The price level, sadly, will jump

According to President Trump

Will Canada shrink?

Will Mexico blink?

As tariffs cause things to go thump

The first thing that moved was the buck

While stock markets were thunderstruck

So, who will blink first?

And who will hurt worst?

No matter, things have run amok

Whatever you think of the man, you must admit that President Trump knows how to maintain the spotlight on himself and his policies to the exclusion of virtually everything else in the news. And so, in the wake of two terrible aviation disasters in short order, pretty much all eyes are now focused on the tariffs that Trump imposed this weekend on Canada, Mexico and China. While there had been a large school of thought that the tariff talk was a cudgel to be used during negotiations but would never actually be imposed as they would be too damaging, that thesis has been destroyed. It appears that President Trump believes his long-term goals of reshoring significant parts of US industry and leveling the playing field with trade partners is achievable via tariff policy and will more than offset any short-term pain that may come. We shall see if he is correct, but certainly, the short-term pain is beginning to arrive.

The early movement in equity markets was uniform around the world, and it was not pretty. The below snapshot of equity futures markets, taken at 6:00am this morning shows that the only two markets that have not fallen are China and Hong Kong, and that is only because they remain closed for the Chinese New Year holidays. But there is plenty of fear all around the world, especially considering that markets throughout Europe and Japan, as well as other nations that have not been named targets of tariffs, have also fallen sharply.

Source: tradingeconomics.com

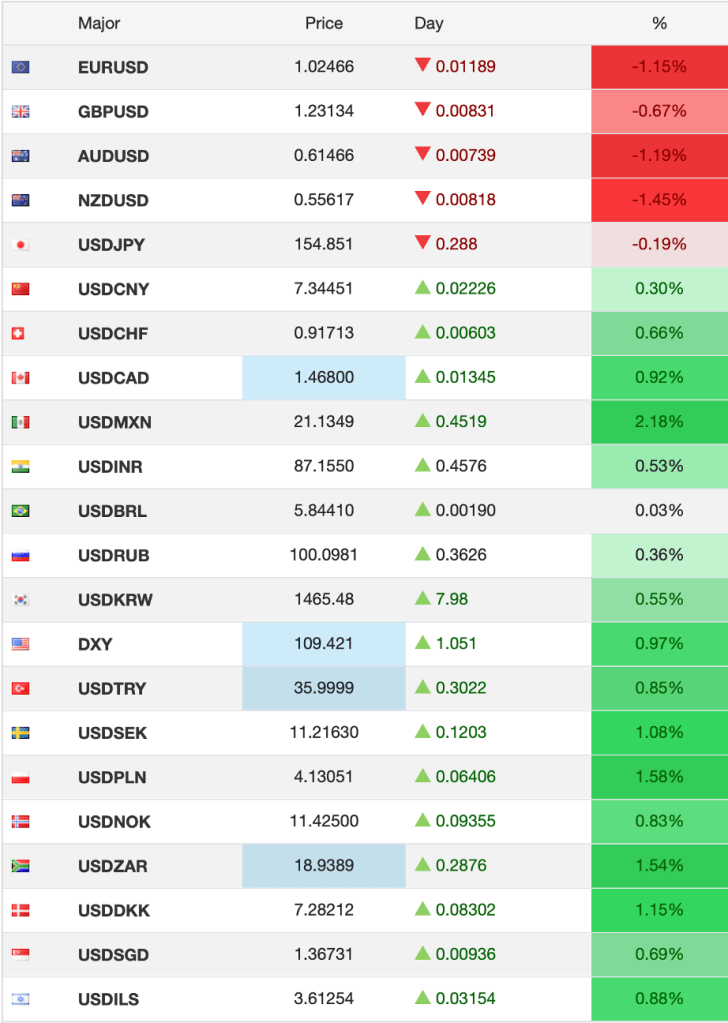

Too, the FX markets have also responded dramatically, with the dollar exploding higher vs. virtually all its counterpart currencies this morning as 1% gains are the norm.

Source: tradingeconomics.com

A special shoutout to ZAR (-1.55%) which while not directly impacted by tariffs, caught Trump’s ire by their recently enacted legislation to confiscate property as they deem fit, oftentimes without compensation. While South African officials have claimed it is akin to eminent domain rules in the US, those require compensation at all times, a not insubstantial difference.

So, what’s a hedger to do? Well, this is why you maintain a hedge program in the first place. Lots of things happen in the world, most of which are beyond any individual or companies’ control, yet the impacts are real. Some of what I have read this morning highlights the idea that Canada and Europe and Mexico are going to stick together to fight these tariffs. However, at the end of the day, the US economy, and by extension its market, is the largest by far, and losing the US as an export destination will be a very difficult pill for those nations and their economies to swallow.

My sense is that Trump, especially if he continues to address the immigration and government waste issues, will have far more runway than most other nations, especially given the precarious situation of many ruling parties right now. But the other thing to consider is that there is no going back to the way things were in the past. Alliances and treaties are going to come under much greater scrutiny by all sides as governments everywhere re-evaluate what they are trying to achieve with various policies and how they can partner with other nations to work together. In fact, I suspect that the EU is going to continue to come under even greater pressure as it becomes more evident that while many countries believe in the trade benefits of the EU, the recent focus by Brussels on other issues like climate activism and immigration run counter to some members’ views. No matter what, the world is changing dramatically, and my take is the change is going to come faster than many will have anticipated.

OK, there are a thousand stories on how the tariffs are going to impact the US, with initial calculations regarding the negative impact on GDP and how much they are going to raise inflation, so I’m not going to go there. Needless to say, the universal belief is things will get worse on those metrics. But here’s something else to consider. On Friday, the BLS will be revising the 2024 jobs data, including their population estimates and the birth/death model that describes the number of new businesses that are formed, net, each month. Early estimates show that the number of jobs created is going to fall by nearly 1 million while population, now taking into account more immigration, is going to rise. I have seen estimates that the Unemployment Rate may rise, or be revised, to 4.5% or 4.6%. If that is the case, it will certainly call into question exactly what the Fed has been doing. It will also, almost certainly, result in a Trumpian tirade about how the BLS is political and was cooking the books to burnish Biden’s economic record. I suspect it will not help equity markets if that is the case, but also probably hurt the dollar as the Fed will be right back onto their rate cutting discussions.

As I’ve already shown the equity and FX markets above, a look at bonds shows that Treasury yields are unchanged this morning, as they seem to be caught between concerns of slower growth and higher inflation due to the tariffs. Remember, too, that Wednesday, the Treasury will issue its Quarterly Borrowing Estimate with all eyes on the mix that new Treasury Secretary Bessent will be seeking as things go forward. Remember, he was quite vocal, before he took the job, as to the mistakes that Yellen made in not terming out more Treasury debt when rates were at extremely low levels. Meanwhile, European sovereign yields are all lower this morning, between -2bps (Italy) and -6bps (Germany) as PMI data released showed that though things were better than last month, they remain well below the key 50.0 level. However, on the inflation front, both Eurozone and Italian data printed higher than expected, clearly not what Madame Lagarde wants to see.

Finally, commodity markets have seen oil prices (+2.6%) rise sharply as the US will be imposing 10% tariffs on imports of Canadian oil products, while NatGas prices have jumped by 9.0% on concerns over supply disruptions from those tariffs. Like I said, the world is a different place today! In the metals markets, both gold and silver are little changed this morning although copper (-0.9%) prices are slipping, perhaps on the idea that these tariffs are going to slow economic activity. And that is one of the key belief sets amongst economists.

As to the data this week, it is reasonably busy, but all eyes will be on Friday’s NFP report, especially with the rumors of a major revision.

| Today | ISM Manufacturing | 49.8 |

| ISM Prices Paid | 52.6 | |

| Tuesday | JOLTS Job Openings | 8.0M |

| Factory Orders | -0.8% | |

| -ex Transport | +0.6% | |

| Wednesday | ADP Employment | 150K |

| Trade Balance | -$96.5B | |

| ISM Services | 54.2 | |

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1855K | |

| Nonfarm Productivity | 1.7% | |

| Unit Labor Costs | 3.5% | |

| Friday | Nonfarm Payrolls | 170K |

| Private Payrolls | 140K | |

| Manufacturing Payrolls | -2K | |

| Unemployment Rate | 4.1% | |

| Average Hourly Earnings | 0.3%(3.8% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.5% | |

| Michigan Sentiment | 70.9 | |

| Consumer Credit | $10.5B |

Source: tradingeconomics.com

In addition to all of this, we will hear from nine different Fed speakers, at least, over 13 different venues this week. Now, things could get quite interesting here given Chairman Powell did not speak to tariffs as they were not yet implemented when he delivered the FOMC news last week, but all of these speakers will have an opinion. I wonder if there will be a unified set of talking points or if each one will truly give their own views. Of course, given that each is a neo-Keynesian economist, I suspect their views will all be aligned anyway.

One other thing from last week that didn’t get much press is that the BOC, after cutting the base rate by 25bps as widely expected, has indicated they will be ending their QT program and, in fact, restarting their QE program over the next several months in order to grow their balance sheet in line with the economy. Do not be surprised if we see other major central banks go down this road as well, regardless of sticky inflation.

Summing it all up, the world is very different this morning compared to Friday morning. Trade and economic disruptions are going to become evident and there is still a great deal of vitriol to be vented at Trump by others, while Trump will continue to decry other nations efforts to weaken the US. As I have written in the past, volatility will be the main underlying thesis this year. Meanwhile, the beauty of a good hedge program is it helps through all market conditions. Do NOT slow things down waiting for a better entry point, be consistent, as that better entry point may not materialize for a long time. My strongest cue will be the bond market as if yields start to decline in anticipation of a significant economic slump, I expect the dollar will suffer, but if they hold up, then there is nothing to stop the dollar from testing and breaking its recent highs.

Good luck

Adf