Said Jay, we are not in a hurry

To cut, as the future is blurry

As well, since it’s Trump

We don’t want a slump

‘Cause really, his favor, we curry

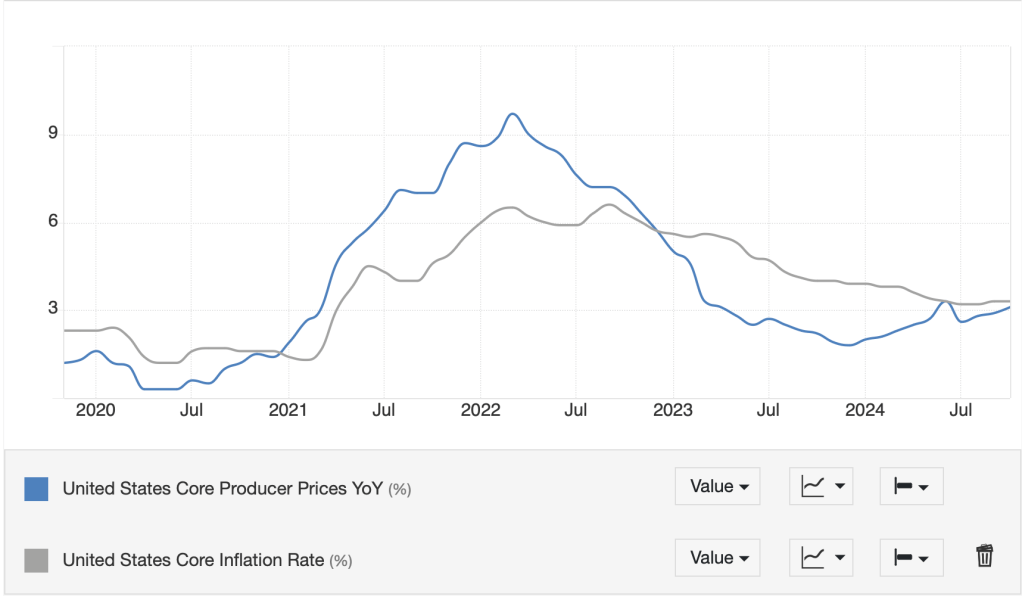

Apparently, the Chairman is reading FX Poetry (🤣) these days as he has come to the same conclusions I have drawn, there is no reason to cut rates anytime soon. Yesterday, in a moderated discussion in Dallas, the Chairman said, “The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.” And let’s face it, yesterday’s data simply added to the picture where the employment situation is not in trouble (Initial Claims rose only 217K, less than expected) while inflation signals remain hotter than desired with both core CPI and core PPI looking like they have bottomed as per the chart below.

Source: tradingeconomics.com

One of the things that Fed speakers consistently discuss is whether or not current policy is accommodative or restrictive based on their view of where the neutral rate of interest lies. The problem, of course, is that neutral rate, also known as R* (R-star) is unknown and unknowable, only able to be determined in hindsight. But that doesn’t stop them from trying.

At any rate, a consistent theme we have heard recently from Fed speakers is that they believe their policy is restrictive, hence the need to lower interest rates at all. But there is a case to be made that policy is not restrictive at all right now as evidenced by the fact that the 10-year Treasury rate is actually below the “true” risk free rate. How is that possible you may ask.

Consider that 30-year mortgage rates are also generally considered risk-free as not only are they collateralized, but they are mostly guaranteed by FNMA, GNMA and FHLMC, quasi government agencies that were shown to have the full faith and credit of the US government behind them when things got tough during the GFC. Historically, meaning prior to Covid, the spread between 30-year mortgage rates and 10-year Treasuries was about 165bps on average. However, since February of 2020, that average spread has expanded to 230bps. (Notice how the green line representing the difference between the two rates is stably higher since Covid in 2020.)

Source: data FRED database, calculations @fx_poet

That difference is important because if you consider the idea that mortgage rates represent a better estimate of the “true” risk-free rate, then Treasury yields are cheap by 65bps relative to where they would otherwise be. In other words, policy is looser by that amount than the Fed believes. Why would this be the case? Well, QE has very obviously distorted the price signals from the bond market. Now, I grant that the Fed has also distorted the mortgage market (recall, they still own $2.26 trillion of those), but despite the ongoing QT process, they own $4.3 trillion of Treasuries. And if price signals are distorted, making policy becomes that much tougher for the Fed. It seems quite possible that through their own actions they have lost sight of reality and therefore, continue to make policy based on inaccurate data. I would offer that as an explanation as to why the Fed always seems out of touch…because they are looking at the wrong things.

Ok, let’s take a look elsewhere in the non-political world to see what is going on. Last night, China released their monthly data on Retail Sales (4.8% Y/Y), IP (5.3% Y/Y), Unemployment (5.0%) and Fixed Asset Investment (3.4% Y/Y). Some parts were good (Unemployment was a tick lower than last month and expected, Retail Sales was a full point higher than expected) and some not so good (IP was 0.3% lower than forecast and Fixed Asset Investment came in 1 tick lower.). As well, the House Price Index there fell -5.9% Y/Y last month, which as you can see in the chart below, is indicative of the fact that the property problems in China are still significant and seemingly getting worse.

Source: tradingeconomics.com

However, one thing China is doing is pumping up its exports ahead of the inauguration of Donald Trump as they are clearly very concerned over the widely mooted 60% tariffs to be imposed on Chinese exports to the US. In October, exports exploded higher by 12.7% and I expect we will see that again in November and December as companies there do all they can to beat the clock. One thing this will do is help goose GDP data in China so that 5.0% growth target seems much more attainable now. How things play out going forward remains to be seen, but for now, China is going to push as hard as possible.

Alas for the Chinese, that data and this idea did nothing to help the stock market there where the CSI 300 fell -1.75% last night, the laggard in the Asian time zone. Given equities are discounting instruments, it appears people are more concerned over the future than the past. Elsewhere in Asia, markets were generally flat to modestly firmer (Nikkei +0.3%) after (despite?) the US equity declines yesterday. In Europe this morning, most markets are little changed to slightly softer although Spain’s IBEX (+0.9%) is bucking the trend with its financial sector performing well, perhaps on the idea that the two big Spanish banks, Santander and BBVA, will benefit from the Fed’s seeming policy shift. However, US futures are softer at this hour (7:15) lower by between -0.3% and -0.6%.

In the bond market, yields around the world are virtually unchanged this morning with 10yr Treasuries at 4.43% and no movement in either Europe or Japan. This feels to me like investors are not sure which way to go. Perhaps more are beginning to understand my type of explanation above regarding where things are now and are unsure how to play the future regarding inflation prospects, especially with potentially large changes coming under a new administration. My take is yields will continue to drift higher alongside rising inflation, but that is not a universal view at all.

In the commodity space, oil (-0.4%) is a touch softer this morning although the big declines seemed to have stopped for now. Here, too, uncertainty about how policy will evolve going forward has traders on the sidelines. In the metals markets, yesterday’s lows seem to be holding for now as while gold is unchanged on the session, both silver (+0.85%) and copper (+1.75%) seem to be rebounding. If yields are going to continue higher, the road for metals is likely to be tough, but ultimately, lack of supply is going to drive this story.

Finally, the dollar is giving back some of its gains from this week in what appears to be a profit taking move. It can be no surprise this is the case, especially given holding positions over the weekend at the current time remains a fraught exercise. After all, will there be an escalation in Israel/Lebanon? Ukraine? Somewhere else? And what will Trump announce over the weekend? There has still been no announcement regarding his Treasury Secretary, and that is obviously crucial. So, the dollar has given back about 0.3% of this week’s move largely across the board and I wouldn’t give it any more thought than that.

On the data front, this morning brings the Empire State Manufacturing Index (exp -0.7) as well as Retail Sales (0.3%, 0.3% ex autos) at 8:30. Then, at 9:15 we see IP (-0.3%) and Capacity Utilization (77.2%). There are no other Fed speakers scheduled today, although after Powell pushed back on further rate cuts yesterday, it will be interesting to hear the next ones and how they describe things. If today’s data is hot, I would expect the probability of a rate cut in December, which currently sits at 62.4%, to fall below 50%. As I have maintained, there just doesn’t seem to be much of a case to keep cutting given the economy’s overall strength.

With that in mind and given that growth elsewhere in the world is lagging, I still like the dollar to maintain and gain strength going forward.

Good luck and good weekend

Adf