Before Mr Trump started speaking

The Chinese explained things are creaking

As growth there is slow

So now they will blow

More funds to achieve what they’re seeking

The Chinese government has outlined a very active agenda for 2025 as the current pace of growth in their economy remains sluggish at best. They continue to focus on a 5% headline GDP target and have promised to increase the budget deficit by a similar amount, so the idea of organic growth seems to be dead. They reiterated their plan to recapitalize the big banks with CNY 500 billion and are looking to raise defense spending by 7.2%. Long term debt issuance will increase with CNY 1.3 trillion planned for this year and they talk about adding 12 million urban jobs. It all sounds fantastic.

But will it work? Of course, there is no way to know yet, but if history is any guide, the mercantilist structure of the Chinese economy remains extremely difficult to overcome and replace with a more consumer-focused economy. The property market there remains in terrible shape and that continues to be a drag on the overall economy as individuals, who had been encouraged to invest in property as a means of creating a retirement nest egg find themselves with much less disposable income and an illiquid and depreciating asset.

President Trump’s tariffs are not going to help them at all, but it is unclear if they will be significantly detrimental. While I would not bet against China reporting 5% GDP growth in 2025, given the questionable reliability of their data, it is not clear it will be reflective of the state of the nation.

My take on market impacts are as follows: Chinese yields will climb as more debt is issued while growth will allegedly increase, Chinese equities should benefit If they are successful at getting things moving, but the yuan will have a harder time in my view, as capital flows to the nation remain stunted. Of course, much will also depend on the evolution of US policy, which has been erratic, to say the least.

Said Trump, It’s a “new golden age”

As finally, we turn the page

On four years of waste

And so, we’ll make haste

With changes despite Dem outrage

Of course, the other big news was last night’s speech by President Trump to a joint session of Congress where he outlined both the many things he has accomplished in the first 6 weeks of his presidency, but also his plans for the rest of the time. While many are still reeling from the speed with which changes are being made, there was no indication that his pace is going to slow.

Mr Trump did acknowledge that there may be some short-term pain as the economy adjusts to the changes he has wrought, but he remains focused on the long-term and how to achieve a strong economy with a far better balance sheet and a smaller government. The implication is that he is still the avatar of volatility, and that aspect will not be changing.

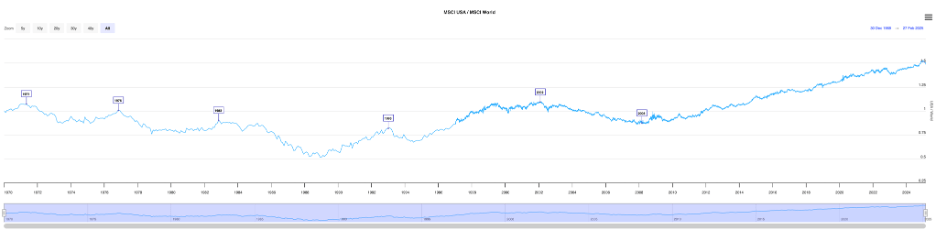

Let us, though, take a step back and look at a much bigger picture. For the past seventeen years, the US economy was the clear leader in global growth with massive government spending and budget deficits incurred to drive the process. Meanwhile, while most of the rest of the world exited the pandemic with a burst of reopening growth, they have all lagged the US. The chart below shows the ratio of the MSCI US index / MSCI World index and demonstrates that investment into the US, following that leading growth profile, has been historic in its effects.

Source: longtermtrends.net

But that situation seems to be changing. President Trump is openly seeking to reduce the size of the US government and withdraw spending on many foreign adventures while the rest of the world is doing the opposite. As per the above, China has just announced significant new stimulus. As well, Europe, now that they need to become more responsible for their own defense, has also announced a major spending plan to rearm themselves. This is the real sea change, I think, and the one that is going to have the biggest medium and long-term impacts on markets everywhere. Changes in the level of capital flows and changes in trade patterns are going to significantly impact the value of the dollar as well as stocks, bonds and commodities. It is a brave new world, so attention must be paid.

In the meantime, let’s see the markets’ initial response to the recent spate of news. The tariff news has served to undermine US equities for the past two sessions and is still dragging on some markets, but the new spending promises are the new drivers. So, in Asia, while the Nikkei (+0.2%) managed only a modest rally, the Hang Seng (+2.8%) exploded higher on the Chinese stimulus story although surprisingly, the CSI 300 (+0.5%) did not do nearly as well. But elsewhere in the region, it was mostly large gains with Korea, India, Taiwan, Indonesia and Thailand all rallying more than 1%. The laggards were Australia and New Zealand, which seemed to focus on the negatives of tariffs.

In Europe, Germany’s DAX (+3.4%) is the beneficiary of most of the mooted defense spending as not only are there quite a few defense focused firms, but rumors are that the government is going to coopt the auto manufacturers into building defense equipment (shades of WWII). As well, the rest of the continent is flying (CAC +1.9%, IBEX +1.6%) and even the UK (+0.45%) is benefitting although there is growing concern that the BOE is not going to be aggressively cutting rates to support the economy because of still sticky inflation. As to US futures, they are bouncing this morning and higher by 0.4% at this hour (7:00).

In the bond market, while Treasury yields rebounded from their recent lows yesterday, gaining 9bps on the day, this morning they are unchanged. However, a look at European sovereigns tells the story of investors anticipation of a big uptick in new issuance to fund that defense spending. The picture below is that of German yields, as an example, showing its 20bp rise this morning, but the entire continent has seen yields rise by at least 16bps!

Source: tradingeconomics.com

The market clearly believes the Europeans are going to move forward!

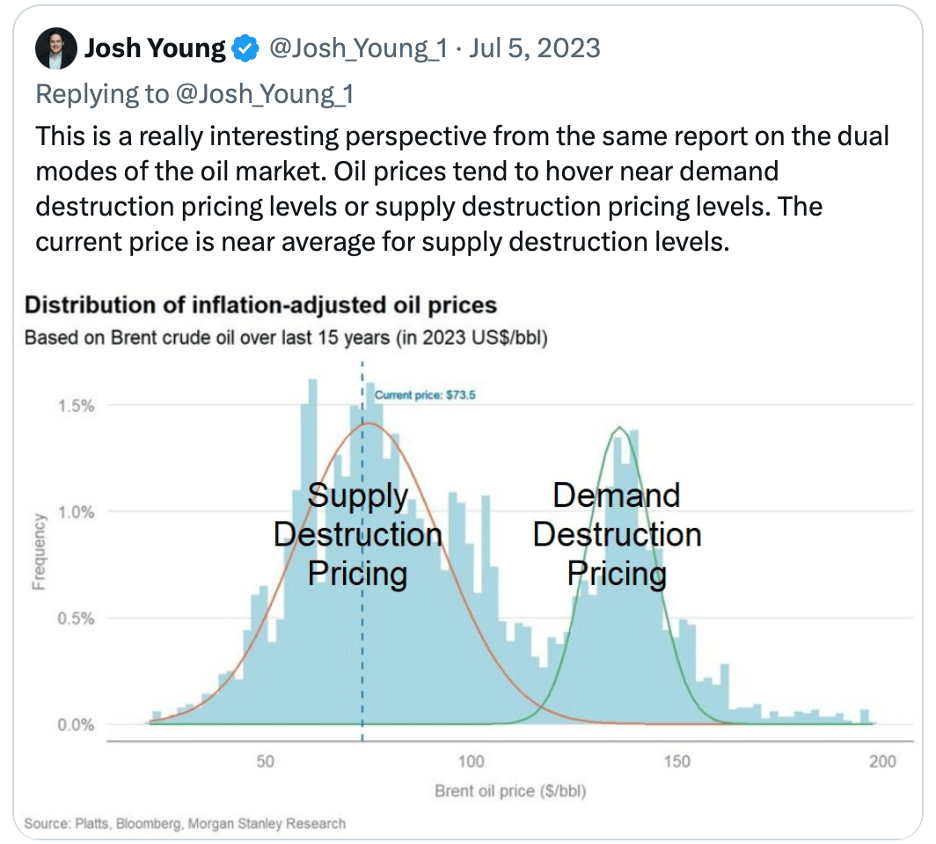

In the commodity markets, oil (-1.6%) remains under pressure as despite the mooted fiscal stimulus, there continues to be more concern over excess supply than newly created demand. The below chart is quite interesting as a history of long-term price activity in oil with the interpretation that if we are near the supply destruction level, the future for prices is likely to be bullish. Something to keep in mind. (as an aside, Josh_Young_1 is an excellent follow on X for oil ideas and information.)

As to the metals markets, gold is little changed but copper (+4.7%) has clearly gotten excited over the Chinese stimulus as well as the European defense spending, where copper will be an important piece of the puzzle.

Finally, the dollar is under substantial pressure this morning vs. both G10 and EMG currencies. Given the yield changes, and my view that 10-year yields have become the FX driver, rather than short-term rates, it should be no surprise that the euro (+0.6%) is rallying to levels not seen since November. The pound (+0.3%) is following suit, also making 5-month highs. But the really impressive moves are in the peripheral European currencies with SEK (+1.1%) and PLN (+1.1%) both trading back to levels not seen since September. On the tariff front, both MXN (+0.25%) and CAD (+0.1%) are lagging the main move but still managing a very modest rally v. the greenback.

In this brave new world, where the US is not the fiscal profligacy leader, but that role is assumed by others, my sense is that the dollar may well have topped for a much longer-term period. While at the beginning of the year I was confident that the dollar would outperform, the policy changes we have seen since then have altered my views. While volatility will still be rampant, I believe the broad direction will be a lower dollar going forward.

On the data front, this morning brings ADP Employment (exp 140K) as well as ISM Services (52.6) and Factory Orders (1.6%). Then we see the EIA oil inventories where a small draw is expected and at 2:00pm, the Fed’s Beige book. Perhaps the best thing about the changing world order is that central banks are losing some of their market power. As I wrote yesterday, perhaps US rates are destined to fall as both the president and Chair Powell are keen to see that happen.

At this point, I think the dollar may have seen its highs for quite a while. Remember, FX trends tend to be very long-term in nature. For those of you who are payables hedgers, keep that in mind going forward.

Good luck

Adf