Apparently, this is the end

So says every article penned

The markets are tanking

But nobody’s banking

On help to arrest the downtrend

The pundits’ unanimous line

Is things before Trump were just fine

Yes, debt was insane

But that gravy train

Allowed them to drink the best wine

Every financial website lead this morning is how President Trump’s policies are causing the worst slide in equity prices in forever, with my favorite today in the WSJ describing this as the worst performance in April since 1932! Much has been made about how President Trump is undermining the Fed’s credibility, as though the Fed has that much credibility to undermine. This is the group that declared stable prices to be an increase in their favored indicator, core PCE, of 2.0% annually, and complained vociferously when inflation was slightly below that level for a decade. In order to adjust things, they changed their target to an average of 2.0% over time, then watched their metrics, in the wake of the Covid fiscal response, explode higher. Now, after more than four years of their target metric above their target, they are concerned they are losing their credibility because of President Trump.

Source: tradingeconomics.com

Certainly, if they had been achieving their goals any time during the past four years, this argument might have had some force. However, given the history, I am suspect.

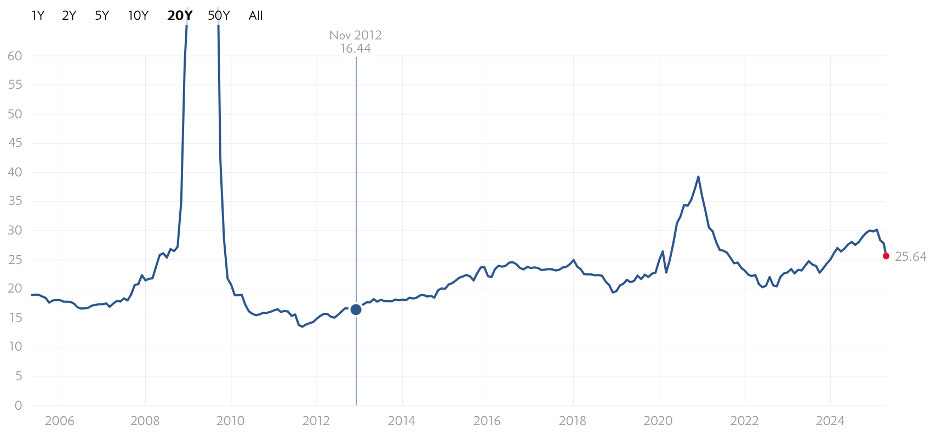

Nonetheless, this is today’s narrative, that equity markets are falling sharply because of Trump. It has nothing to do with the fact that US equity markets have been overvalued by nearly every measure since November 2012, (the last time the S&P 500 P/E ratio was at its mean of 16.14 vs today’s still very high 25.64). This is not to say that the president’s tactics have necessarily been the best possible, but we have all long known that a catalyst would come along and adjust prices to a more sustainable level.

Source: multpl.com

Once again, I will highlight that President Trump was elected with a mandate to make substantial changes to the way things work in the US, both the economy and other issues like immigration. Remember, too, that many of his supporters are not heavily invested in equity markets, so this is not really a problem for them. I believe he can tolerate a lot more downside in equity prices before feeling it necessary to address them. And if he is successful in signing some trade deals during his 90-day time frame, I expect that things will calm down quite quickly.

But right now, investors are very unhappy, and since virtually everyone in the media is an investor, we are going to hear a lot more on this topic, especially since they almost certainly didn’t vote for President Trump.

Here’s the thing about markets, overvaluations correct over time. In fact, often they result in under valuations as markets tend to overshoot in both directions. However, you have probably heard of the Buffett Indicator, which is Warren Buffett’s shorthand way of determining stock valuations. He simply divides the total market capitlaization of US equities by GDP. His view is that when that ratio is between 110% and 130%, equity markets are fairly valued. Below that, things are cheap, and it is a good time to buy stocks. Above that, like today, and good values are hard to find. You are also probably aware that Berkshire Hathaway is currently holding its largest cash position ever, a sign that he still thinks things are overvalued. One need only look at the below chart to see that while the recent decline in stocks has brought the indicator lower, its current level of 173% remains extremely overvalued.

Source: buffettindicator.net

All I am trying to do is offer some perspective on the recent movement. Risk appetite was over extended while the US ran 7% budget deficits and issued a massive amount of debt to fund it. Much of that funding went into risk assets. That situation has clearly changed, or at least that is the goal of the Trump administration. It is a painful transition, but likely one that we need to absorb for longer term fiscal and economic health.

Ok, let’s see how market behaved overnight, after a rout in the US yesterday, now that everybody is back at their desks. Major Asian markets were very quiet, with limited movement in Japan, China, Korea, Australia and India, although we did see sharp declines in Taiwan (-1.6%) and New Zealand (-2.25%) with the latter seeming to be one of the few markets tracking the US directly. The only news there was a larger than expected trade surplus, which doesn’t seem the type of thing to cause a sell-off. Meanwhile, in Europe, there is also little net movement with a couple of modest gainers (Spain, UK) and a couple of modest laggards (France Germany) with everything trading less than 0.5% different than their last closes. Interestingly, US futures are all higher by about 1.0% at this hour (7:05).

In the bond market, this morning is quiet everywhere with movements of +/-1bp the norm although yesterday did see Treasury yields climb 6bps in the session. Something that is starting to move in fixed income markets are credit spreads, which have been abnormally tight for a long time and may be starting to widen out to previous historical levels. If spreads start to widen, that will not help equity markets at all, and that could be the signal that policy adjustments are coming, both from the administration and the Fed. We will keep an eye here.

In the commodity markets, nothing is stopping the gold train, up another 0.7% this morning to another new high. This movement is parabolic and that cannot last very long. Beware of a correction.

source: tradingeconomics.com

In the meantime, silver (-0.2%) and copper (+0.5%) are still hanging around, but without the same panache as gold. In the oil market, WTI (+1.3%) has rebounded from yesterday’s decline as the latest stories are that capex by the oil majors is going to decline and with it, we will see a reduction in supply, hence higher prices. On the flip side, if a deal with Iran is signed and their oil comes back on the market freely, that will weigh on prices for at least a while.

Finally, the dollar, which along with equities, has been sold aggressively of late, is bouncing slightly this morning. This story remains perfectly logical as one of the reasons the dollar had been so strong was foreign investors bought dollars to buy the Mag7 and US equities in general. With US equities weakening, these foreigners are likely to start to sell more and take their money home, or elsewhere, but nonetheless, they don’t need those dollars. Certainly nothing has changed my bearish view here with today’s gains a modest correction. There are two outliers this morning, with MXN (+0.6%) and ZAR (+0.5%) the only currencies of note rallying against the greenback, both seemingly following the commodity rally.

On the data front, there is nothing noteworthy this morning, but a bit of data later in the week.

| Wednesday | Flash Manufacturing PMI | 49.4 |

| Flash Services PMI | 52.8 | |

| New Home Sales | 680K | |

| Fed’s Beige Book | ||

| Thursday | Initial Claims | 221K |

| Continuing Claims | 1880K | |

| Durable Goods | 2.0% | |

| -ex Transport | 0.2% | |

| Existing Home Sales | 4.13M | |

| Friday | Michigan Sentiment | 50.8 |

| Michigan Inflation Expected | 6.7% |

Source: tradingeconomics.com

In addition, we have 7 Fed speakers over 8 venues this week, with four of them today. However, it is not clear that they have much impact these days. Expectations for a cut next month are down to 9% although the market is pricing 90bps of cuts this year. But, once President Trump started implementing his policies, the Fed slipped into the shadows. It is interesting that there are questions about the Fed’s credibility as lately, nobody has listened to them anyway. I don’t expect anything other than patience from them for now as they await the “inevitable” decline in the economy. However, until the data really starts to show something, and there is nothing forecast in this week’s releases, that points to economic weakness of note, they are on the sidelines.

Overall, I expect more volatility in risk assets, and I do believe the trend for foreign investors to reduce their exposure to the US will continue. That, too, will weigh on the dollar. Maybe not today, but another 10% this year is quite viable.

Good luck

Adf