Inflation is still somewhat higher

Though currently nor quite on fire

Thus, further reductions

In rates may cause ructions

In markets, which we don’t desire

“With regard to the outlook for inflation, participants expected that inflation would continue to move toward 2 percent, although they noted that recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated. Several observed that the disinflationary process may have stalled temporarily or noted the risk that it could. A couple of participants judged that positive sentiment in financial markets and momentum in economic activity could continue to put upward pressure on inflation.” [emphasis added]

I think this paragraph from the FOMC Minutes was the most descriptive of the evolving thought process from the committee. Since then, we have heard every Fed speaker discuss the need for caution going forward with regard to further rate reductions although to a (wo)man, they all remain convinced that they will achieve their 2% target while still cutting rates further, just more slowly. While today is a quasi-holiday, with the Federal government closed along with the stock exchanges, although banks and the Fed are open and making payments, I anticipate activity will be somewhat reduced. This is especially so given tomorrow brings the NFP data which will be closely monitored given the recent strength seen in other economic indicators. If that number is strong, I anticipate the market will reduce pricing for future rate cuts towards zero from this morning’s 40bps total for 2025. This, my friends, will serve to underpin the dollar going forward.

In England, there is quite a fuss

As traders begin to discuss

Can Starmer and Reeves

Address what aggrieves

The nation, or are they now Truss?

The situation in the UK seems to be going from bad to worse. Even ignoring the horrifying stories regarding the cover-up of immigrant grooming gangs and their actions with young girls, the economic and policy story is a disaster. While the exact genesis of their fiscal issues may not be certain, the UK’s energy policy, where they have doubled down on achieving Net Zero carbon emissions and continue to remove dispatchable power from their grid, is a great place to start looking. UK electricity prices are the highest in Europe, even higher than Germany’s, and that is destroying any ability for industry to exist, let alone thrive. The result has been slowing growth, reduced tax receipts and a growing government budget deficit.

Some of you may remember the Gilt crisis of September/October 2022, when then PM Liz Truss proposed a mini-budget focused on growth but with unfunded aspects. Confidence in Gilts collapsed and pension funds, who had been seeking sufficient returns during ZIRP to match their liabilities and had levered up their gilt holdings suddenly were facing massive margin calls and insolvency. The upshot is that the BOE stepped in, bought loads of Gilts to support the price and PM Truss was booted out of office.

While the underlying issues here are somewhat different, the market response has been quite consistent with both Gilts (+5bps this morning, +34bps in past week) and the pound (-0.6% this morning, -2.0% in past week) under significant pressure again this morning. Unlike the US, with the global reserve currency, the UK doesn’t have the ability to print as much money or borrow as much money as they would like to achieve their political goals. In fact, the UK is far more akin to an emerging market than a G7 nation at this stage, running a massive fiscal deficit with rising inflation and a sinking currency amid slowing economic growth. There are no good answers for the BOE to address these problems simultaneously. Rather, they will need to address one thing (either inflation and the currency by raising rates, or economic activity by cutting them) while allowing the other problem to become worse.

It is very difficult to view this situation as anything other than a major problem for the UK. While it occurred before even my time in the markets, back in the 1970’s, the UK was forced to go to the IMF to borrow money to get them through a crisis. There are some pundits saying they may need to do this again. For some perspective, the chart below shows GBPUSD over the long-term.

Source: tradingeconomics.com

The history is the pound was fixed at $2.80 at Bretton Woods and then saw several devaluations until 1971 when Nixon closed the gold window, and Bretton Woods fell apart. The spike lower in the 1970’s was the result of the UK policies driving them to the IMF. The all-time lows in the pound were reached in 1985, when the dollar topped out against its G10 brethren, and that resulted in the Plaza Accord. But since then, and in truth since the beginning, the long-term trend has been for the pound to depreciate vs. the dollar.

It continues to be difficult for me to see a strong bull case for the pound as long as the current government seems intent on destroying the economy. FX option markets have seen implied volatility spike sharply, with short dates rising from 8% to 13% in the past week while bids for GBP puts have also exploded higher. Meanwhile, the gilt market cannot find a bid. Something substantive needs to change and don’t be surprised if it is political, with Starmer or Reeves, the Chancellor of the Exchequer, finding themselves out of office and a new direction in policy. However, until then, look for both these markets to continue lower.

I apologize for the history lesson, but I thought it best to help understand today’s price action in all things UK. And that’s really it for discussion. Yesterday’s mixed US session was followed by weakness in Asia (Nikkei -0.95%, Hang Seng -0.2%, CSI 300 -0.25%) with the rest of the region also lower. However, this morning in Europe other than the DAX, which is basically unchanged, modest gains are the order of the day. Surprisingly, the FTSE 100 (+0.55%) is leading the way higher, but given the large majority of companies in this index benefit from a weaker pound, perhaps it is not so surprising after all.

In the bond market, Treasury yields are 3bps lower this morning, although still near recent highs above 4.65%, while European sovereigns continue to rise as the global interest rate structure climbs amid growing concerns nobody is going to adequately address the ongoing inflation. Even Chinese yields rose 2bps despite CPI data showing deflation at the factory gate continues and consumer demand remains moribund.

Commodity prices are modestly firmer this morning with oil (+0.2%) stabilizing after a sharp decline yesterday on supply concerns after a large build of product inventories in the US. Metals prices continue to be supported (Au +0.4%, Ag +0.8%, Cu +1.2%) despite the dollar’s ongoing strength as it appears investors want to hold real stuff rather than financial assets these days.

Finally, the dollar continues to climb with most currencies sliding on the order of -0.2% aside from the pound mentioned above and the yen (+0.3%) which seems to be acting as a haven this morning. Nonetheless, this remains a dollar focused process for now.

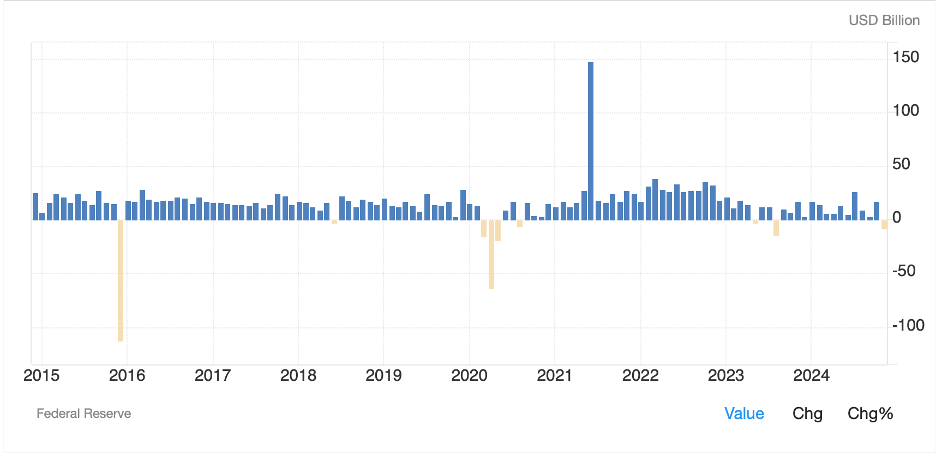

There is no economic data to be released today although I must note that Consumer Credit was released yesterday afternoon and fell -$7.5B, a much worse outcome than expected. As you can see from the below chart, declining consumer credit, while not completely unheard of, is a pretty rare occurrence. You can clearly see the Covid period and the best I can determine is the December 2015 decline is a data adjustment, not an actual decline. The point to note, though, is that despite lots of ostensibly strong economic data, this is a warning.

Source: tradingeconomics.com

I keep looking for something to turn the tables on the dollar, but for now, it is hard to make the case that the greenback is going to suffer in any broad-based manner. Tomorrow, though, with NFP should be quite interesting.

Good luckAdf