The talk of the town ‘bout the Fed

Was not what the Minutes had said

But rather the look

Into Lisa Cook

And whether the rules she did shred

It seems now both parties agree

That lawfare is how things should be

Impeachment was first

But now there’s a thirst

For vengeance ‘gainst your enemy

The FOMC Minutes released yesterday were not that informative overall. After all, the two dissensions by Waller and Bowman have already been dissected for the past 3 weeks and reading through the Minutes, they basically said that most participants had no idea how things would play out. They couldn’t decide if tariffs would be more inflationary, if the impact would be consistent or a one-off and so doing nothing felt right. As to the employment situation, there too they had no clarity as to their thoughts, with some positing things could get worse while others thought the employment situation would be fine. Anyway, with Powell speaking tomorrow, it was all old news.

However, the real Fed news came from the head of the FHFA, Bill Pulte, who revealed that he had forwarded information to the DOJ to investigate potential mortgage fraud by Fed Governor Lisa Cook. In what has become something of a pattern, Ms Cook appears to have misrepresented the purchase of a secondary home she was planning to rent out as her primary residence in an effort to get a reduced rate on her mortgage. This is remarkably similar to the case against NY Attorney General Letitia James as well as California Senator Adam Schiff. While the latter two appear vengeful in that both of those two were instrumental in personal political attacks on President Trump, it is Ms Cook’s situation that may have the bigger impact. If she is forced to resign, as has already been demanded by President Trump, then that opens another seat on the Fed for Mr Trump to fill. Based on Trump’s current views, one would anticipate it would turn the Fed that much more dovish if that is the way things evolve.

Sitting here in the bleachers, I have no idea as to the veracity of the claims against any of these three, but it will not be a huge surprise to see charges brought in each case. It will certainly be a sticky wicket for Chairman Powell if a Fed governor is brought up on charges of mortgage fraud given her role in monetary policy making. At this stage, my working assumption is we will see all three served and cases brought against them. If that is the case, we have to assume the Fed is going to become that much more dovish during the rest of the year regardless of the data.

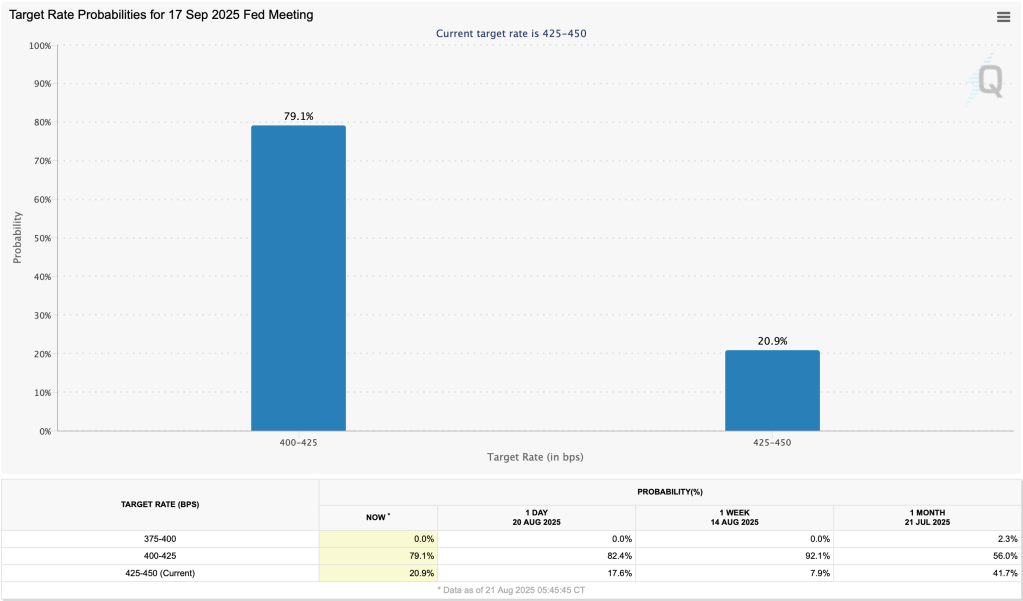

Interestingly, one cannot look at Fed funds futures and conclude this will be the case as the probability of a rate cut next month has actually declined a bit further, now at 79% as per the below chart. In fact, if you look at the recent history, you can see that just one week ago, that probability was 92% and the week prior to that it was over 100%.

Source: cmegroup.com

There is an irony in the idea that President Trump wants to see the Fed cut rates while describing the economy as doing great. Arguably, if the economy is doing great with rates where they are, why change them. The answer, I believe, is the administration’s goal to run the economy as hot as possible with the idea that faster growth in real activity will help overcome the debt problems. Alas, part of running it hot means that inflation is unlikely to fall much further. And that, my friends, is the conundrum. A hot US economy will continue to draw investment and support the dollar’s strength. While that will help moderate inflation, it will negatively impact manufacturing competitiveness. And that is the balance that every government wants to control but is impossible to do. This is the very essence of Triffin’s dilemma.

(PS: if you want to protect against that hotter inflation, a great tool is USDi, the only fully backed, CPI tracking cryptocurrency available.)

Turning from the political, which keeps interfering in the daily financial commentary, to the financial directly, we have continued to see pressure on the semiconductor sector drive US equity markets a bit lower, notably the NASDAQ, which continues to play out elsewhere around the world. In Asia, the Nikkei (-0.65%) was emblematic of that with the Hang Seng (-0.25%) slipping as well, but in truth, Asia had an overall better performance as Taiwan (+1.4%), Australia (+1.1%) and Korea (+0.4%) all fared well. I think some of this was a reversal of the previous day’s sharp declines on the semiconductor concerns although Australia was the beneficiary of some solid Flash PMI data.

In Europe, however, all markets are weaker this morning led by the CAC (-0.6%) and IBEX (-0.6%) with the DAX (-0.3%) and FTSE 100 (-0.3%) not quite as badly off after PMI data there showed things were better than last month, but still not particularly great. It seems the commentary attached to the numbers indicated serious concerns about future activity. As to US futures, at this hour (7:15) they are modestly lower across the board, on the order of -0.15%.

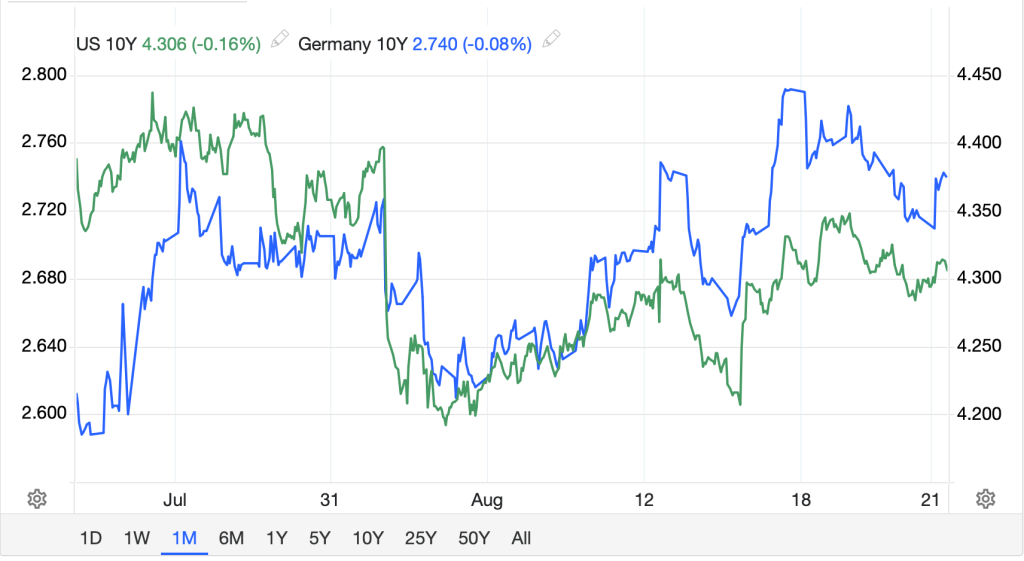

In the bond market, zzzzzz’s are the story. While yields have edged slightly higher this morning (+1bp in Treasuries, +2bps to +3bps in Europe), the trend remains a flat line with none of these markets doing anything other than chopping around.

Source: tradingeconomics.com

The one exception here is Japan, which has seen 10-year yields march consistently higher over the past year with the past 10 sessions showing consistently higher yields. Perhaps their debt chickens are finally coming home to roost.

Source: tradingeconomics.com

Turning to commodities, oil’s (+0.85%) modest bounce continues but it remains nearer the bottom than the top of its recent trading range. The EIA data yesterday showed a surprisingly large draw in crude oil as well as gasoline stocks with reduced imports, so this does make sense. In the metals markets, yesterday’s rally is being reversed this morning with the major markets all lower by about -0.4%.

Finally, the dollar remains quite uninteresting excepting two currencies; NOK (+0.6%) which is clearly benefitting from the recent rebound in oil while JPY (-0.4%) is under further pressure as there appears to be an increase in short JPY carry trades being initiated, especially against the dollar as more traders discount the idea the Fed is even going to cut 25bps next month. Otherwise, there is nothing noteworthy here this morning.

We finally get data this week as follows: Initial (exp 225K) and Continuing (1960K) Claims, Philly Fed (7.0), Flash PMI (Manufacturing 49.5, Services 54.2) and Existing Home Sales (3.92M). We also hear from Atlanta Fed president Bostic this morning, but I do believe the market remains almost entirely focused on Powell’s speech tomorrow. Of course, if the semiconductor space continues to underperform, that would be an entirely different kettle of fish and likely create some serious market adjustments.

Net, it is difficult for me to remain too bearish the dollar overall, especially if the market starts to price out a rate cut in September.

Good luck

Adf