There once was a war between nations

That led to some huge fluctuations

In markets worldwide

As pundits all cried

The world’s shaken to its foundations

In secret, though, pundits all cheered

‘Cause they all hate Trump, and thus steered

The narrative toward

This Damocles’ sword

That hung o’er the world and was feared

But now, twixt the US and China

There is just a bit less angina

Both sides, tariffs, slashed

And quite unabashed

These pundits said things were just fine-a

The wonderful thing about controlling the narrative is that it doesn’t matter if you are right or wrong at any particular time, because if you are wrong, you simply change the narrative. At least that’s my impression looking here from the cheap seats. At any rate, the news this weekend brought the end to the trade war, or at least a 90-day cease fire, as both the US and China slashed their announced tariffs dramatically, with US tariffs falling to 30% on Chinese goods and Chinese tariffs falling to 10% on US goods. Between now and August, Treasury Secretary Bessent will be leading trade talks with Chinese Vice Premier He to try to come up with a more permanent solution.

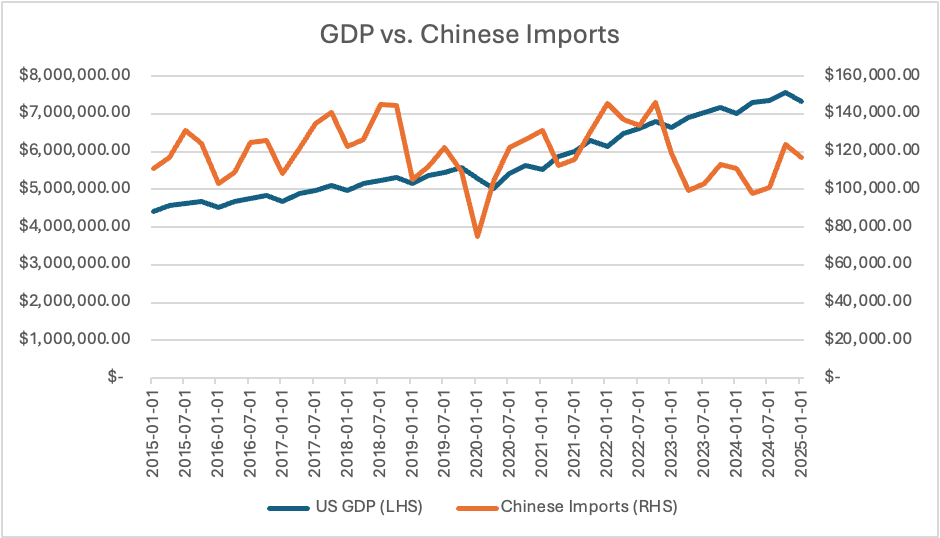

In the interim, it will be interesting to see how the narrative evolves. Certainly, I got tired of the different articles I saw explaining that there were no ships crossing the Pacific from China to the US and that store shelves would be empty by summer. I wonder if we will see any of those claims retracted. (I’m not holding my breath). I also wonder why that is the case simply from a mathematic perspective. After all, annual US GDP is ~$28 trillion and imports from China in the twelve months from April 2024 through March 2025 were ~$444 billion, according to the FRED database. So, does that mean that the other $27.56 trillion in economic activity was all services? A look at the charts below created from FRED data shows that not only has the amount of imports from China not been growing lately, as a percentage of GDP, they have been shrinking. I am not saying Chinese activity is unimportant to the US, just that the reduction in relative trade has been happening far longer than President Trump has been in office this time.

While certainly, low priced items could become a bit scarcer, it strikes me that there was more than a bit of hyperbole involved in those claims. Of course, the next question is, will those ships start sailing again? I guess we shall find out soon enough.

But stepping back a bit, I think it is critical to remember that prior to President Trump’s “Liberation Day” tariff announcements, it’s not as though the world trade system was all peaches and cream. In fact, this weekend I listened to an excellent Monetarymatters podcast with guest George Magnus discussing the trade situation and why it was untenable in its current form before President Trump tried to change things. He is far more eloquent and knowledgeable than a mere poet like me, and it is worth listening. In the end, as others have also said, the status quo was unsustainable as both US government spending needs to be cut and the US reliance on China (or any other nation) for things of national security importance could not continue without grave results for our nation.

I contend there is no easy way to change a system that has evolved over 80 years with goals changing during that period. I also contend that the idea that a proverbial scalpel would have been a better method to do things, as it would not have created the market ructions we have all felt for the past few months, would never have worked. Just like in changing the way the federal government works, the inertia in the trade system is far too great to be adjusted by tweaks here and there. To make a lasting change, major disruptions are needed and that is what President Trump has been doing, disrupting things majorly. Whether or not he will ultimately be successful is hard to say, but the odds of a change are greater now than before he started. And almost everybody agreed that things were unsustainable.

One last thing you are sure to hear, especially now that the negotiations have begun is that the only reason is because President Trump “blinked” and couldn’t stand the pain of the market and the slings and arrows of the punditry. However, it remains very difficult for me to look at the data that has been released of late, with Chinese growth slowing rapidly and Chinese stimulus unable to solve the problem and believe that President Xi hasn’t felt enormous pressure to speed up the economy. It is clearly in both sides interest to come to a resolution, and that is what we should focus on going forward.

So, how did markets take the news? Well, it should be no surprise that Chinese (+1.2%) and Hong Kong (+3.0%) shares both rallied sharply given they are the direct beneficiaries of the story. Taiwan (+1.0%) and Korea (+1.2%) also fared well in the euphoria, but perhaps the biggest news in Asia was the ceasefire between India and Pakistan that was brokered by the US. That saw Indian shares (+3.8%) and Pakistani shares (+9.0%) both explode higher. It is certainly better that the explosions are in the relevant stock markets than on the ground! As to the rest of Asia, markets were generally higher but not nearly as ebullient. Meanwhile, in Europe, screens are green (Germany +0.9%, France +1.35%, UK +0.4%) but the gains pale compared to some of the Asian price action. US futures, though, are soaring at this hour (6:50) with gains between 2.4% (DJIA) and 4.0% (NASDAQ).

In the bond market, yields are soaring everywhere with Treasuries (+7bps) rising a similar amount to all European sovereigns (Bunds +7bps, OATs +6bps, Gilts +8bps) and JGBs (+8bps). It appears that with money flowing rapidly back into the equity markets now that the trade war has ended RISK IS ON baby!!! Either that or the only way to generate this new growth is by spending lots of government money which will require even more issuance. I’ll take the first for now.

But that risk on trade is clear in commodities with oil (+3.6%) soaring higher to its highest level in three weeks and despite the idea that OPEC+ is going to increase production. In fact, there are many things ongoing in the oil market that are far too detailed for this commentary, but in a nutshell, from what I understand, OPEC’s changes are simply catching up to the reality of what members have already been pumping and the market is now focusing on the renewed growth enthusiasm with the trade war on hold. As well, if risk is no longer a concern, you don’t need to hold gold, and the barbarous relic is under huge pressure this morning, tumbling -3.5% and taking silver (-2.1%) with it. Copper (+0.4%), however, is higher on the growth story.

Finally, the dollar is flying this morning. on the one hand, given risk is in such demand, that doesn’t make much sense as historically, risk on markets tend to see the dollar weaken. But my take is that all the stories about the end of American exceptionalism, with respect to US equity markets, got destroyed by the truce in the trade war, and now folks are buying dollars to buy US equities. So, the euro (-1.4%) is under major pressure along with the pound (-1.1%) and the yen (-2.0%) is in more dire straits, as is CHF (-1.8%). Other G10 currencies have also fallen, albeit not as far. In the Emerging markets, only two currencies are rallying this morning, both benefitting from truces; INR (+0.7%) which is obviously benefitting from the military ceasefire and CNY (+0.6%) which is benefitting from the trade ceasefire. As to the rest of the bloc, all currencies are lower between -0.6% and -1.6%.

On the data front, we see the following this week:

| Tuesday | CPI | 0.3% (2.4% Y/Y) |

| -ex food & energy | 0.3% (2.8% Y/Y) | |

| Thursday | Initial Claims | 230K |

| Continuing Claims | 1890K | |

| Retail Sales | 0.0% | |

| -ex autos | 0.3% | |

| PPI | 0.2% (2.5% Y/Y) | |

| -ex food & energy | 0.3% (3.1% Y/Y) | |

| Empire State Manufacturing | -10.0 | |

| Philly Fed Manufacturing | -12.5 | |

| IP | 0.2% | |

| Capacity Utilization | 77.9% | |

| Friday | Housing Starts | 1.37M |

| Building Permits | 1.45M | |

| Michigan Sentiment | 53.1 |

Source: tradingeconomics.com

As well as all the data, we hear from six Fed speakers, including Chairman Powell on Thursday morning. I cannot help but think that things are a bit overdone this morning but perhaps not. It is certainly positive that the US and China are speaking about trade, but it remains to be seen what can be agreed. In the end, while this week is starting off well, I suggest not getting too excited yet. As to the dollar, certainly this is positive news, but I have not changed my view that eventually it will slide.

Good luck

Adf