The news cycle’s still ‘bout the vote

With Harris and Trump in full throat

‘Bout why each should be

The one filled with glee

When voters, to prez, they promote

Meanwhile, out of China we hear

More stimulus is coming near

The rumor is on

That ten trillion yuan

Is how much Xi’ll spend through next year

The presidential election continues to be the primary source of news stories and will likely remain that way until a winner is decided. The vitriol has increased on both sides, and that is unlikely to stop, even after the election as neither side can seem to countenance the other’s views on so many subjects.

As we watch Treasury yields continue to rise, many are ascribing this move to the recent polls that show former President Trump gaining an advantage. The thesis seems to be that his proffered plans will increase the budget deficit by more than Harris’s proffered plans, but I find all this a bit premature as budget deficits are created by Congress, not presidents, so the outcome there will have a significant impact on the budget. With that in mind, though, if we continue to see the yield curve steepen as long-end rates rise, my take is the dollar will continue to perform well.

But the election is still a week away and while there is no new data of note today, we do see important numbers starting tomorrow. In the meantime, one of the big stories is that the Chinese National People’s Congress is now considering a total stimulus package of CNY 10 Trillion to help support the economy, and that if Trump wins, that number may grow larger under the assumption that he will make things more difficult for the nation. This report from Reuters indicates that there would be a lot of new debt issuance to help support local governments repay their current borrowings as well as support the property market.

Now, this is very similar to what was reported last week, although the totals are larger, but there is nothing in the story indicating that President Xi is going to give money to citizens, nor focus on new production. This all appears to be an attempt to clean up the property market mess (remember, most local government debt problems are a result of the property debacle as well), which while necessary is not sufficient to get China back to its pre-pandemic growth trend.

As it happens, this story did not print until after the Chinese equity markets closed onshore, so the CSI 300’s decline of -1.0% has been reversed in the futures aftermarket. As well, given that Hong Kong’s market doesn’t close until one hour later, it had the opportunity to rebound before the close and finished higher on the day by 0.5%. As to the rest of Asia, it mostly followed the US rally from yesterday with the Nikkei (+0.8%) performing well and gains seen across virtually all the other markets there.

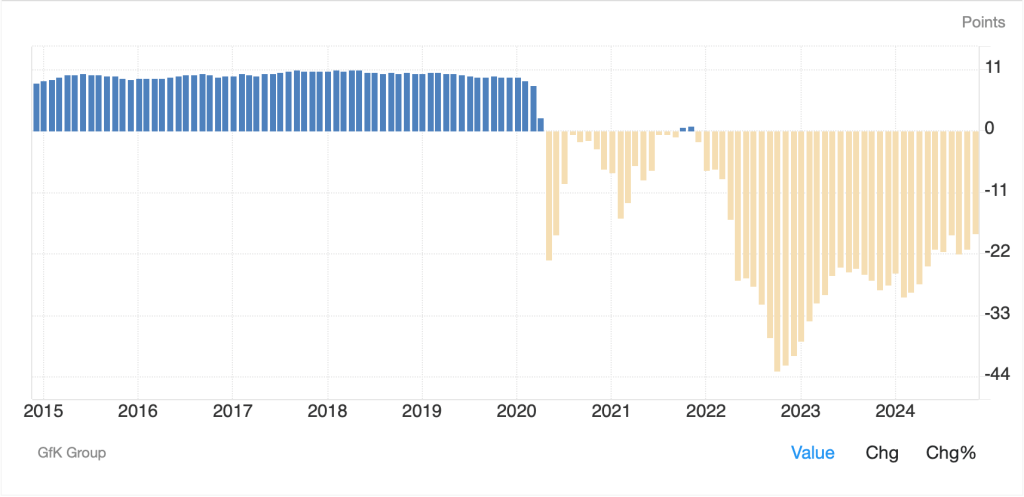

Turning to Europe, the only data of note was the German GfK Consumer Confidence index which rose to -18.3. While this was better than last month and better than expected, a little perspective is in order. Here is the series over the past ten years.

Source: tradingeconomics.com

While it seems clear that consumers are feeling a bit more confident than they have in the past year, ever since the pandemic, the German consumer has been one unhappy group! And the other story from Germany this morning helps explain their unhappiness. VW is set to close at least 3 factories and reduce wages by 10% as they try to compete more effectively with Chinese EV’s. I can only imagine how confident that will make the people of Germany!

Now, the interesting thing about confidence is that while it offers a view of the overall sentiment in markets, it doesn’t really correlate to any specific market moves. For instance, the euro (-0.2%) remains rangebound albeit slightly lower this morning, while the DAX (+0.25%) has actually rallied a bit, although that is likely on the basis of the VW news helping to convince the ECB that they need to cut rates further and faster. In fact, most European bourses are firmer this morning on the lower rate thesis I believe, although Spain’s IBEX (-0.25%) is lagging after some moderately worse earnings news from local companies.

Turning to the commodities sector, it should be no surprise that they are higher across the board as the combination of proposed Chinese stimulus and potential future inflation in the US based on a possible Trump victory (although there is nothing in the Harris policies that seem likely to reduce inflation) means that commodities remain a favored outlet for investors. After a couple of days of choppiness, we are seeing oil (+1.2%) rise nicely (perhaps the decline was a bit overdone on position adjustments) and the metals complex rise as well (Au +0.3%, Ag +1.3%, Cu +1.1%) as all three will benefit from all the new spending that is likely to occur in the US as well as China.

One other thing to note, which disappointed the gold bulls, as well as the dollar bears, is that the BRICS meeting in Kazan, Russia resulted in…nothing at all regarding a new currency to ‘challenge’ the dollar. Toward the bottom of their proclamation, they indicated they would continue to look for ways to work more closely together, but there is nothing concrete on this subject. As I have been writing for the past several years, and paraphrasing Mark Twain, rumors of the dollar’s demise have been greatly exaggerated. So, there will be no BRICS currency backed by gold or anything else, no new payment rails and Treasuries are going to remain the haven asset of choice alongside gold.

As to the dollar vs. its other fiat counterparts, it is a bit stronger this morning alongside US yields (Treasuries +3bps) with even the commodity bloc having difficulty gaining ground. Of note is USDJPY, which is higher by 0.35% and now firmly above 153.00. Last night, we did hear our first bout of verbal concern from a MOF spokesman explaining they are watching the yen carefully. I’m sure they are, but I believe they will be very reluctant to enter the market when US yields are rising, and the BOJ is not keeping pace. In fact, while the November rate cut is baked in at this point, the probability of the Fed cutting in December continues to slowly decrease (now 71%). If we see a good NFP number Friday, I would look for that to decrease more rapidly and the dollar to see another leg higher.

And that’s all the market stuff today. On the data front, Case Shiller Home Prices (exp 5.1%) and the JOLTS Job Openings data (7.99M) are the major releases. As well, the Treasury is auctioning 7-year Notes this morning after a tepid 2-year auction yesterday. It is very possible investors are starting to get a bit nervous about the US fiscal situation and if that continues, the irony is that higher yields will beget a higher dollar despite the concerns.

It is difficult to get away from the election impact on markets, and it seems that as momentum for Trump builds, the market is going to continue to push yields and stocks higher with the dollar gaining ground alongside gold. Go figure.

Good luck

Adf