The battlelines are being drawn

On one side, the dollar is gone

‘Cause debt will explode

And once down that road

They claim folks would rather the yuan

But others are making the case

That dollar debt has much more space

To grow and expand

As it can withstand

More stress since it’s used everyplace

And finally, one thing left to note

Is Europe appears set to float

A digital euro

That ought to ensure-oh

The market, its price, will demote

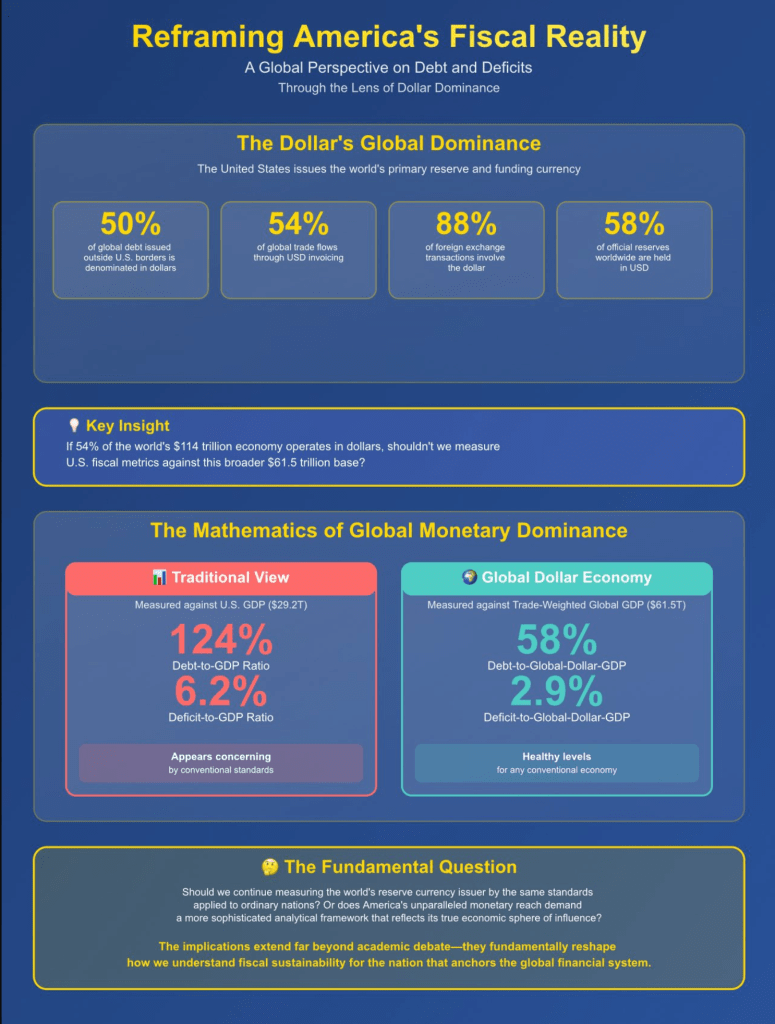

Friday, I highlighted an idea which I had toyed with, but never explained eloquently, but that was done so by Michael Nicoletos (@mnicoletos on X). While I offered a link to his work Friday, I know that many never click on links in notes like this, so I am copying his page showing this perspective. It is clear, clean and asks the proper questions.

The reason I am doing this is because this weekend, I listened to a podcast with another very smart macro guy, Luke Gromen (@lukegromen) who has a very different take on the state of the world. In short, Luke’s belief is that the US is already past the point of no return and that a potential downward spiral, caused by excessive US debt, is going to kick off soon. The result is that we will see the dollar decline severely (as described by the DXY), gold, bitcoin, and equities rally, and that Treasury debt, especially long dated debt, will get killed. In essence, he is explaining the inflation trade, higher US inflation will lead to those outcomes.

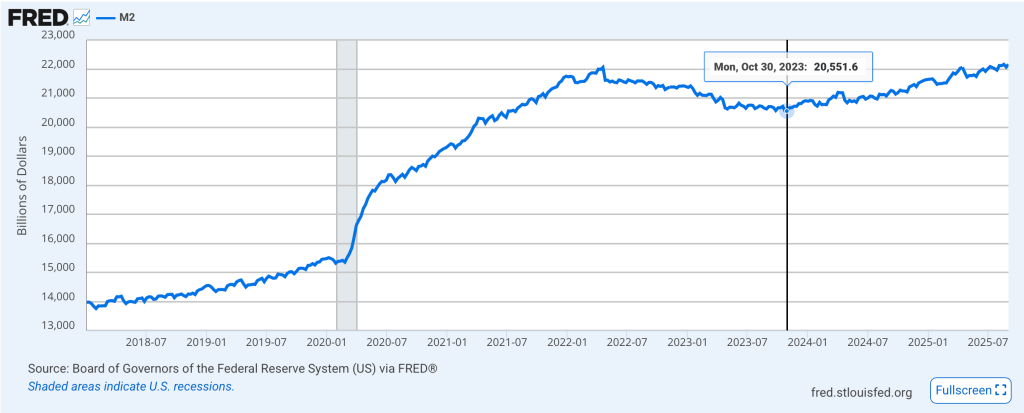

Let me start by saying, I agree with Luke on certain things, like the fact that we are likely to see higher inflation going forward as the government is in no mood to cut off the liquidity taps. If you look at the below chart of M2 from the FRED database of the St Louis Fed, you can see that this measure has set a record high and risen 7.8% since its local nadir on October 30, 2023.

So, in a bit less than 2 years, it has grown about 8% after having shrunk that much in the prior 2 years during the first phases of the Fed’s QT program. But now, despite the fact the Fed continues to slowly shrink their balance sheet, money supply is growing again, and my take is it will continue to do so for the foreseeable future as the government needs to essentially monetize the debt.

Back to the argument, I believe that in this scenario of run it hot, gold and equities will do well while bonds will do poorly, but the question of the dollar on the FX markets is very different. And this is where the Nicoletos’s theory comes into play. If he is correct, and we adjust our idea about what constitutes excess leverage for the US, then expecting the dollar to fall in the FX markets may not be the best idea. Rather, the news that the ECB is seeking to institute a digital euro, as per a speech by Madame Lagarde two weeks’ ago, and UK PM Starmer is claiming digital ID is necessary, to be followed by a digital pound, leads me to believe that institutions and individuals may decide they want more control over their own finances, rather than governments who have proven themselves exceptionally incompetent across numerous areas (energy, finance, and defense come to mind). That implies that the dollar is likely to find a lot more support than those claiming it is set to collapse.

Again, I ask, will developing nations really want to keep their reserves in the CNY, or store their reserves of gold in Shanghai given the long history of capriciousness that the CCP has demonstrated. People may hate the US; yet more people want to come here than go anyplace else because they have a higher degree of faith that their property will remain their property.

This is not to say things are great, there are huge problems worldwide, just to say that my medium- and longer-term views are the dollar will be seen as TINA if other nations go down the road they are currently claiming they will follow.

The overnight narrative’s turned

To government shutdown concerns

As Trump and Dems meet

The word on the Street

Is too many bridges are burned

As to this morning’s market activity, the most noteworthy story is the question of whether the Senate will pass a continuing resolution (CR) to keep the government operating past midnight on Tuesday when the current spending authority runs out. The House of Representatives have passed a ‘clean’ resolution which leaves the spending levels exactly where they are and lasts for 6 weeks allowing Congress time to pass the individual spending bills. However, in the Senate, they need 60 votes to overcome the filibuster, and the Republicans only have 53 seats. Minority Leader Schumer has promised to shut down the government unless he gets spending promises in the CR of upwards of $1 trillion over the next 10 years, and that feels unlikely. Too, the House of Representatives is in recess, so no changes to their bill can be made on a timely basis.

My take is the Senate will cave in, but if not, they will not be able to withstand the pressure for very long as I believe that they will ultimately receive the blame for the outcome. Turning to the market impact of this story, the most notable move overnight has been in precious metals where Gold (+1.3%), Silver (+1.8%) and platinum (+0.8%) are all continuing their recent runs and all at recent (and for gold all-time) highs. However, it is difficult for me to understand this as a response to the potential shutdown in isolation.

Perhaps, if we turn to the dollar, which is lower, but only by -0.2% on the DXY, we can have a better understanding as at least it would make some sense that the dollar declines if the government does shut down. And certainly, a weaker dollar manifests as stronger commodity prices, but the metals moves are so much larger, I have to believe there is another driver there. Some talk focuses on the fact that Friday’s PCE data was not too hot thus keeping alive the hopes for further Fed rate cuts. Personally, I lean toward the idea that the combination of concerns over increased military activity and the ensuing inflation are much more likely to be the drivers of precious metals’ rally.

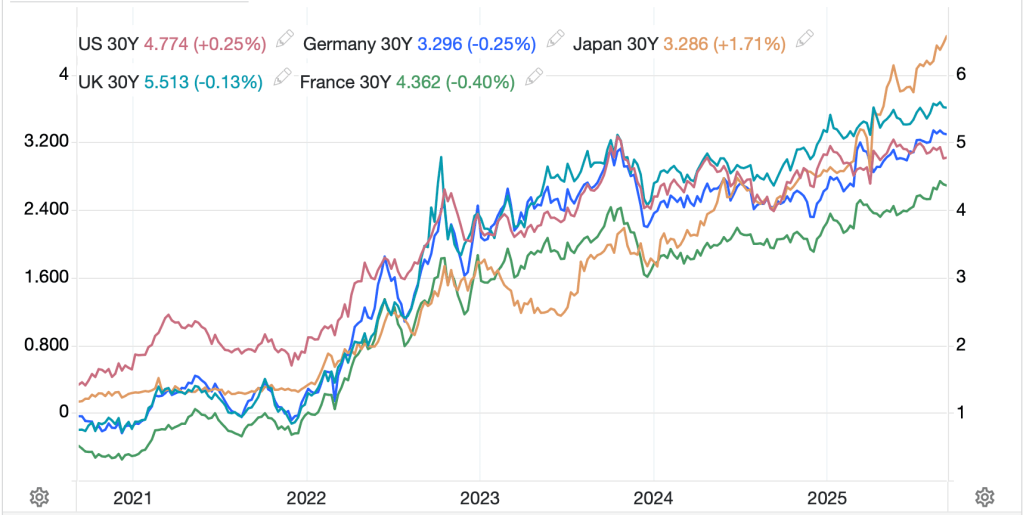

Weirdly, despite concerns over inflation, bond yields are not responding in the manner one might expect as Treasuries are lower by -3bps and we are seeing similar moves throughout all the European sovereigns this morning. As well, there was a very interesting article in the WSJ this morning about the fact that credit markets are incredibly strong, meaning the spread between corporate and Treasury yields has shrunk to the lowest levels on record for investment grade, and near that for junk bonds.

To sum this up, bond markets are completely unconcerned with future inflation while precious metals markets are screaming inflation is coming soon. Of course, one possible explanation for this seemingly divergent behavior is that the amount of liquidity that continues to be pumped into markets globally by central banks is driving fixed income investors to seek investments within their remits, i.e. bonds, while others are watching and trying to prepare for the inevitable. In a funny way, the fixed income folks may be doing the right thing because if YCC comes into play, and I am almost certain it will, then yields will be lower still!

As to the rest of markets, equities are all about more liquidity as Friday’s US rally, which is continuing this morning with futures higher by 0.5% at this hour (7:15) demonstrates. In Asia overnight, Japan (-0.7%) did not follow suit as a BOJ member hinted that a rate hike was coming at the October meeting, and we all know how much equities hate rate hikes. But China (+1.5%) and HK (+1.9%) both rocked as word of a new government plan to inject CNY 500 billion into local governments to spur investment made the news. Korea also benefitted from the combination of those things although India was unchanged and Taiwan (-1.7%) seemed to respond to a story that President Xi is seeking to get President Trump to agree that Taiwan is part of China.

As to Europe, the UK (+0.55%) is the leading gainer amid stories about pharma giants there raising prices, while continental markets are +/-0.2%, really not showing much life at all.

Oil (-1.8%) is slipping on news that Kurdish oil in the amount of up to 180K bbl/day is going to start flowing to the market again, adding to supply as OPEC is also talking of increasing production. There was, however, an interesting article in the WSJ about the fact that Russian production is starting to turn down as 3 years of war and sanctions has reduced their capability of producing absent Western technology.

Finally, the dollar, as mentioned above, is a bit softer this morning with JPY (+0.4%) and NZD (+0.4%) the G10 leaders although the rest of the bloc has seen gains on the order of 0.1% or 0.2% only. In the EMG bloc, KRW (+0.6%) is top dog with CNY (+0.2%) actually the next best performer. So, overall, movement here has not been that impressive despite the narrative.

I’ve gone on far too long and as there is no front-line data today, I will post it tomorrow. Of course, payrolls come Friday and be aware of five Fed speakers today and a total of ten this week.

Good luck

Adf