As Harris and Trump try persuading

The voters, the markets keep trading

So, narrative writers

Are pulling all-nighters

To pump up the side that is fading

The latest attack is on Trump

Who’s blamed for the bond market slump

But what of the Fed

Whose rate cuts have spread

The fear that inflation will jump?

It appears we have reached the point in time when macroeconomic data is taking a backseat to the political situation. Almost every story you can read in any of the mainstream media right now is about how the election is going to affect whatever subject an article is about. The latest discussion, which I have seen across numerous sources like Bloomberg, the WSJ and Reuters, just to name a few, is that the bond markets recent decline is entirely Trump’s fault. The logic is that as Trump’s election prospects improve, and those of fellow Republicans in both the House and Senate alongside him, the market is suddenly concerned that the government is going to spend a lot of money and run a large deficit. You can’t make this up!

The federal government deficit under the current administration is pegged to be just shy of $2 trillion this fiscal year, and you have all heard about the fact that interest payments on the government’s nearly $36 trillion of debt have grown to be more than $1 trillion. But that is not the driver according to the narrative. The driver is the idea that the Republicans could sweep and that would mean large deficits because…Trump.

Now, I realize I am only an FX guy (FX poet I guess), but my rudimentary understanding of economics is that when economic activity is strong (like the current data implies) and the central bank then adds more liquidity to the system to goose demand, say by cutting interest rates in the front end of the curve, then demand can outstrip supply and prices will rise. As such, bond investors, when they see a dovish Fed entering an easing cycle while economic activity continues to move along and the government is already running a large fiscal deficit, are concerned over higher inflation ahead and so demand higher yields to own Treasury securities. Of course, that view doesn’t necessarily suit the narrative so desperately pushed by the mainstream media that Trump is the root of all evil, but it does seem to make more sense.

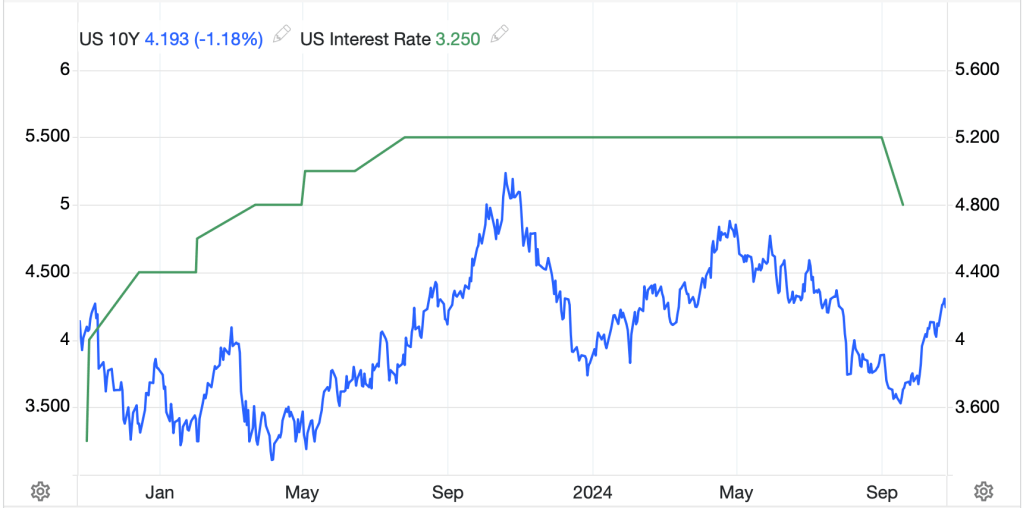

At any rate, for the next two weeks at least, and likely four years if Trump wins, I can assure you that every negative day in any financial market will be blamed on Trump and his policies, despite the fact that the Fed seems to be the one with far more direct impact on short-term economic outcomes. A look at the below chart, showing 10yr Treasury yields and the Fed funds rate cannot help but show that it was the Fed’s rate cut that is coincident with the recent sharp rise in yields, and this took place long before the odds of a Trump victory improved. Look through the narrative and instead at the data and Fed activities for the most important clues as to what is actually happening. I would argue that this is a bond market that is concerned about returning inflation as the Fed’s policy prescription no longer matches the reality on the ground.

Source: tradingeconomics.com

One other thing. If the Fed does continue to cut rates while US economic data continues to demonstrate solid growth, look for commodity prices to continue their ongoing rally, likely equity markets to continue to perform well, but the dollar is more nuanced as rising inflation ought to undermine the greenback, but given we are seeing more aggressive rate cuts elsewhere in the world (Bank of Canada just cut 50bps this week and the ECB and BOE are going to be cutting again next month), it is entirely possible the dollar holds its own despite macroeconomic fundamentals that should point to weakness.

Ok, let’s see what happened overnight. Yesterday’s US sell-off, the third consecutive day of broad market weakness, seems to have been sufficient to wash out some of the froth in the market as US futures are pointing higher this morning, especially after Tesla’s better than expected earnings report. But overnight, the trend from yesterday’s US session was intact with most Asian markets under pressure (Hang Seng -1.3%, CSI 300 -1.1%, KOSPI -0.7%) with only Japan (Nikkei +0.1%) bucking the trend. In Europe, however, this morning’s color is green with all the major bourses showing life (CAC +0.75%, DAX +0.7%, FTSE 100 +0.5%). Now, there was data released in Europe with the Flash PMI readings out this morning. The funny thing is that they did not paint a great picture, with continued softness almost everywhere. My take is Europe is going through a ‘bad news is good’ phase where the weak PMI data implies there will be more aggressive rate cuts by the ECB going forward. Certainly, Eurozone economic activity, led by Germany’s virtual stagnation, is lackluster at best.

In the bond markets, after several sessions of rising yields, Treasuries have seen yields slip back 5bps this morning with similar declines across the board in European sovereign markets. Part of this is the weak PMI data I believe, but part of it is a simple trading response to a market that is likely somewhat oversold. After all, for the past month, bonds have been under significant pressure so a bounce can be no surprise.

In the commodity markets, after yesterday’s rout, where there seemed to be a lot of profit taking of the recent rally, this morning the march higher continues. Oil (+1.0%) is leading the energy complex higher and the entire metals complex (Au +0.5%, Ag +0.7%, Cu +0.5%, Al +0.9%) is back in gear as all the underlying drivers (rising inflation, solid demand, and for gold, ongoing geopolitical concerns) remain in place.

Finally, the dollar is a bit softer this morning, but this too seems like a response to what has been a strong rally. Once again, using DXY as a proxy (see chart below) for the broad dollar, the rally over the past month has been quite strong, so a day of backing off is to be expected. As I mentioned above, the future of the dollar is nuanced because while the macro indicators point to potential weakness, if the rest of the world eases monetary policy more aggressively, the dollar will still rally.

Source: tradingeconomics.com

As to today’s movement, currency gains have been between 0.2% and 0.5% with the commodity bloc the biggest beneficiary (ZAR +0.5%, NOK +0.4%, AUD +0.3%) and we have also seen the yen (+0.5%) regain a little of its footing amid declining US yields, although it remains far above the 150 level. There are those who are looking for another bout of intervention, but I am not in that camp, at least not in the near-term.

On the data front, this morning brings the Chicago Fed National Activity Index (exp 0.2), Initial Claims (242K), Continuing Claims (1880K), Flash PMI (Mfg 47.5, Services 55.0) and New Home Sales (720K). Yesterday’s Existing Home Sales data was weaker than expected at 3.84M, arguably a testament to the fact that mortgage rates have followed Treasury yields higher and are back above 7.0% again. On the Fed front, we hear from new Cleveland Fed president Beth Hammack, but it feels like Fed speak is losing some momentum. Nobody believes that they are going to stop cutting rates, and fewer and fewer analysts think they should continue amid strong growth. The futures market is now pricing a 95% probability of a November cut but only a 71% probability of a December cut to follow. I remain in the camp that they pause in December, especially in the event of a Trump victory.

While the dollar is under pressure today, I continue to believe it retains the ‘cleanest shirt in the dirty laundry’ appeal and will ultimately continue to rally.

Good luck

Adf