The pundits are still talking gold

But what is the reason it sold?

Liquidity drying

Means selling, not buying

Of havens. Has, now, the bell tolled?

One of the great things about FinX (FKA FinTwit) is that there are still a remarkable number of very smart folks who post things that help us better understand market gyrations. The recent parabolic rise and this week’s reversal in the price of the barbarous relic seem unrelated to any concept of fundamentals one might have. After all, perhaps the only fundamental that impacts gold is the rate of inflation, and since we haven’t seen a reading there in a month, it seems unlikely that had anything to do with this price action. However, there is a far more likely explanation for the move lower, which has been very impressive in any context. First, look at the chart below from tradingeconomics.com which shows the daily bars for the past 6 months. The rise since early September has been nothing short of remarkable.

This begs two questions; first, why did it rise so far so fast, and second, what the heck happened on Friday to turn it around so dramatically?

The first question has several pieces to its answer including ongoing concerns over fiat currencies in general (the debasement trade that became popular), increased central bank buying and a recent change in financial advisors’ collective thought process about the merits of holding gold in an investment portfolio. In fact, I think it was Bank of America (but I could be wrong) that recently suggested that the 60:40 portfolio should really be 60:20:20 with the final 20% being gold! Given the human condition of jumping on bandwagons, it is no surprise that this type of ‘analysis’ has become more popular lately. Whatever the driver, or combination of drivers, the price action was remarkable and clearly overdone. After all, compare the current price, even after the recent sharp decline, to the 50-day moving average (the blue line on the chart) as an indicator of the extreme aspect of the price action.

But let’s focus on the last few days and the sharp reversal, which takes me back to X. There is an account there (@_The_Prophet_) who put out an excellent step by step rationale of what led up to yesterday’s dramatic decline and why it is important. I cannot recommend it highly enough as a short read.

In sum, his point is, and I fully subscribe to this idea, that when things get tough, investors/traders/speculators sell what they can sell, not what they want to sell. If liquidity is drying up for the funding of speculative assets that are highly leveraged, then when margin and collateral calls come, and they always do, those owners sell whatever they have that they can liquidate. In this case, given the massive run up in the price of gold, there was a significant amount of value to be drawn down and utilized to satisfy those margin calls.

History has shown this to be the case time and again. I would point to the Long-Term Capital Management fiasco back in 1998 where the Nobel Prize winning fund managers quickly found out that liquidity was much more important than ideas and they were forced to sell out their Treasury holdings rather than their leveraged positions because the former had prices and the latter didn’t. This ultimately led to the liquidation of their fund along with some $5 billion in capital.

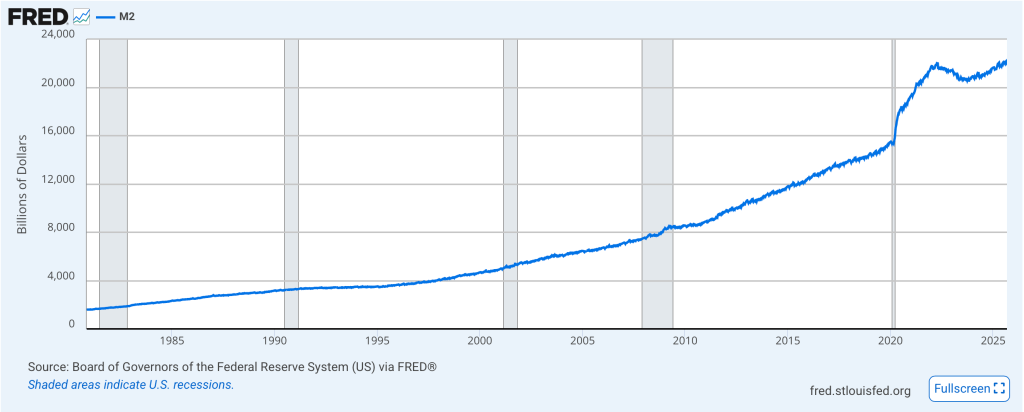

There has been much discussion as to the nature of the recent rise in asset prices with many pundits calling it the everything bubble. Bubbles are created when central banks pump significant liquidity into the system and this is no different. We know the Fed has allegedly (look at the graph of M2 below to see how much they have been increasing money supply during their tightening) been trying to reduce its balance sheet (i.e. liquidity) but this could well be a sign that phase is over. Typically, the next step is QE in some form, so beware. And when that comes, you can be sure that gold will rally sharply once again!

Of course, while the gold move has been the most spectacular, we have seen a lot more market volatility in the past several sessions, so let’s look at how things behaved overnight. Yesterday’s mixed US session was followed by more laggards than leaders in Asia with Japan essentially unchanged, while HK (-0.9%) and China (-0.3%) both slid a bit. Recent comments by President Trump that he may not sit down with President Xi next week have investors and traders there nervous. Elsewhere, Korea (+1.5%) and Thailand (+1.1%) had solid sessions while the rest of the region (Indonesia -1.0%, Malaysia -0.9%, Australia -0.7%) all lagged.

In Europe, the UK (+0.9%) is benefitting this morning from softer than expected inflation readings (3.8% vs 4.0% expected) which has tongues wagging that the BOE will now be cutting rates. The market priced probability has risen to 60% for a cut this year, up from 40% yesterday, before this morning’s data release. However, on the continent, only Spain (+0.6%) is showing any life on local earnings performance while the rest of the markets are all lower by varying degrees between -0.1% and -0.5%. As to US futures, at this hour (7:20) they are unchanged.

Bond markets continue to see yields slide lower with Treasuries (-1bp) now nicely below 4.00% and trading at their lowest level in more than a year (see below)

Source: tradingeconomics.com

European sovereign yields have seen similar movement, edging lower by -1bp except for UK gilts, which have fallen -10bps this morning after that inflation report. Perhaps more interesting is the fact that despite Takaichi-san becoming PM, with her platform of increased fiscal spending, JGB yields are 2bps lower this morning.

Turning to the rest of the commodity space, oil (+2.1%) is rising on the news that the US has started to refill the SPR. While the initial bid is only for 1 million barrels, this is seen as the beginning of the process with the administration taking advantage of the recent low prices. Arguably, given they want to see more drilling as well, it is very possible that $55/bbl is as low as they really want it to go. As to the metals beyond gold (-2.4% this morning), silver (-1.6%) is still getting dragged along but copper (+0.6%) and platinum (+0.9%) seem to be consolidating after sharp declines in both. My sense is gold remains the liquidity asset of choice given its far larger market value. (One other thing to note is that there was much discussion how gold has replaced Treasuries as the most widely held central bank reserve asset. That was entirely a valuation story, not a purchase story. In other words, the dramatic rise in the price of gold increased the value of its holdings relative to other assets on central bank balance sheets.)

Finally, the dollar is doing just fine. It continues within its recent trading range and basically hasn’t gone anywhere in the past six months. In fact, of you look at the DXY chart below from Yahoo Finance, it is arguably in the upper quintiles of its long-term price action. It is very difficult for me to listen to all the reasons that the dollar is going to be replaced by some other reserve currency and take it very seriously.

As to specific currency moves today, the pound (-0.3%) is slipping on the increased belief in a rate cut coming soon and ZAR (-0.5%) is suffering on the ongoing gold price decline but away from those two, +/-0.1% is the story of the day.

EIA Crude Oil inventories are the only data of the day with a modest build expected. Yesterday, Governor Waller discussed payment systems and cryptocurrencies never straying into monetary policy so we will need to wait for CPI on Friday, the FOMC next Wednesday and whenever the government reopens, which I sense is coming sooner rather than later as the Democrats have been completely unsuccessful in making the case this is President Trump’s fault.

It appears the cracks in the leverage that has accompanied the recent rally in asset prices are beginning to appear. If things get worse, and they probably will, look for the Fed to respond and haven assets to be in demand. Amongst those will be the dollar.

Good luck

Adf