‘Bout markets, Scott Bessent’s not worried

As favor with specs can’t be curried

Instead, what he seeks

Is policy tweaks

To help growth, though folks want that hurried

Meanwhile, Chairman Jay and his team

Continue their policy theme

Inflation’s still falling

Although they are calling

For patience, as bulls start to scream

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said Sunday on NBC’s Meet The Press. “I‘m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.”

The above comments from Treasury Secretary Scott Bessent yesterday morning (quote courtesy of Bloomberg.com) have garnered a remarkable amount of commentary amidst both the political and market punditry. My first comment is I must be much older than Mr Bessent, since I have been in the investment business for 43 years. However, as I have written numerous times over the course of the past years, the market has not cleared for a very long time. Since the 1987 stock market crash, when then Fed Chair Greenspan started pumping liquidity into the financial markets to stabilize things, and realized he could do that to prevent serious downturns, we have seen two significant downdrafts, the tech bubble and the housing market crash, both of which were immediately met with massive liquidity injections, extremely low interest rates and for the latter, the advent of QE.

All of that liquidity has resulted in market excesses across many markets and has been a key driver in the stock market’s exceptional rise since the Covid blip. Adding to that was the massive fiscal spending (remember those 7% budget deficits?) which has helped to insure that not only did markets rise, but so did retail prices.

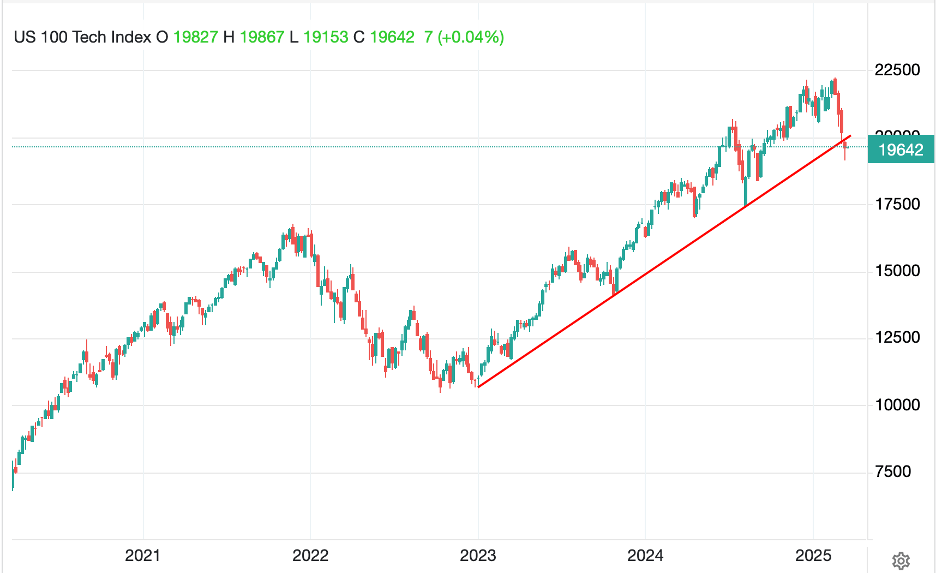

Now, along comes a Treasury Secretary who hasn’t married himself to higher stock markets on a day-to-day basis and instead is focused on the long-term. What I find most interesting is that the same pundits who are screaming about Bessent and Trump destroying the economy, were all-in on the discussion of how the US debt was going to ultimately cause a collapse. Yet as the administration explicitly tries to address that issue (you may disagree with their methods, but that is their clear goal) suddenly, the fact that stock prices are falling is a tragedy of biblical proportions. Here’s the thing, the worst performer, the NASDAQ, is down about -12% since its peak last month as per the below chart. I might argue that is hardly a collapse. In fact, a healthy correction doesn’t seem to be a bad description.

Source: tradingeconomics.com

There is no doubt that uncertainty about the near-term direction of the economy has grown, and there is no doubt that President Trump’s mercurial tendencies make long-term planning difficult. However, I would contend we are a long way from the apocalypse or even a stockopalypse. But once again, I highlight that volatility remains the key metric for now, and that hedging exposures remains very important.

With that as backdrop, the FOMC meets on Wednesday and while there is no expectation of any rate move, the market continues to price three rate cuts for the rest of the year, pretty much one each quarter. A key unknown is just how hawkish or dovish Fed members currently find themselves given the recent market gyrations. As well, while inflation had seemingly been the primary focus, with all the concern over a significant slowdown in the US economy, there are now many who believe we will see a rising Unemployment Rate despite a lack of evidence from the weekly Claims data. These same pundits are also certain that Trump’s tariff policy will lead to rising inflation, really putting the Fed in a bind with a stagflationary outcome. And maybe that is what will happen.

But I would contend it is far too early to assume that is our future. First off, on the inflationary front, energy prices have fallen, a key inflation component, and as far as the tariffs are concerned, if they reduce demand, that is likely to cap prices. If on the other hand, demand is not reduced, I don’t see slowing growth as the likely outcome.

In the end, if the economy is adjusting from one with far more government spending support, to one with more organic private sector economic activity, the transition may be bumpy, but the outcome will be far stronger. We shall see if that is how things evolve.

In the meantime, let’s look at how the world has responded to the latest stories. Friday’s US equity rebound was welcomed everywhere, although the key narrative remains the end of American exceptionalism, at least as regards equity markets. Friday also saw the exiting German Bundestag agree to eliminate the debt brake for infrastructure and defense, with Chancellor-to-be Merz agreeing to waste spend €100 billion on climate related projects to convince the Green Party, which is out of the new government, to vote in the rule change before the new government is seated. It is not clear to me how spending that money on net-zero ideas will defend Germany, but then I am just a poet, not a German policymaker.

As to Asian markets, other than mainland China (-0.25%) green was the predominant color on screens overnight with Japan (+0.9%), Australia (+0.8%) and Hong Kong (+0.8%) all following the US. One of the remarkable things, though, is that Chinese data overnight showing IP (5.9%), Retail Sales (4.0%) and Fixed Asset Investment (4.1%) was generally solid. Of course, Unemployment (5.4%) rose 2 ticks, an unwelcome outcome, and House prices (-4.8%) continue to decline, albeit at a slowing rate, but neither of those speak to a rebound in the Chinese economy. The end of the Chinese NPC offered more platitudes about supporting the consumer, but it is not clear where the money is coming from. And recall, more than 60% of Chinese household wealth remains tied up in housing investment, which continues to decline in value. The Chinese have a long way to go in my view.

Quickly, European bourses are all modestly higher this morning, on the order of 0.3% or so, as hope springs eternal that the rearming of Europe will drive profit margins higher. Unfortunately, at this hour (7:15), US futures are pointing lower, about -0.25% across the board, although that is up from earlier session lows.

In the bond market, Treasury yields have slipped -2bps this morning, but are really just trading around in their new trading range of 4.20% to 4.35% as investors try to get a handle on which of the big themes are going to drive markets going forward. European sovereigns are all seeing rallies, with yields slipping -5bps to -6ps which seems out of step with the news about the end of the German debt brake. Perhaps bond investors don’t believe the legislation will pass, or perhaps that they won’t spend the money after all. As to JGB yields, the edged lower by -1bp in the 10yr, although longer dated paper has seen yields rise with 40-year bonds touching 3.0% for the first time in their relatively short history.

In the commodity markets, oil (+1.4%) is continuing to bounce of its lows from last week but remains well below levels seen at the beginning of the month. The US attack on the Houthis is being called the beginning of an escalation in the Middle East by some, and perhaps that has traders concerned. On the flip side, ostensibly, Presidents Trump and Putin are to speak tomorrow in an effort to get peace talks moving along, potentially a bearish oil signal. In the metals markets, gold (+0.6%) remains in great demand having crested the $3000/oz level last week and rising from there. This has helped both silver and copper, with the latter, despite concerns over slowing economic activity, pushing closer to $5.00/lb. There is much talk of shortages in the market driving the price action.

Finally, the dollar is under pressure this morning with every G10 currency firmer led by NZD (+0.6%) and AUD (+0.4%) although gains elsewhere are on the order of +0.25%. This story seems to go hand-in-hand with the German defense spending and the end of US exceptionalism. As to the EMG bloc, most of these currencies are also stronger this morning, but the magnitude of these moves is generally less than the G10 bloc. Recall, Trump wants a lower dollar, and my default is that is where we are headed at this point.

On the data front, we have an action-packed week ahead starting this morning.

| Today | Retail Sales | 0.6% |

| -ex autos | 0.4% | |

| Empire State Manufacturing | -0.75 | |

| Tuesday | Housing Starts | 1.375M |

| Building Permits | 1.45M | |

| IP | 0.2% | |

| Capacity Utilization | 77.8% | |

| Wednesday | FOMC Rate Decision | 4.50% (unchanged) |

| Thursday | Initial Claims | 224K |

| Continuing Claims | 1880K | |

| Philly Fed | 12.1 | |

| Existing Home Sales | 3.92M | |

| Leading Indicators | -0.2% |

Source: tradingeconomics.com

As we have seen over the past many months, I suspect that this week’s data will be likely to give analysts on both sides of the economy is stronger/weaker argument new fodder. While the Fed won’t be doing anything, and despite their relative decline in importance, I suspect that Chairman Powell’s press conference will still get a lot of attention.

While we don’t know what the future will bring for sure, I remain convinced that the dollar will slide, and commodities will rally. As to stocks and bonds, well your guess is as good as mine.

Good luck

Adf