The OECD has declared

That growth this year will be impaired

By tariffs, as trade

Continues to fade

And no one worldwide will be spared

The funny thing is, the US

This quarter is showing no stress

But how things evolve

Is hard to resolve

‘Cause basically it’s just a guess

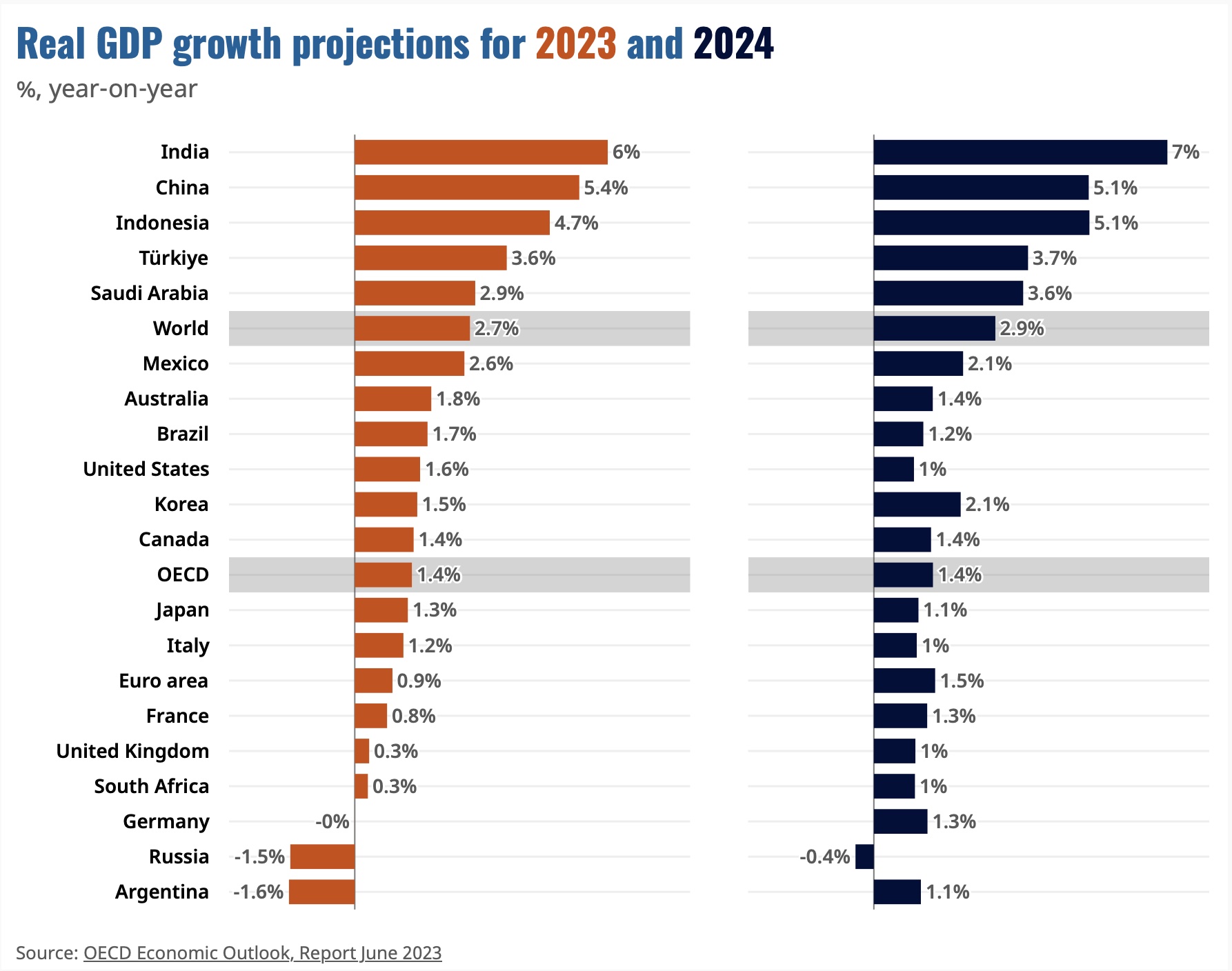

The OECD published their latest economic outlook and warned that global economic growth is likely to slow down because of the changes in tariff policies initiated by the Trump administration. Alas for the OECD, the only people who listen to what they have to say are academics with no policymaking experience or authority. It is largely a talking shop for the pointy-head set. Ultimately, their biggest problem is that they continue to utilize econometric models that are based on the last 25-30 years of activity and if we’ve learned nothing else this year, it is that the world today is different than it has been for at least a generation or two.

At the same time, a quick look at the Atlanta Fed’s GDPNow forecast for Q2 indicates the US is in the midst of a very strong economic quarter.

Now, while the US does not represent the entire OECD, it remains the largest economy in the world and continues to be the driver of most economic activity elsewhere. As the consumer of last resort, if another nation loses access to the US market, they will see real impairment in their own economy. I would argue this has been the underlying thesis of the Trump administration’s tariff negotiations, change your ways or lose access, and that is a powerful message for many nations that rely on selling to the US.

Of course, it can be true that the US performs well while other nations suffer but that is not the OECD call. Rather, they forecast US GDP growth will fall to 1.6% this year, down from 2.4% last year and previous forecasts of 2.2%.

But perhaps now is a good time to ask about the validity of GDP as a marker for everyone. You may recall that in Q1, US GDP fell -0.2% (based on the most recent update received last Thursday) and that the media was positively gleeful that President Trump’s policies appeared to be failing. Now, if Q2 GDP growth is 4.6% (the current reading), do you believe the media will trumpet the success? Obviously, that is a rhetorical question. But a better question might be, does the current calculation of GDP measure what we think it means?

If you dust off your old macroeconomics textbook, you will see that GDP is calculated as follows:

Y = C + I + G + (X – M)

Where:

Y = GDP

C = Consumption

I = Investment

G = Government Spending

X = Exports

M = Imports

In the past I have raised the question of the inclusion of G in the calculation, as there could well be a double counting issue there, although I suppose that deficit spending should count. But the huge disparity between Q1 and Q2 this year is based entirely on Net Exports (X -M) as in Q1, companies rushed to over order imports ahead of the tariffs and in Q2, thus far, imports have fallen dramatically. But all this begs the question, is Q2 really demonstrating better growth than Q1? Remember, the GDP calculation was created by John Maynard Keynes back in the 1930’s as a policy tool for England after WWI. The world today is a far different place than it was nearly 100 years ago, and it seems plausible that different tools might be appropriate to measure how things are done.

All this is to remind you that while the economic data matters a little, it is not likely to be the key driver of market activity. Instead, capital flows typically have a much larger impact on market movements which is why central bank policies are so closely watched. For now, capital continues to flow into the US, although one of the best arguments against President Trump’s policy mix (and goals really) is that they could discourage those flows and that would have a very serious negative impact on financial markets. Of course, he will trumpet the real investment flows, with current pledges of between $4 trillion and $6 trillion (according to Grok) as offsetting any financial outflows. And in fairness, I believe the economy will be better served if the “I” term above is real foreign investment rather than portfolio flows into the S&P 500 or NASDAQ.

There is much yet to be written about the way the economy will evolve in 2025. I remain hopeful but many negative things can still occur to prevent progress.

Ok, let’s take a look at how markets are absorbing the latest data and forecasts.

The barbarous relic and oil

Spent yesterday high on the boil

While bond yields are tame

These rallies may frame

A future where risk may recoil

I’ll start with commodities this morning where we saw massive rallies in both the metals and energy complexes yesterday as gold (-0.8% this morning) rallied nearly 2% during yesterday’s session and both silver (-1.4%) and copper (-1.7%), while also slipping this morning, saw even bigger gains with silver touching its highest level since 2012. Copper, too, continues to trade near all-time highs as there is an underlying bid for real assets as opposed to fiat currencies. Meanwhile, oil (+0.3%) rallied nearly 4% yesterday and is still trending higher, although remains in the midst of its trading range. Given the bearish backdrop of declining growth expectations and OPEC increasing production, something isn’t making much sense. Lower oil prices have been a key driver of declining inflation readings around the world. If this reverses, watch out.

Turning to equities, yesterday’s weak US start turned into a modest up day although the follow through elsewhere in the world has been less consistent. Tokyo was basically flat while Hong Kong (+1.5%) was the leader in Asia on the back of the story that Presidents Trump and Xi will be speaking this week as well as some solid local news. But elsewhere in Asia, the picture was more mixed with modest gains and losses in various nations. In Europe, despite a softer than expected inflation reading this morning, with headline falling to 1.9%, equity indices have been unable to gain much traction in either direction. This basically cements a 25bp cut by the ECB on Thursday, but clearly the trade situation has investors nervous. Meanwhile, US futures are pointing slightly lower at this hour (7:25), but only on the order of -0.2%.

Bond yields, which backed up yesterday, are sliding this morning with -2bps the standard move in Treasuries, European sovereigns and JGBs overnight. We did hear from Ueda-san last night and he promised to adjust monetary policy only when necessary, although given base rates there are 0.5% and CPI is running at 3.5%, I’m not sure what he is looking at. The very big picture remains there is too much debt in the world and the big question is how it will be resolved. But my take is that won’t happen anytime soon.

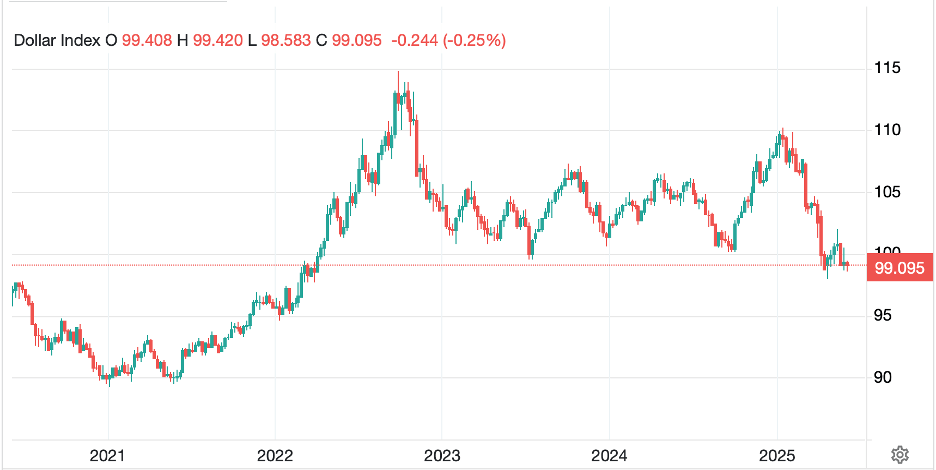

Finally, the dollar, which had been under pressure yesterday has rebounded this morning, regaining much of the losses seen Monday. The euro (-0.5%) and pound (-0.4%) are good proxies for the magnitude of movement we are seeing although SEK (-0.7%) is having a little tougher time. In fairness, though, SEK has been the best performing G10 currency so far this year, gaining more than 13%. In the EMG bloc, PLN (-1.0%) is the laggard, perhaps on the election results with the right-wing candidate winning and now calling into question the current government there and its ability to continue to move closer to the EU policy mix. It should also be noted that the Dutch government fell this morning as Geert Wilders, the right-wing party leader, and leading vote getter in the last election, pulled out of the government over immigration and asylum issues. (and you thought that was just a US thing!). In the meantime, I will leave you with the following 5-year chart of the DXY to allay any concerns that the dollar is about to collapse. While we are at the bottom of the range of the past 3 years, we have traded far below here pretty recently, let alone throughout history.

Source: tradingeconomics.com

On the data front, JOLTs Job Openings (exp 7.1M) and Factory Orders (-3.0%, 0.2% ex Transport) are on the docket and we hear from 3 more Fed speakers. But again, Fed comments just don’t have the same impact as they did even last year. In the end, I do like the dollar lower, but don’t be looking for a collapse.

Good luck

Adf