The data on Friday exceeded

All forecasts, and has now impeded

The idea the Fed

When looking ahead

Believes further rate cuts are needed

Meanwhile from the Chinese we learned

Their exports are still widely yearned

But imports are falling

As growth there is stalling

And Xi is quite clearly concerned

Under the rubric, even a blind squirrel finds an acorn occasionally, my prognostications on Friday morning turned out to be correct as the NFP number was much stronger than expected, the Unemployment Rate fell, and signs of labor market strength were everywhere. One of the most interesting is the number of quits rose to 13.8%, its highest level in several years and an indication that there is growing confidence amongst the labor force that jobs are available if needed. As well, as you all are certainly aware, the market responded by selling equities and bonds while reducing the probability of Fed rate cuts this year. In fact, this morning, the market is pricing in just 24 basis points of cuts for all of 2025, in other words, one cut only.

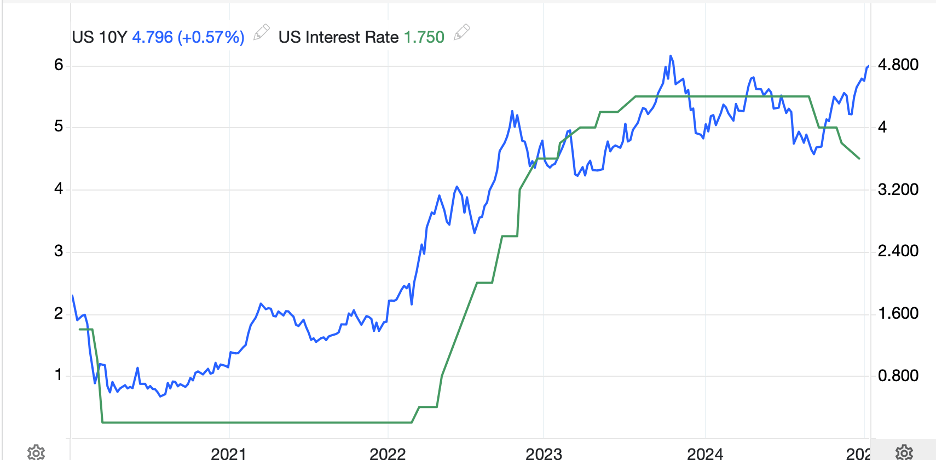

Meanwhile, the bond market continues to sell off with yields rising another 2bps this morning. the chart below shows the dichotomy between Fed funds and 10-year Treasury yields. Historically, when the Fed was cutting or raising rates, the bond market followed. But not this time.

Source: tradingeconomics.com

There have been many explanations put forth by analysts as to why this is the case, but to me, the most compelling is that investors disagree with the Fed’s analysis of the economy and, more specifically, with their pollyannaish tone that inflation is going to magically return to 2% because their models say so. In fact, when looking back over the past 50-years of data, this is the only time that I can see when this dichotomy even existed.

Source: tradingeconomics.com

If I had to guess, there is going to be a lot more volatility coming as previous market signals, and more importantly, Fed market tools, no longer seem to be working as desired. Nothing has changed my view that 10-year yields head to 5.5%, and if I am correct, look for equity markets to suffer, perhaps quite a bit.

The other story of note overnight was the Chinese trade surplus, which expanded to $104.8 billion in December which took the 2024 surplus to $1.08 trillion. Now, much of this seems to be preordering of Chinese goods ahead of Trump’s inauguration and the promised tariffs. But China’s surplus with other Asian economies also grew dramatically last year. Remember, President Xi is desperate to achieve 5% growth (even on their accounting) and since the Chinese public remains unenthusiastic about spending any money given the $10 trillion hole in their collective savings accounts due to the property market collapse, Xi is reliant on exporting as much as possible. While this is not making him any friends anywhere else in the world, it is an existential issue for him, so he doesn’t really care. It will be very interesting to see just how the Trump-Xi relationship moves forward and what concessions are made on either side.

In the end, while the renminbi is basically unchanged this morning, it remains pegged against its 2% limit vs. the CFETS fixing onshore and is 2.35% weaker in the offshore market. That pressure is going to continue until either the Chinese step up, apply significant stimulus to the domestic economy and start to rebalance the trade process or the PBOC lets the currency go. Remember, too, Xi is in a tough position because he continuously explained that the renminbi is a good store of value and has been asking his trading partners to use it rather than the dollar. But if he lets it slide, that will destroy that entire narrative, a real loss of face at the very least, and potentially a much bigger economic problem. Interesting times.

And so, let us turn to the overnight market activity and see how things are shaping up for today and the rest of the week. Friday’s sharp decline in US equity indices was followed by similar price action throughout Asia (Nikkei -1.05%, Hang Seng -1.0%, CSI 300 -0.3%, Australia -1.25%) as the narrative is struggling to come up with a positive spin absent further US rate cuts. European bourses have also come under pressure (DAX -0.7%, CAC -0.8%, IBEX -0.7%, FTSE 100 -0.4%) despite the fact that ECB talking heads continue to explain that more rate cuts are coming, they just won’t be coming quite as quickly as previously expected. At this point, the market is pricing in 84bps of cuts by the ECB this year. And yes, US futures are also in the red at this hour (7:00), falling between -0.5% (DJIA) and -1.1% (NASDAQ).

It seems that the narrative writers are struggling to put together a bullish story right now as inflation refuses to fall while growth, at least in Europe, continues to abate. At least, a bullish story for equities and bonds. The dollar, on the other hand, has gained many adherents.

Turning to bonds, yields continue to climb across the board with European sovereign yields rising between 2bps (Germany) and 8bps (Greece) and everything in between. It seems nobody wants to hold bonds right now. The same was true overnight in Asia where the best performer was the JGB, which was unchanged, but other regional bond markets all saw yields rise between 3bps (Korea) and 9bps (Australia). Even Chinese yields edged higher by 1bp!

In the commodity space, oil (+2.0%) is en fuego, as the impact of further sanctions on the Russian tanker fleet is being felt worldwide. It seems the Biden administration has added another 150 Russian tankers to the sanctions list along with insurance companies, and so China and India, who have been the main recipients of Russian oil, are seeking supplies elsewhere. As long as this continues, it appears oil has further to run. Meanwhile NatGas (+3.8%) has blasted through $4.00/MMBtu and is now at its highest level since December 2022. Despite all those global warming fears, the recent arctic blast has increased demand dramatically!

As to the metals markets, the story is different with gold (-0.5%) sliding alongside silver (-2.1%) and copper also trickling lower (-0.15%). Part of this is clearly the dollar’s strength, which is impressive again today, and part is likely concern over how things are going to play out going forward between the US and China as well as the overall global economy. Certainly, a case can be made that growth is going to be much slower going forward.

Finally, the dollar is king again, rallying sharply against the euro (-0.5%) and pound (-0.8%) with smaller gains against the rest of the G10 (JPY excepted as it rallied 0.2% on haven flows). But we are also seeing gains against virtually all EMG currencies (CLP -0.6%, PLN -0.7%, ZAR -0.4%, INR -0.6%) as concerns grow that these other nations will not be able to ably fund their dollar debt as the dollar continues to rise. FYI, the DXY (+0.35% to 110.07) is at its highest level since October 2022 and looking for all the world like it is going to take out the highs of that autumn at 113.20.

On the data front, this week brings CPI and PPI as well as Retail Sales. In addition, I was mistaken, and the Fed is not in their quiet period so we will hear a lot more from them this week as well.

| Tuesday | NFIB Small Biz Optimism | 100.8 |

| PPI | 0.3% (3.4% Y/Y) | |

| Ex food & energy | 0.3% (3.7% Y/Y) | |

| Wednesday | CPI | 0.3% (2.8% Y/Y) |

| Ex food & energy | 0.2% (3.3% Y/Y) | |

| Empire State Manufacturing | 4.5 | |

| Fed’s Beige Book | ||

| Thursday | Initial Claims | 214K |

| Continuing Claims | 1870K | |

| Retail Sales | 0.5% | |

| Ex autos | 0.4% | |

| Philly Fed | -4.0 | |

| Friday | Housing Starts | 1.32M |

| Building Permits | 1.46M | |

| IP | 0.3% | |

| Capacity Utilization | 76.9% |

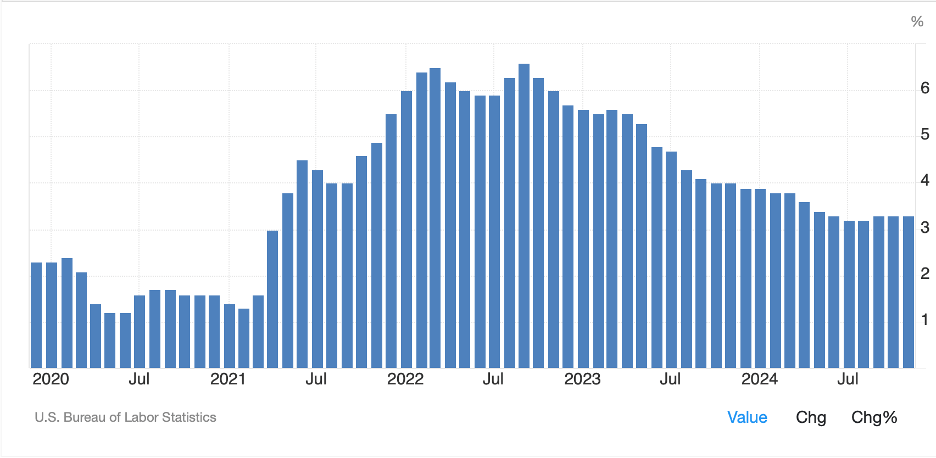

Source: tradingeconomics.com

As well, we hear from five Fed speakers over six venues. Now, the message from the Fed has been pretty unified lately, that caution and patience are appropriate regarding any further rate cuts but that to a (wo)man they all believe that inflation is heading back down to 2.0%. I’m not sure why that is the case because if you look at the data, it certainly has the feeling that it has bottomed, and inflation rates are turning higher as you can see from the below chart of core CPI.

Source: tradingeconomics.com

And this is before taking into account that energy prices have been soaring lately! I realize I’m not smart enough to be an FOMC member, but they certainly seem to be willfully blind on this issue.

At any rate, certainly all things still point to a higher dollar going forward, and I imagine we are going to test some big levels soon enough (parity in the euro, 1.20 in the pound) but I am beginning to get uncomfortable as so many analysts have come around to my view. Historically, if everybody thinks something is going to happen, typically the opposite occurs. Remember, markets are perverse!

Good luck

Adf