When fired upon, his response

Was jumping back up at the nonce

His cry was to “Fight!”

And some on the right

Now claim he’s a man, renaissance!

As John Lennon told us in 1977:

Nobody told me there’d be days like these

Strange days indeed

While this poet tries to keep politics largely out of the discussion, during these strange days, it is THE story of note. Of course, by now you all not only have heard of the assassination attempt on former President Trump’s life on Saturday at a political rally in Butler, PA, but you all almost certainly have your own opinions about all the different theories, conspiracy and otherwise, so I will not go down that road. I will simply note that it speaks poorly of the current political zeitgeist. And while cooler heads are calling for a step away from the abyss, I have not yet seen the public take that step backwards. Maybe soon.

In the meantime, my efforts are designed to help make sense of how both the political and economic storylines may impact the markets, and correspondingly, try to help those of you who need to hedge financial exposures, with a little understanding. But history shows, when politics leads the news, the degree of difficulty goes up significantly.

The first thing to note is that sometimes, when momentous things occur in the real world, any financial implications take some time to manifest themselves. With that in mind, I thought I would take a 30,000 foot view of the macroeconomic situation as we head into the new week.

The data of late calls into question

If we are now in a recession

With joblessness rising

And prices downsizing

Perhaps growth is seeing regression

And it’s not just here in the States

Where growth appears in dire straits

In China, as well,

Things have gone to h*ll

As data of late demonstrates

The question that is being asked more frequently is, are we currently in a recession? While the data that has been released of late has been slowing, in the US it has not generally reached levels consistent with inflation, although there are some outliers that do point in that direction. For instance, Friday’s Michigan Sentiment reading was pretty lousy at 66.0, well below expectations, and as can be seen in the below chart from the FRED data base, seemingly heading toward, if not already at, levels consistent with recessions (gray shaded areas).

Source: FRED Data base

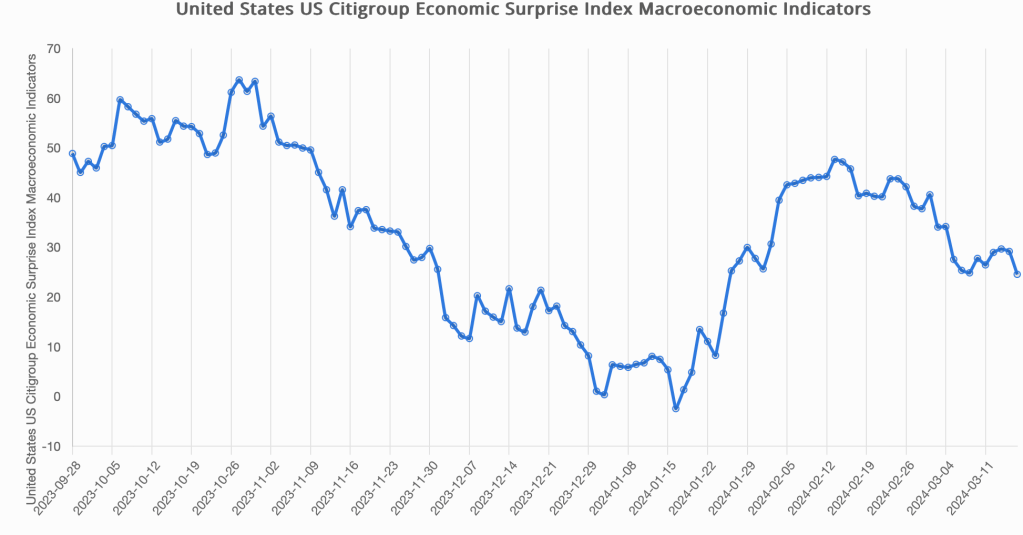

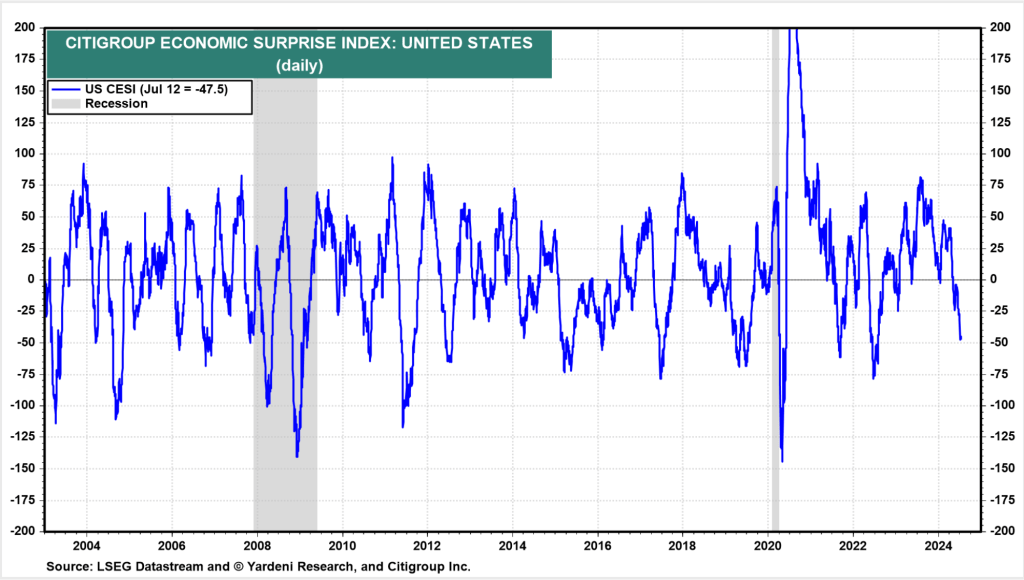

As well, a look at the Citibank Economic Surprise Index, an index that tracks the difference between the actual data releases and the consensus forecasts ahead of time, shows that data is consistently failing to meet expectations.

Source: Yardeni.com

Here, too, the data does not appear to have quite reached levels seen in the previous two recessions, but recall that those two recessions were not garden-variety, with the GFC the deepest recession since the global depression in 1929, and the Covid recession remarkably short and sharp in the wake of the unprecedented government shutdowns that occurred in early 2020. But going back in time, it is generally true that if data released consistently underperform expectations, it is a signal of overall economic weakness.

There are many other data points that are showing similar tendencies like the Unemployment Rate, which I have discussed lately, and is gaining momentum in its move higher. As well, a look at almost all production factors or Retail Sales, which are reported in nominal terms, shows that when they are deflated by the inflation data of the past several years, real activity has been minimal or even declining. A look at the below chart shows Retail Sales in both nominal and real terms with the latter actually declining since 2021 despite the rising nominal figures. In other words, people are simply paying more for the same amount or less of stuff.

Source: brownstone.org

And this is not just a US situation. As is typically the case, if the US is slowing, the rest of the world is going to suffer given its place as both the largest economy overall, and the largest mass consumer of everybody else’s stuff. So, last night when China released its latest data, it showed the Q2 GDP disappointed, printing 4.7% while Retail Sales rose only 2.0%, far below Industrial Production, which grew 5.3%.

Source: Bloomberg.com

In fact, this chart is the graphic representation of why nations around the world are calling for more tariffs on Chinese goods. The combination of a still-collapsing property market there with the absence of significant government stimulus and a massive debt overhang has led President Xi to seek to increase industrial output and exports (remember the trade data from last week where exports soared, and imports actually declined) thus flooding other markets with goods and harming local manufacturing in other nations. This is merely one more issue that policymakers must navigate amid a growing global concern over both political and economic unrest.

Summing it all up, I believe the case for there being a recession is growing strongly, and while nominal GDP is likely to remain positive, especially in the US given the government’s nonstop spending spree, real economic activity is suffering. This has major implications for markets, especially as they appeared to still be priced for that perfect 10-point landing. As I have written consistently, if (when) things turn more sharply, the Fed will respond quickly and cut rates and the impact on markets will be significant, especially for the dollar which will almost certainly decline sharply. Just be nimble here.

I am sorry for the extended opening, but obviously, there is much ongoing. So, let’s take a look at how things are behaving this morning. At the opening of trading on Sunday evening, arguably the market that was showing the most impact was FX, where the dollar, which had fallen sharply at the end of last week in the wake of that CPI data, had rebounded a bit. The narrative seems to be that the assassination attempt will secure President Trump’s reelection and the dollar will benefit from the economic policies that are believed to come with that. As well, at this hour, (6:30) we are seeing US equity futures rallying, up 0.4% across the board. That’s quite the contrast with the overnight session where the Nikkei (-2.5%) came under severe pressure as investors grow concerned over potential JPY strength. Too, the Hang Seng (-1.5%) fell sharply although mainland shares have behaved better, little changed overnight, as investors look toward the Third Plenum with hopes that President Xi will unveil something to help the Chinese economy.

In Europe, though, this morning sees red across the screens, albeit not dramatically so. The CAC (-0.4%) in Paris and the IBEX (-0.5%) in Madrid are the laggards, unwinding some of last week’s rebound, but every major market is under pressure this morning. The lone piece of data released was Eurozone IP (-0.6%) which fell back into negative territory for the 6th time in the past twelve months. Certainly, this is not pointing to a robust economy in Europe.

In the bond market, Treasury yields have backed up 4bps, also on the “Trump” trade, as investors believe that a Trump victory will result in more aggressive growth policies and higher US yields. However, in the Eurozone, and in Asia, government bond yields are essentially unchanged from Friday’s levels as I don’t think foreign investors know what to think now about the US and how it may impact other nations going forward. After all, if the US does grow more quickly in response to a Trump victory, will that mean more or fewer opportunities for tariffs and other mechanisms to affect foreign nations?

In the commodity markets, things are quiet with oil essentially unchanged this morning, as it consolidates at its recent highs. Market technicians are looking for a break above $85.00/bbl, but I think that will require some substantially better economic data, which as explained above, does not seem to be in our immediate future. In the metals markets, precious metals are little changed with gold consolidating above the $2400/oz level near its recent all-time highs, although copper (-0.9%) and aluminum (-0.8%) are both under pressure on the weaker economic picture.

Finally, the dollar is little changed overall this morning from Friday’s levels. The early dollar strength seen last night has ebbed a bit although we still are seeing some strength against peripheral currencies like ZAR (-1.2%), NOK (-0.5%) and SEK (-0.5%). The rand story seems to be more about local politics and the inability to get the new government up and running, while deeper investigation into the Skandies shows that this is a phantom move based on an unusual close on Friday. My sense is there has really been no net movement here, as we have seen in the euro and the pound, both of which are mere pips from Friday’s closing levels.

On the data front this week, there is some important news as well as a series of Fed speeches starting with Chairman Powell this afternoon at 12:30.

| Today | Empire State Manufacturing | -6.0 |

| Tuesday | Retail Sales | 0.0% |

| -ex autos | 0.1% | |

| Business Inventories | 0.3% | |

| Wednesday | Housing Starts | 1.31M |

| Building Permits | 1.39M | |

| IP | 0.3% | |

| Capacity Utilization | 78.6% | |

| Thursday | ECB Rate Decision | 4.25% (unchanged) |

| Initial Claims | 235K | |

| Continuing Claims | 1855K | |

| Philly Fed | 2.9 | |

| Leading Indicators | -0.3% |

While there is not as much information due as we saw last week, I think the Retail Sales data will be instructive as another indicator of whether the economy is starting to roll over. As well, watch for revisions from previous data releases as history shows that revisions to weaker numbers are another signal of a recession. It will be quite interesting to see if Powell hints at a cut at the end of the month. Certainly, the Fed funds futures market is not looking for that with <5% probability currently priced in although the September meeting is now a near-lock at 94%. Remember, too, that after Friday’s speeches conclude this week’s group of 10 Fed comments, they will enter their quiet period and we won’t hear anything else until the FOMC meeting on July 31st.

While there is much to digest, my take is that we have rolled over in the economy. The real question is about inflation and its ability to continue to decline. Friday’s PPI data was the opposite of the CPI data on Thursday, showing hot prints for both headline and core, and indicative of resurging price issues. Alas, I don’t rule out more stagflationary outcomes. Funnily, I think that will ultimately help the dollar after an initial dip.

Good luck

Adf