Though recently there’s been a ton

Of news, which has led to much fun

The markets today

Have little to say

Though recent trends ain’t been undone

Sometimes traders simply get tired

And find, in a rut, they’ve been mired

But you needn’t worry

‘Cause soon they will scurry

To come back with ideas inspired

As much activity and new news that has been part of the process over the past several weeks, today is one of those days when it appears we may be able to step back and catch our collective breath. One thing I have observed throughout my career on trading desks is that no matter the underlying news, narrative or data, traders, even algorithms, can only remain in a frenzy for so long. Consider it has been nearly two weeks of nonstop news since the US exfiltration of former Venezuelan president Maduro, yet some markets have exploded. Silver is probably the poster child for this price action and as you can see below, since markets reopened after that news, gold’s little brother has risen nearly 25%, including today’s modest -2.3% retracement.

Source: tradingeconomics.com

But all the precious metals, and base metals as well, have had massive runs and the narrative regarding supply constraints and increased strategic purchases by China along with the US labeling many as critical national defense requirements, has been enough to bring retail into the mix. But a 25% move in less than two weeks is really exhausting for the folks who are in those markets every day.

At the same time, the amount of energy that has been consumed regarding Greenland, Iran and Minneapolis (which even though it is not a market related issue, is so widespread in its reporting takes up space in one’s brain) seems to have reached a peak yesterday, at least a local maximum. I don’t, for a minute, believe that these trends have ended. But a few sessions of modest net movement as positions are adjusted is a normal response to dramatic movement. We should welcome the rest!

Reading through as much as I could find this morning, there really is no new story on which to hang your hat, so without further ado, I will review overnight market activity and perhaps ponder how things may evolve going forward.

A key sign of the slower activity was yesterday’s US equity markets where modest declines were the order of the day. That was followed by a mixed session in Asia with some gainers (China +0.2%, Australia +0.5%, Korea +1.6%) and some laggards (Tokyo -0.4%, HK -0.3%, Taiwan -0.4%, India -0.3%). Other than Korea’s strong session, which was inspired by central bank and government efforts to get investment to come back home to support the won, it appears traders are now biding their time ahead of the next major event.

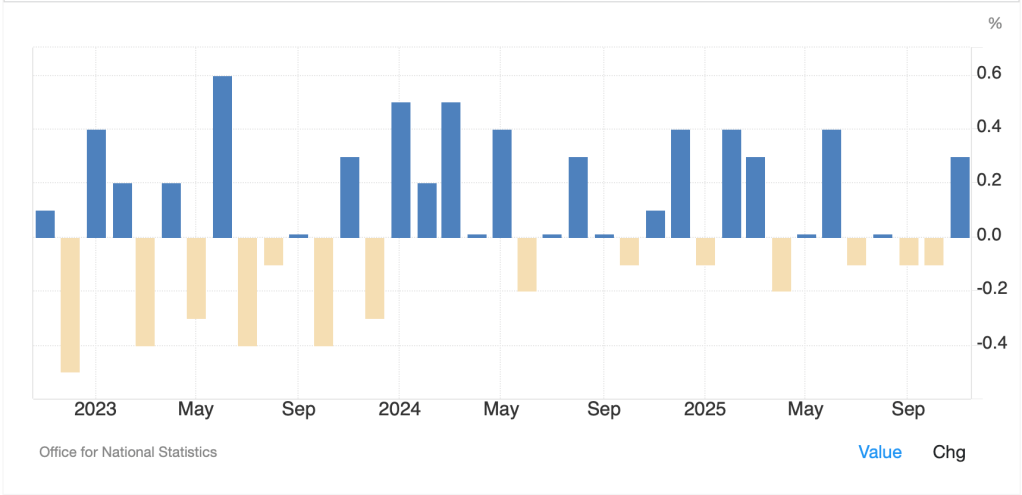

European bourses are also mixed (Germany -0.1%, France -0.3%, Spain -0.1%, UK +0.4%) with the UK benefitting from a stronger than expected GDP report where growth jumped to 0.3% on the month, well above expectations of a 0.1% increase. But a look at the chart below indicates one ought not get too excited about the economic growth in the UK with 14 negative months in the past 3 years.

Source: tradingeconomics.com

As to US futures, at this hour (7:10) they are pointing higher, currently almost exactly offsetting yesterday’s declines.

In the bond market…ZZZZZZ is the story of the day week month past four months as evidenced by the chart below.

Source: tradingeconomics.com

There are a number of conflicting narratives here with one story that the economy is going into a tailspin as a look beneath the headline data shows weakness everywhere (housing, employment, manufacturing) and the result is rates will fall along with inflation because of the coming recession. Another narrative is that the ongoing debt expansion to fund unending budget deficits in the US is going to lead to the collapse of the dollar and much higher long-term rates as investors require far more payment to hold this much riskier than previously assumed asset.

Right now, neither of these seem to be living up to their promises. Yesterday’s Retail Sales print was much stronger than expected at +0.6%, which hardly portends a recession. Now, the CPI data has been polluted by the missing October numbers and is biased downward based on the BLS methodology, but you can be confident that it will recoup those losses in a few months’ time. Meanwhile, there is no indication the Fed is going to do anything in two weeks, and my take is there is significant uncertainty over the future direction of the economy, with both positive and negative pieces. Until we get indications that growth is either truly cratering along with rises in unemployment, or that things are exploding higher, remaining in the range seems the most likely outcome. Remember, too, the OBBB is going to goose economic activity right away and running it hot remains the mantra.

As to European sovereign yields, they have edged higher by 1bp this morning with one outlier, Portugal (+13bps) which seems to be reacting to the prospect of a runoff in the presidential election this Sunday, in the race between a populist outsider and a Socialist party insider, with the populist seen a slight favorite. As to JGB yields, they have slipped back -2bps as the market becomes accustomed to the idea of the snap election.

In the commodity space, oil (-3.6%) has ceded most of its recent gains after President Trump indicated that there would be no bombing by the US, and the Mullahs ostensibly promised no executions of protestors. Added to that was a massive build in inventories reported yesterday and supply concerns have abated. In the metals markets, we are seeing that breather across the board (Au -0.25%, Ag -2.3%, Cu -0.8%, Pt -0.6%) which is very clearly profit taking after we saw record highs in all metals yesterday. Nothing has changed the fundamentals here, so higher is still the way, IMO, but a few days of chop ought not be surprising.

Finally, the dollar appears to have found a comfortable home at 99.00 in the DXY. There has been limited movement across the board with even JPY unchanged on the day as traders wait before trying to push the currency lower again. KRW (-0.3%) is the worst performer today as it has been weakening steadily for a year. Adding to the discussion above, the Korean government is trying to internationalize the won to some extent in their effort to get Korea taken out of the emerging market bucket for markets. This relaxing of restrictions has seen capital outflow, but my take is this will be temporary as the country remains in very good fiscal and economic condition and will attract investment in my view. Otherwise, there is nothing of note.

On the data front today, we get the weekly Initial (exp 215K) and Continuing (1890K) Claims as well as Empire State Manufacturing (1.0) and Philly Fed (-2.0) all at 8:30. We hear from 3 more Fed speakers and it seems the hymnal now contains a single talking point, Fed independence is crucial and the subpoenas to Powell are lawfare and inappropriate. Only Steven Miran is not singing that tune, but given he is Trump’s appointee, that is no surprise.

As commodities, and really metals, have driven the entire narrative lately, if they are going to have a quiet day, look for quiet all over. Longer term, nothing has changed, but nothing goes up in a straight line, and that is what we are witnessing today.

Good luck

Adf