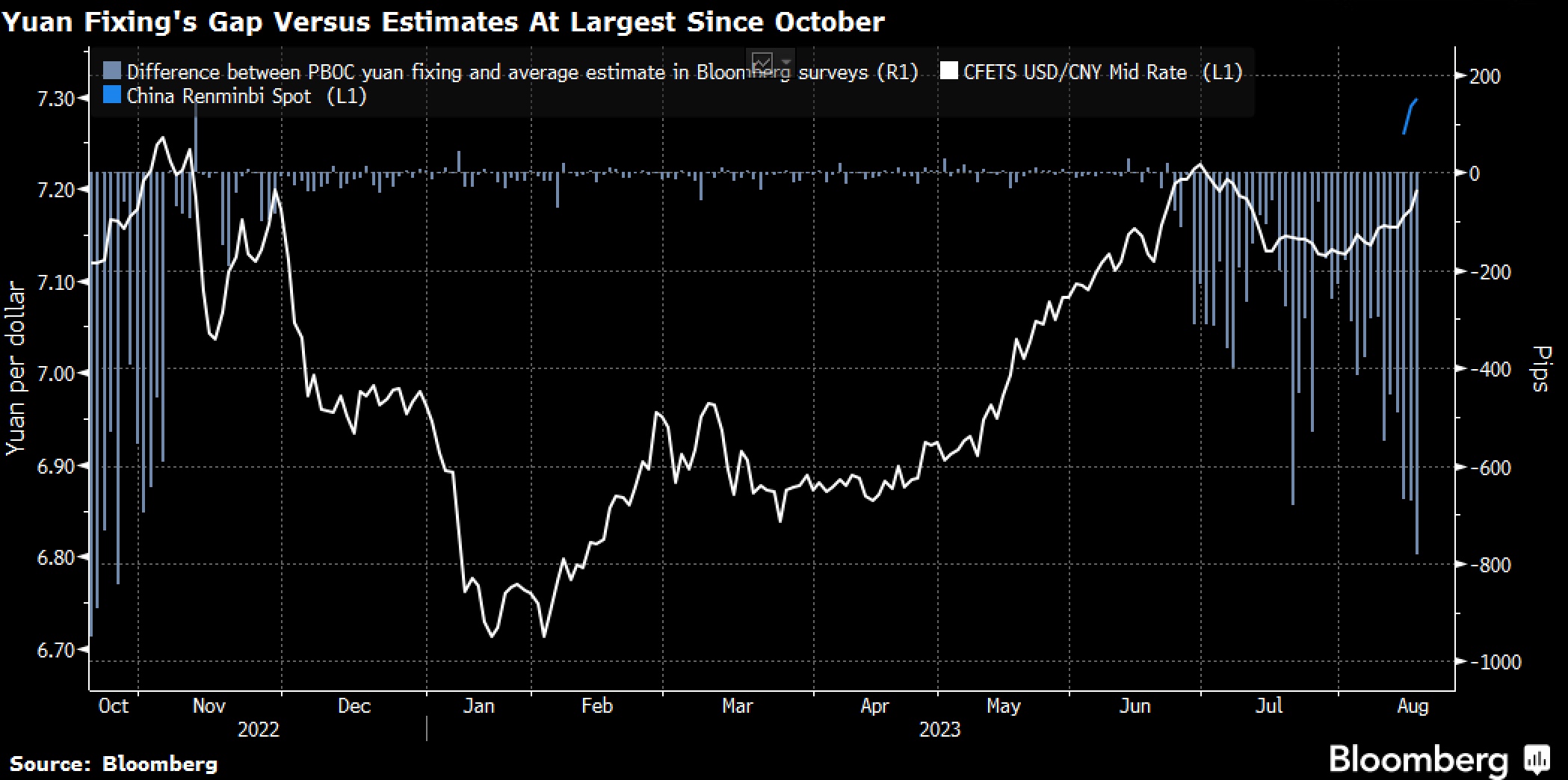

A brief recap of the process in the onshore CNY market shows that each morning the PBOC sets a central rate for the day (the CFETS rate), ostensibly based on a basket of currencies they follow, and when the market starts trading, it must remain within a +/- 2% band around that central rate. Historically, when the PBOC wanted to signal that the currency was getting too strong or too weak, that CFETS rate would be set further in their desired direction than the model implied to help guide the market. Well, lately, the PBOC has been setting the CFETS rate for a much stronger than expected CNY, but the market has largely been ignoring that. Bloomberg has an excellent chart showing the rising discrepancy that I have reprinted below.

The bars on the chart represent the difference, in pips on the RHS axis, between the actual CFETS fix and the estimates from analysts’ models. Notice that from November 2022 through the beginning of July, that difference was virtually nil. The point is the models have proven themselves over time to be accurate, so these big discrepancies are policy choices.

As the PBOC watches the currency of its closest ally, Russia, collapse in slow-motion, it is clearly concerned about its own situation. The added pressure of slowing growth and the problems in the investment sector are making things more difficult. The fact that China is on a monetary easing path while the rest of the world is still tightening is naturally going to undermine the value of the renminbi, but the great fear in China is a rapid devaluation.

The biggest problem the PBOC has is that unlike the situation with youth unemployment, where they simply decided to stop publishing the data, they don’t really have that choice in this situation. They cannot hide what they are doing and expect that the FX market will be able to function realistically. And China needs an FX market because of the huge portion of their economy that is reliant on international trade.

There is no easy answer for the Chinese here. If they seek to support the domestic economy with easier monetary policy, the renminbi is very likely to continue to fall as locals seek to get their money out of the country and invest in higher yielding assets. The fact that the Chinese equity markets have been slumping simply adds more pressure to the situation. There is a well-known idea in international finance called the impossible trilemma which states that no country can have the following three things simultaneously:

- A fixed foreign exchange rate

- Free capital movement

- Independent monetary policy

China’s situation is that while the FX rate is not actually fixed, it is carefully and closely managed; while there are significant capital controls, there is still a steady flow of funds leaving the country, often via international real estate investments, so there is some freedom of flows; although of course, there is no attempt at independence by the central bank. However, what we can readily observe is that even maintaining control of the currency while there is any ability to move capital offshore is virtually impossible these days. Nothing has changed my view that we are headed to 7.50 and beyond over time. And, to think, I didn’t even have to discuss weak earnings from Tencent or further concerns about Country Garden going bankrupt.

With that as our backdrop, it cannot be surprising that risk is under some pressure. After all, the Chinese economy remains the second largest in the world. The big change for markets is that after two decades of China being the fastest growing major economy in the world, now it is much slower than both Japan and the US (Europe is still in the dumps) and portfolio adjustments are still being made.

Looking at the overnight session, after a weak US market, with all three major indices lower by more than -1.0%, Asia followed suit completely, with markets there also under significant pressure, falling by -1.0% or more pretty much throughout the time zone. European bourses, though, have edged higher after a weak performance yesterday, but the gains are di minimis, and in the UK, after inflation data showed the BOE’s job is not nearly done, the FTSE is a bit softer. US futures are little changed this morning as the market awaits the FOMC Minutes this afternoon.

Treasury yields have backed off a bit, down about 2bps, and we are seeing similar movements in Europe. However, 10yr Treasury yields remain well above 4.0% and certainly seem like they are trending higher. In the wake of the much stronger than expected Retail Sales data yesterday morning, 10yr yields spiked to 4.26%, their highest level since last October, and tantalizingly close to the highest levels seen in more than 15 years.

Oil prices (+0.3%) which have been sliding for the past week, consolidating their strong move over the past two months, seem to be stabilizing above $80/bbl for now. We are also seeing modest strength in the metals complex today, although the movement has been very tiny. Gold has managed to hold the $1900/oz level, but its future performance will depend on the dollar writ large I think.

And finally, the dollar, which has been quite strong overall lately, is softening a touch this morning, with only two weaker currencies in the EMG bloc, KRW (-0.5%) and CNY (-0.1%) as both respond to the problems mentioned above. But elsewhere, this seems to be a bit of a relief rally with the dollar sagging broadly. The G10 space is seeing similar price action with only CHF (-0.2%) and JPY (-0.1%) lagging slightly, while the rest of the bloc edges higher. But movement of this tiny magnitude tends to mean very little.

On the data front, Housing Starts (exp 1450K) and Building Permits (1463K) come first thing with IP (0.3%) and Capacity Utilization (79.1%) at 9:15. Finally, at 2:00 the Minutes from the July FOMC meeting will be released and given the change in tone we have heard from several members lately, with cuts now on the table for next year, it will be interesting to see how that plays out.

Today feels like a consolidation day, without any significant catalysts, so I expect a quiet session overall. Unless the Minutes change everyone’s views regarding the next steps by the Fed, I maintain my view of dollar strength over time. At least until the Fed actually turns things around.

Good luck

Adf