It turns out inflation’s not dead

Despite what we’ve heard from the Fed

Will Jay now admit

His forecasts are sh*t

Or are there more rate cuts ahead?

To listen to some of his friends

They’re still focused on the big trends

Which they claim are lower

Though falling much slower

If viewed through the right type of lens

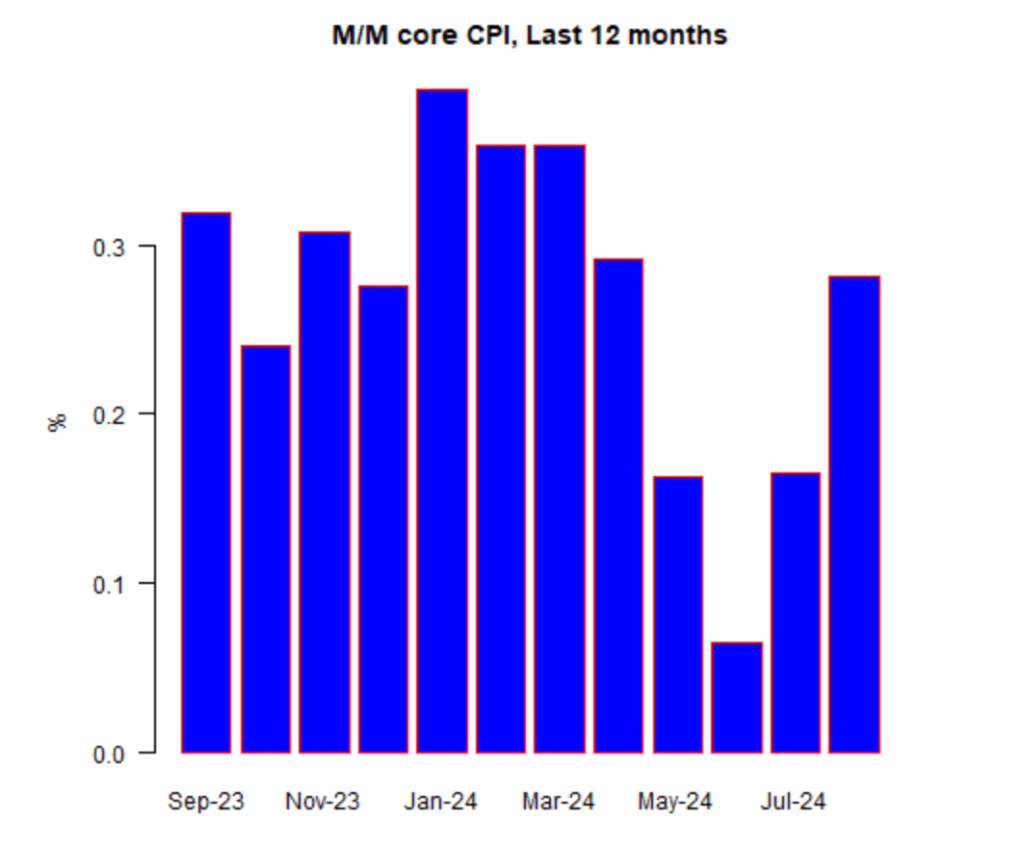

I guess if you squint just the right way, the trend in inflation remains lower. I only guess that because that’s what we heard from three Fed speakers yesterday, Williams, Goolsbee and Barkin, but to my non-PhD trained eye, it doesn’t really look that way. Borrowing the chart from my friend @inflation_guy, Mike Ashton, below are the monthly readings for the past twelve months for Core CPI.

As I said, and as he mentioned in his CPI report yesterday, it is much easier to believe that the outliers are May through July than the rest of the series. But remember, I am not a trained PhD economist, so it is entirely possible that I simply don’t understand the situation.

At any rate, both the core and headline numbers printed higher than forecast which saw bonds sell off and the dollar rally while stocks edged lower. Arguably, the big surprise was that commodity prices raced ahead with oil (+3.0% yesterday) and gold (+0.75% yesterday) both showing strength. It seems that both of these markets, though, benefitted from rumors that Israel is getting set to finally retaliate against Iran for the missile bombardment last week, and fears of a significant disruption in oil markets, as well as a general rise in the level of uncertainty, has been sufficient to squeeze out a bunch of recent short positions.

In China, investors are waiting

For details on how stimulating

The plans Xi’s unveiled

Will truly be scaled

And if they’ll be growth generating

The other topic du jour is China, where tomorrow, FinMin Lan Fo’an is due to announce the details of the fiscal stimulus that was sketched out right before the Golden Week holiday, and which has been a key driver in the extraordinary rise in Chinese equities since then. Alas, last night, as traders and investors prepared for these announcements, selling was the order of the day and the CSI 300 (-2.8%) fell sharply amid profit taking. I find it telling that they are waiting to make these announcements while markets are not open, a sign, to me at least, that they are likely to be underwhelming. Current expectations are for CNY 2 trillion (~$283 billion) of fiscal stimulus, which while a large number, is not that much relative to the size of the Chinese economy, currently measured at about $17 trillion. And unless they address the elephant in the room, the decimated housing market, it seems unlikely to have a major positive impact over the long term.

That said, Chinese stocks have become one of the hottest themes in the market with many analysts claiming they are vastly undervalued relative to US stocks. However, I saw a telling chart this morning on X, showing that flows into Chinese stocks from outside the nation, the so-called northbound flows from Hong Kong, especially when compared to flows from the mainland to Hong Kong, have been awful, despite this recent rally. As with many things regarding the Chinese economy and markets, the headlines can be deceiving at times in an effort to make things look better than they are.

While we did see the renminbi rally sharply after those initial stimulus announcements, it has since retraced most of those gains. I cannot look at the situation there without seeing an economy that has serious structural imbalances and a terrible demographic future. Meanwhile, the biggest problem is that President Xi has spent the past decade consolidating his power and eliminating much of the individual vibrancy that had helped the nation grow so rapidly. Ultimately, I see CNY slowly depreciating as it remains the only relief valve the Chinese have on an international basis.

With that in mind, let’s take a look at how markets responded to the US CPI data and what other things may be having impacts. Ultimately, US equity markets regained the bulk of their early losses yesterday to close marginally lower. We’ve already mentioned China’s equity woes and Hong Kong was closed last night for a holiday. Tokyo (+0.6%) managed a small gain, tracking the weakness in the yen (-0.25%) while the bulk of the region drifted modestly lower. It seems many traders are awaiting this Chinese news to see how it will impact the rest of Asia. As to European bourses, the movement here has also been di minimus with the FTSE 100 (-0.2%) the biggest mover after its data releases showing that GDP continues to trudge along slowly, growing only 1.0% Y/Y. Continental exchanges are +/- 0.1% from yesterday, so no real movement there. US futures, too, are essentially unchanged at this hour (7:00).

In the bond market, yields continue to edge higher with Treasuries gaining 3bps and European sovereigns all looking at gains of between 3bps and 5bps. An interesting interest rate phenomenon that has not gotten much press is that the fact that at the end of September, the General Collateral Repo rate surged through the upper bound of the Fed funds rate, a condition that describes a potential dearth of liquidity in the markets.

Source: zerohedge.com

The implication is that QT may well be ending soon in order for the Fed to be certain that there are sufficient bank reserves available for banks to meet their regulatory targets and not starve the economy of capital. It has always been unclear how the Fed can start cutting rates while continuing to shrink the balance sheet as that was simultaneously tightening and easing policy, but it appears that we are much closer to universal policy ease, something else that will weigh on the dollar and support commodity prices over time.

Speaking of commodities, after yesterday’s rally, this morning, the metals complex is continuing modestly higher (Au +0.3%, cu +0.4%) but oil (-0.8%) is backing off a bit. So much of the oil trade appears linked to the Middle East it is very difficult to discern the underlying supply/demand dynamics right now.

Finally, the dollar, after several days of strength, is consolidating and is little changed to slightly higher. The DXY is trading right at 103 and the euro is hovering just above 1.09 with USDJPY at 149.00. Several weeks ago, these numbers would have seemed ridiculous given the then current view of the Fed aggressively cutting rates. But now, all that bearishness is fading, and it is true vs. almost every currency, G10 or EMG this morning.

On the data front, PPI leads the way this morning although given we already got the CPI data, it will have virtually no impact I would expect. Estimates are for headline (0.1% M/M, 1.6% Y/Y) and core (0.2% M/M, 2.7% Y/Y). As well, we get Michigan Sentiment (70.8) at 10:00 and we will hear from several more Fed speakers, including Governor Bowman, the dissenter at the FOMC meeting who looks quite prescient now. One thing to note is yesterday’s Initial Claims data was much higher than expected at 258K, but that was attributed to the effects of Hurricane Helene, and now that Hurricane Milton has hit, I expect that those claims numbers will be a mess for a few more weeks before all the impact has passed through.

While Fedspeak remains far more dovish than the data, my take is if the data continues to show economic strength, especially if the next NFP release, which is just before the FOMC meeting, is strong again, the Fed will be hard pressed to cut even 25bps then. For now, good economic news should support the dollar and weigh on bonds.

Good luck and good weekend

Adf