The talk of the town is the Fed

And who Mr Trump will embed

As governor, next

Amid a subtext

That Powell, by May, will have fled

Meanwhile, other stories are muted

As tariffs’ impact seem diluted

And earnings have been,

To most bears’ chagrin,

Much better than had been reputed

Yesterday was a modest down day in equities, although the trend remains clearly higher at this point as evidenced by the chart below. As well, the price action remains well above the 50-day moving average, a key technical indicator defining the trend, with no indication it is set to retrace there. As of this morning, we are sitting about 2.5% above that average, so a decline of that magnitude will be necessary to get tongues wagging about a change.

Source: tradingeconomics.com

This is not to say that everyone is sanguine about the situation as just yesterday, three investment banks, Morgan Stanley, ISI Evercore and Deutsche Bank, all put out research calling for a retracement in the near term. Certainly, the recent data has been mixed, at best, with still a lot of discussion regarding last Friday’s weak NFP data. Meanwhile, the ISM Services data was weak (50.1 vs 51.5 expected), while the PMI Services was strong (55.7 vs 55.2 expected).

Corporate earnings continue to be solid, with about two-thirds of the S&P 500 having reported Q2 numbers and 82% have beaten EPS estimates, higher than the recent 5-year average, and the growth rate at 10.3% on a quarterly basis. This does not seem indicative of the recession that many continue to claim is ongoing or imminent.

But let us take this time to briefly consider both sides of the argument regarding the future of the economy, and by extension financial market activity.

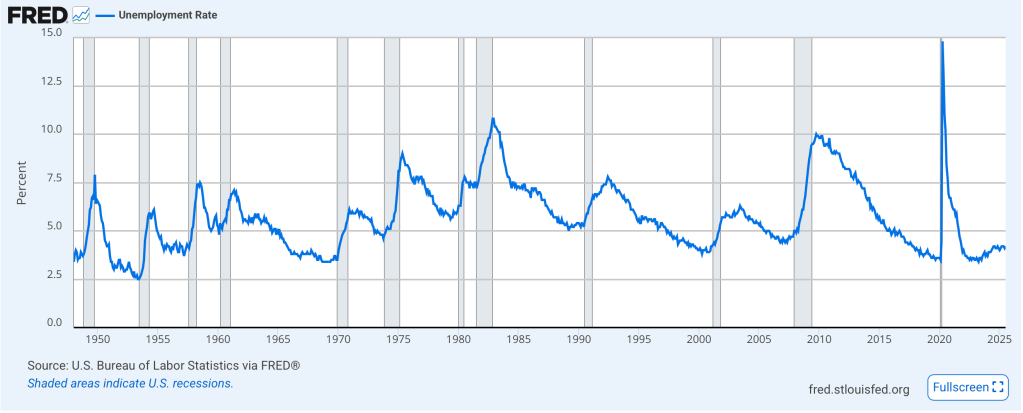

On the plus side, while the NFP number was soft, the Unemployment rate remains at 4.2%, in the lowest quintile since 1948 as per the below chart.

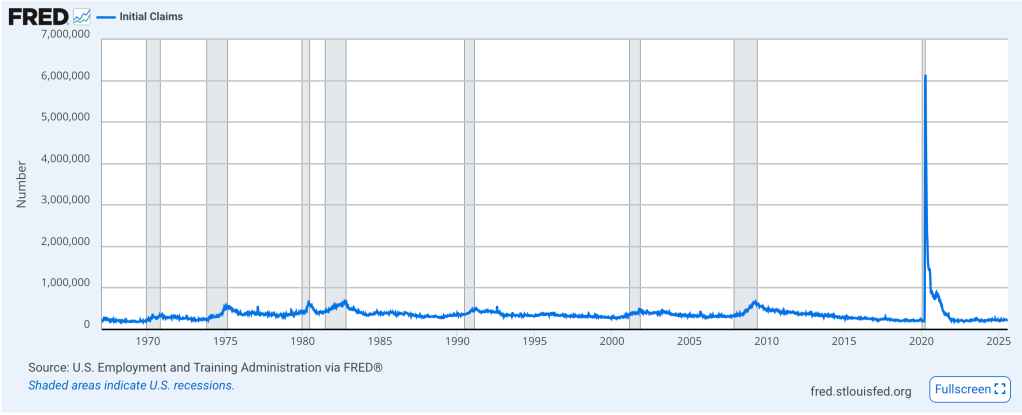

As well, Initial Claims data, the most frequent labor market data that is available, remains at the 13thpercentile, an indication that despite a great deal of concern by a certain segment of analysts, the labor market is still pretty strong. In fact, the last time Initial Claims was this low during a recession, in 1970, the US population was about 205 million compared to today’s 340 million. After all, this has been the issue on which Powell has been hanging his hat, and why Friday’s NFP number changed the narrative regarding the Fed.

The most recent GDP data was also quite positive, with Q2 growing at 3.0%, better than expected and then yesterday we saw the Trade deficit shrink to -$60.2B, its smallest level since September 2023. Trade, though, is a double-edged sword as a smaller deficit could indicate weaker domestic demand, or it could indicate stronger domestic supply. Naturally, this is the president’s goal, to achieve the latter, hence his tariff blitz.

As to inflation, it is off its recent lows, and remains well above the Fed’s 2.0% target, but with core CPI at 3.0%, it is hardly hyperinflationary. The tariff impact remains uncertain at this point as so far, it appears many companies are eating a significant portion. I guess that will become clearer in the Q3 earnings reports, although analysts continue to forecast strong growth there.

So, across jobs, growth and inflation, there is a case to be made that things are doing fine. Add to this the idea that fiscal stimulus is unlikely to end, merely be redirected from the previous administration’s favorites to this one’s, and you can understand the view that things are pretty good.

However, the other side of the story continues to have many adherents as well. Most of the negative outlook comes from digging underneath the headline numbers and extrapolating out to the negative trends that may exist there blooming into the full story.

For instance, regarding employment data, while the headlines have been ok, ISM Manufacturing Employment has fallen to 43.4, its lowest level in more than 5 years and pretty clearly trending lower, even on a cyclical basis as per the below chart.

Source: tradingeconomics.com

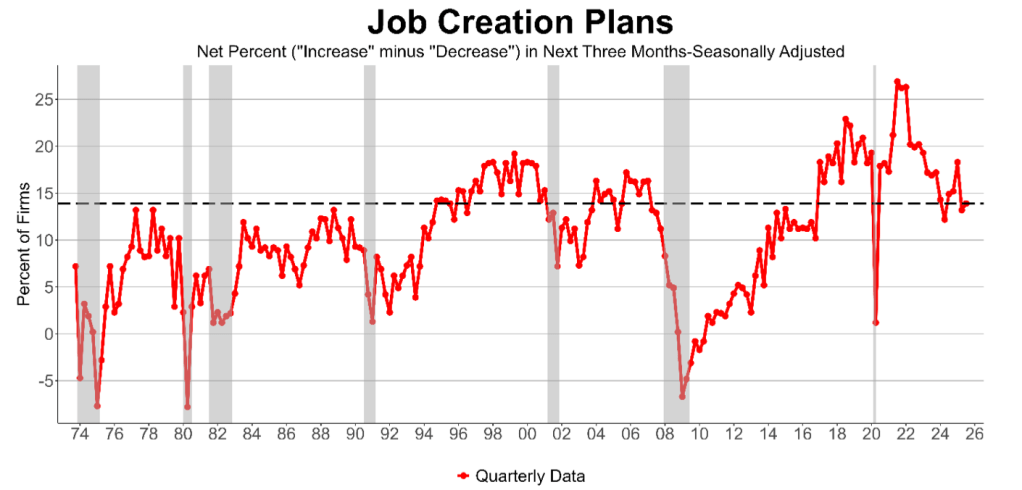

Too, ISM Services employment has fallen to 46.4 (anything under 50.0 indicates recession-type weakness). NFIB Employment surveys are negative, with small businesses planning to create fewer jobs in the next three months as per the below chart from the NFIB July report.

Challenger job cuts are rising again, with much of the blame put on AI. JOLTS Job Openings have been trending lower since Covid, but it is difficult to really tell there, as the levels are far above pre-Covid data as per the below BLS chart.

There is also a hue and cry that the deportations are removing a significant number of manual workers in fields like construction and agriculture, which is likely true. However, as I highlighted earlier in the week, the mix of employed in the US has turned to a greater proportion of US-born workers vs. foreign-born workers with net growth. So, perhaps many of those jobs are being filled anyway.

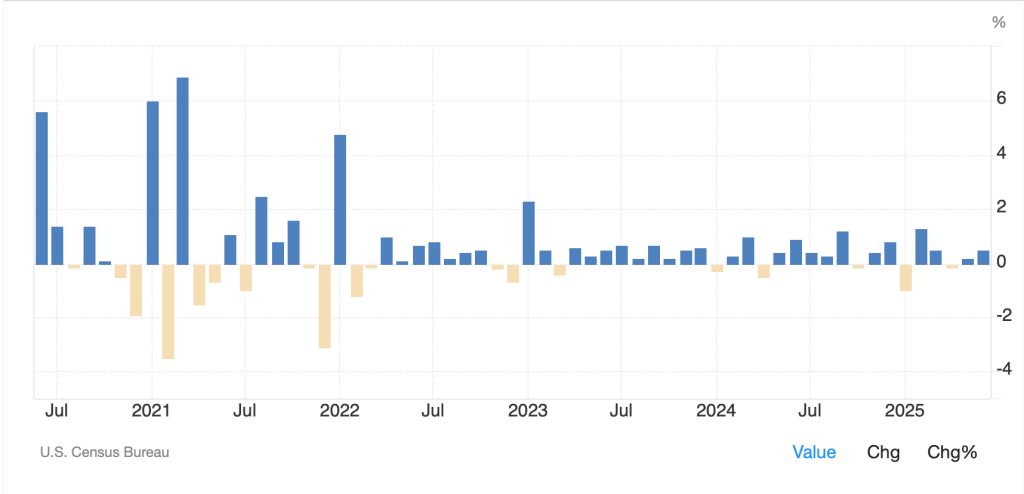

From a GDP perspective, the economic bears tend to dig into the pieces and have focused on declining consumption data although Retail Sales continues to motor along pretty well, rising 5.3% in the past twelve months when looking at the control group (excluding food services, auto dealers, building materials and gas stations) which is what is used in the GDP data. I am hard-pressed to look at the below chart and explain a dramatic slowing in growth.

Source: tradingeconomics.com

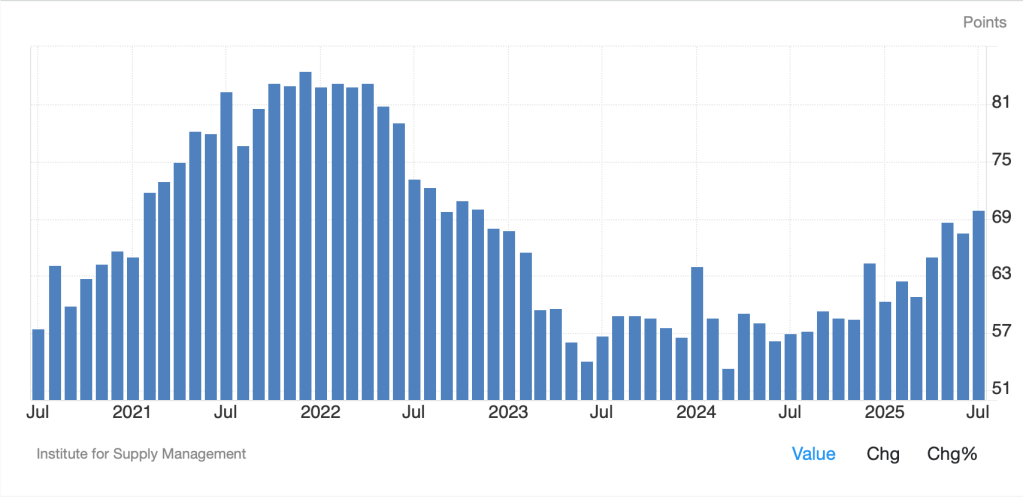

As to inflation, there continues to be a strong set of beliefs that tariffs are going to create a significant uptick, although it has yet to appear. ISM Prices paid did rise in Services, to 69.9, their highest level since the retreat from the 2022 “transitory inflation”.

Source: tradingeconomics.com

However, ISM Manufacturing prices appear to be stabilizing after some recent increases. The overall ISM price data is more worrisome as tariffs are only going to be on goods, and if services prices are rising, that is likely to feed through to general inflation more directly.

Concluding, we seem to be an awful long way from stagflation that some analysts are calling for as growth continues apace and there is no indication that fiscal stimulus is going to end. Rather, I would expect that we will see overall hotter growth, with higher prices coming alongside, and likely higher wages as well. I still have trouble seeing the collapsing US economy story, although things are hardly perfect.

And how will this impact markets? Well, broadly, while equities have clearly had an impressive run, and the trend is your friend, a pullback would not be a huge surprise. But dip buyers will be active, of that you can be sure.

As to bonds, if the US does run things hot, unless the budget deficit starts to shrink substantially, with the next release coming on August 12, yields are very likely to continue to remain bid. Right now, the curve is steepening because traders are banking on the Fed to cut next month so the 2yr yield has fallen sharply. But if growth remains strong, I would say there is a floor to yields although absent a significant rise in inflation, I don’t see them exploding higher either. And if the BBB actually does generate more revenue and reduce the budget deficit, look for yields to decline anyway.

Finally, the dollar should do well unless the Fed become aggressive. That story is too difficult to forecast given the machinations on the board and the questions of who the next Fed chair will be. As I have written before, in the short and medium term, a dollar decline is quite viable, but long term, most other nations have much bigger problems than the US, and I think investment will ultimately flow in this direction.

My apologies for the length of the opening and given the fact that there is so little happening in markets, with just a little back and forth, I will skip the recap.

Good luck

Adf