Confusion is clearly what reigns

As even the punditry strains

To understand whether

Investors will tether

Their future to stocks or take gains

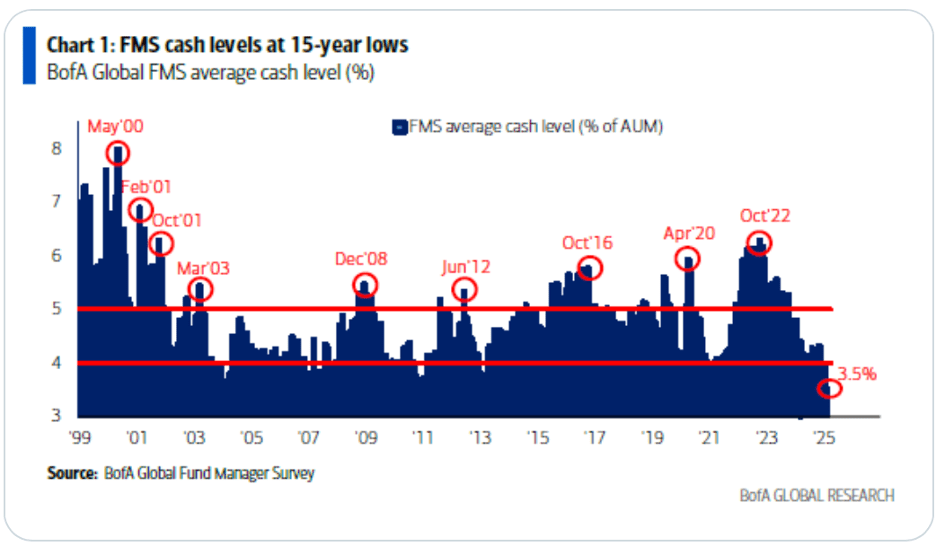

As there was no activity in the US financial markets yesterday, it seems there was time for analysts to consider the current situation and make pronouncements as to investor behavior. Ironically, we saw completely opposite conclusions from two major players. On the one hand, BofA posted the following chart showing that investors’ cash holdings are at 15-year lows, implying they remain fully invested and quite bullish.

Meanwhile, the WSJ this morning has a lead article on how bearish investors are, claiming they are the most bearish since November 2023 according to the American Association of Individual Investors. Apparently, 47.3% of investors surveyed believe stock prices will fall over the next 6 months.

So, which is it? Are investors bullish or bearish? To me this is a perfect description of the current situation. Everyone is overloaded with information, much of which is contradictory, and so having a coherent view has become extremely difficult. This is part and parcel of my view that the only thing we can clearly expect going forward is an increase in volatility. In fact, someone said that Donald Trump is the avatar of volatility, and I think that is such an apt description. Wherever he goes, mayhem follows. Now, I also believe that people knew what they were voting for as change was in demand. But for those of us who pay close attention to financial markets, it will take quite the effort to keep up with all the twists and turns.

Fed speakers are starting to feel

Like they have become a fifth wheel

So, let’s get prepared

For Fed speaking squared

As they work, their views, to reveal

Away from the conundrum above, the other noteworthy thing is that FOMC members are starting to feel left out of the conversation. Prior to President Trump’s inauguration, market practitioners hung on their every word, and they apparently loved the power that came with that setting. However, now virtually every story is about the President and his policies with monetary policy falling to a distant issue on almost all scorecards. Clearly, for a group that had grown accustomed to moving markets with their words, this situation has been deemed unacceptable. The solution, naturally, is to speak even more frequently, and I fear believe this is what we are going to see (or hear) going forward.

Yesterday was a perfect example, where not only, on a holiday, did we have multiple speakers, but they actually proffered different messages. From the hawkish side of the spectrum, Governor Michelle Bowman, the lone dissenter to the initial 50bp rate cut back in September, explained caution was the watchword when it comes to acting alongside President Trump’s mooted tariff and other policies, “It will be very important to have a better sense of these policies, how they will be implemented, and establish greater confidence about how the economy will respond in the coming weeks and months.” That does not sound like someone ready to cut rates anytime soon.

Interestingly, from the dovish side of the spectrum, Governor Christopher Waller, an erstwhile hawk, explained in a speech in Australia (on the day the RBA cut rates by 25bps for their first cut of the cycle and ending an 18 month period of stable rates) that, “If this wintertime lull in progress [on inflation] is temporary, as it was last year, then further policy easing will be appropriate.” I find it quite interesting that Governor Waller suddenly sounds so dovish as many had ascribed to him the intellectual heft amongst the governors. This is especially so given that is not the message that Chairman Powell articulated either after the last meeting or at his Humphrey-Hawkins testimony recently.

So, which is it? Is the Fed staying hawkish or are they set for a turn? That will be the crux of many decision-making processes going forward, not just in markets but also in businesses. We will keep tabs going forward.

Ok, on to the market’s overnight performances. Lacking a US equity market to follow, everybody was on their own last night which showed with the mixed results. Japan (+0.25%) showed modest gains while the Hang Seng (+1.6%) rocketed higher on the belief that President Xi is going to be helping the economy, notably the tech firms in China, many of which are listed in Hong Kong. Alas, the CSI 300 (-0.9%) didn’t get that memo with investors apparently still concerned over the Trump tariff situation. Elsewhere in the region, Korea and Taiwan rallied while Australia lagged despite the rate cut. In Europe, unchanged is the story of the day with most bourses just +/-0.1% different than yesterday’s close. Right now, in Europe, the politicians are trying to figure out how to respond to the recent indication that the US is far less interested in Europe than in the past, and not paying close attention to financial issues. As to the US, futures at this hour (7:25) are pointing higher with the NASDAQ leading the way, +0.5%.

In the bond market, yields are climbing led by Treasuries (+4bps) with most of Europe seeing yields edge higher by 1bp or 2bps as well. Remember, yesterday European sovereign yields rose smartly across the board. Also, I must note JGB yields (+4bps) which have made further new highs for the move and continue to rise. It appears last night’s catalyst was a former BOJ member, Hiroshi Nakaso, explained he felt more rate hikes were coming with the terminal rate likely to be well above 1.0%. While I believe the Fed will be cautious going forward, I still think they are focused on rate cuts for now. With that in mind and the ongoing change in Japanese policy, I am increasingly comfortable with my new stance on the yen.

In the commodity markets, last Friday’s sell-off in the metals markets is just a bad memory with gold (+0.5%) rallying again and up more than 1% since Friday’s close. I continue to believe those moves were positional and not fundamental. Too, we are seeing gains in silver (+0.2%) and copper (+0.6%) to complete the triad. Meanwhile, oil (-0.25%) continues to lag, holding above its recent lows but having a great deal of difficulty finding any buying impulse. Whether that is due to a potential peace in Ukraine and the end of sanctions on Russian oil, or concerns over demand growth going forward is not clear to me, but the trend, as seen in the chart below, is clearly downward and has been so for the past year.

Source: tradingeconomics.com

Finally, in the FX markets, the dollar is firmer this morning rising against all its G10 counterparts with NZD (-0.6%) the laggard. But losses of -0.2% are the norm this morning. In the EMG bloc, we are seeing similar price behavior in most markets although MXN (+0.2%) is bucking the trend, seemingly benefitting from what appears to be a hawkish stance by Banxico and the still highly elevated interest rate differential in the peso’s favor.

On the data front, Empire State Manufacturing (exp -1.0) is the only data point although we will hear from two more Fed speakers, Daly and Barr. I cannot believe that they have really changed their tune and expect that caution will remain their guiding principle for now, although I expect to hear that repeated ad nauseum as they try to regain their place in the spotlight.

Aside from my yen view, I still find it hard to be excited about many other currencies for now. There is still no indication the Fed is going to move anytime soon, and other central banks are clearly in easing mode. That bodes well for the dollar going forward.

Good luck

Adf