For Jay and the FOMC

There’s nothing that’s likely to be

Enough to adjust

The often discussed

Reduction in rates, all agree

But as we look off to next year

The sitch has become much less clear

The dot plot and SEP

Could very well prep

Investors for caution and fear

*Let me begin by explaining this will be the last poetry for 2024 as I take some time to reflect on the past year as well as my views for 2025. Come January 2nd, I will offer those views, as I always do, in a long-form poem. For all of you who have come along for the ride, thank you very much, I sense next year may be even more interesting than the one ending in a few weeks*.

Now, back to our regularly scheduled programming. To my eye, the ongoing coordinated policy easing by central banks around the world (US, Europe, UK, Canada, China, Switzerland, etc.) feels at odds to the ongoing inflation data that seems to show a reluctance for price rises to slow back to the preferred pace of those same central banks. Certainly, in the US, as evidenced by both the CPI data Wednesday, and even more so by yesterday’s PPI data, the null hypothesis that the rate of inflation is slowing toward 2% feels as though it is no longer valid. One needn’t dig too far under the surface to see core and median inflation readings with 3% and 4% handles and given this is almost entirely in the services sector, the sector that encompasses more than two-thirds of the economy, it seems increasingly hard to make the case that inflation is going to decline much further. This is not to imply we are heading for hyperinflation, just that the slow pace of price increases that existed since the GFC seems to have ended.

At least in the US, the economic growth story appears to be a bit more positive than elsewhere around most of the world, and so the opportunity exists for wages to keep up with prices. Alas, elsewhere in the world, that is not necessarily the case. Yesterday, Madame Lagarde and the ECB cut rates by a further 25bps, as universally expected, and the market is looking for another 25bp cut in January. However, despite what is a clearly slowing growth impulse on the continent, even Lagarde felt it necessary to caution about the sticky services prices in Europe and how they must be careful in their policy decisions to prevent a reemergence of inflation. Remember, too, the ECB’s sole mandate is price stability, so theoretically, even if Europe falls into recession, it is not the ECB’s task to rescue the economy there.

Perhaps the one place where policy ease is appropriate is China, where the pace of activity in the economy is very clearly slowing. President Xi and his minions have not yet been able to arrest the decline in the property market there, which given such a large proportion of Chinese GDP growth over the past decade was contingent upon an ever-growing property sector and consistently rising prices, is a problem. An interesting feature of their recent announcements is that they seem ready to have the central bank lend directly to the government (monetizing debt) to finance activity rather than have the central bank buy bonds from the Chinese banking community (otherwise known as QE). In fact, arguably the biggest problem in China is that the banking system there is dangerously overleveraged and undercapitalized when taking a true account of bad loans outstanding. It seems that Xi and friends have figured out it would simply be cheaper to print money and directly give it to the government rather than pass it through a creaking banking system that no longer works. While this almost certainly is smart policy given the circumstances, it doesn’t speak well of the overall situation there.

(As an aside, can we really be surprised that the Chinese banking system, which is basically an arm of the government’s finance ministry which directed lending to favored companies/industries without any real analysis, is having problems?)

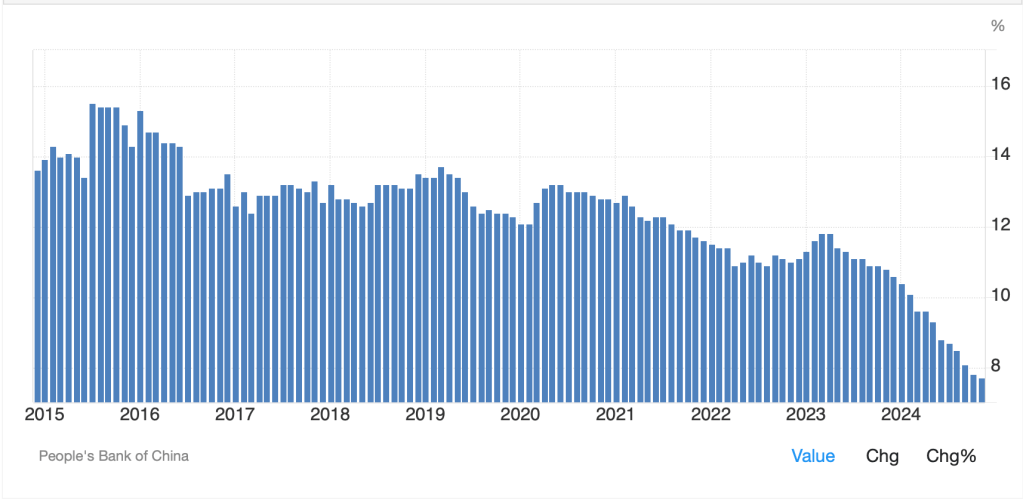

Under the guise, a picture is worth 1000 words, a quick look at the below chart from tradingeconomics.com which shows the trajectory of outstanding Yuan Loan Growth over the past 10 years is pretty descriptive. Banks in China have lost their ability to help the government implement monetary policy so the government is going to simply do it themselves. The “moderately loose” policy the Politburo announced seems likely to go beyond moderate as 2025 progresses, at least in this poet’s eyes.

In the end, there are many problems extant in the global economy. As well, there has been an uptick in overall uncertainty with the election of Donald Trump as US president given his history of sudden, unpredictable pronouncements. I would contend that the one constant in 2025 and beyond is that volatility is far more likely to increase than decrease across markets everywhere.

Ok, let’s take a quick tour of the overnight activity before my short-term hiatus. Once again, US equity markets were under modest pressure yesterday as I continue to see more and more pundits calling for a short-term pullback before the next leg higher. That weakness was followed by Asian markets selling off with China (-2.4%) and Hong Kong (-2.1%) both suffering from ongoing disappointment that the modest loosening wasn’t dramatic loosening! Interestingly, despite the JPY (-0.55%) weakening further (its 5th consecutive down day) the Nikkei (-1.0%) couldn’t gain any traction, perhaps undercut by concerns over the tech story and rising US rates. However, both Korea and India put in solid positive sessions. Clearly Asia is not a monolithic market.

In Europe this morning, the screens are green, but it is a pale green, with gains on the order of 0.1% to 0.3% only as investors seem to have taken some heart by the ECB’s cut and modest dovish follow up. Meanwhile, US futures are slightly firmer at this hour (8:00).

In the bond market, yields continue to climb in the US (Treasuries +2bps) and Europe (Bunds +4bps, OATs +3bps Gilts +2bps) as bond investors are far more circumspect of the ECB cutting rates while inflation lurks in the background. Chinese yields continue to fall, with the 10-year there hitting a new low of 1.78% and talk now that by the end of 2025, Chinese yields may fall below those in Japan! Now that would be something, and I suspect the FX markets would see a lot of volatility if that happens.

Oil prices (+0.5%) continue to hold the $70/bbl level with very little impetus after the rally early in the week. Metals prices, though, are under modest pressure this morning, perhaps on the idea that Chinese demand is going to falter. After all, if Chinese shares can’t hold up, why would traders believe they will be buying up copper, silver and gold? All three are lower by about -0.2% this morning.

Finally, the dollar is mixed this morning, having rallied vs. some counterparts like JPY, BRL (-0.75%) and ZAR (-0.55%) while declining vs. the euro (+0.45%), NOK (+0.75%) and the CE4 currencies. My take is the euro’s rebound, and that of the CE4, is more position related after a sell-off yesterday and given today is Friday, rather than anything fundamental.

There really is no data today and while we do see Retail Sales next Tuesday (exp 0.5%, 0.4% ex autos), I think it’s really all about the Fed next Wednesday. The market is still pricing 97% probability of a cut, and I don’t see anything changing that. Rather, the Fed’s dot plot will be the story for markets as the narrative starts to account for higher inflation and therefore, a higher long-term outcome for the neutral rate.

Again, none of this portends a weaker dollar as we head to the end of 2024. For 2025, you will need to wait for January 2nd to see my views then.

Good luck, good weekend and have a wonderful holiday season

Adf