The data was pretty darn good

And so, it must be understood

The world is not crashing

Though some things are flashing

Red signs, where recession’s a ‘could’

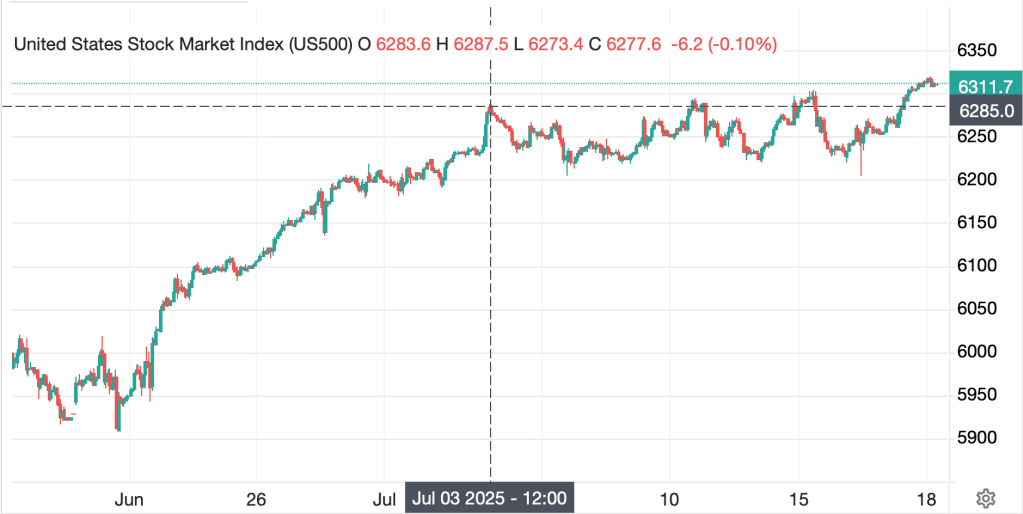

A review of yesterday’s economic data shows that Retail Sales were stronger than expected on every metric and subcomponent, Import Prices rose a scant 0.1%, the Philly Fed Index was much stronger than expected and Jobless Claims fell on both an Initial and Continuing basis. In truth, it was a sweep of positive economic news. As such, we cannot be surprised that equity markets responded positively, as did the dollar, while bonds held their ground, given the lack of inflationary signals. But if we look at the movements in markets, they remain very modest overall. Sure, the S&P 500 made a new high, by 2 points, but if you look at the chart below, since July 3rd, the rally has been 26 points, or 0.4%. This is hardly the stuff of excitement.

Source: tradingecononmics.com

Of course, this did not stop the pundits who are calling for recession to highlight any negative subtext, nor did it prevent Fed Governor Waller from claiming that a rate cut in July was appropriate because the labor market is on the edge. But the naysayers find themselves with diminishing attention these days as market price action has been quite positive. In fact, most markets have shown similar behavior. Whether gold or oil or other equity indices or bonds, we have been in a narrow range for a while now and it is not clear what it will take to break us out. But here’s one thought…

On Sunday, Japan

Will vote for their Upper House

Is there change afoot?

While market insiders will discuss today’s options’ expirations as the key driver of things in the short-term, I think we need turn our eyes Eastward to Japan’s Upper House elections this Sunday. PM Ishiba’s LDP-Komeito coalition is already in a minority status in the more powerful Lower House, a key reason why so little has been accomplished there. But at least he had a majority in the Upper House to rubber stamp anything that was enacted. However, signs are pointing to the LDP losing their majority in the Upper House which could well lead to Ishiba getting forced out.

Now, why does this matter to the rest of us? There is a case to be made that flows in the JGB market are an important driver of global bond flows, including Treasuries. For instance, Japan is the second largest net creditor nation with about $3.73 trillion invested abroad (according to Grok), much of which is Japanese insurance companies searching for higher yields than have been available there for the past decades. You may remember back in May, when there was a spike in long-dated JGB yields as all maturities from 20 years on out reached new historic highs (see below chart), well above 3.0%.

Source: tradingeconomics.com’

Now, consider if you were a Japanese life insurer looking to match your assets to your liabilities. Historically, buying Treasury bonds, with their much higher yield, was the place to be, especially over the past several years when the yen weakened, adding to your JPY gains. However, that is still a risky trade, and hedging the FX risk is expensive given the yield differential between the US and Japan. (Hedgers need to sell USD forward and the FX points reduce the effective exchange rate and by extension the benefits of the higher bond yields.)

But now, for the first time ever, JGB yields are above 3.0%, and that can be earned by a Japanese life insurer with zero FX risk, a very attractive proposition. In fact, Bloomberg has an article this morning discussing just such a situation with one of the larger insurers, Fukoku Life.

Circling back to the election, it appears that the key issues are the rising cost of living and what the government is going to do about it. Apparently, there are two approaches; the LDP is talking about giving out cash bribes grants of ¥20,000 to individuals while the opposition is talking about reducing consumption taxes on necessities like food. However, in either case, the reality is that fiscal policy would loosen further with the MOF needing to issue yet more JGBs to make up for either the increased outlays or reduced income. Add to that the uncertainty over future Japanese policy if the LDP loses its majority, and the pressure from the US regarding tariff negotiations and suddenly, it makes a lot more sense that the knock-on effects of this election can be substantial, at least with respect to the global bond markets and the USDJPY exchange rate. (It must be said that Japanese inflation data last night actually fell to 3.3%, but that was due entirely to declining oil prices as fresh food prices, the big issue there, continue to rise.)

An election outcome that weakens PM Ishiba, potentially leading to a fall of his government and new elections in the Lower House, would be a distinct negative for the yen, and likely for the JGB market. The impact would be felt in global bond markets as yields in the back end would almost certainly rise everywhere around the world. This is not to imply that yields would rise by 100bps or more, but rather that the current trend of rising long-dated yields would continue for the foreseeable future. And that will make things tough on every government.

Ok, sorry, I went on a bit long there. A quick turn through markets shows that other than Japan (-0.2%) Asian equity indices were mostly nicely in the green following the US lead with the biggest winners Australia (+1.4%), Hong Kong (+1.3%) and Taiwan (+1.2%). Meanwhile, in Europe this morning, while green is the color, the movement has been miniscule, averaging about 0.1% gains. And US futures are also modestly higher at this hour (7:00) about 0.15% across the board.

In the bond market, Treasury yields have edged lower by -2bps but European sovereign yields are all higher by 2bps across the board. The talk in Europe is over concerns regarding the conclusion of a trade deal with the US, where concerns are growing nothing will be achieved by the end of the month.

In the commodity markets, oil (+1.3%) is continuing its rebound, perhaps on the beginnings of a belief that the economy is not going to crater in the US. Certainly, yesterday’s data was positive. As to the metals markets, they are in fine fettle this morning with both gold (+0.4%) and silver (+0.4%) trading back to the middle of their trading ranges and copper (+1.3%) pushing back toward its recent all-time highs.

Finally, the dollar is under pressure this morning, sliding against the euro (+0.25%), pound (+0.2%) and AUD (+0.4%). But the real movement has been in the commodity space where NOK (+0.8%) and ZAR (+0.7%) are both having solid days. There continues to be a great deal of discussion regarding President Trump’s desire to fire Chairman Powell with a multitude of articles describing how that would be the end of the world as we know it because the Fed cherishes their “independence”. Let’s not have that discussion.

On the data front, this morning brings Housing Starts (exp 1.3M) and Building Permits (1.39M) and then Michigan Sentiment (61.5) at 10:00. There are no Fed speakers on the slate for today although Governor Kugler, not surprisingly, explained that waiting was the right call for the Fed when she spoke yesterday.

It is a Friday in the summer with relatively unimportant data. Absent another surprise from the White House Bingo card, I expect a quiet session overall as most traders and investors leave the office early for the weekend. The dollar’s biggest risk is the Fed does cut early, but if the data keeps cooperating, it will be much harder for dollar bears, especially since so many are already short, to sell it aggressively from here.

Good luck and good weekend

Adf

Excellent commentary. None better anywhere.

And the poetry is a bonus!