The market is now quite excited

As trade talks have been expedited

With Bessent and He

Now speaking, we’ll see

If buyers last night were farsighted

However, do not ignore gold

Whose price is a thing to behold

The past several days

There’s been quite a craze

As sellers now rue what they’ve sold

Source: tradingeconomics.com

I don’t often lead with a chart, but I think it is worthwhile this morning. I grabbed this picture at 7:00pm last night, shortly after the news hit that Treasury Secretary Bessent and Trade Representative Greer were heading to Switzerland later this week to sit down with He Lifeng, the Chinese Vice Premier and trade negotiator and begin trade talks. Prior to that announcement, the barbarous relic had rallied more than $200/oz over the past four sessions, a pretty impressive move for something that has maintained a low overall volatility. The first explanation of the reversal, which coincided with a sharp gain in equity futures (see chart below) is that all the fear of the world ending with corresponding equity weakness and a need to hold gold, has ended! Hooray!!!

Source: tradingeconomics.com

Alas, just as I never believed the world was ending before, neither do I believe that everything is suddenly better. Seemingly, this is all part of the process. The idea that China could simply accept much of the stuff they produce would not be able to find a home in the US was never going to be the case. I have no idea how things will work out, and they certainly will take a lot of time to come to some agreement, but it is very positive that the dialog has begun.

On the subject of which side blinked, which is a favorite for the punditry, especially those who despise dislike President Trump and believe this shows weakness on his part, I would note that the Chinese are the ones who have recently reported weaker economic data and last night the PBOC cut their 1-week reverse repo rate by 0.1% and reduced their Reserve Requirement Ratio by 50 basis points, both monetary easing measures to address the ongoing weakness in China. Neither side benefits from this process in the short-term, but we will need to see the results of the talks, which will take many months I presume, before we know if goals have been achieved.

Away from the story on trade

The Fed story must be portrayed

Alas, it’s quite dull

As Jay and friends mull

The idea rate cuts be delayed

The only other story of note today is the FOMC meeting where they will release their policy statement at 2:00 this afternoon revealing no change in policy, and very likely almost no change in the wording, and then Chairman Powell will face the press at 2:30. However, given the low probability of any changes, and given nothing regarding trade policy has really changed since they entered their quiet period, it seems unlikely that we will learn anything of consequence from Powell. Today will be a complete non-event.

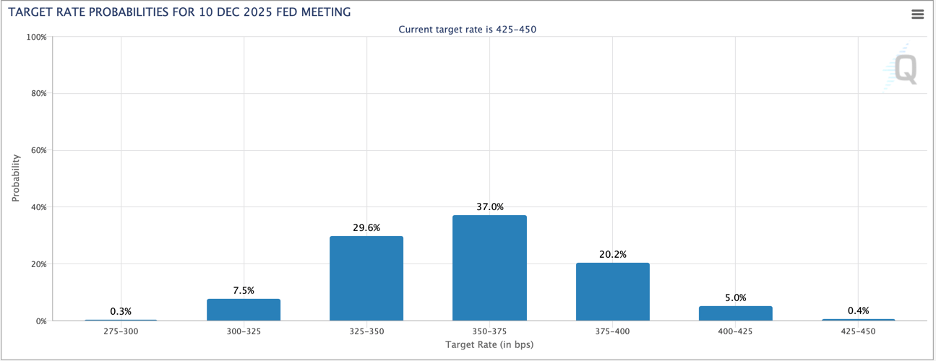

However, I cannot help but consider why the futures market appears so convinced that there are going to be rate cuts going forward this year. As of this morning, the Fed funds futures are pricing a total of 78 basis points of cuts for the rest of this year, so three 25bp cuts as per the below chart from the CME.

Certainly, the data released thus far this year have not indicated the economy is heading into a tailspin. Of course, there are many analysts calling for a recession to start in Q2 or Q3 as the tariff impacts ostensibly undermine the economy. It is important to note, however, that these are the same analysts who have been calling for a recession for the past three years. The boldest calls are for a period of stagflation, with the tariffs simultaneously killing growth and raising prices.

It is entirely possible that we see a recession this year, especially if government spending decreases given its role in supporting recent growth data. (According to the BEA, Federal government spending in Q1 declined -5.1% while investment in the economy expanded more than 2%.). If this is the path forward, the long-term benefits will be substantial, but they must be maintained. As well, if this is the path forward, total economic activity in the US will expand substantially and it is not clear that rate cuts will need to be part of that mix.

Regardless, it seems that today’s activity is less likely to be impacted by the Fed than by any random headlines regarding trade or other administration maneuvers. So, let’s see how markets have responded to the US-China trade talk news.

The China news came long after the close yesterday so the US markets closed lower on the session, approaching 1% declines, but US futures are currently higher by around 0.7% at 7:15. In Asia, however, we did see some modest gains although the Nikkei (-0.15%) faded a bit, both China (0.6%) and Hong Kong (+0.15%) managed to rally. As to the rest of the region, most markets were modestly higher although in a seeming sympathy move on the China news. In Europe, bourses are softer this morning with the CAC (-0.7%) leading the way and other key indices falling less. The data releases show Construction PMI softening on the continent as well as weak Eurozone Retail Sales (-0.1%), so I imagine that is weighing on investors’ minds today.

In the bond market, Treasury yields are 2bps firmer this morning but have been trading either side of 4.30% for the past several sessions as traders try to estimate the next big thing. I see just as many stories about how yields are going to 10% as I do about how they are headed to 2% amid the depression coming, so my take is, we are going to range trade for a while yet. In Europe, sovereign yields are lower by between -3bps (Germany) and -5bps (Italy) as that softer data is encouraging investors to believe that inflation will continue to decline and the ECB will cut further.

The commodity market has been where the real action is of late with oil (+0.9% today after +2.0% yesterday) rising after comments by two US oil companies that they will not be drilling any more if oil prices stay at these levels. What I don’t understand is, what will they be doing as they are oil companies? At any rate, this will be the tension in markets, who can afford to drill and sell oil at lower prices. I expect we will hear from companies and pundits on both sides of this equation. I discussed gold above, which has bounced slightly from its lowest levels overnight and I don’t believe anything will derail this train for a while yet. However, both silver (-0.75%) and copper (-2.6%) are softer this morning, partly based on gold’s slide and partly on the weaker economy story.

Finally, the dollar is modestly firmer this morning, at least against its G10 counterparts with JPY (-0.6%) the weakest of the bunch, followed by SEK (-0.5%) and AUD (-0.3%). The euro and pound are little changed and NOK (+0.15%) has gained on the back of oil’s strength. In the EMG block, KRW (-1.1%) and TWD (-1.1%) have both rebounded some from their recent highs (dollar lows) in what seems more like a trading reaction than a change in policies. Elsewhere in this bloc, though, MXN (+0.2%) is a touch stronger while ZAR (-0.5%) is a touch weaker and CNY is little changed. There is a story making the rounds today that a well-known currency analyst, Steven Jen, is claiming that there could be as much as $2.5 trillion of excess currency reserves held by Asian nations that they may no longer need. If this is true and these reserves were sold quickly, it would certainly drive the dollar much lower. However, it strikes me that given the enormous amount of USD debt that has been issued by Asian companies and countries, and given these countries do not have access to Fed swap lines in emergencies, there is no reason to sell the dollars. Rather they will simply have a ready supply without having to chase them when repayment and rollovers come due. I would take this story with a large grain of salt.

Other than the Fed, we see EIA oil inventory data where some drawdowns are anticipated and that is really the day. We are all awaiting the trade negotiation outcomes and I would say nobody has an inside track there. Bigger picture, though, I do think the dollar has further to slide.

Good luck

Adf