For users of Bloomberg worldwide

This morning, the service has died

So, traders are struggling

As it’s like they’re juggling

With one hand, behind their back, tied

While market activity continues, it seems that the single issue receiving the most attention today is that the Bloomberg professional service is not working almost anywhere in the world. From what I have seen so far, there is no explanation other than technical problems, and on the Bloomberg website that I reference (the professional service is way too expensive for poets) the only mention has been oblique in the news that auctions in the UK and Europe have been extended in time until the service is operational again. However, on X, the memes are wonderful. I’m sure they will fix things shortly, and the financial world will go back to worrying about things like interest rates and equity valuations, but right now, this is the story!

JGB markets

Are garnering far more press

Than Ueda wants

Yesterday’s story about JGB yields continues to be a key market issue this morning, and likely will be so for some time to come. Yields there continue to climb and as we all know, the fiscal situation in Japan has been tenuous at best. The Japanese government debt/GDP ratio is somewhere around 263%. Consider that when the US has been deemed the height of fiscal irresponsibility with a number half that high. Granted, Japan is a net creditor nation, which is why they have been able to maintain this situation for so long, but as with every other situation where trends seem to go on forever, at some point they simply stop.

Sourve: tradingeconomics.com

The thing that seemed to allow Japan to continue for so long was the fact that inflation there had remained quiescent, for decades. It has been more than twenty years since official Japanese policy was to raise inflation. Alas, to paraphrase HL Mencken, be careful what you wish for, you just may get it good and hard. It appears that the good people of Japan are beginning to feel what it is like when a government achieves a policy goal after twenty years. Notably, the key issue is that inflation, after literally decades of negative or near zero outcomes, has risen back to levels not seen since the early 1990’s, arguably two generations ago. (The blip in 2014 was the result of the rise in Japan’s GST, their version of VAT, to 10%, which was a one-off impact on prices that dissipated within 12 months.)

This lack of inflation was deemed the fatal flaw in the Japanese economy, despite the fact that things there seem to work pretty well. The infrastructure is continuously modernized and works well and while my understanding is that a part of the population was frustrated because their nominal incomes weren’t rising, with inflation averaging 0.0% or less for 20 years, they weren’t falling behind. However, the broad macroeconomic view from policy analysts around the world was that Japan, a nation with an actual shrinking population, needed to do everything they could to push inflation higher in order to better the lives of its citizens. Well, they have done so with inflation there now higher than the most recent readings in the US. I fear that the good people of Japan are going to be asking many more questions about why the government thought this was a good idea as prices continue to rise. It is already apparent in the approval numbers of the current government with readings on the order of 27%.

So, now we must ask, how will different markets interpret the ongoing rise in inflation. We are already seeing what is happening in long-dated JGB markets, with the 30yr and 40yr yields rising to record levels, albeit below, and barely at current inflation readings respectively. But, as I mentioned yesterday, the broader market question will be at what point will Japanese investors, who are one of the key sources of global capital, decide that the yield at home is sufficient to bring assets back from around the world, notably the US. That level has not yet been reached although I suspect we are beginning to see the first signs of that.

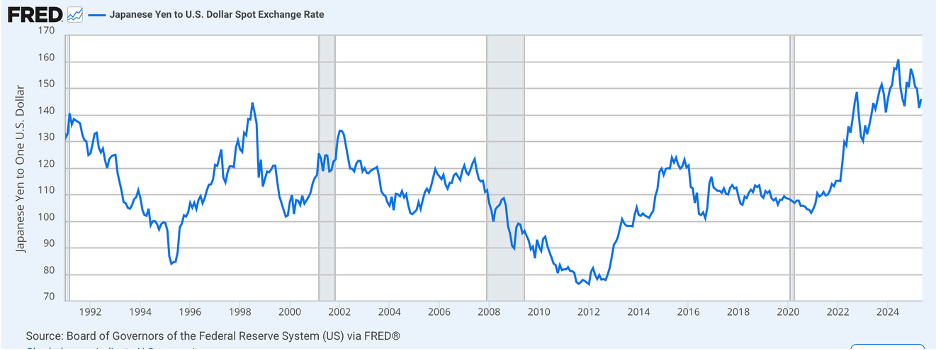

In the event this occurs, and I believe it will do so, what will be the impact on markets? The first, and most obvious outcome will be a significant rise in the JPY (+0.6%). As you can see below, while the yen has strengthened compared to levels seen in mid and late 2024, it remains far weaker than levels seen over the past 30+ years, where the average has been 112.62, more than 20% stronger than the current levels.

As to Treasury markets, Japan remains the largest non-US holder of Treasuries and while I doubt they will sell them aggressively, it would certainly be realistic to see them allow current positions to mature and not buy new ones but rather bring those funds home (stronger yen) while removing a key bid for the market (Kind of like their version of QT!). Higher US yields are a real possibility here. As to equities, these will likely be sold, although the Japanese proportion of holdings is not as large relative to others, but with rising yields and a falling dollar, it doesn’t feel like a good environment for equities.

Of course, all of this is dependent on the status quo in US policy remaining like it is today. If President Trump can get Congress to implement his policies and they are successful at reinvigorating the US domestic economy, two big Ifs, these views will be subject to change. The key to remember about markets, especially currency markets, is that there are two sides to every story, and expecting a particular outcome because one side of the equation moves may be quite disappointing if the other side moves and was unanticipated.

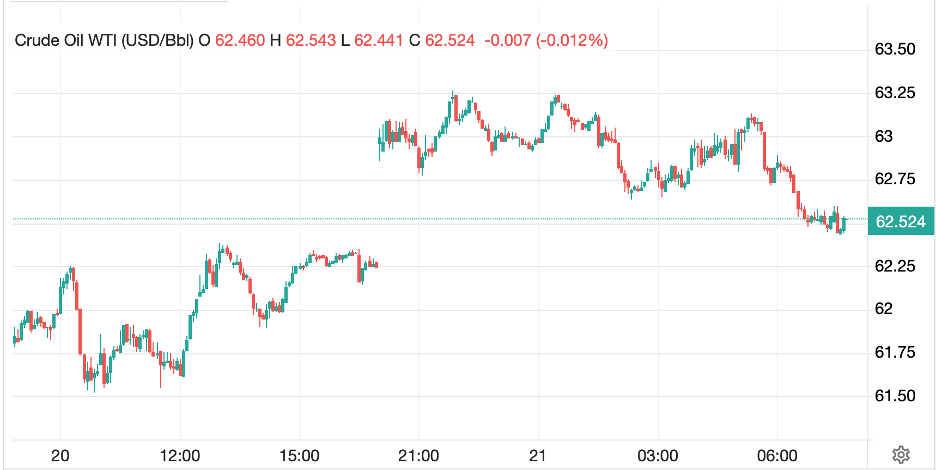

Ok, I spent far too long there, but not that much else is exciting. The other story with some press has been driving oil markets higher (WTI +0.85%) with a gap up on news that Israel was considering a strike against Iranian nuclear facilities. Naturally, this has been denied, and oil’s price has retreated from the early highs seen below.

Source: tradingeconomics.com

Sticking with commodities, gold (+0.5%) continues to rally, perhaps on fears of that Israeli news, or perhaps simply because more and more investors around the world want to own something they can hold onto and has maintained its value for millennia.

In the equity markets, yesterday’s modest US declines were followed by weakness in Japan (-0.6%) but strength in China (+0.5%) and Hong Kong (+0.6%). As to the rest of the region, there were many more gainers (Korea, India, Taiwan, Australia) than laggards (Malaysia, Thailand) so a net positive tone. In Europe, though, modest declines are the order of the day with the CAC (-0.5%) the worst performer and the FTSE 100 (-0.1%) the best. US futures are also pointing lower at this hour (7:50) down on the order of -0.5% across the board.

Treasury yields (+4bps) have moved higher again this morning and have taken the entire government bond complex along with them as all European sovereign yields are higher by between 4bps (Germany, Netherlands) and 6bps (Switzerland, UK). We have already discussed JGB yields where 10yr yields have moved higher by 2bps.

Finally, the dollar is softer across the board this morning with the DXY (-0.45%) a good proxy of what is happening. The outliers are KRW (+1.2%) and NOK (+1.1%) with the latter an obvious beneficiary of oil’s rise while the former seems to be climbing in anticipation of something coming out of the G10 FinMin meeting in Canada this week. Otherwise, that 0.45% move is a good proxy for most things.

On the data front, we have another day sans anything important although EIA oil inventories will be released with a solid draw expected. Fed speakers were pretty consistent yesterday explaining that patience remains a virtue in a world where they have no idea what is going on. Fed funds futures markets have pushed the probability of a June cut down to 5% and only 50bps are priced in for all of 2025. (Personally, I see no reason that a cut is coming.)

The dollar remains on its back foot, and I expect that the combination of pressure from the Trump administration to keep it that way is all that is going to be necessary to see things continue with this trend. Of course, an Israeli strike on Iran would change things dramatically in terms of risk perception and likely support the dollar, but absent that, right now, lower is still the call.

Good luck

Adf