For market practitioners, Trump

Is more than a modest speed bump

His willingness to

Most norms to eschew

Can force long-term views to go bump

Meanwhile, as the markets prepare

For Powell to sit in his chair

In front of the Senate

A popular tenet

Is more rate cuts he will foreswear

It is very difficult to keep up with the news these days as President Trump really does address so many disparate issues in such short order, it is hard to know which ones will potentially impact markets and which will simply be headline fodder. Obviously, the tariff discussions remain front and center, but even those plans seem to be evolving at a very fast pace, and while yesterday he did invoke 25% tariffs on steel and aluminum imports, that has literally become old news already. The next question is what will occur with the latest idea of reciprocal tariffs, where the US will charge the same tariff on imports from other nations as those nations charge on imports from the US.

Generally speaking, US tariffs are the lowest overall around the world, which arguably is exactly what Trump wants to address. I am not going to argue the merits or detractions of tariffs, that is pointless. The only thing to consider is if they are implemented, what are the potential impacts. One of the key things to remember about the effectiveness of tariffs is the price elasticity of the products being tariffed. If, for instance, a product has substantial competition and is easily replaced, the nation being tariffed is likely going to absorb the bulk of the pain. Consider Colombia and how quickly they caved regarding the deportations. While I am not a coffee drinker, and I am sure there are those who believe Colombian coffee is the best, coffee also comes from Brazil, Vietnam, Hawaii and Indonesia, and as none of those nations (and obviously Hawaii) were subject to tariffs, Colombia would have paid the freight had they been implemented.

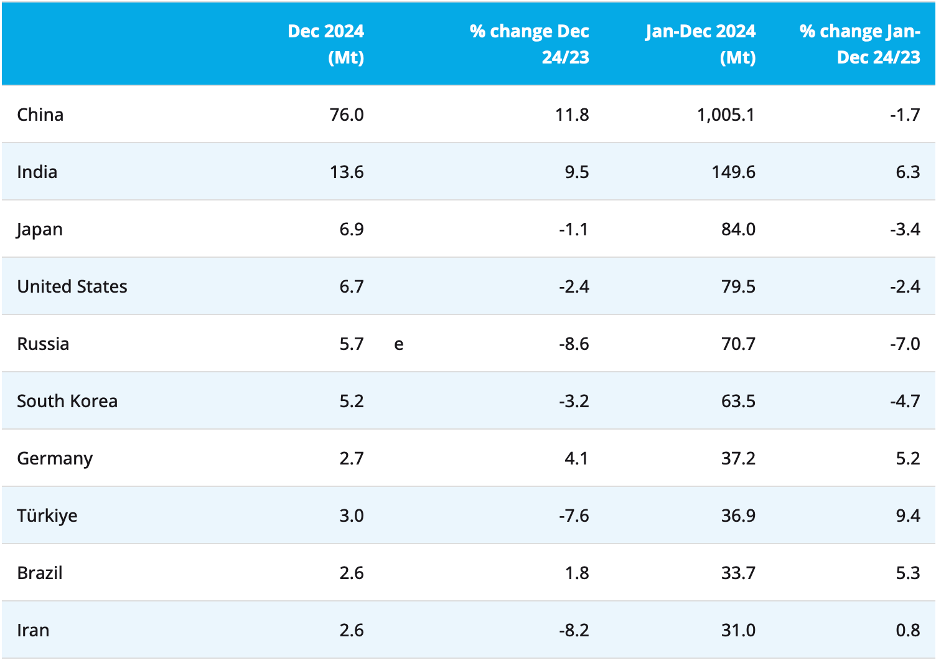

But, for a product like solar panels, where there are few suppliers other than the Chinese, to the extent the demand remained in place, the purchaser would see higher prices. Turning to steel and aluminum, the below graphic shows the top 10 global steel producing nations and how much they produced in 2024. This graphic says all you need to know about why President Trump is unhappy with China and their trade policies. (well, this and the next one)

Source: worldsteel.org

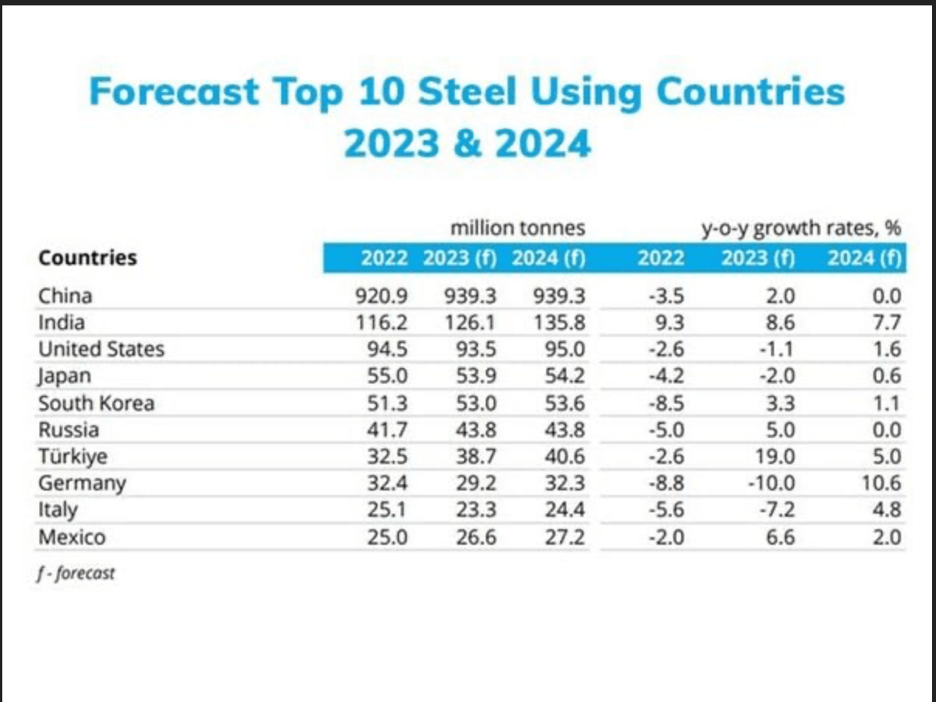

And while this is not an exact apples-to-apples comparison, the below chart shows forecasts for steed demand in 2023 and 2024. The mismatches are clear as China, South Korea and Japan have a significant surplus to export while the US and India need imports.

Source: mrssteel.com.vn

The point is President Trump is seeking to address that imbalance and is of the mind that the US would be better off if we make our own steel. In fact, this is simply part of his entire philosophy to reshore US manufacturing capabilities.

Now, steel is a traded commodity, although in financial markets, not so much. But changes in the flows of imports and exports will have an impact on FX markets, while tariffs could well also impact investment flows. In fact, it is not hard to see why Nippon Steel wants to buy US Steel. if they own a steel manufacturer in the US, they can increase production with no concerns over tariffs.

Remember, too, this issue is merely a microcosm of the potential chaos that will be seen across industries and nations, both of which will impact financial markets. Once again, I harp on the idea that a robust hedging program is a necessity these days.

Turning to today’s activities, Chairman Powell will be testifying before the Senate Banking Committee this morning. On the one hand, I wonder if he is upset by the fact that virtually nobody is concerned about what he says these days as Trump continues to dominate every conversation. For someone who has become quite accustomed to being the center of attention with respect to markets, this may well be a blow to his vanity and ego. On the other hand, it is also quite possible that maintaining a low profile is precisely his strategy here, and if that is the case, I expect we will not learn anything new at all. The Fed mantra is currently that they will be cautious before implementing any further rate cuts. Remember, CPI is released tomorrow as well, so when he goes before the House, they will have that information in hand. But to Powell’s benefit, Treasury Secretary Bessent made clear he and President Trump are far more concerned about the 10-year yield than Fed funds. This may be the most amazing transformation of all, a Fed chair who becomes a wallflower!

Ok, after yesterday’s US equity rally, the story in Asia was far less positive. Japan and Australia were unchanged while the Hang Seng (-1.1%) and CSI 300 (-0.5%) both suffered, perhaps on the tariff impositions. Elsewhere in the region, Taiwan and South Korea both had solid sessions while weakness was evident in Indonesia, India and the Philippines. In fact, all three of those markets have been declining steadily since October, with declines between 15% and 20% as prospects in those economies seem concerning, especially with Trump’s tariff mania. In Europe, virtually every market is unchanged this morning as the EU quickly explained they would retaliate against any US tariffs. Of course, that is what makes Trump’s reciprocal tariff structure so interesting. How can Europe complain that other nations impose the same level of tariffs they do? Meanwhile, at this hour (7:05), US futures are pointing slightly lower, about -0.25%.

In the bond market, yields are climbing with Treasuries higher by 3bps, now 12bps above the lows seen early last week, while in Europe, yields are substantially higher, with France (+10bps) leading the way, but the rest of the continent showing rises of between 4bps and 6bps. Part of this move on the continent is driven by a catch up to yesterday afternoon’s US yield rally. As to the French, seemingly their Unemployment Report, which showed a much better than expected 7.3%, may have investors concerned about quickening growth and inflation. That feels like a lot, but there are no real explanations I have seen.

In the commodity markets, oil (+1.5%) is continuing to rebound off its recent lows, although still looks like it is in the middle of its trading range. Gold (-0.7%) and silver (-1.2%) are both finally retracing some of the extraordinary rally that we have been witnessing for the past two months. Copper (-2.7%), too, is under pressure this morning, unwinding some of its recent spectacular gains.

Finally, the dollar is very modestly softer, but not universally so. For instance, the euro (+0.2%) and yen (-0.2%) seem to offset each other while most other G10 currencies have moved even less. In the EMG bloc, though, INR (+0.9%) is the biggest gainer as the RBI has been intervening to address what had been an acceleration in the rupees decline in the past few weeks (see below).

Source: tradingeconomics.com

Elsewhere in the space, gains are less impressive, with moves on the order of +0.4% (PLN and HUF) or smaller.

On the data front, the NFIB Small Business Optimism Index was released at a softer than expected 102.8 as it seems the Trumpian chaos is having an effect for now. Otherwise, the only thing is Powell and three other Fed speakers, but again, given the relative lack of discussion regarding Powell, the other three will get even less press in my view.

It is difficult to claim nothing has changed lately, but perhaps more accurately, there is no clear directional change at this point. We need to start seeing some consistency in the policy impacts and that is likely to take months. Until then, volatility is the watchword across all markets.

Good luck

Adf