Japanese prices

Are rising ever higher

Probably nothing!

Meanwhile Ueda

Explained QE can still be

The Japanese Tao

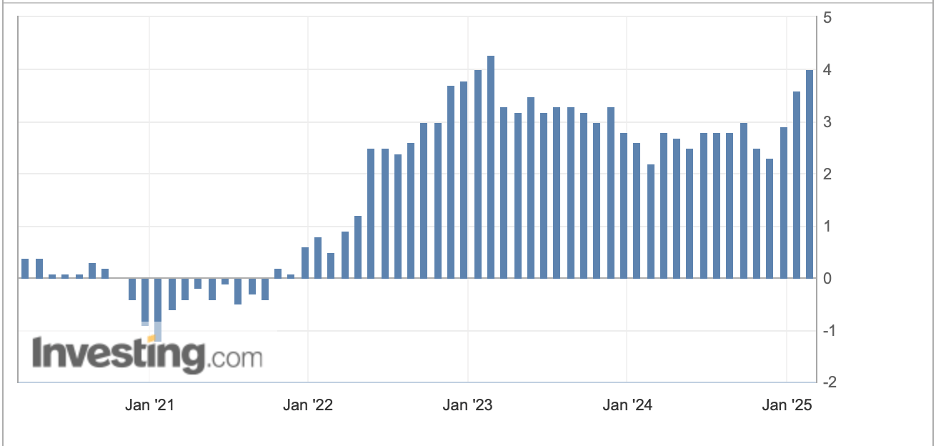

Japanese inflation data was released last night, and the picture was not very pretty. In fact, let me show you. The first chart shows the monthly readings of annual inflation for the past 5 years. Last night’s 4.0% reading was not the highest in that period, (that distinction belongs to Feb 2023 at 4.3%), but it is pretty clear that any sense of declining inflation is beginning to dissipate and has been doing so for the past year. PS, remember, Japanese interest rates range from 0.5% in the overnight to 1.425% in the 10-year, so real rates remain highly negative regardless of your timeframe.

The second picture takes a longer-term perspective to help us better understand the long history of inflation in Japan. While a decade ago, inflation showed an uptick of nearly the recent magnitude, that was driven specifically by the government raising the GST (goods and services tax) which was Japan’s answer to a VAT. It was highly controversial at the time but was also understood to have a truly transitory impact as it was a one-off rise in prices. However, beyond that period, the Japanese have been living with inflation somewhere between -2.2% in the wake of the GFC and 2.0% since the turn of the century. In fact, going back to the 1990’s, inflation didn’t reach current levels, and one must head back to 1981 to see significant inflation in Japan. This means there are two generations of people who have basically never seen prices rise in the current manner.

So, what do you think the central bank is considering? Let me give you Ueda-san’s own words, [emphasis added] “In exceptional cases where long-term interest rates rise sharply in a way somewhat different from normal movements, we will flexibly increase purchases of government bonds to promote stable formation of interest rates in the market.” You read that correctly inflation is rising sharply, JGB yields are rising in sync and the BOJ’s response is to BUY MORE BONDS!!! You cannot make this stuff up. I guess old habits die hard.

The market response to this was as you might expect. JGB yields dipped 2bps, Japanese equities managed a modest rally (+0.3%) as they seem caught between lower rates and higher inflation, and the yen ( -0.5%) weakened. In essence, it appears the combination of a strengthening yen and rising interest rates has the potential to wreck the Japanese government’s budget, and the BOJ went back to form and discussed more QE as a response. This is simply more proof that there isn’t a central bank in the world that truly cares about inflation. While stable inflation may be a mandate, it is the last of their concerns.

Inflation is, however, not the last of our concerns, at least as we try to live day to day. This is what has me concerned about Chairman Powell and his minions at the Fed, they continue to believe that the current interest rate structure is restrictive and despite the fact there is virtually no evidence prices are ever going to get back to their target of 2.0%, let alone true stability, still see cuts as the way forward. Perhaps I am mistaken to believe that the Fed will see the light and maintain current policy levels or even tighten as inflation rebounds. If that is the case, my entire dollar thesis is going to come under a lot of pressure!

Ok, away from the Japanese antics overnight, a brief word about China. Last night, Premier Li Qiang explained that China will look to “vigorously” improve the services sector of the economy, specifically education, health care, culture and sports, as they once again try to adjust the balance of economic activity to a more domestic focus rather than their historical mercantilist process. Earlier this week the PBOC reiterated their support for the property market, although for both these efforts, this is not the first time they have been discussed, and the evidence thus far is all their efforts have been fruitless. But for one day, at least, these comments have been embraced as the Hang Seng (+4.0%) and CSI 300 (+1.3%) both rallied sharply on the news of more domestic support for the Chinese economy. The Chinese are set to hold a key economic confab as they try to plan how to shake things up a bit, and these comments, as well as a seeming promise the PBOC is going to cut rates again, are all of a piece. Maybe they will be successful this time, but I am not holding my breath.

Otherwise, the only other noteworthy economic news came from the Flash PMI’s across Europe which were soggy at best, certainly not indicative of significant growth coming soon. With that in mind, let’s look at the rest of the markets’ overnight performance. The rest of Asia’s equity markets were mixed with Taiwan’s the best performer and several modest declines elsewhere including India, Australia and New Zealand. In Europe, though, despite those modest PMI outcomes, most markets are higher led by the CAC (+0.5%). Perhaps, the view is the ongoing weakness will force the ECB to cut rates more quickly, and we have heard several ECB members indicate further cuts are coming. However, counter to that, Isabel Schnabel, one of the more hawkish members, mentioned this morning that she believed they were already at neutral, and more cuts may not be necessary. While that is not the consensus view yet, it is worth remembering. As to the US futures market, at this hour (7:00), all three major indices are basically unchanged.

In the bond market, yields have fallen across the board with Treasuries, after sliding yesterday, down another 2bps this morning and back below 4.50% for the first time in a week. In a Bloomberg interview yesterday, Secretary Bessent explained that although his goal is to reduce the issuance of T-bills and term out debt, given the situation which he inherited from the previous administration, that process will take longer than some had considered previously. In other words, there won’t be a large increase in 10-year issuance any time soon. European sovereign yields are also much softer, down between -3bps and -5bps on those further rate cut hopes, or perhaps the lackluster PMI data.

In the commodity markets, oil (-0.8%) is backing off its recent rally highs, but remains quiet overall and well within its ever-tightening trading range. It seems traders don’t know how to handicap the constant discussions from the Trump administration and whether Russian sanctions will end or not, as well as how quickly OPEC may ramp up production and what is happening to demand. While none of these things are ever certain, right now they seem particularly fraught. In the metals space, gold (-0.4%) is backing off from yesterday’s latest all-time highs, and taking both silver and copper with it, but the uptrend in all three of these metals remains quite strong.

Finally, the dollar is higher this morning gaining ground against all its G10 counterparts with the yen being the worst performer, but also against all its EMG counterparts with HUF (-1.0%) the true laggard although the entire CE4 are under pressure, arguably responding to the mayhem over how the Ukraine situation plays out. After all, they are the closest in proximity and likely to be the most impacted.

On the data front, this morning brings Flash PMI data (exp manufacturing 51.5. Services 53.0), Existing Home Sales 4.12M) and Michigan Sentiment (67.8). We also hear from two more Fed speakers, Jefferson and Daly, but again, caution and stasis are the story until further notice, and that notice is not coming from Mary Daly but rather from Jay Powell.

Perhaps the most interesting thing happening right now is that although tariffs remain a major economic force and are clearly on the table, they are not even the 4th most important topic in the market. Back to my earlier comments, I sincerely hope that the BOJ’s overwhelming dovish stance is not a harbinger of things to come here in the States. Right now, I don’t think so, but I am far less confident than I was earlier this week.

Good luck and good weekend

Adf