The verdict, as best I can tell

Is Trump and his new personnel

Are being embraced

So, buy risk, post-haste

Lest owners all choose not to sell!

And yet there seems always a price

Where owners will sell in a trice

But if it’s that high

It just might imply

It’s worth it to think more than twice

Euphoria is one way to describe what we have seen in markets over the past several sessions, with substantial gains across both equity and bond markets while havens like gold and the dollar have been discarded. Insanity may be a better way to do so. Regardless of your description, the facts are that risk assets have been consistently higher since the election results and there is a palpable excitement about how the future, at least for markets, will unfold. I hope all this excitement is not misplaced, but it is still early days. Just remember, that whatever ideas are currently being bandied about regarding Trumpian policies, it is almost certain that the reality will not quite live up to the hype.

Consider, too, for a moment just how different the impact will be on different markets. The obvious first thought is China, where we have seen a significant divergence between the S&P 500 and the CSI 300 over the past week as seen in the chart below.

Source: tradingeconomics.com

My point is all that euphoria is very country specific. After all, yesterday’s comments by President-elect Trump that on day one he will impose tariffs of 25% on all imports from both Mexico and Canada had the expected impact on their currencies, weakening both substantially. In fact, it is quite interesting to look at a longer-term chart of USDCAD and see that this is the third time in the past decade the exchange rate has traded above 1.40. The previous two times were the beginnings of Covid, amid massive risk-off trading…and in 2016 when Mr Trump was previously elected president.

Source: tradingeconomics.com

I assure you that whatever China decides to do, and they have many inherent strengths as well as weaknesses, both Mexico and Canada are going to ultimately concede to whatever Trump wants as they cannot afford to ignore it. In fact, my take is that the reason so many political leaders around the world are distraught is because they recognize that they are going to have to change their policies to keep in Trump’s good graces. To me, the implication is that we are due for much more volatility as markets respond to all the changes that are coming.

And that should be our watchword going forward, volatility. We live in a time where previous theories that led to previous policies are being questioned and upended. We are also living through what appears to be the end of the Pax Americana era, where the US is turning its focus inward rather than concerning itself with pushing its brand globally. These realignments are going to be ongoing for quite a while, and as new models will need to be developed and implemented, in both the public and private sectors, outcomes are going to remain quite uncertain for a while. It is this that will drive all the volatility. Once again, I urge hedgers to keep this in mind and maintain robust hedging programs as risk mitigation is going to be critical for future performance.

Ok, so let’s look at how things turned out overnight. While the rally in the US equity market continues, especially in value and small-cap stocks, the story in Asia was far less positive with declines in Japan (-0.9%), China (-0.2%) and Australia (-0.7%) and almost every regional exchange in the red overnight. This seems a direct response to the resurgence of tariff talk from Trump and I expect may be the guiding force for a while yet, perhaps even until the Inauguration. Of course, we could also see some nations capitulating quickly in an effort to gain favor and I would expect those markets to reflect a more positive stance in that situation. Neither is Europe immune from tariff talk as every bourse on the continent is weaker this morning amid concerns that tariffs are coming for them as well. In addition, Trump has made it clear he is uninterested in supporting the Ukraine effort which means that either Europe will need to spend more money, or the map is going to change in an uncomfortable manner. As to US futures, at this hour (7:20) they are modestly firmer.

In the bond market, yesterday saw the largest rally (-14bps) since the July NFP report showed Unemployment jumped to 4.3% in early August and triggered all sorts of claims that recession had started. Yesterday’s catalyst was far more ambitious, ascribing success to Treasury Secretary selection Scott Bessent’s ability to rein in the fiscal deficit. That bond rally dragged European sovereign yields lower, although a much smaller amount, 3bps-5bps, and this morning things are back to more normal trading with Treasury yields unchanged while Europeans are generally trading with yields lower by -2bps. Certainly, if fiscal issues are successfully addressed, the opportunity for bond yields to decline exists, but this seems like a lot of hope right now.

In the commodity markets, gold had its worst day in forever, falling $110/oz although it is rebounding a bit this morning, up $21/oz or 0.8%. That move seemed entirely driven by this same euphoria that has been underpinning both stocks and bonds, namely the future is bright, and havens are no longer needed. Silver, too, had a rough day yesterday and is rebounding this morning, +1.4%, while copper sits the whole move out. Oil (+0.8%) sold off yesterday amid the same risk thoughts as well as the news that an Israeli/Hezbollah ceasefire may be coming soon, reducing Middle East risk. In the short-term, the day-to-day vicissitudes of oil’s price are inscrutable to all but the most connected traders, but nothing has changed my longer term view, which has only been enhanced by Trump’s drill, baby, drill thesis, that there is plenty of oil around and sharp price rises are unlikely going forward.

Finally, the dollar seems to have put in a top last Friday and has been selling off since the Bessent announcement. I’m not sure I understand the logic here as Bessent is seeking to increase real GDP growth while reducing the deficit, both of which strike me as dollar positives. Perhaps the idea is interest rates will be able to be lower in that situation, thus undermining the dollar, but again, on a relative basis, it seems quite clear that the US remains in far better macroeconomic condition than virtually every other nation. So, if the US is cutting rates, others will be cutting even faster. However, that is where we are this morning, with both the euro (+0.5%) and pound (+0.4%) climbing alongside the yen (+0.7%). Offsetting that is the Loonie (-0.7%) and MXN (-0.8%) as both are the initial targets of those potential tariffs. It strikes me that we are likely to see a number of previous relationships break down as the tariff talk adjusts views on different national outcomes. Once again, volatility seems the watchword.

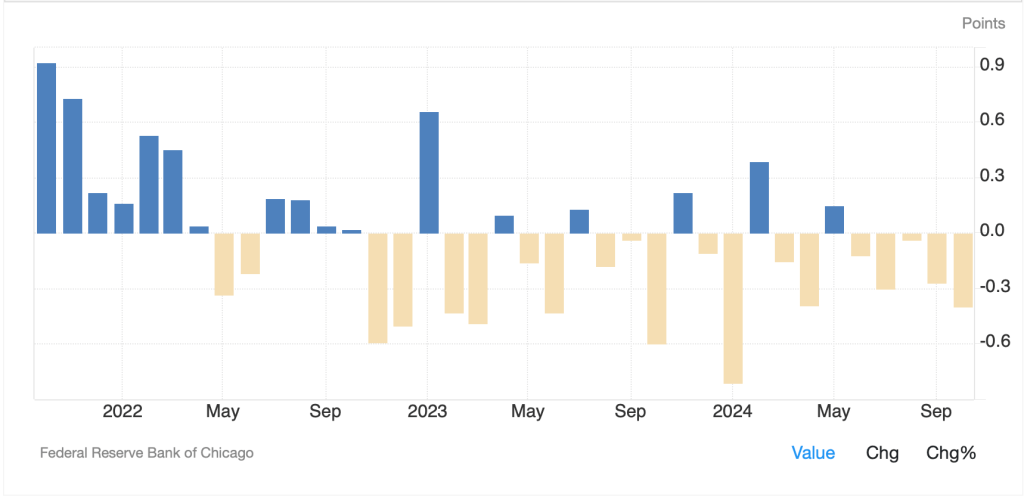

On the data front, this morning brings Case-Shiller Home Prices (exp 4.8%), Consumer Confidence (111.3) and New Home Sales (730K) and then the FOMC Minutes are released at 2:00. All eyes will be there as things have so obviously changed since the meeting earlier this month, including Chairman Powell’s downshifting on the rate cutting cycle. You remember, he is no longer in a hurry to do so. Interestingly, as of this morning, the futures market is pricing in a 60% chance of a cut next month, up from 52% yesterday morning. Perhaps that is a result of yesterday’s Chicago Fed National Activity Index, a meta index looking at numerous other indicators, which printed at -0.40, much worse than the expected -0.20, and as can be seen below, has shown a consistent trend that growth may not be what some of the headline data implies.

Source: tradingeconomics.com

Remember, too, with the holiday on Thursday, tomorrow brings a huge data dump so macro models will be waiting to respond. As well, given the holiday, liquidity is likely to be less robust than normal meaning price dislocations are quite possible.

My sense is the dollar’s decline is more of a profit taking exercise (recall it rallied more than 7% in a few months) than a change in the long-term fundamentals. But it is always possible that the new administration’s policies will be focused on pushing the dollar down, although funnily enough I don’t think Trump really cares about that this time. My take is he is far less concerned about growing exports than reducing imports and bringing production home. We shall see.

Good luck

Adf